Alibaba Adjusts Course, but Navigating New Pathways Proves Challenging

![]() 12/31 2024

12/31 2024

![]() 460

460

Since its inception, Alibaba (09988. HK) has faced several pivotal turning points, yet it has largely steered in the right direction.

As Alibaba ventured into more diverse territories, assessing the merit of its decisions has become increasingly nuanced, transcending simple binary evaluations.

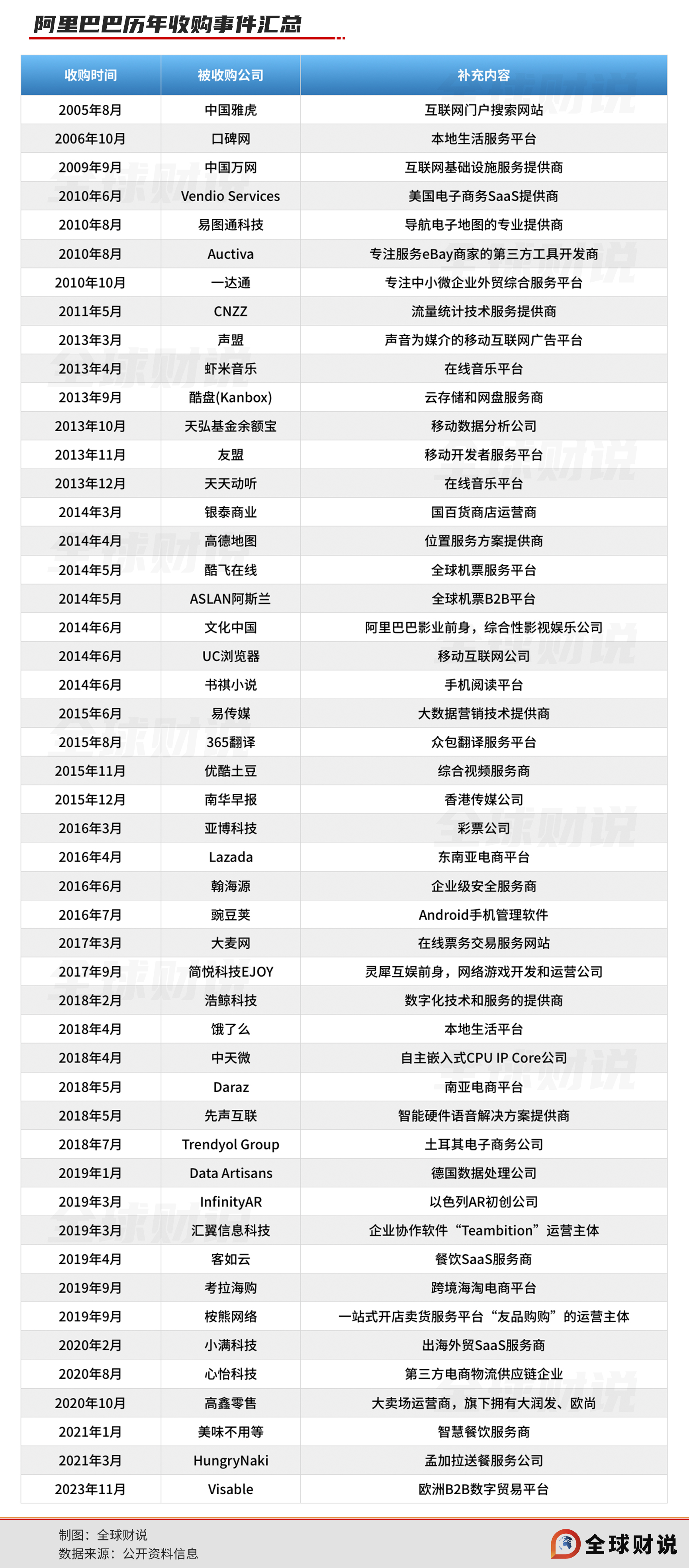

Initially, Alibaba's investments were predominantly financial, targeting firms like China Yahoo, Koubei, and Wanwang, aiming for returns on those investments.

By 2013, Alibaba's investment strategy evolved to emphasize strategic acquisitions. Jack Ma publicly affirmed that Alibaba Group would bolster its competitiveness through mergers and acquisitions.

Since then, Alibaba's investment horizon has continually broadened, aiming to cultivate an extensive ecosystem. Today, Alibaba boasts various business segments, including local life, entertainment, and new retail, many of which stem from this period of investments. This underscores Alibaba's ambitious endeavor to permeate every facet of daily life, bridging the online and offline worlds.

In recent years, Alibaba has undergone frequent business and personnel adjustments, a rarity in its over two-decade history. This underscores the multifaceted challenges it currently faces and the strategic uncertainty that accompanies them.

Four years ago, a public relations crisis toppled "Alibaba's Crown Prince" Jiang Fan from his pedestal. Not only was he removed from the list of Alibaba Partners, but he also lost control of Tmall and Taobao in 2022, being reassigned by the group to develop international business ventures overseas.

During Jiang Fan's absence, Tmall and Taobao grappled with the ascendancy of emerging players like Pinduoduo and Douyin e-commerce.

Performance-wise, since the 2022 fiscal year (April 2021 to March 2022), when Tmall-Taobao Group peaked at 575.993 billion yuan in revenue, it has confronted the dilemma of shrinking scale. In the 2024 fiscal year, revenue dwindled to 434.893 billion yuan, with a compound annual growth rate of -13.11%. During this period, its contribution to Alibaba Group's total revenue declined from 69.48% to 46.21%.

In terms of profitability, from the 2022 fiscal year to the 2024 fiscal year, the adjusted EBITA of the Tmall-Taobao Group increased from 182.114 billion yuan to 194.827 billion yuan, representing a compound annual growth rate of 3.43%.

In the mid-year report for the 2025 fiscal year (ending September 30, 2024), the Tmall-Taobao Group continued to experience a decline in scale and profits. Revenue dipped 0.11% year-on-year to 212.367 billion yuan, while adjusted EBITA decreased 3.11% year-on-year to 93.4 billion yuan.

In stark contrast, Pinduoduo (PDD.O) has witnessed rapid growth over the same period. From 2021 to 2023, Pinduoduo's revenue surged from 93.95 billion yuan to 247.639 billion yuan, with a compound annual growth rate of 62.35%. Its profitability is even more impressive, with net income attributable to shareholders soaring from 7.769 billion yuan to 60.027 billion yuan, reflecting a compound annual growth rate of 177.97%.

Having lost ground, Alibaba has transitioned from being "unrivaled" during the Jack Ma era to a "hard-running pursuer" in today's competitive landscape.

In November 2024, amidst continued sluggish growth in its e-commerce business, Alibaba announced the formation of an e-commerce business group, consolidating Tmall-Taobao Group, Alibaba International Digital Commerce Group, and e-commerce ventures like 1688 and Xianyu, encompassing the entire domestic and international e-commerce supply chain. Jiang Fan also returned to the helm at Alibaba, assuming the role of CEO of the Alibaba e-commerce business group, reporting directly to Alibaba CEO Wu Yongming.

Previously, in 2023, Alibaba underwent its most significant organizational restructuring to date. Under the "1+6+N" framework, with Alibaba Group at its core, six business groups were established: Tmall-Taobao Commerce, Alibaba Cloud Intelligence, International Digital Commerce, Cainiao, Local Life, and Entertainment, along with N subsidiary ventures. Each business group operates under a CEO responsibility system, governed by its respective board of directors.

The hierarchical structure has transformed into a collaborative roundtable, with each entity accountable for its operations and outcomes.

Wu Yongming's establishment of the e-commerce business group signifies another structural adjustment. At the time, the integration and synchronization of domestic and international e-commerce ventures aimed to respond to the international expansion of cross-border e-commerce platforms like Pinduoduo's Temu and Douyin's TikTok. Jiang Fan, with nearly three years of experience expanding Alibaba's overseas presence, naturally emerged as the ideal candidate for this role.

In the mid-year report for the 2025 fiscal year, Alibaba's International Digital Commerce Group segment witnessed a year-on-year revenue increase of 30.73% to 60.965 billion yuan, surpassing the Cloud Intelligence segment to become the second-largest revenue contributor among Alibaba's six business segments.

However, Alibaba's current challenges extend beyond its core e-commerce business. Various acquired ventures have frequently lagged behind competitors, gradually declining from their peak performance.

Among Alibaba's six business segments, Entertainment remains the underperformer. Despite substantial group support, it has struggled to achieve sustainable growth.

Since 2014, Alibaba has intensified its investment in the film industry, music, literature, games, and other domains, successively acquiring related ventures. In June 2016, Alibaba's Entertainment segment was officially launched.

At the time, Alibaba Entertainment was a formidable force, encompassing Youku Tudou, UC Browser, Alibaba Pictures, Alibaba Music, Alibaba Sports, Alibaba Games, Alibaba Literature, Alibaba Digital Entertainment, and other ventures, posing a significant threat to its competitors.

However, observing the current ecosystem, only Youku, Alibaba Pictures, and DaMai remain within Alibaba's Entertainment segment. Other ventures have been integrated into the Innovation Business Group. The significant contraction of its entertainment empire raises questions about Alibaba's ability to succeed in this industry.

From the 2017 fiscal year to the 2024 fiscal year, the Entertainment segment accumulated adjusted EBITA losses of nearly 60 billion yuan over eight years, with a loss of 15.796 billion yuan in the 2019 fiscal year alone.

Entering the 2025 fiscal year, Alibaba Entertainment's losses have narrowed but continue to persist. For the six months ending September 30, 2024, adjusted EBITA losses amounted to 281 million yuan, compared to 138 million yuan in the corresponding period last year.

This lackluster growth and mediocre performance recently prompted Alibaba Entertainment CEO Fan Luyuan to publicly criticize Alibaba's game brand Lingxi Interactive Entertainment, leading some netizens to liken it to the pot calling the kettle black.

In early December 2024, Fan Luyuan made a series of "unrestrained" remarks during an internal meeting of Lingxi Interactive Entertainment, focusing on issues such as the team's lack of Alibaba spirit and culture, stating that Lingxi Interactive Entertainment had gradually lost its market competitiveness since leaving the Entertainment segment.

It is understood that Lingxi Interactive Entertainment was originally a game development company, Guangzhou Jianyue, acquired by Alibaba for 1 billion yuan in 2017. It was initially part of Alibaba's Entertainment segment and was spun off in September 2020 to operate as an independent business group for game development, operation, and licensing. However, in January 2024, management control of Lingxi Interactive Entertainment reverted to Fan Luyuan.

Although Fan Luyuan's narrative portrays Lingxi Interactive Entertainment in a negative light, the company's actual performance is noteworthy.

According to Sensor Tower's store intelligence platform, in November 2024, Lingxi Interactive Entertainment ranked fifth in the iOS market's China mobile game publisher revenue rankings. In terms of mobile game revenue rankings, Lingxi's cash cow "Sanguo Zhi: Strategy Edition" ranked eighth.

Fan Luyuan's scathing criticism of Lingxi Interactive Entertainment was more emotional than substantive, reflecting his frustration with the Entertainment segment's inability to succeed and his aspirations for the gaming business.

"Within five years, Tencent and NetEase will no longer have an edge. I hope that within the next eight years, Lingxi Interactive Entertainment can become the third-largest game company in China. Within 12 years, it must rise to the second position. Within the next 15 to 18 years, the entire Alibaba Entertainment segment must rank third in the global entertainment industry," Fan Luyuan declared.

Whether it truly attains global third-place status remains to be seen, but for Fan Luyuan, the head of Alibaba Entertainment, after scrutinizing the various ventures under his purview, Lingxi Interactive Entertainment appears to be the most promising.

Taking Youku, which Alibaba acquired for 4.67 billion dollars, as an example, in the early days of video streaming, Youku not only became China's first listed video platform but also pioneered UGC (User-Generated Content), rivaling YouTube.

It was precisely because of Youku's robust traffic resources that Alibaba fully acquired Youku Tudou Group in October 2015.

However, things did not unfold as planned. With the prevalence of copyright payments and membership models, Youku gradually abandoned the UGC content model and transitioned to paid copyright content. This strategic shift deprived Youku of its valuable foundation, transforming its bold decision into a regrettable one.

In the protracted battle between copyright and self-produced content, Youku has never been able to keep pace with iQIYI and Tencent Video. Even in the abandoned UGC model, Bilibili has emerged as a rising star.

According to QuestMobile data for September 2024, China's top five online video monthly active users are Tencent Video with 377 million, iQIYI with 360 million, Mango TV with 257 million, Bilibili with 209 million, and Youku trailing with 197 million.

The latest development is that Youku is revisiting UGC and focusing on short videos. However, the video industry has significantly evolved, and short videos are unlikely to rescue Youku.

But compared to Youku, Xiami Music, which has become an electronic relic, has fared worse.

As one of China's earliest digital music platforms, Xiami Music once formed a "tripod" with NetEase Cloud Music and QQ Music. However, after being acquired by Alibaba, it did not experience rapid growth. Instead, as Alibaba's investment focus gradually shifted, Xiami Music began to decline. It not only lost ground in the copyright battle, shedding a large number of users, but its development also stagnated, eventually being abandoned by Alibaba in the winter of 2021.

Such stories are not uncommon within Alibaba Entertainment, making it difficult for the business segment to achieve profitability and rendering it the most loss-making segment within the Alibaba ecosystem.

Judging from Alibaba's investment trends in recent years, it has shifted from aggressive expansion in the early stages to a more cautious approach.

This is evident in the relevant deployments made by Wu Yongming after assuming the role of Alibaba's CEO. While emphasizing the two core businesses of e-commerce and Alibaba Cloud, he is methodically divesting from non-core assets acquired through earlier investments.

In 2024 alone, Alibaba reduced or sold its holdings in companies across multiple sectors, including GOGOVAN, Bilibili, Momo, NetEase Cloud Music, and Lareau. Recently, it even went so far as to sell Intime Retail, a cornerstone asset in its "New Retail" strategy.

In 2014, Alibaba invested 5.37 billion Hong Kong dollars in Intime Department Store (the predecessor of Intime Retail), becoming the second-largest shareholder after its founder Shen Guojun. In 2017, Alibaba invested an additional 19.8 billion Hong Kong dollars to privatize Intime Retail, becoming its controlling shareholder with a cumulative investment of over 25 billion Hong Kong dollars.

According to Alibaba's announcement regarding the sale, the total proceeds from the sale of Intime Retail amounted to approximately 7.4 billion yuan, and Alibaba expects to record a loss of approximately 9.3 billion yuan from the transaction.

It is worth mentioning that when Alibaba acquired Intime Retail, the online traffic dividend was gradually becoming saturated, and major e-commerce platforms were adjusting their strategies to focus on "New Retail". Other offline retail entities acquired by Alibaba later, such as RT-Mart and Sanjiang Shopping, were also core assets in its "New Retail" strategy.

As an important "test bed" in Alibaba's New Retail strategy, Intime Retail was bestowed with high expectations by the group, with visions expressed in 2019 of "creating another Intime Department Store online in the next five years".

Five years have passed, and although Intime Retail has continued to strengthen its online channels with Alibaba's internet resources, the high-cost heavy-asset model does not hold an advantage compared to the light-asset model of e-commerce platforms.

After acquiring Intime Retail, Alibaba did not disclose Intime's performance data separately. However, observing RT-Mart, another Alibaba-owned listed company with a heavy-asset model, it has faced multiple loss crises in recent years, relying on store closures and layoffs to polish its earnings, making survival a challenging endeavor.

According to Alibaba's latest business structure, the "New Retail" strategy is gradually being downplayed by the group, with new retail ventures such as Intime and RT-Mart being classified under the "N" business segment.

In addition to new retail ventures, the "N" segment also encompasses ventures in diverse fields such as Hema, Alibaba Health, Lingxi Interactive, Smart Information (primarily comprising UC Browser and Quark), Flying Pigs, DingTalk, and more.

However, the intricate business landscape also hampers the profitability of the "N" segment. According to Alibaba's mid-year report for the fiscal year 2025, revenue from the "All Other" business segment surged by 5.68% year-on-year to reach 99.179 billion yuan, accompanied by adjusted EBITA losses amounting to 2.845 billion yuan.

Over the years, Alibaba has invested billions of yuan in various ventures, with mixed results. Some investments have faltered due to slow development or being outpaced by competitors, while others have encountered strategic missteps leading to significant losses. Ultimately, the company's foundation remains grounded in its core e-commerce business.

Perhaps, as RT-Mart founder Huang Mingduan lamented after Alibaba's acquisition of RT-Mart, "We defeated all our competitors but lost to the times."

In the rapidly evolving landscape of our times, even a giant like Alibaba, which has orchestrated numerous miracles, may not be able to maintain its lead indefinitely. As the adage goes, it's challenging to turn a big ship around. The future direction of this colossal cruise ship that has navigated China's e-commerce history remains uncertain.