Cross-border E-commerce in 2024: SHEIN – The Journey Continues, Yet the Bell for Public Listing Still Unrung

![]() 01/02 2025

01/02 2025

![]() 667

667

In 2024, while sectors such as new energy vehicles and AI saw fierce competition, unnoticed transformations took place in other established industries.

Cross-border e-commerce is a prime example. Mainstream platforms embarked on model transformations or upgrades to capture larger markets and attract more users. Led by the "Four Little Dragons of Cross-border E-commerce," with support from mid-tier platforms and independent overseas sellers, the collective effort painted a vivid picture of globalization. These bold transformers have emerged as the compass for cross-border e-commerce.

(Image source: Unsplash)

SHEIN cannot be overlooked when discussing cross-border e-commerce.

The saying "like a dragon, seen the head but not the tail" aptly describes something or someone as mysterious and unpredictable. SHEIN has long embodied this ethos. However, in 2024, a year marked by rapid change, SHEIN underwent a series of unexpected transformations: the emergence of its enigmatic founder, fluctuating IPO progress, business breakthroughs in some markets, and rumored declines in performance data.

In cross-border e-commerce, such a unique narrative rarely unfolds. It not only portrays the situation of one platform but also encapsulates the vicissitudes of the fast fashion sector and the cross-border e-commerce industry, a tapestry woven with joys and sorrows, warmth, and chill.

Transformation in Progress

In 2024, significant changes permeated the industry. Hugo summarized the top ten cross-border e-commerce events, including the onset of the semi-managed model war, AI infiltration driving technological shifts, and the rise of innovative marketing and content e-commerce. Specifically, events like Amazon's collaboration with TikTok to enter the low-cost e-commerce market, AliExpress's debut in the US during "Singles' Day," and Wish's low-price sales overwhelmed cross-border sellers and supply chains.

However, the core discussion revolves around the internal changes made by major platforms for their development, rather than mere business competition. For SHEIN, the spotlight in previous years was on its mystery and rapid growth, but 2024 witnessed several interconnected, significant changes.

In April, SHEIN fully opened its self-operated model, covering several European countries; in June, it launched a "semi-managed" model in the US, expanding it to Germany, the UK, France, Italy, Spain, and other European countries in August. In December, exclusive financial reports revealed that, led by one of SHEIN's founders, the three core departments – merchandise center, category operation center, and global operation center – would operate independently and be financially self-sufficient, fostering fair competition between self-operated and platform businesses.

These actions supported the platform transformation initiated in May 2023. SHEIN significantly expanded its business recruitment scale this year, primarily targeting Europe with an e-commerce offensive to seek growth opportunities. In October, SHEIN announced the free opening of its European and American warehouses to fully managed merchants, assisting in overseas inventory management and fulfillment and delivery.

(Image source: Unsplash)

Undoubtedly, "transformation" was both a trend in the cross-border e-commerce industry and a keyword for SHEIN in 2024. However, not all these transformations were conscious upgrades but also reflected the helplessness of industry competition.

A Caixin report on October 23, 2024, revealed that SHEIN earned $18 billion in revenue in the first half of 2024, with year-on-year growth slowing from 40% last year to 23%, and future revenue growth expected to remain within the 20%-30% range; net profit was less than $400 million, a year-on-year decrease of over 70%; and net profit margin fell from 8% last year to 2%.

Different institutions have varying opinions, and SHEIN has not responded to these figures. However, media generally believe this mirrors the trajectory of domestic e-commerce competition, where rapid transformation and competitive pressure prevent SHEIN from sustaining its initial black horse-like growth. While its small-order, quick-response model initially caught the industry off guard, as TechPlanet once quoted an insider saying:

"SHEIN wants to be a platform, but the women's wear market share is already large enough; there's not much room for expansion."

Old Waves and New Tides

SHEIN owes its popularity to global female consumers. Its fast fashion products, beauty items, accessories, etc., are well-suited to capture the hearts of female consumers through high-frequency, low-cost offerings.

(Image source: Unsplash)

However, the penetration rate in a specific region, the number of target consumers, and the number of expandable regions are not infinite. SHEIN is not content with just a slice of the pie.

This naturally leads to a distinctly defined curve for businesses in these categories:

During the growth stage, rapid penetration and development may yield impressive results. For example, after entering the Japanese market in 2020, SHEIN surpassed Uniqlo in online user numbers due to the e-commerce boom. According to data from Japanese research firm VALUES, in September 2024, SHEIN had 8.04 million app users, exceeding Uniqlo's 6.48 million online users.

Another example is that, according to Similarweb data, SHEIN was the most visited clothing and fashion brand globally in September and the third quarter of this year.

In the maturity stage, a steep growth curve over a short period indicates rapidly increasing market competition and shrinking growth space. In September, SHEIN was reported to have laid off employees. Data from the third-party e-commerce data platform ECDB shows that from 2020 to 2023, SHEIN's revenue growth rate declined from 238% to around 40%. The expected growth rate of 20% to 30% suggests that the market believes SHEIN still faces downward pressure.

One possible source of this perception is the inherent constraints of the fast fashion sector itself. In September this year, Wired, a globally renowned tech media outlet, criticized SHEIN as the world's "largest polluter in fast fashion." Prior to this article, in March, ECNS reported that France planned to introduce legislation to strictly regulate "fast fashion," imposing taxes on each garment to curb pollution and waste.

(Image source: WIRED official website)

The sector SHEIN occupies has inherent disadvantages. While emphasizing "speed," fast fashion is hard to avoid criticism from the media and institutions regarding its turnover model.

Furthermore, although SHEIN initiated its platform transformation in May 2023, the semi-managed model was not launched until May 2024, and the implementation of business line reforms arrived only towards the end of the year, indicating that SHEIN also needed time to explore responses to environmental changes. Additionally, according to TechPlanet, non-apparel categories currently account for about 40% of SHEIN's sales, but while apparel offers high returns due to high consumption, it remains a question whether other categories can offer better returns on investment.

In the fast fashion sector, SHEIN once "trounced" overseas brands that refused to give in with its innovative stance. By 2024, however, SHEIN had become the "big brother" of the industry and could no longer normalize breakthroughs.

According to the well-known data company Statista, 70% of American fashion online shoppers are familiar with SHEIN. But once their demand for SHEIN's products is satisfied, they will start looking for new consumption hotspots. SHEIN's platform expansion will inevitably be anchored on this, continuously opening up space and meeting challenges. Compared to the speed of changing consumer demands, the efficiency of a series of service constructions that cross-border e-commerce needs to undertake ultimately lags behind.

The Bell Hasn't Rung Yet

Faced with a complex development situation, in October this year, multiple media outlets reported that Xu Yangtian, SHEIN's enigmatic founder and true helmsman, began to actively participate in offline events, effectively ending SHEIN's low-profile past.

As the richest person in the fashion and retail industry on Forbes's "2024 China Rich List," Xu Yangtian no longer needs to emerge for SHEIN's operational tasks. The media has noted that he needs to meet with investors to prepare for the crucial step of going public.

The "crucial step" is not an empty phrase. To date, there has been no definitive news of SHEIN's IPO.

Earlier this year, the UK's Financial Conduct Authority (FCA) overhauled the listing rules for London-listed companies, aiming to attract more active enterprises to boost its IPO market. After encountering obstacles in its US IPO plans, SHEIN also chose the UK. The FCA's CEO also stated that the focus for a company to list in the UK is on risk, "as long as the company discloses it and investors understand it." In other words, there is no opposition to SHEIN listing in London.

However, despite these statements, regulatory agencies have not been lax. In fact, since it was reported in June this year that SHEIN had secretly submitted a prospectus to London, it has undergone a longer IPO process than usual. When researching SHEIN's business model, consulting firm Xingyuan Consulting commented that "just as Mencius' mother moved three times in ancient times, SHEIN has moved its headquarters twice now." However, even with its headquarters in Singapore and senior executives stating that SHEIN is not a Chinese company, SHEIN cannot bypass necessary processes and inspections.

Chen Caijing of Xiaoxiang Morning Post cited a Reuters report stating that UK financial regulators are still examining and assessing the risks associated with SHEIN. One certain direction may be that UK legislators plan to conduct an inquiry into "employment rights" in January 2025, with SHEIN likely to be questioned.

(Image source: Financial Times, UK)

While this seems like a necessary process for SHEIN, it will undoubtedly further delay its IPO process. The biggest impact is that, unlike players in emerging sectors like AI, who can potentially win higher valuations by delaying and relying on industry buzz, as a member of the fast fashion sector, SHEIN needs to go public while maintaining relatively high growth value.

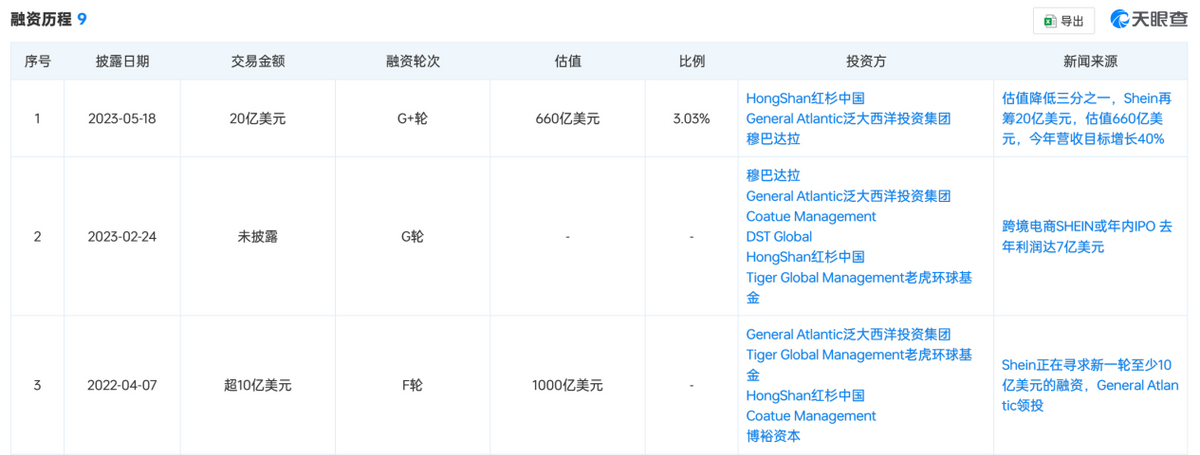

According to a Wall Street Journal report cited by 36Kr, when SHEIN completed fundraising in May last year, it raised $2 billion, but its post-fundraising valuation was $66 billion, a decrease of over one-third from $100 billion in 2022. As 2024 draws to a close, SHEIN has further observed the shifting market hotspots and the subdued IPO market.

(Image source: Tianyancha)

This can still be attributed to increasing competition in the fast fashion sector and cross-border e-commerce industry. However, as the center of attention, SHEIN can only strive to complete all actions required for its IPO and submit its answer sheet accordingly.

In short, as the last day of 2024 passes, all this will soon be left behind. SHEIN has many tasks ahead, and it will become accustomed to being scrutinized by the outside world. Becoming a listed company is a necessary milestone for it.

Source: Pinecone Finance