Reddit vs Zhihu in 2024: Traffic, AI, Collaboration - Who Will Dominate the Future of Knowledge Commerce?

![]() 01/10 2025

01/10 2025

![]() 567

567

Is Zhihu Finally Scaling New Heights?

In 2024, Reddit (RDDT.US), often referred to as the "American counterpart of Baidu Tieba," successfully went public in late March after nearly two decades. Within a year of its IPO, Reddit's share price has tripled, continuously setting new benchmarks, making it a sought-after investment on Wall Street.

In contrast, Zhihu, listed on U.S. and Hong Kong stock exchanges in 2021 and 2022 respectively, has witnessed its share price languish for over a year. As knowledge-sharing Q&A communities, can Zhihu keep pace with Reddit's surge in the new year? What advantages does Reddit possess in 2024? Will Zhihu lag behind again, and why?

Considering these questions, perhaps we can ascertain whether Zhihu can achieve new heights once more.

Timing is Crucial: What Advantages Does Reddit Have in 2024?

The core essence of Zhihu and Reddit is identical; they are both knowledge-based Q&A platforms. The primary difference lies in Reddit's more thorough approach to being "genuinely democratic" by minimizing the influence of the platform and key opinion leaders (KOLs).

Specifically, unlike Douyin or WeChat Mini Programs, where users can "passively receive content" through platform recommendations, Reddit users navigate the platform based on their interests in specific communities or posts, or by searching for content. Consequently, Reddit and Zhihu exert less control over traffic compared to search platforms like Douyin or WeChat Mini Programs that have both public and private domain traffic.

However, unlike Zhihu, Reddit pursues a truly "decentralized" model where users cannot "follow" each other, only "private message." This design makes it challenging for Reddit to cultivate an influencer economy.

This unique positioning has allowed Reddit, founded around the same time as Facebook, to endure from the PC era, through the "Internet+" era, to the new AI era. During this time, it withstood the pressure from numerous mobile era newcomers such as Instagram, Snapchat, and Twitter. Nevertheless, its user base has never matched these content giants. By the end of 2023, Reddit had 73.1 million DAUs globally.

Yet, being "decentralized" is both a boon and a bane. While Reddit has survived, it hasn't grasped the scale of commercialization effectively. The platform cannot control the traffic, nor does the traffic belong to KOLs; it belongs to the communities. Traffic is significantly diverted among similar communities, limiting Reddit's commercialization path.

For over a decade after its founding in 2005, Reddit struggled to establish a viable business model. It didn't even have a proper advertising system until 2018, and its official app was launched in 2016.

It wasn't until 2019 that Reddit truly embarked on its commercialization journey. After revenue reached $480 million in 2021, Reddit gained the confidence to pursue an IPO.

However, the real turning point in addressing the core contradiction of platform commercialization occurred in 2023. Prior to that, Reddit's user growth remained sluggish, with only single-digit increases.

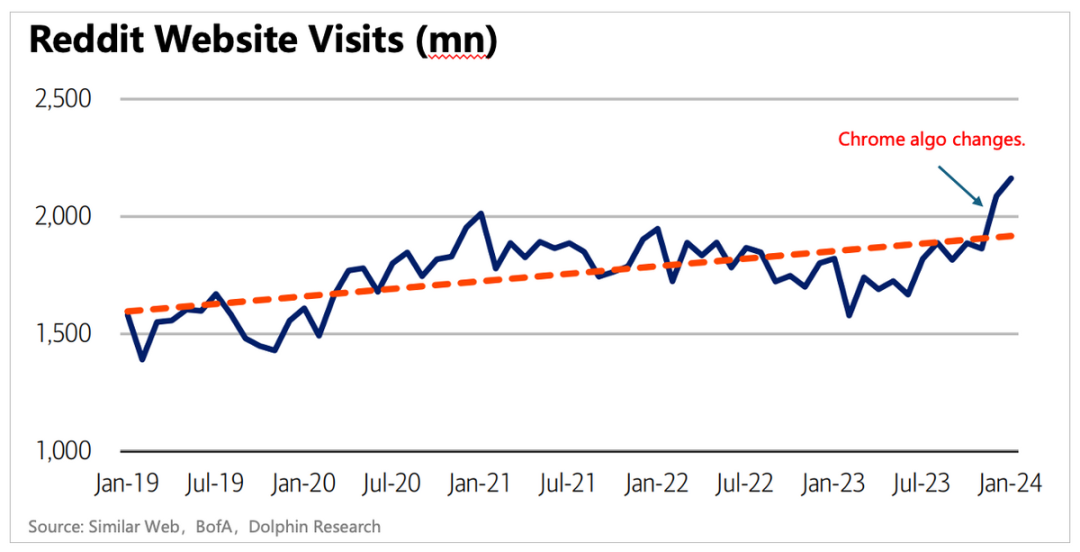

In the second half of 2023, Reddit successfully seized the opportunity to collaborate with Google. According to the collaboration agreement, both parties adjusted their search algorithms, significantly increasing the proportion of Reddit links in Chrome search results and placing them in more prominent positions. It's no exaggeration to say that Google directed its vast global traffic of 3 billion directly to Reddit.

Furthermore, in the second quarter of 2024, Reddit introduced OpenAI to provide technical support, enhancing Reddit's translation and moderation needs with AI technology, helping the platform swiftly attract international users from non-English-speaking regions. By the first half of last year, Reddit had launched translation functions for French, Spanish, German, and Portuguese.

After these two successful collaborations, starting from the third quarter of 2023, Reddit's daily active users began to grow rapidly, with both U.S. and international users experiencing a 50% expansion in less than a year.

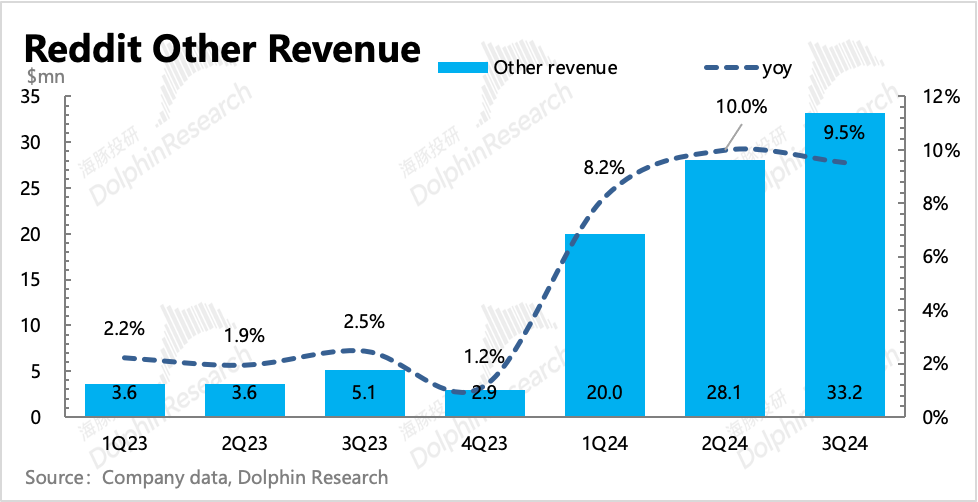

Additionally, as we enter the era of digital intelligence, the commercial value of Reddit's core data assets is being explored. To date, Reddit has authorized its content data to Google and OpenAI for training large models and to some small and medium-sized platforms for user behavior data analysis. According to contract agreements, the three-year contracts signed by Reddit with Google and OpenAI are worth approximately $200 million and $135 million, respectively.

It is evident that the influx of massive traffic from internet giants and the exploration of new AI businesses are helping Reddit overcome the contradiction between traffic equity and commercialization.

Coincidentally, the second half of 2024 marks the beginning of the commercialization of AI applications. During this period, many U.S. stock data analysis companies, such as Palantir, experienced the Davis double play of new AI-driven growth and significant share price increases, demonstrating the commercial path of AI applications in content. As a content enterprise with genuine AI incremental logic, Reddit's IPO naturally enjoyed a significant premium.

Does this logic imply that Zhihu's layout in the AI field is not eye-catching enough?

Once Ahead, Now Facing Greater Challenges

As China's largest question-and-answer online community, Zhihu is undoubtedly successful. Over the years, it has survived the onslaught of new forces such as Douyin and Xiaohongshu, as well as numerous new search models, and achieved dual listings on U.S. and Hong Kong stock exchanges in 2021 and 2022 respectively.

At the dawn of the technological transformation era, the focus now is on analyzing Zhihu's business model and its changes.

Zhihu's business model has always been clear, consisting of two main modules: knowledge payment and advertising revenue. The primary change has been in the priority of these two modules.

Zhihu's website was launched in 2011, and in 2013, it transitioned from an invitation-only registration method to be open to the public.

Three years later, Zhihu embarked on its commercialization journey. In that year, Zhihu simultaneously launched its advertising business and knowledge payment business. However, the management prioritized the advertising business as the starting point for commercialization. Zhou Yuan, the founder of Zhihu, explicitly stated at the time, "When Zhihu considers making money and monetization, the first thing to do is advertising."

This turned out to be the case. As of 2021, the year Zhihu went public on the U.S. stock market, online advertising and commercial content solution businesses contributed more than 71% of its total revenue, while content payment only contributed a little over 20%. It can be said that half of Zhihu's success in the commercial market ahead of Reddit is attributed to its advertising business.

As for the paid content business, it wasn't until the launch of Yanxuan membership in 2019 that Zhihu officially entered this sector, resulting in a slightly slower growth rate compared to the advertising business in the following years.

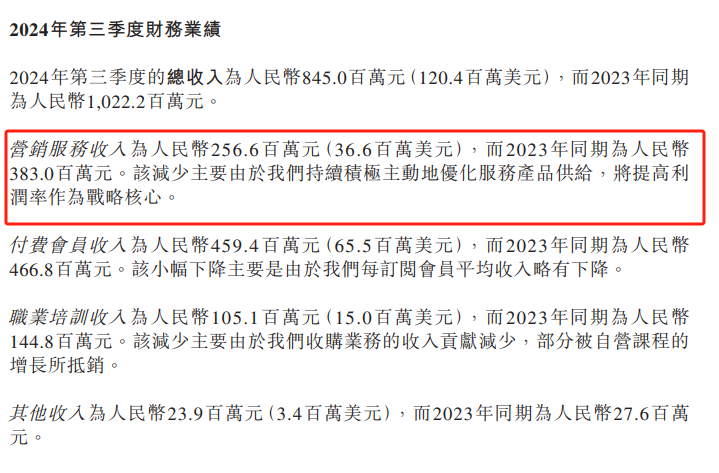

In recent years, with the emergence of various forms of commercial advertising solutions and content platforms, Zhihu's online advertising business expansion advantage has begun to wane, and content payment has successfully taken over, driving the platform's growth. From 2021 to 2023, Zhihu's annual revenue scaled from 2.96 billion yuan to 4.199 billion yuan. As of the third quarter of 2024, paid reading business revenue increased by 48.4% year-on-year, contributing half of Zhihu's revenue, while marketing services accounted for around 30%.

Based on its strong fundamentals, Zhihu's performance in the stock market was commendable during its initial public offering. However, what has concerned investors in the past one to two years is that AI technology, as a cutting-edge tool, has brought disruptive impacts on content industries such as search engines. The sustainability of growth in Zhihu's content payment business may not be as reliable or sufficient to withstand the pressure from numerous competitors.

This means that in an era where traffic and scale are paramount, although Zhihu has already established a business model and its business scale continues to expand, its two main businesses are suffering from impacts from technology and peers.

Meanwhile, since the end of 2022, when ChatGPT ignited the era of AI generation, almost all internet giants, software and hardware technology companies, or various application vendors have intensified their layout in related fields.

On the one hand, Zhihu has maintained its keenness on new technologies. For example, in April 2023, it launched the Chinese large model "Zhihai Tu AI," shortly after "ERNIE Bot." It has also been active subsequently. On the other hand, as of now, AI's commercial value has achieved certain tangible results on both the hardware supply side and the software application side. In comparison, Zhihu seems somewhat inconspicuous.

These factors have constituted important reasons suppressing its market value performance.

Therefore, to boost investor confidence, Zhihu needs to re-clarify its new strategies going forward.

Breaking Boundaries: Collaboration is Crucial for Industry Leaders

In fact, Zhihu has swung rapidly under various impacts in recent years. In 2021 and 2023, Zhihu twice promoted short video and short content strategies but withdrew after finding that they would impact its ecosystem, ultimately returning to the principle of "ecology first".

As the founder Zhou Yuan clearly stated, "professional discussion" will be Zhihu's long-term positioning. However, this does not mean that content forms cannot be innovated at all. Videos and short content should be supplementary to organic community content.

To respect users' mainstream needs, Zhihu's content forms have evolved from initial text-based Q&A to image-text content. Later, Zhihu also explored video and live streaming content forms, and its content categories have expanded from mainly internet and technology to entertainment, fashion, digital, and other mass content consumption areas.

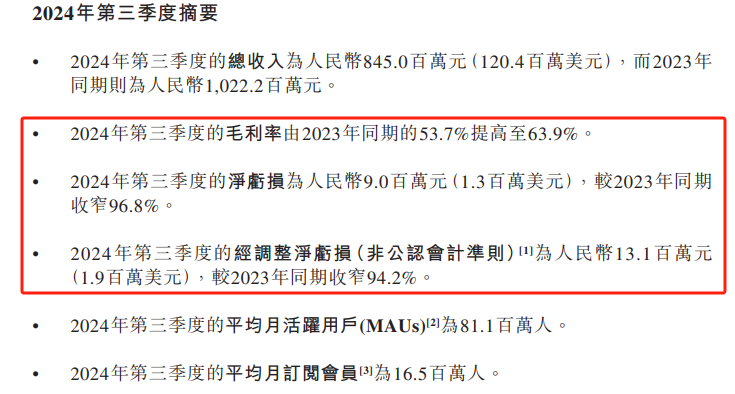

Currently, Zhihu has over 30 sections, including finance, esports, health, and careers. The creators' experience, content satisfaction, and community atmosphere have significantly improved, matching the commercial growth rate adapted to community expansion. Taking the paid user business in the third quarter of 2024 as an example, the average monthly subscription membership was 16.5 million, a year-on-year increase of 11.49% compared to 14.8 million in the same period last year.

This community spillover growth driven by the ecosystem may not be as eye-catching as scale-driven expansion, but it cultivates a land that can create sustainable value, fostering healthy competition.

While stabilizing its basic operations, Zhihu must also consider how to fight this challenging battle with AI.

According to available information, Zhihu has made several moves in the AI field in 2024, including continuously optimizing the "Zhihai Tu AI" large model; launching the official product "Zhihu Direct Answer" on the search application with the added "Professional Search" feature, providing users with over 50 million pieces of Chinese and English literature data; using AI technology for intelligent content moderation to improve efficiency and accuracy; and hosting events such as the "Zhihu AI Pioneer Salon" for community interaction.

Based on these layouts, according to the AITOP product ranking, "Zhihu Direct Answer" saw a staggering 430% increase in monthly visits in July, ranking fifth on the global AI product growth chart, leading all domestic AI products.

Meanwhile, empowered by AI technology, its net loss in the third quarter of 2024 narrowed by 96.8% year-on-year to 9 million yuan, again setting a record for the largest loss reduction and the lowest net loss in a single quarter since its IPO. During the same period, the gross margin increased by 10 percentage points, reaching a record high of 63.9%.

After years of hard work, Zhihu is finally on the cusp of positive profitability.

However, unlike Reddit's qualitative change resulting from Google's traffic infusion and the monetization of its data resources in the hands of giants, the above-mentioned factors are not yet enough for investors to determine that Zhihu has undergone a "qualitative" change in the short term.

In the era of transformation driven by AI technology, it is inevitable that some companies will lag behind, but others will see the other side of competition - collaboration - and thus turn the tide against the wind.

The stark contrast between Reddit and Zhihu is not uncommon at home and abroad. For example, Xingtu, backed by ByteDance, is quietly experiencing explosive growth, while Meitu, which has lost its growth direction, has begun dabbling in Bitcoin.

At this juncture, "Zhihus" that hold vast data resources or user traffic need to step out of their comfort zones and re-examine the dialectic of collaboration and competition. At least in the lush and fertile soil of AI, timely collaboration may bring more unexpected possibilities.

Source: U.S. Stock Research Society