2025: The Year of Anti-Involution for E-commerce

![]() 01/10 2025

01/10 2025

![]() 687

687

E-commerce platforms are aligning with merchants in a significant shift.

By Guo Xiaomiao, Edited by Wan Tiannan

On January 6, Douyin launched nine merchant support policies, marking the commencement of the e-commerce industry's anti-involution battle for 2025. Following suit, on January 9, Taobao and Tmall unveiled numerous measures at their merchant service conference to optimize the business environment and safeguard merchant rights.

Overall, Douyin's support policies are divided into two primary categories: fee reductions and platform mechanism adjustments. These include waiving commissions for live streaming and short video scenarios, automatic refunds of promotion fees, and reduced shipping insurance and deposits. Additionally, the platform is optimizing algorithm mechanisms and cracking down on vicious competition.

Meanwhile, Tmall had already introduced new regulations after last year's 618 shopping festival, such as de-emphasizing the lowest price and adjusting the full refund policy. This round of "updates" focuses more on optimization and refinement. For instance, establishing an account system to protect merchants from "wool-pulling" behavior, continuing to enhance the "Return Assurance" service, and clarifying dispute resolution rules for different industry segments.

E-commerce platforms' embrace of anti-involution is not only a platform-driven direction but also a regulatory mandate. At the Central Economic Work Conference held late last year, it was explicitly stated that involutional competition should be opposed and rectified.

Fundamentally, the collective anti-involution movement arises from platforms realizing that the lowest prices and full refunds are unsustainable for high-quality growth. In a bilateral platform model, excessively favoring either side disrupts the ecological balance, leading to mutual loss. Furthermore, as e-commerce platform users approach their peak, the primary channel for GMV growth shifts from user expansion to higher average order values and increased repurchase frequencies.

Parallel to anti-involution is the pursuit of "incremental growth." For example, recently, WeChat and Taobao leveraged the Spring Festival bonus to introduce gifting functions.

Anti-involution and incremental growth will be the dominant themes for e-commerce platforms in 2025.

Full refunds and the lowest prices have left many merchants and brands feeling stifled.

After purchasing a $1.10 item online and requesting a full refund without returning the goods, the merchant sued, and the court ruled that the buyer must pay $800 in compensation. One merchant fought over 30 lawsuits in a year against "wool-pulling" behavior. Additionally, a gray industry has emerged to exploit shipping insurance, with some speculators openly posting guides on "exploiting shipping insurance, easy to get started," among other tactics.

This trend began in 2021 when Pinduoduo pioneered the "full refund" policy in China, enabling users to receive refunds without returning goods. Initially aimed at perishable fresh produce, this rule later expanded to all categories.

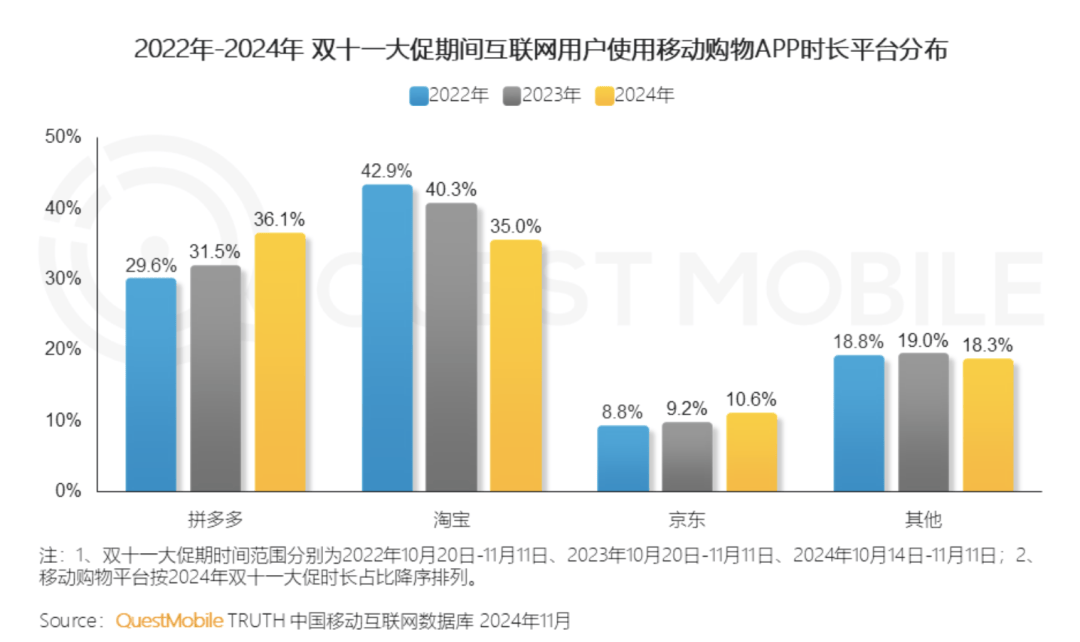

Pinduoduo's rapid growth continuously eroded the market share of other platforms, evoking envy among competitors. According to QuestMobile's 2024 "Singles' Day" insight report, Pinduoduo's user engagement time has surged over the past three years, surpassing Taobao to reach 36.1% by 2024.

Starting in September 2023, Douyin, Taobao, JD.com, and Kuaishou successively followed suit with full refund policies. By early 2024, full refunds had almost become standard in e-commerce, intensifying low-price competition. However, this excessive user-centric focus led to frequent incidents of "wool-pulling" mentioned earlier.

The "2024 E-commerce Platform 'Full Refund' Survey Report," released by "DianSuBao" in collaboration with the China Academy of Information and Communications Technology's (CAICT) E-commerce Research Center, revealed that among nearly 1,000 consumer survey respondents, 25% used the "full refund" service for "wool-pulling," and 18.75% chose whether to use it based on the merchant's handling.

In November 2024, Xia Jiechang, President of the China Marketing Association, publicly criticized that low prices are merely a means, and the real goal is to attract more traffic and convert it into sales, i.e., traffic monetization. In the complex system comprising low prices, traffic, and sales, "only low prices" and "seeking traffic" are not sustainable rules for merchants.

Merchants' backlash and criticism from various sectors have prompted platforms to collectively reflect on the rationality of full refunds and the lowest prices, successively introducing new regulations to counter involution and improve the merchant business environment. These measures are primarily divided into the following four aspects:

First, no longer blindly pursuing the lowest prices.

After the 2024 618 promotion, Taobao announced it would weaken the search weight of "Five-Star Price Force," shifting assessment focus to GMV and AAC (Average Annual Consumption). In July, Douyin announced it would weaken the price comparison strategy and prioritize GMV. Last November, Pinduoduo allowed merchants to opt-out of the "automatic price following" function during promotions.

Second, refining the "full refund without return" rule.

Regarding malicious full refund incidents, in December 2024, Kuaishou E-commerce directly announced the termination of the "refund without return" service.

In the nine new e-commerce regulations launched by Douyin on January 6, it was clearly stated that when users apply for a full refund, Douyin will proactively intervene to safeguard merchants' legitimate rights and interests. The algorithm has also been adjusted to minimize users encountering the same product after placing an order but before receiving it. For Douyin, which has strong media attributes, this strategy is more effective than simply adjusting full refund rules.

In July 2024, Taobao and Tmall announced they would give merchants after-sales autonomy, reducing or eliminating after-sales intervention for stores with a rating of 4.8 or above. On January 9, Taobao and Tmall went further, announcing the establishment of the e-commerce industry's first account integrity system. For abnormal full refunds, return swaps, false returns, and the use of online/edited images, merchants can report these behaviors through complaints, which will be recorded in the account integrity system. Based on the situation, the platform will reject after-sales service, limit purchases in single stores or across the platform, etc. For professional "wool-pullers," Taobao and Tmall will also cooperate with relevant departments to transfer cases to judicial authorities.

There are also measures surrounding the account integrity system. For example, Tmall has taken the lead in giving merchants with stores rated 4.8 or above certain capabilities to handle abnormal behaviors, including but not limited to the platform not proactively intervening, restricting orders for accounts and stores, and excluding product returns/dispute rates.

Besides wool-pulling, disputes sometimes arise between merchants and consumers regarding returns. To address this, Tmall has introduced industry standards for segmented industries to reduce disputes, covering clothing, jewelry, pets, and other sectors.

Third, directly reducing merchant pressure through measures like shipping insurance discounts.

In September 2024, Tmall launched the "Return Assurance" service, which can reduce merchants' return and exchange costs by 10% to 30%, expected to save merchants 2 billion yuan in return and exchange shipping costs throughout the year. In the new regulations announced on January 9, Tmall will also pilot a user enrollment mode, allowing merchants to choose whether to use the "Return Assurance" product during promotions, helping small and medium-sized merchants further reduce operating costs.

Douyin has coordinated with partners to reduce shipping insurance costs by 10%-40% for eligible merchants or influencers, expecting to save merchants over 4.5 billion yuan in 2025.

Fourth, reducing merchant operating costs by decreasing commissions, deposits, etc.

In September 2024, Pinduoduo announced it would automatically refund technical service fees for refund orders of all products.

Douyin E-commerce disclosed that it saved merchants tens of billions of yuan by directly waiving commissions on product cards in the shelf field in 2024. This effort will continue to expand. According to the newly issued regulations, Douyin E-commerce will extend this scope to multiple categories in live streaming and short video scenarios. It is expected that the first phase will cover three major categories: fruits and fresh produce, daily necessities, and kitchenware, with subsequent expansion to 18 categories such as agricultural products, seafood, handicrafts, and intangible cultural heritage skills. The deposit for 32 first-level categories has been continuously reduced, with the maximum reduction reaching 98.7%, covering about 80% of merchants.

Moreover, Douyin has introduced a promotion fee refund policy, unprecedented on other platforms: Previously, if a consumer refunded an item, the merchant's advertising fee would be wasted. Now, the advertising fee will also be refunded for refunded items. This means that only when traffic is more precise can the platform earn money. It is expected that within 2025, advertising costs on Douyin may increase, and content requirements for merchants will also be elevated.

For small and medium-sized merchants, Douyin E-commerce plans to invest hundreds of millions of yuan to establish a "Small Merchant Assistance Fund," providing support for product launches, first-order incentives, long-term operations, and other scenarios. Small merchants can receive up to 6,000 yuan in traffic vouchers and targeted traffic subsidies on the platform.

The major platforms' rejection of involution is not merely out of sympathy for merchants' difficulties; there are also regulatory requirements from external factors.

In November 2024, the State Administration for Market Regulation summoned six e-commerce platforms, informing them of issues like their "full refund" rules squeezing merchant survival space and fostering a culture of low-quality, low-price competition. Rectification requirements were proposed in terms of optimizing agreement rules, enhancing rule transparency, and safeguarding merchants' independent operating rights.

Beyond complying with regulatory requirements, a more direct reason is that platforms have discovered that prioritizing low prices and after-sales policies excessively biased towards consumers is difficult to sustain high-quality growth.

According to a LatePost report, in March and April 2024, Douyin E-commerce's sales growth rate slowed down for the first time, with year-on-year sales growth declining below 40% for two consecutive months; in May, it fell to less than 30%. In 2023, this figure was basically maintained above 50%.

Since 2023, JD.com, which focuses on service, has shouted the slogan of "truly cheap" with low prices as its main theme. According to financial report data, JD.com's revenue growth rate decreased from 9.95% to 5.12% from 2022 to the third quarter of 2024.

An insider from JD.com told Caijing Story that they have found that when users consume high-end products with high average order values, such as hundred-inch TVs, "these users are not short of money and are actually more sensitive to service quality." Therefore, JD.com should strengthen its strengths in service and quality.

For the six months ended September 30, 2024, Tmall Group's revenue was 212.3 billion yuan, almost the same as the same period last year.

Even Pinduoduo's growth rate has begun to slow down. According to financial report data, Pinduoduo's revenue in the third quarter of 2024 increased by 44.33% year-on-year, compared to 93.89% in the same period last year.

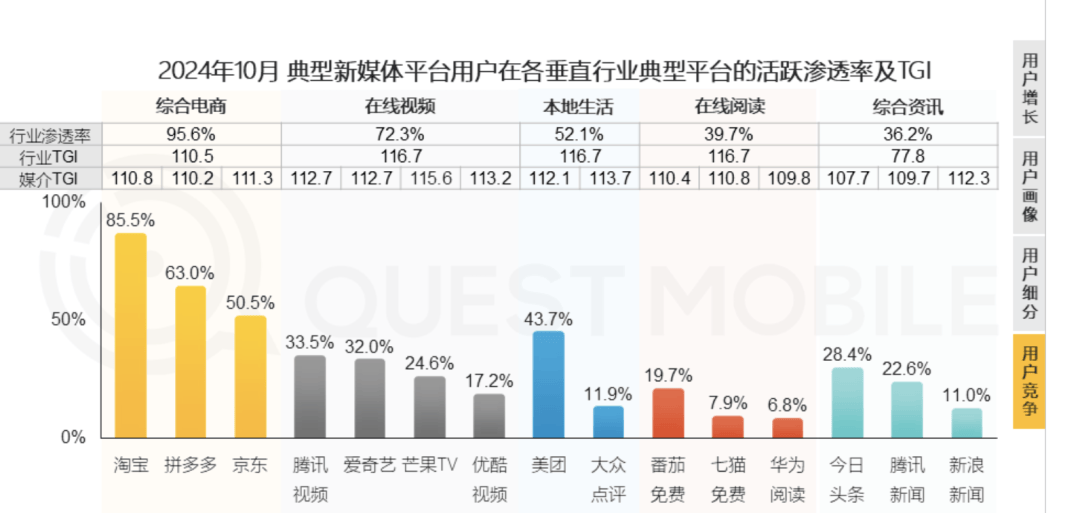

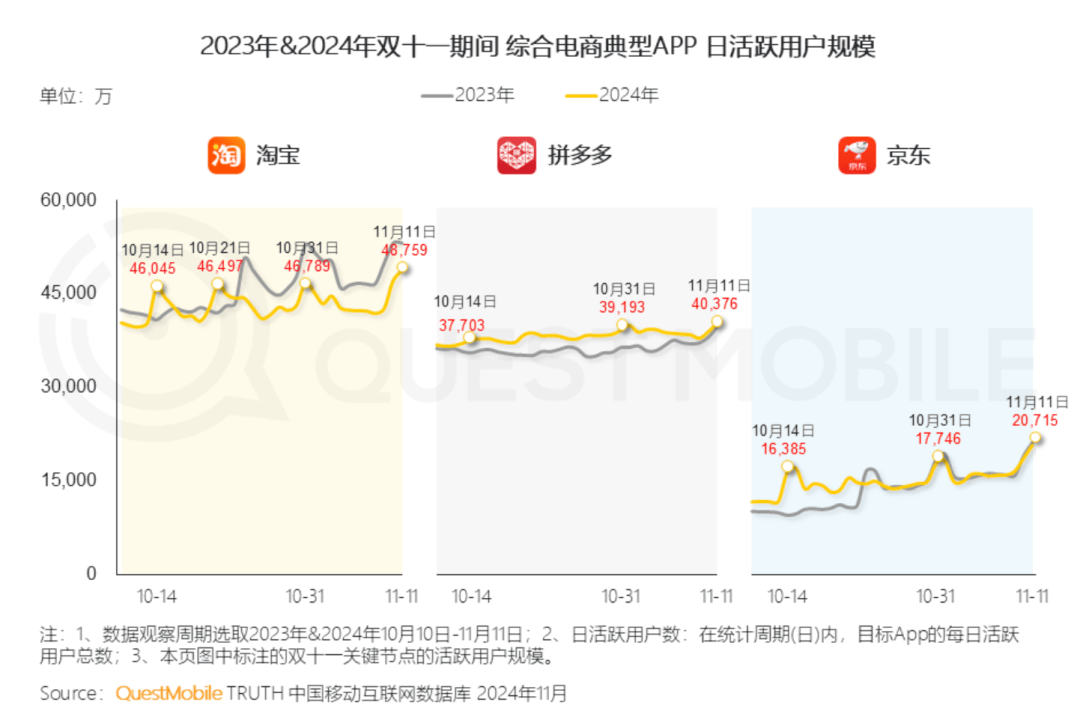

E-commerce platform users are gradually entering a saturation period. According to QuestMobile data, the active penetration rate of the comprehensive e-commerce industry was 95.6% in October 2024, indicating that the number of e-commerce platform users has almost peaked. From the peak daily active user data during the 2024 Double 11 shopping festival, Taobao saw a year-on-year decline, while JD.com and Pinduoduo remained flat.

For platform companies like e-commerce, which operate in bilateral markets, early on, they can rely on the marginal growth of user numbers to drive merchant count, GMV, and platform revenue. However, as user growth slows down and the marginal effect diminishes, improving user stickiness, repurchase rates, and average order values becomes the optimal choice for growth.

An economic view posits that in the short term, demand is key, but in the long term, supply is crucial. Only high-quality supply that meets high-quality consumer demand can drive high-quality development.

Nowadays, even Pinduoduo, which started with low prices, is well aware of this. As early as 2018, Pinduoduo launched the "New Brand Plan," attempting to create or introduce brands and drive ARPU (Average Revenue Per User) and revenue growth through high average order value products. Previously, Pinduoduo always required brands to offer the lowest prices across the entire network, but during the 2024 Double 11 shopping festival, it unprecedentedly relaxed the price requirement, requiring only that brands offer "same item, same price."

E-commerce, in essence, boils down to speed, quality, and cost-effectiveness. Although low prices briefly unified the messaging of e-commerce platforms, after a round of involution and trial and error, the platforms now understand clearly that a game that cannot benefit platforms, merchants, and users simultaneously cannot be sustained.

Next, competition among e-commerce platforms will shift to a comprehensive evaluation encompassing product quality, platform capabilities, user experience, and other integral strengths.

Externally, platforms are breaking down barriers, interconnecting, and learning from each other's strengths.

In terms of payments, last September, Tmall integrated WeChat Pay, and by October, JD.com announced plans to gradually integrate Alipay. During the same period, Taobao and Tmall officially integrated JD Logistics, while JD.com integrated Cainiao Express and Cainiao Stations. Additionally, Douyin advertised for Tmall's Double 11 promotion. These scenarios, unimaginable just a few years ago, underscore the importance of collaboration over zero-sum competition, especially amid stagnating internet platform traffic and the urgent need for new growth avenues on all fronts.

Internally, platforms are integrating and connecting resources to enhance growth efficiency.

In November 2024, Wu Yongming, CEO of Alibaba Group, issued an internal letter announcing changes to the organizational structure: Alibaba established the "Alibaba E-commerce Business Group," encompassing core e-commerce businesses like Tmall and Alibaba International, with Jiang Fan appointed as CEO of the E-commerce Business Group.

This adjustment is straightforward. Alibaba's strength lies in its supply chain, which facilitates global sales and boosts development efficiency. Additionally, departmental integration reduces redundancy, lowers operating costs, and enhances collaboration.

Beyond resource integration, platforms are also expanding into new scenarios. For instance, Taobao, WeChat, and Douyin have all set their sights on "gift giving." Given the Chinese tradition of gift-giving during the Spring Festival, this period presents a crucial opportunity for merchants and platforms to capture consumer attention. These platforms are leveraging this period to explore new growth potential.

Last December, WeChat's small stores began a grayscale test of the "gift giving" function. Except for jewelry and education and training products, other categories of WeChat small stores will default to supporting the "gift giving" function for products priced at or below 10,000 yuan. This recalls the 2014 red envelope war between WeChat and Alipay and is viewed by TF Securities as "potentially a socially disruptive moment for WeChat E-commerce."

In the same month, it was also revealed that Douyin supported gifting some products from e-commerce and local life group purchases. Furthermore, after receiving a gifted product, users can choose another product from the same store to gift back, deepening social interactions.

Subsequently, in January this year, Taobao also introduced products that "support gift giving." Users can click "Send as a Gift" to complete the order and payment, then "Send to a Friend," and share it via Taobao passwords, QR codes, etc., to complete the gift-giving process, which also supports sharing to WeChat.

Beyond exploring new scenarios through social and e-commerce, Douyin and Kuaishou are also prioritizing the shelf field.

For example, in March 2024, Douyin launched "Douyin Mall."

Arming oneself with technology is also the ultimate approach for platforms to reduce costs and increase efficiency.

In 2025, Taobao and Tmall will upgrade their AI shopping assistant XiaoMi, aiming to provide personalized AI intelligent services such as after-sales self-service to assist merchants in reducing costs and improving efficiency. Data shows that the customer service robot XiaoMi previously launched by Taobao and Tmall for merchants currently has 6 million active merchants. In the refund scenario, Taobao and Tmall will introduce refund analysis and upgrade order recovery tools to help merchants minimize losses.

After adjusting platform strategies and mechanisms, the next step is to introduce and support merchants.

To meet consumers' pursuit of cost-effective products, platforms are striving to strike a balance between low prices and quality and have promoted new regulations focusing on the upstream supply chain. This is the crux of competition behind the platforms.

On the eve of Double 11 in 2024, JD.com strengthened its support for industrial belt merchants and launched the "Factory Goods Subsidy Program" worth 10 billion yuan. Taobao held a matchmaking event for industrial belt merchants and suppliers to facilitate transactions, with most merchants hailing from crucial clothing industrial belts across the nation. Douyin Electric Commerce announced plans to create 20 industrial belts worth 10 billion yuan. Pinduoduo, through methods such as "direct shipping from origin" and "direct supply from factories," drove major agricultural production areas and industrial belts to directly connect with the national new year goods market, including relatively high-end categories like abalone and fish maw.

While products are available, selling them to consumers often necessitates operation on e-commerce platforms. However, for these industrial belt merchants focused on manufacturing, investing in content and traffic acquisition requires extra effort.

Consequently, platforms collectively emphasize services to reduce the market entry costs for industrial belt merchants – allowing them to focus solely on supply.

In May 2024, JD.com reduced the operational burden on industrial belt merchants through the "fully managed" and "quasi-self-operated" models. On the eve of Double 11 last year, Taobao conducted an internal test of its new store system, providing merchants with multiple store operation solutions to lower the operational threshold, including management tools and store products.

In the past, to bolster the platform's mindset towards live streaming sales, platforms tended to provide traffic support to major live streamers. However, the traffic pie is finite, and any inclination towards one side means reduced support for the other. Now that Douyin and Kuaishou have mature mindsets towards live streaming sales, they are also increasing their support for store live streaming.

36Kr reported in July 2024 that Douyin is decreasing the proportion of traffic allocated to influencer live streaming and redirecting it to high-quality short videos and brand store live streaming.

On one hand, this can bring more traffic to white-label merchants' self-broadcasting. For the platform, store live streaming also means generating more revenue, achieving a win-win situation with merchants. In a 2022 research report, Guohai Securities pointed out that under the brand self-broadcasting model, the platform primarily earns advertising fees from brand placements. Under the influencer broadcasting model, the platform earns commissions and MCN/influencer placements. The comprehensive monetization rate of brand self-broadcasting is higher than that of influencer sales.

In the past, platforms grew rapidly relying on traffic dividends. However, in the current era, platforms need to refine their mechanisms and mature. Biology has a concept called symbiosis, which refers to the cyclical process of competition and mutual assistance among all species within an ecosystem to achieve healthy growth.

The same applies to the e-commerce ecosystem. As a vital link connecting merchants and consumers, the platform's responsibility is to safeguard the interests of both parties and foster a healthy business environment. From the race to low prices to anti-involution, this shift represents major platforms re-evaluating their strengths and characteristics, ceasing homogeneous competition, and returning to healthy competition.