Xiaohongshu Emerges as Unexpected Global Hit Amid TikTok Ban

![]() 01/14 2025

01/14 2025

![]() 574

574

Author | Tang Fei Editor | Li Xiaotian

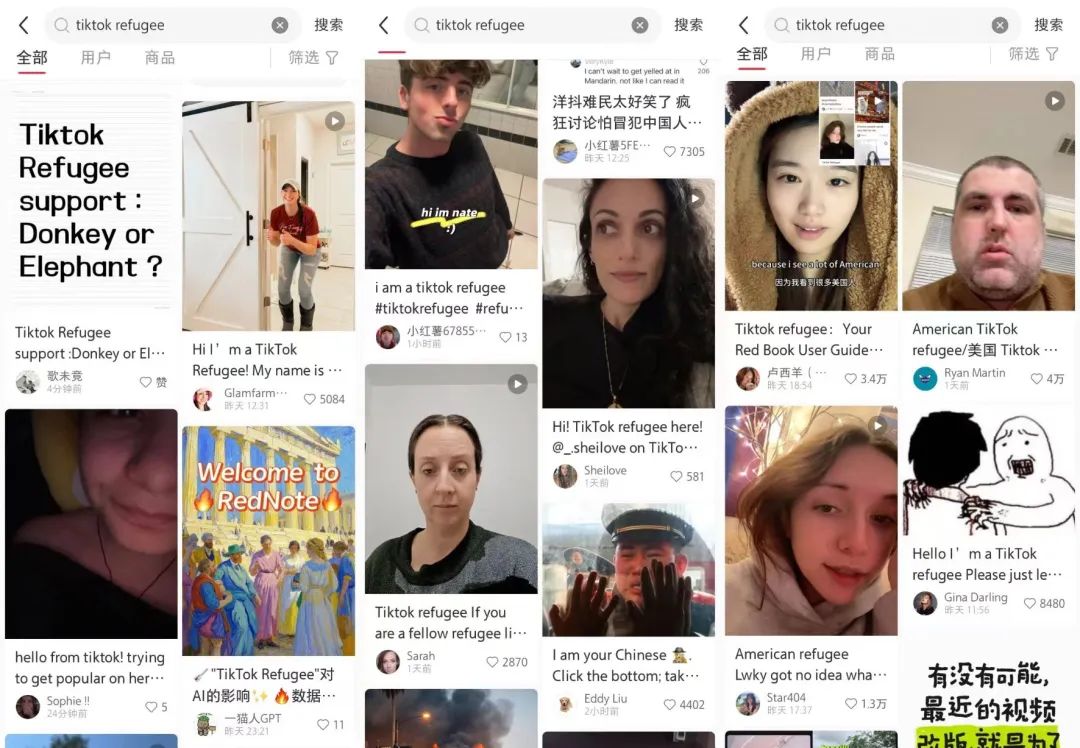

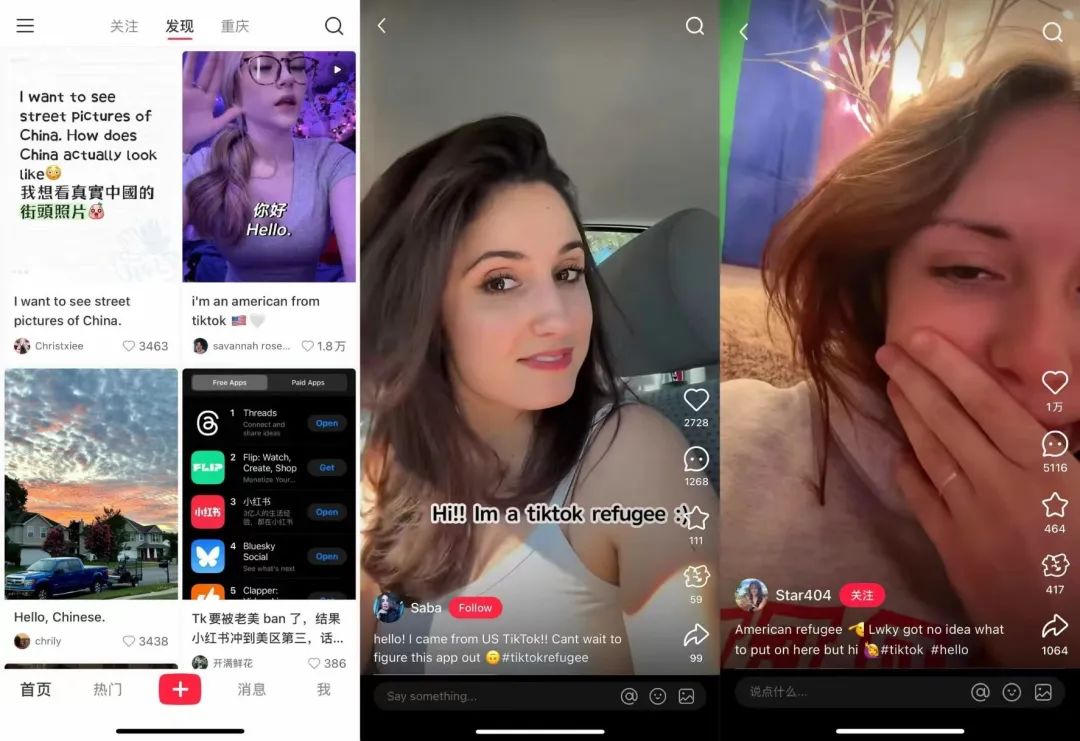

With the January 19 deadline for TikTok's forced sale looming, less than a week away, users are wondering where they will turn if the app is delisted in the US. The answer, surprisingly, is Xiaohongshu. On January 14, news broke that RedNote, the international version of the Chinese social app Xiaohongshu, has swiftly gained traction in the US. Opening Xiaohongshu, one encounters English content posted by American users who have tagged themselves as "#TikTokRefugee." As of 13:30 on January 14, the hashtag boasted 84,000 posts, over 44 million views, and more than 1.3 million discussions.

Xiaohongshu's sudden surge in popularity in the US is largely attributed to TikTok's impending delisting. According to a Bloomberg report, TikTok's oral arguments before the US Supreme Court concluded last Friday. Although no ruling was issued at the time, it now appears likely that the ban will be upheld. TikTok's lawyer, Noel Francisco, stated during Friday's debate that unless the justices overturn Congress's legislation or issue a temporary injunction, the platform will effectively cease operations on January 19. Despite outgoing President Trump's desire to save TikTok, his inauguration on January 20, the day after the ban takes effect, makes it unmistakably "too late." Consequently, a substantial number of TikTok users have been compelled to seek a new "refuge," with Xiaohongshu emerging as their top choice.

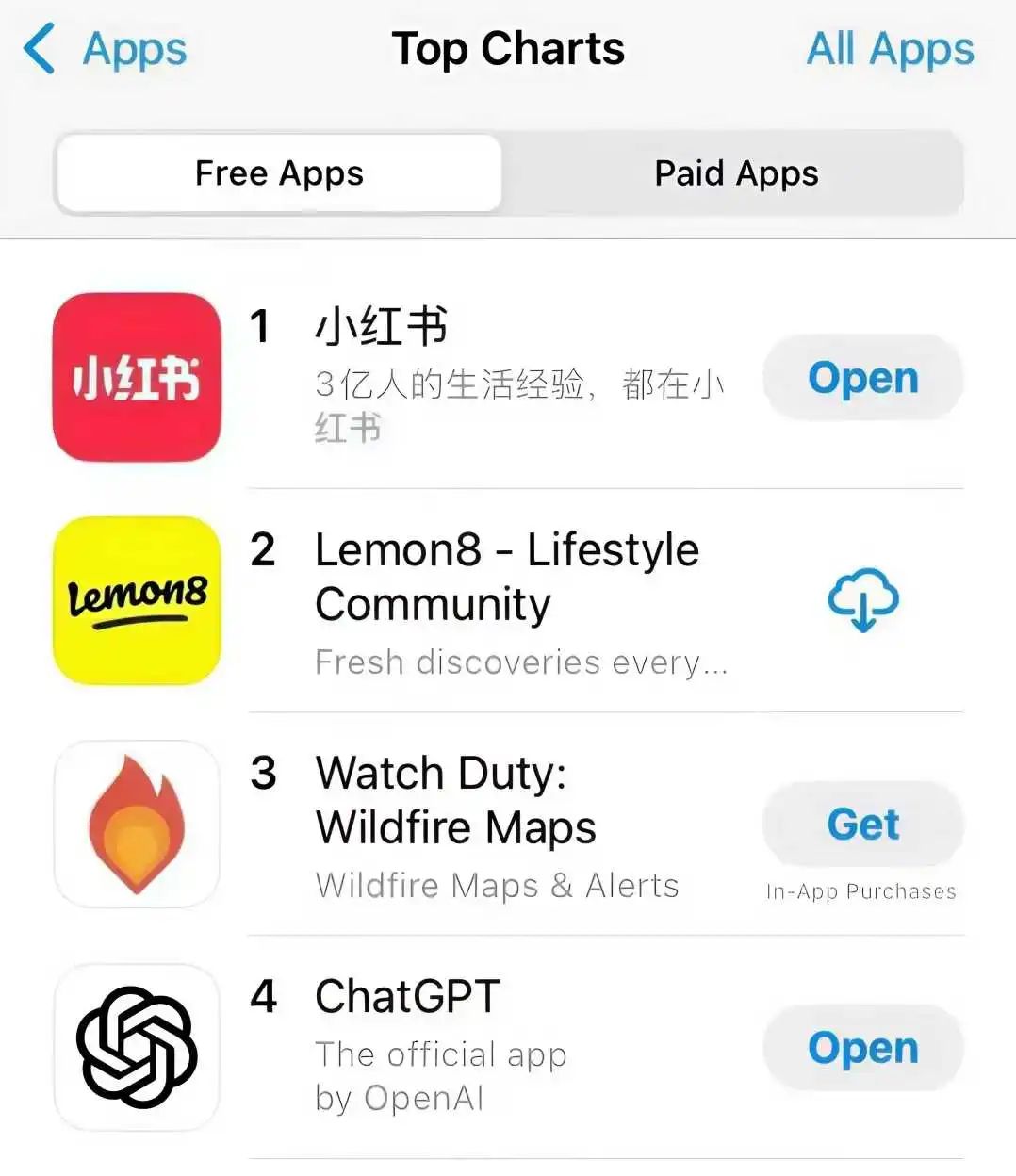

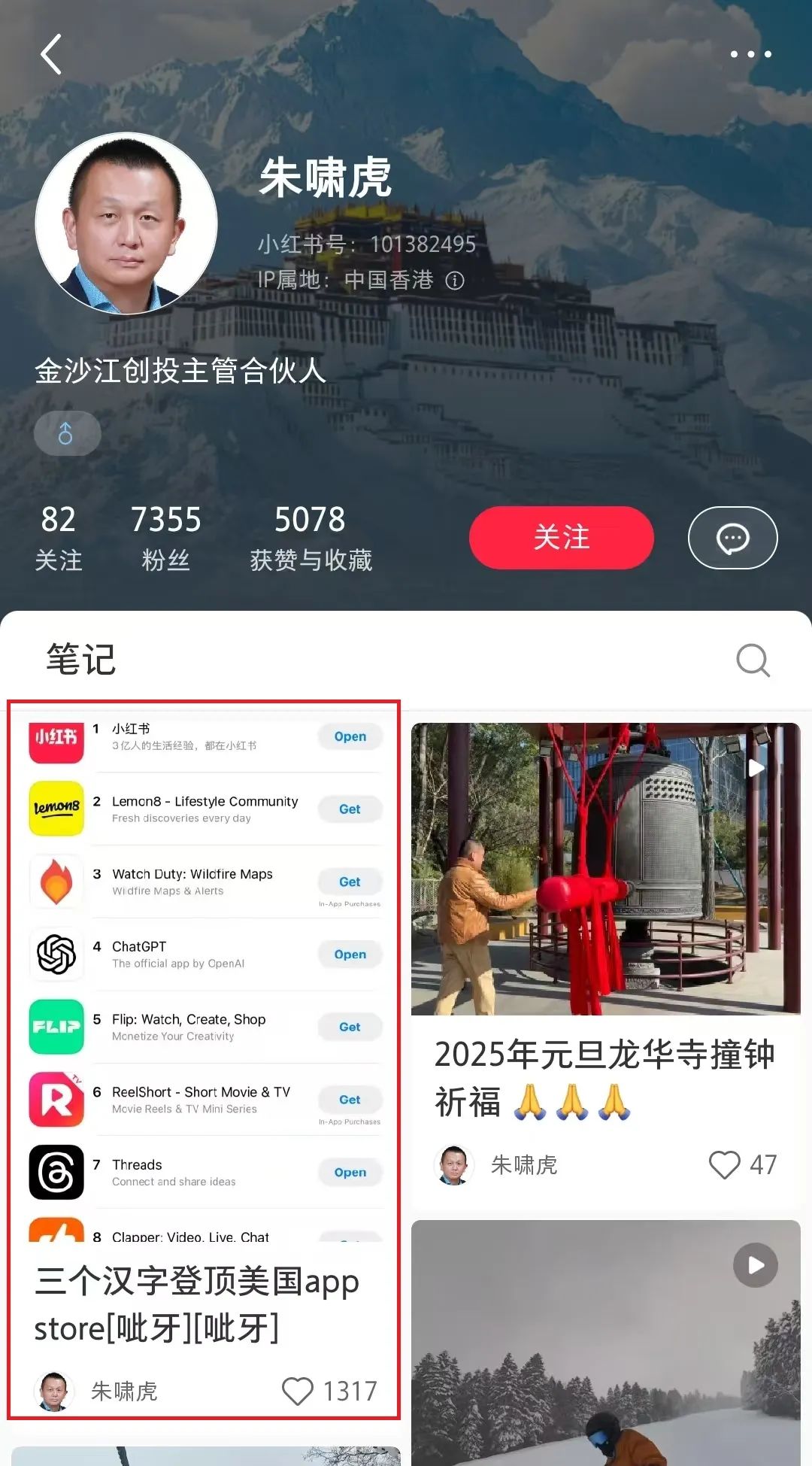

US App Store Download Rankings

Data from Qimai reveals that in the US region, the Xiaohongshu app ranked 209th on the app chart on January 12 but swiftly climbed to second place on January 13 and topped the chart on January 14. From the perspective of the US social app chart, Xiaohongshu has fluctuated within the top 100 over the past year, with a previous high of 24th place, until it surged to the top spot in the past two days.

Zhu Xiaohu, managing partner of GSR Ventures and one of Xiaohongshu's earliest investors, also excitedly posted a congratulatory message on Xiaohongshu for topping the US App Store rankings.

Image Source: Xiaohongshu

For a long time, many creators have repurposed or drawn inspiration from Xiaohongshu's fashion and beauty content for TikTok, building a significant level of popularity for Xiaohongshu. Currently, there are over 130,000 short videos with the #xiaohongshu hashtag on TikTok, mostly repurposed content from users.

Xiaohongshu blends Instagram's visual presentation with Reddit's community interaction features, positioning itself as a lifestyle sharing platform. For overseas users, the migration, learning, and usage costs are relatively low, which may also be a crucial factor in Xiaohongshu's popularity.

Image Source: Xiaohongshu

For Xiaohongshu, this "breakout" due to user migration in the US market will not only help expand its overseas user base but also significantly enhance its brand influence in the international market, bringing greater commercialization potential to the platform. However, the continuous influx of American users may also pose more severe challenges. On one hand, the massive content generated by foreign users will undoubtedly greatly increase Xiaohongshu's burden in terms of content moderation and compliance. The platform must ensure the full expression of multicultural content while strictly adhering to various regulatory requirements. On the other hand, given the many questions raised by US regulators previously about TikTok, Xiaohongshu is likely to face similar scrutiny. Issues such as user data security and data compliance are likely to become the focus of US regulators' attention on Xiaohongshu. Ideally, Xiaohongshu can learn from Douyin and TikTok's dual-version operation model, providing independent product architectures for domestic and overseas markets. This will not only help avoid regulatory risks but also more flexibly meet the needs of users in different markets, accelerating the internationalization process.

Although Xiaohongshu has attracted some American users, there are still significant differences between its content format and positioning and TikTok. For instance, in terms of functional positioning, TikTok focuses on entertainment, attracting many young users with short videos and live streaming, satisfying their strong desire for novel creativity and visually stunning experiences. In contrast, Xiaohongshu emphasizes social interaction and content sharing, with a particular focus on comprehensive lifestyle sharing, guiding users' consumption decisions. Its main audience is young women. In terms of content format, TikTok takes short videos as its core, relentlessly enhancing its entertainment value and visual appeal. Xiaohongshu, on the other hand, uses graphic and text notes as its main content carrier, appropriately incorporating short video elements, making its content more diverse and rich, focusing on sharing life moments and shopping recommendations, with a stronger "seeding" attribute. Although the two platforms exhibit significant differences in market positioning, functional architecture, user personas, and content formats, they share a high degree of similarity in the underlying logic design of their recommendation algorithms and the use of the UGC (User-Generated Content) model. Diverse author participation and content formats have become the main ways for both to attract users.

Image Source: Xiaohongshu

Why is it Xiaohongshu that is receiving this wave of traffic, not Facebook, Instagram, or X?

Objectively analyzing, the underlying factor behind the migration of a large number of American internet users is "emotional backlash." As the deadline for TikTok's ban approaches, there has been an overwhelming emotional backlash, specifically manifested in resistance to the US government's arbitrary banning of a platform and restricting speech on the pretext of security, disregarding users' wishes. Users mostly harbor a "rebellious psychology," and some creators have even stated on Xiaohongshu, "The more you tell me to stay away from China, the more I want to go somewhere where I can mix with Chinese people." On Reddit, after TikTok's Supreme Court hearing last week, many users also launched a campaign to boycott Meta and Google, as well as the US government's ban on TikTok. They are angry about the ban and the role played by Meta and Google in supporting it. This is one of the reasons why they did not choose Facebook, Instagram, X, or other mainstream European and American social software. Then why didn't this influx of traffic go to Douyin (the Chinese version)? The reason is simpler: Xiaohongshu allows registration with global mobile phone numbers, while Douyin (the Chinese version) requires a Chinese mobile phone number for registration. Additionally, Douyin (the Chinese version) cannot be downloaded in the US region, while Xiaohongshu is readily available on the US App Store with a single click. All of this has contributed to this mass migration of TikTok refugees. In fact, Lemon 8, known as the "Little Yellow Book" by the outside world, also had the opportunity to capture this wave of traffic. However, due to its inseparable relationship with TikTok, many users hesitated. According to an interview by Caixin, some overseas users did not choose Lemon8 because it also comes from ByteDance. They are also afraid that it will be banned by the US government, only to escape from the tiger's mouth into the wolf's lair. To avoid encountering a similar dilemma as TikTok, ByteDance changed the developer information of Lemon8 in the app store to Heliophili, a company based in Singapore, trying to distinguish it from the "foreign adversary" status in the US forced sale order. However, according to public information, Heliophili shares its headquarters with ByteDance's Singapore office. Currently, US federal law restricts ByteDance's management rights over its applications, allowing Lemon8, which is under the actual control of Heliophili, to temporarily escape restrictions. But this does not mean it can rest easy. Once the US government turns its attention to Lemon8 and determines that it is still controlled by ByteDance, Lemon8's fate may also change.

For Xiaohongshu, the most likely post this morning might be, "I actually succeeded in going global without realizing it"? In fact, Xiaohongshu has been quite "Westernized" since its inception. It once became an internet sensation with its "Xiaohongshu Overseas Shopping Guide" PDF, which received over 500,000 downloads upon release. On the current Xiaohongshu app, one can still see a vast amount of content sharing about overseas shopping, travel, work, and study. The amount of "going global" content has always been ahead of other apps. However, Xiaohongshu's overseas journey has been fraught with setbacks. In the past three years, Xiaohongshu has launched several overseas independent apps in an attempt to replicate the success of its domestic lifestyle community, but none have achieved good results. These include fashion community Uniik, camping enthusiast community Takib, and beauty community habU in Japan; Spark, which is highly similar to domestic Xiaohongshu and targeted at the Southeast Asian market; and Catalog, a home sharing community for the European and American markets. However, as of now, Uniik and Catalog have ceased operations, and other apps have not achieved the same huge impact as TikTok.

Image Source: Xiaohongshu

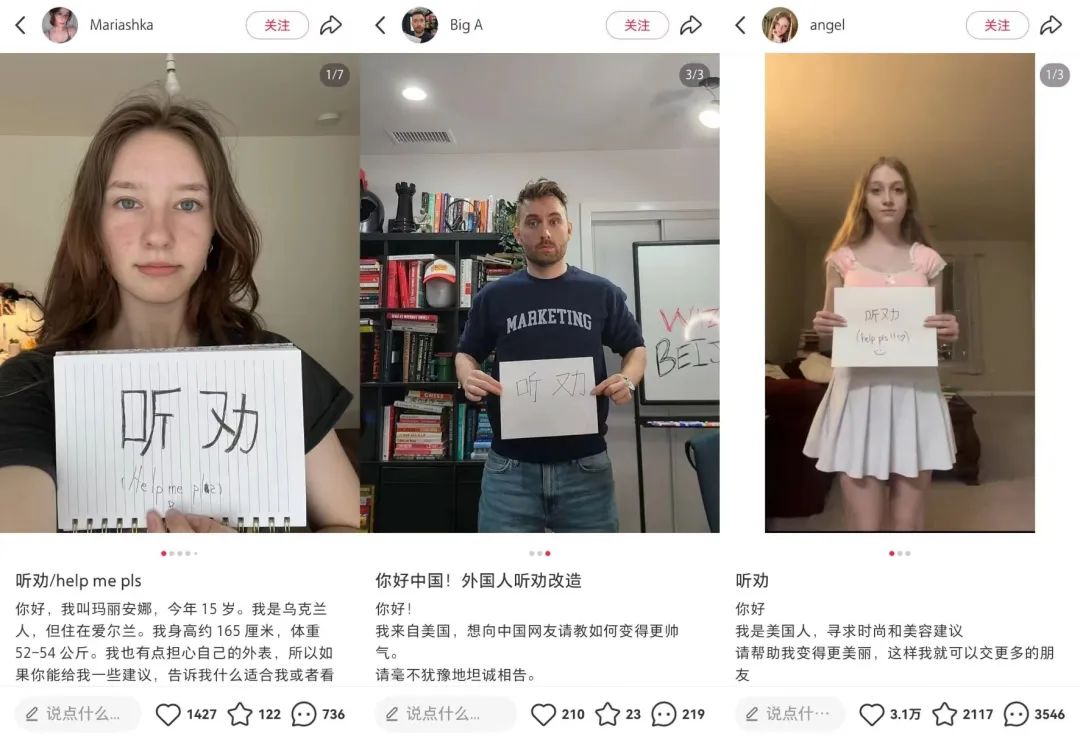

In 2023, many overseas users held up pieces of white paper with the word "Listen" written on them, accompanied by their photos, seeking "overhaul" advice from Chinese netizens, briefly going viral. But after the explosion of popularity, everything returned to silence.

And this influx of "TikTok refugees" may truly be Xiaohongshu's closest brush with large-scale "going global." Benefiting from this surge in traffic on Xiaohongshu, on the morning of January 14, A-share Xiaohongshu concept stocks collectively opened higher. Companies such as Yaowang Technology, Yinli Media, Yiwang Yichuang, Aimer, Gloria, and Piano saw their share prices surge to the daily limit. By the time of writing in the afternoon, Fushi Holding and Yiwang Yichuang had seen their share prices surge by 20%, while Yaowang Technology, Tianxiaxiu, Huayang Lianzhong, Aimer, Yinli Media, Laiyifen, and Yaoji Technology had all hit the daily limit. Additionally, Jiayun Technology and Sunya International saw their share prices increase by over 10%. However, internet hotspots are always fleeting. Xiaohongshu's rise in popularity due to topics related to TikTok seems a bit like capitalizing on a "disaster." As for how long this "disaster profit" can last, we will have to wait until the court hearing concludes on January 19. A new story may just be beginning.