Bilibili Rises Above the Streaming Media Fray

![]() 01/15 2025

01/15 2025

![]() 687

687

Internet companies spearheaded last year's rebound in Hong Kong stocks, achieving remarkable growth rates and shareholder returns. This transformed the internet sector into a robust growth and income segment, characterized by easy ascents but difficult descents, bolstering the independent performance of Hong Kong stocks. Notably, several smaller internet firms outperformed their larger counterparts.

Among them, XD.com, which has embarked on its game product release cycle, witnessed a doubling in value. Bilibili, a mid-sized internet stock, also shone, rebounding by nearly 50% despite financial losses, achieving a maximum increase of 150%. Compared to its peers in the video sector, such as Kuaishou and iQIYI, Bilibili stands out prominently.

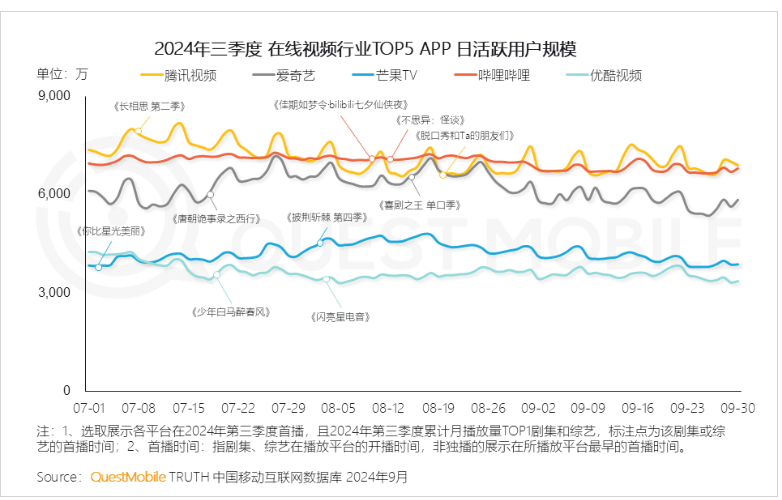

Further data reveals that in 2024, amidst fierce competition in the internet industry, Bilibili maintained traffic growth, solid commercialization progress, and a revenue growth rate that escalated quarter by quarter. It began to outpace short-form video companies like Douyin and Kuaishou, while several long-form video streaming companies gradually fell behind.

However, Bilibili's commercialization journey is fraught with challenges. A profit of 200 million yuan in the first quarter is insufficient to support its current market value of 50 billion yuan. Following a steep rise in October, substantial capital appeared to seize the opportunity to take profits and exit, causing Bilibili to swiftly revert to its year-start price, retaining only 53% of its annual 150% increase.

Despite being one of the internet stocks with the largest retracement, Bilibili's fundamentals continue to improve. This retraction presents an opportunity for investors who have yet to participate in its market performance. Having returned to its starting point, can Bilibili rise again?

Perhaps now is the time to observe whether Bilibili can ride the wave across the entire long and short video sector, continuing to excel in commercial expansion during this period. Will 2025 bring more highlights?

I. Long-form Video Gradually Loses Vitality

The core profit model for long-form video streaming hinges on self-produced dramas and variety shows. However, it is evident that these are increasingly constrained by the dramatic form of expression. User-generated content (UGC) offers a diverse range of themes and creativity, constantly iterating new topics and expanding its competitive edge.

UGC producers are individual media personalities who assume the benefits and risks of optimizing content and controlling costs. In contrast, long-form video project teams lack such autonomy. Ultimately, this disparity in cost and efficiency widens. Currently, the quality of long-form videos produced by many Bilibili uploaders rivals that of film and television production levels.

In the overseas market, with billions of people, Netflix has unified the entire market. The cost of dramas and films is shared by global users, who also benefit from the cost advantages of global film and television actors. For instance, using Korean actors and Indian IT professionals to generate revenue in Europe and America. This model naturally yields significant marginal benefits and substantial commercial returns.

Conversely, in the more competitive domestic market with fewer paying users, iQIYI, Youku, Tencent, and Mango TV compete fiercely. Limited by language barriers, they struggle to expand into overseas markets. Now, Douyin and Kuaishou are disrupting the market with short dramas, leading to a scenario where profitability remains elusive for all players.

This year, iQIYI and Youku continued to lag behind, while Tencent maintained its leading position. The trend also indicates that Bilibili has surpassed iQIYI and is catching up with Tencent Video, poised to maintain stability at the top. Furthermore, Bilibili does not rely on content cycles, avoiding the fluctuating performance typical of other long-form videos, thus ensuring greater stability.

Since iQIYI achieved profitability in 2024, long-form video streaming has entered a state of sluggish competition. Industry cooperation has intensified, and various cost-reduction measures have been implemented, including salary cuts, slower filming paces, and exploring high-return, low-cost suspense drama models. However, iQIYI's profitability was short-lived, lasting only a few quarters before regressing, similar to Tencent Video and Mango TV.

The crux lies in cost reduction for dramas, which slows down production and reduces willingness to pay. Other internet giants have discovered the new video mode of short dramas, seizing a significant market share from the dramatic category monopolized by the four long-form video companies.

Douyin and Kuaishou have emerged as new carriers for short dramas, continuously capturing traffic. Producers no longer rely on self-production as their core competitiveness, as was the case with long-form videos. The low threshold for short dramas has attracted numerous players, with online literature companies flooding the market. The so-called self-produced full-chain profit model does not apply to short dramas. iQIYI, Youku, and Tencent's own short dramas have made little impact.

Inserting short dramas into their apps harms the traffic of their self-produced long dramas. Nonetheless, to maintain traffic, they must proceed with this strategy.

Overall, the long-form video model is grappling with a lack of stable profits and traffic peaks, making it increasingly challenging to maintain platform/app status. The only viable solution is for multiple companies to merge. Otherwise, the subsequent outcome will be commercial degradation, transforming into a film and television creative production company that sells program copyrights to Douyin, Kuaishou, Bilibili, etc., or produces its own movies, which are essentially product sales. While this model can yield higher and more stable profits, such degradation may be unacceptable, leading to continued slow decline.

The cycle faced by long-form video is that cost reduction leads to quality reduction, which in turn leads to user loss. Consequently, profits do not increase, and the development of short dramas further erodes their long-form video traffic due to the inability to profit from self-produced content. The decline in cash flow also discourages investors from listening to their stories, further reducing the production quality and cost of dramas.

In fact, we can observe their closely related counterpart, the film industry, which is already caught in a negative cycle.

China's film market has also declined significantly this year. Film production companies, actors, and streaming media platforms share almost the same demographic. The film industry has fully exposed the dilemma of low investment and innovation.

There are fewer and fewer big-budget special effects productions, and films are becoming increasingly opportunistic, exploiting realistic themes and gender-opposing topics, relying on alternative themes to compensate for the reduction in special effects.

But audiences vote with their feet. Without exquisite special effects that cannot be seen in reality, just a few people chatting in a room or running around on a few streets, no one is willing to pay for a 30-yuan movie ticket. With lower box office receipts and no profits, it is impossible to increase investment in blockbuster films.

Cost reduction for long-form video companies is a misconception. Netflix's approach is to find actors and production teams from low-income countries to engage in cost arbitrage. After all, dramas and films can be transmitted across borders at no additional cost. Unfortunately, this approach will never work for Chinese companies.

As mentioned earlier, Bilibili's content, fueled by the growth of numerous uploaders, allows them to control topic acceptance and cost, leading to continuous iteration and improvement in content quality, which is approaching professional film and television production levels. This further drives users to shift their video entertainment preferences to Bilibili.

In fact, Bilibili's strategy here is commendable. In recent years, it has reduced the proportion of self-produced variety shows and programs, focusing instead on anime for self-production. This avoids moving closer to the iQIYI, Youku, and Tencent model. The self-produced, self-financing model is more viable.

However, data indicates that the number of Bilibili's paid members has not increased. For instance, the number of annual members slightly declined in Q3 and can only be maintained at around 22 million, while Tencent and iQIYI have over 100 million members. It is unclear if Bilibili is taking away business from its competitors.

This is understandable. Bilibili does not have substantial self-produced content or pre-roll ads, so there is minimal difference in rights between members and non-members. The primary difference lies in video quality, which is vastly different from the membership models of iQIYI, Youku, and Tencent.

Referring to YouTube, there is a significant contradiction between collecting advertising fees and membership fees. Those who can afford to pay for a membership are the target audience for advertisements, hence advertising and membership income can only be one or the other.

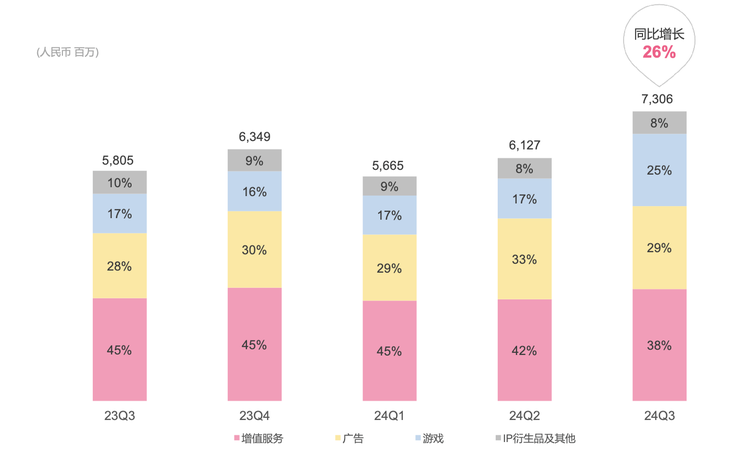

Therefore, it is sufficient for Bilibili's value-added services + advertising revenue to continue growing. Currently, it still meets the standard, with a year-on-year increase of 17% in Q3. In the long run, if Bilibili's membership + advertising revenue targets the current total revenue of iQIYI and Tencent, there is still considerable room for growth. Of course, Douyin and Kuaishou are the real benchmarks.

II. Advertising Growth and Gaming Rebound

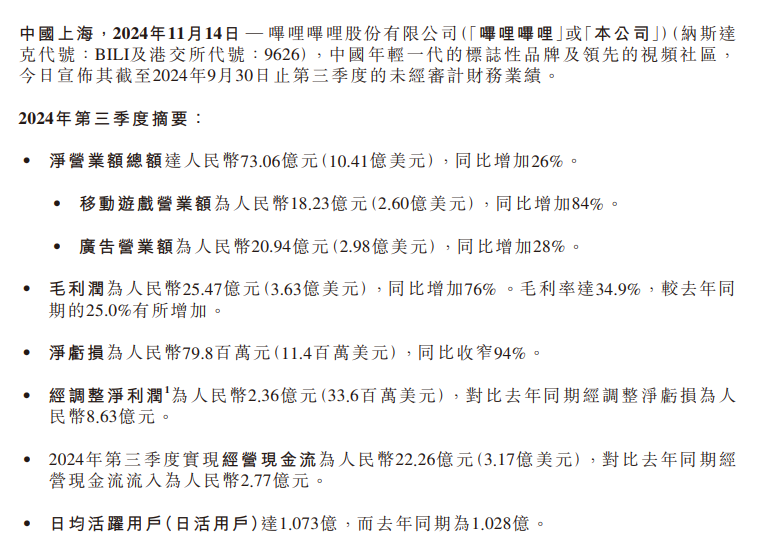

From the table above, it is evident that Bilibili has begun to accelerate its growth, but the growth rate of value-added services + advertising business is only average. More revenue growth is driven by the gaming business, with a growth rate as high as 84%.

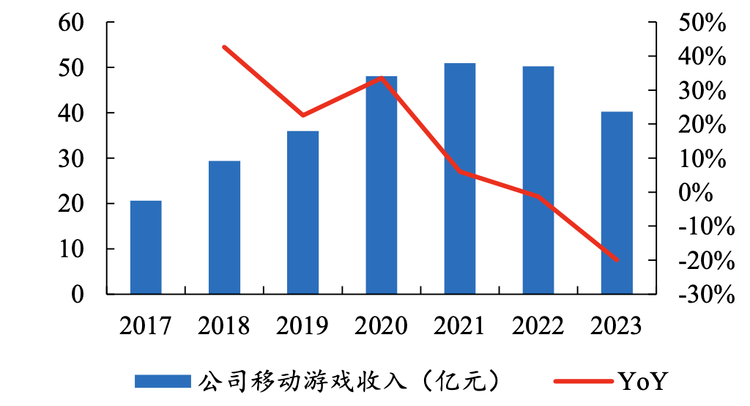

Since Bilibili's listing, gaming has consistently been a pillar business contributing the most profit. However, later, the platform de-emphasized gaming. After realizing that other businesses were less profitable, it refocused its efforts, which can be seen as a correction.

Games are inherently superior self-produced content compared to dramas and variety shows. This year, "Sanmou" fueled a rebound in Bilibili's gaming business. Of course, succeeding in the gaming business necessitates a skilled team and the right genes. Traffic is merely a catalyst, not an engine. No matter how hard Tencent tries, it cannot replicate Genshin Impact and Black Myth: Wukong. However, with games of similar quality, having an effective promotional tool enhances the probability of success.

The product cycle of the gaming business is highly volatile. Who can predict the success of the next game? Based on this issue, Bilibili's stock price plummeted after its third-quarter profit announcement. Many believed that the success of "Sanmou" was mere luck, and the company's profit was not substantial, amounting to only 230 million yuan in a single quarter. Conversely, this indicates that the main station business still contributes minimally to performance. "Sanmou" has already begun to decline, and Bilibili's profits may falter again in the future.

But the facts may not be that simple.

Judging from the current state of China's gaming industry, the profit release cycle of games often occurs in the mid-term rather than the early stage after launch. Games that fail immediately upon launch are not worth mentioning. Games that can sustain a long-term curve typically maximize profits after user acquisition ends and enters into stock operation, with decreasing buy-in costs. Half a year has passed, and "Sanmou" remains stable in the top 20. It seems there is a discrepancy between everyone's estimates of Bilibili's gaming profit release curve and the current profit distribution across the company.

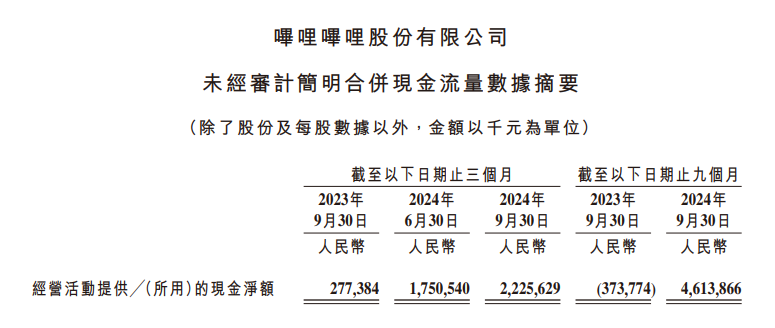

Secondly, although Bilibili's profitability is not stellar, it has over 4 billion yuan in cash flow, which is significantly different from its profits. This is the financial item that has seen the most improvement.

Excluding equity incentives, part of the increase is in payables. Bilibili has indeed gained several billion yuan in cash, of which 3 billion is used to repay debts. However, it is not entirely debt owed to suppliers and employees. Deferred revenue has increased by 1.3 billion yuan, which is more closely tied to member payments, to some extent indicating that Bilibili's membership + advertising revenue still has ample growth potential. The slow growth rate of the advertising and membership business can also be seen as not fully realizing its growth potential.

Certainly, Bilibili still has many shortcomings, such as the low sophistication of its advertising business and the scarcity of advertising slots. This represents both a growth opportunity and a deficiency. Whether it can be capitalized on depends on management.

Previously, Bilibili's advertising business was inefficient and difficult to match accurately, posing technical challenges in optimizing efficiency. However, the development of AI has given Bilibili an opportunity to turn things around. For instance, automating the replacement of advertisements in video soft advertisements makes it significantly easier to achieve precise placement akin to short videos.

Q4 is generally Bilibili's best quarter of the year. Bilibili has much to deliver. One is the continued release of profits from advertising + membership. Secondly, the gaming business enters its profit release period. Optimistically, if it can achieve an adjusted profit of over 1 billion yuan in a single quarter, then the current stock price has considerable flexibility.

Conclusion

Nevertheless, the influence of peer constraints cannot be overlooked.

With profits of 15 billion yuan and a price-to-earnings ratio of 10 times, coupled with numerous share repurchases, Kuaishou has effectively dampened the market's valuation expectations for Bilibili. When comparing daily active users, Bilibili trails with 100 million, whereas Kuaishou boasts 300 million. Hence, Bilibili's market value of 50 billion yuan appears reasonably positioned.

Therefore, assuming a pessimistic outlook for 2025, it is unrealistic to envision Kuaishou stagnating while Bilibili soars. Bilibili's independent market performance and α space are constrained. Its slight edge over Kuaishou lies in its model's independence and steady, albeit slow, growth, which might accelerate in 2025. Kuaishou's proximity to the finish line poses a challenge, but this is unlikely to translate into a substantial difference in growth rates, merely a matter of a few dozen percentage points.

Consequently, it is anticipated that throughout 2025, Bilibili's annual growth will remain modest. It is more plausible to expect a speculative market performance. The stock price has already declined, creating room for maneuverability. Should Q4 performance defy expectations and continue to improve significantly, a considerable rebound could ensue. Notably, during the first quarter, Bilibili secured the broadcast rights to the CCTV Spring Festival Gala for the first time. In this interim period preceding the performance announcement, such events could potentially offer additional pleasant surprises.