ByteDance Aims for the Next TikTok in Overseas Short Drama Market

![]() 01/15 2025

01/15 2025

![]() 628

628

TikTok's business-oriented digital marketing platform, TikTok for Business, released the "2024 White Paper on Marketing Short Dramas Overseas" last year. The report concluded that the business model and user demand for short dramas in China have been validated, and the overseas market is poised for explosive growth. Currently, overseas short dramas primarily rely on a mixed monetization model combining in-app advertising (IAA) and in-app purchases (IAP), with a projected market size reaching tens of billions and a user base of 200-300 million.

ByteDance has also ventured into the overseas short drama space with its own app. Media reports indicate that Melolo, ByteDance's free short drama app, launched in markets like Indonesia and the Philippines in November 2024, and the company is actively exploring and refining its business strategy. Additionally, ByteDance has established an overseas short drama business team and is actively recruiting for various related positions.

Currently, Melolo is still in its nascent stages, with low download numbers and limited media exposure. However, it is only a matter of time before TikTok makes a significant impact on the short drama market, and the platform's main site holds high strategic value beyond a standalone app.

According to Cinda Securities, from November 2022 to October 2024, over 100 short drama apps were active in overseas markets. Excluding apps with no download data for three months, 83 overseas short drama apps accumulated over 287 million downloads during the statistical period, generating in-app purchase revenue of $490 million.

This timeline aligns with the surge in popularity of short dramas in China over the past two years. Unlike the delayed commercial expansion of overseas web novels, the Chinese experience with short dramas has been swiftly replicated abroad.

For ByteDance, swiftly capitalizing on traffic trends and integrating overseas short dramas into its content ecosystem was a strategic move. However, TikTok currently faces an uncertain future in the United States. On January 10, TikTok confirmed that it might shut down in the U.S. on January 19 unless the Supreme Court overturns or delays the law compelling the app's sale.

Under these circumstances, the need to build additional traffic pillars becomes even more urgent.

01. Holding "Douyin" and Forging Another "Hongguo"?

Most players entering the overseas short drama market already possess relevant resources or experience in China, often in the form of web novel platforms with script IPs, social media apps with users and traffic, or established short drama platforms. ByteDance's advantage lies in its existing top-down industrial chain infrastructure and emphasis on localized operations.

Drawing from the experience of web novels, overseas consumption trends for such cultural and entertainment products are highly stereotyped, with a particular fondness for specific themes and formulaic plots. While romantic tropes like "overbearing CEO" and "cleverly seizing and forcibly taking" are universally enjoyable, the love for themes related to "werewolves" and "royalty" stems from European and American history and popular culture.

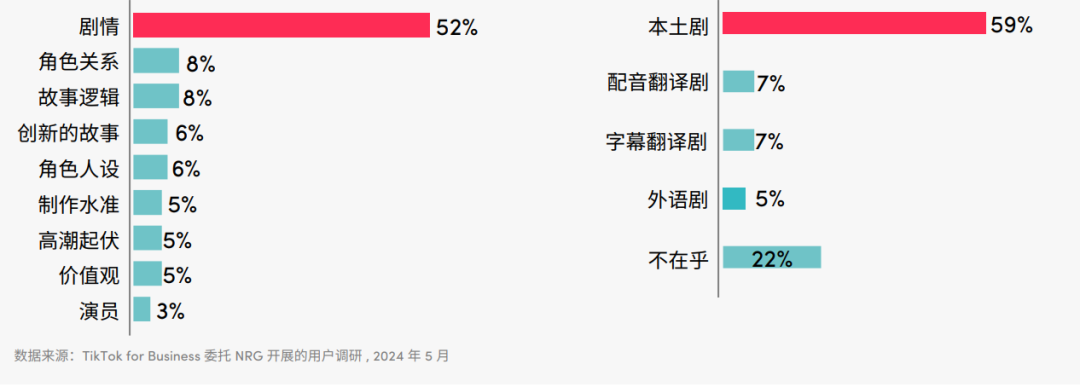

The same applies to short dramas. TikTok For Business's research found that users prefer short dramas for their originality and unique, creative narratives. While 59% of short drama users still favor local content, 22% do not mind the filming location or language.

Source: "2024 White Paper on Marketing Short Dramas Overseas"

ByteDance launched the overseas web novel platform Fizzo in 2021, initially investing heavily to recruit authors. Fizzo has gained significant influence in Southeast Asia, particularly in Indonesia, a country with low reading interest according to UNESCO. Within two years, Fizzo climbed to the top of the local Books Apps Ranking, a feat attributable to localized operations and traffic guidance from TikTok.

In China, the IAA+IAP mixed monetization model for short dramas is well-established. As of November 2024, Hongguo short dramas boasted 140 million monthly active users, with over 40 million paying subscribers. From IP copyrights to user traffic, coupled with the experience of independent short drama apps in China, the platform has ample operational space, whether mobilizing local resources for original production or translating and exporting ready-made Chinese short dramas.

However, the most critical aspect at this stage remains TikTok.

Multiple Chinese companies compete in the global short drama market. Sensor Tower data shows that Maple Interactive's short drama app ReelShort generated a net income of $63.43 million in the third quarter of 2024, a 52% increase quarter-on-quarter and a 327% increase year-on-year. Another app from the same studio, Sereal+, is also on the rise, with 2.21 million downloads and $13.45 million in revenue during the same period.

However, beyond creating blockbusters by catering to local tastes, as mentioned earlier, the significance of advertising investment in ReelShort's success cannot be overstated. When ReelShort launched in 2022, its download and revenue data were unremarkable until several blockbusters were released in 2023, leading to a sharp increase in relevant metrics.

In June of that year, the blockbuster short drama "Fated to My Forbidden Alpha" premiered, and ReelShort began investing heavily in advertising. The traffic and spending on TikTok advertising materials based on the drama surged, closely mirroring the app's download data curve.

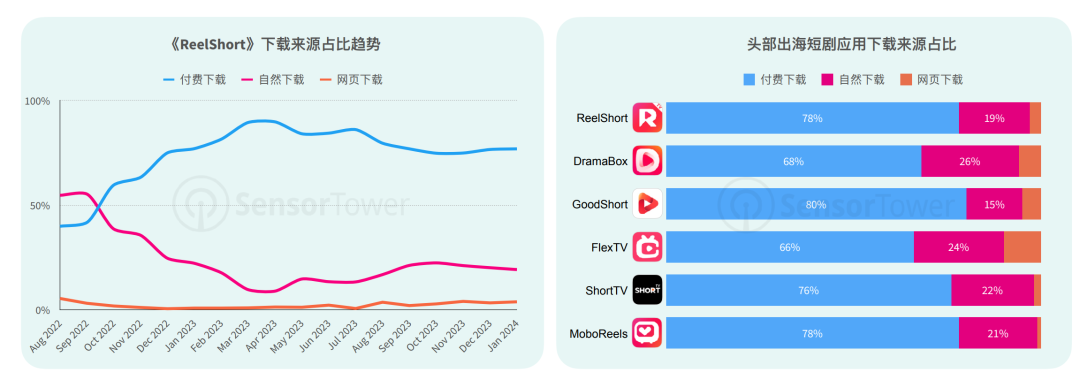

According to Sensor Tower, besides ReelShort, advertising investment is crucial for other top overseas short drama apps, with paid downloads accounting for over 75% of their app download sources.

Source: Sensor Tower

The growth of short dramas is heavily reliant on advertising investment, both domestically and internationally, with an even greater dependence internationally. The core value of the industry flows to content distribution, making content platforms like TikTok, Meta, and Instagram vital for short drama marketing. Besides developing its own short drama app, guiding users to complete conversions directly within TikTok may be a more efficient monetization approach at this stage.

02. Higher Internet Attributes Than Cultural and Entertainment Attributes

The Information reported in November last year that TikTok considered producing Quibi-style short dramas to expand its influence. However, Quibi is not a positive example.

Backed by Hollywood producers and the former CEO of HP, Quibi received $1 billion in funding when it started in 2018 and garnered support from various forces in Hollywood, making it a highly anticipated star project. Quibi's positioning differs slightly from current short dramas. It targets young people aged 18-34, aiming to provide high-quality short dramas with a production standard comparable to Hollywood, each episode lasting about 10 minutes.

Quibi represented American investors' predictions about user consumption in the mobile internet era at the dawn of short video popularity. Founder Katzenberg believed that Quibi-style short dramas, with a total length of around 2 hours (similar to a movie) divided into short chapters of less than 10 minutes each, would fill users' fragmented time. As the app's slogan put it, "Quickbites Big stories," it was a sliced presentation of traditional stories.

Quibi's downfall was equally astonishing. Officially launched in early April 2020, by the end of April, app downloads had plummeted from 300,000 on the first day to below 100,000. Far fewer subscribers than expected led Quibi to announce its official closure in October of that year.

"Short dramas with short durations and small capacities" are not a novel concept, but American market exploration in this field, including Quibi, tends to view short dramas as an extension of traditional film and television entertainment, a culturally entertaining product with compressed plots.

The "short dramas" nurtured by the Chinese market are more deeply rooted in the social media ecosystem. While satisfying entertainment and leisure needs, they also incorporate additional functions such as content marketing and product promotion. They possess stronger internet attributes and are often highly integrated with live streaming, e-commerce, and other business formats to form a closed business loop.

Therefore, what is truly transplanted in overseas short dramas is firstly a highly standardized production process or a product approach oriented towards blockbusters. Specifically, the production process is generally more lightweight, led by small teams, and it takes only a few weeks or even days from idea to finished product. To ensure alignment with current hot topics and user tastes, a production strategy of filming while broadcasting may also be adopted.

This model has already been validated in the web novel industry, combining efficient and low-cost production with user interest drive. Once a "blockbuster" emerges, it can be batch-produced around the theme and content framework. Such products are inherently consistent with the content creation logic of short video platforms represented by TikTok.

Moreover, gradually transplanting the domestic short drama business model may become the focus of the next stage for overseas short dramas.

GeekPark reported that Nan Yapeng, Vice President of Maple Interactive, also discussed the Quibi case in his keynote speech. While Quibi made some doubt the acceptance of micro-short dramas in the European and American markets, its subscription model is more akin to traditional streaming platforms like Netflix, where users pay a fixed monthly fee to access content.

Nan Yapeng believes that when the initial content volume is small, users find it difficult to accept the subscription model immediately. However, the paid model of unlocking episodes allows users to leave at any time and have more choices. It is foreseeable that the commercialization of overseas short dramas will follow a similar path to that in China, starting with paid unlocking and gradually exploring membership subscriptions, content-free advertising monetization, customized marketing, and more.

Market education will be more challenging than pure content output but is also a key entry point for TikTok, with its vast user base, to gain influence in overseas short dramas.

03. Conclusion

Currently, ByteDance's overseas business remains heavily concentrated on TikTok. However, whether through launching independent apps or improving the short drama conversion chain within the platform, the company's efforts in product and business diversification are evident.

Besides short dramas, the previously mentioned Fizzo and MyTopia Books belong to the reading app series, while the AI camp includes Doubao chatbot, Dreamina (AI Dream), and CapCut (CapCut International). Similar to the symbiotic relationship between CapCut and Douyin, CapCut also holds considerable influence overseas. Statistics from last October showed that its monthly active users ranked second globally, second only to ChatGPT.

ByteDance aims to expand its global mobile internet ecosystem, but a single platform is highly susceptible to market and policy risks. Currently, it needs to transplant TikTok's influence to more products and reuse its technology and resources.

However, the opportunity to seize global market influence is open to all internet companies, particularly at this juncture.

On January 13, a large influx of TikTok users dissatisfied with the U.S. ban flooded into Xiaohongshu, causing its downloads to surge rapidly and ultimately topping the U.S. App Store's free chart. Benefiting from algorithmic recommendations, users who have developed short content consumption habits are seeking alternative products but do not necessarily need to follow ByteDance's footsteps.

Interestingly, the market initially believed that Lemon8 would be ByteDance's alternative solution for North American users after TikTok's ban. Lemon8, a lifestyle community app initially modeled after Xiaohongshu, coincidentally also imitates its features.

*The title image and images in the article are sourced from the internet.