Gaode's Strategic Gamble: Embracing Douyin Group Buying

![]() 01/16 2025

01/16 2025

![]() 631

631

Can Gaode Maps address the critical shortcomings of its local business strategy by integrating Douyin Group Buying?

Original Creation: Entropy

Both Douyin and Gaode Maps, facing challenges in their local business ventures, have chosen to collaborate for mutual support.

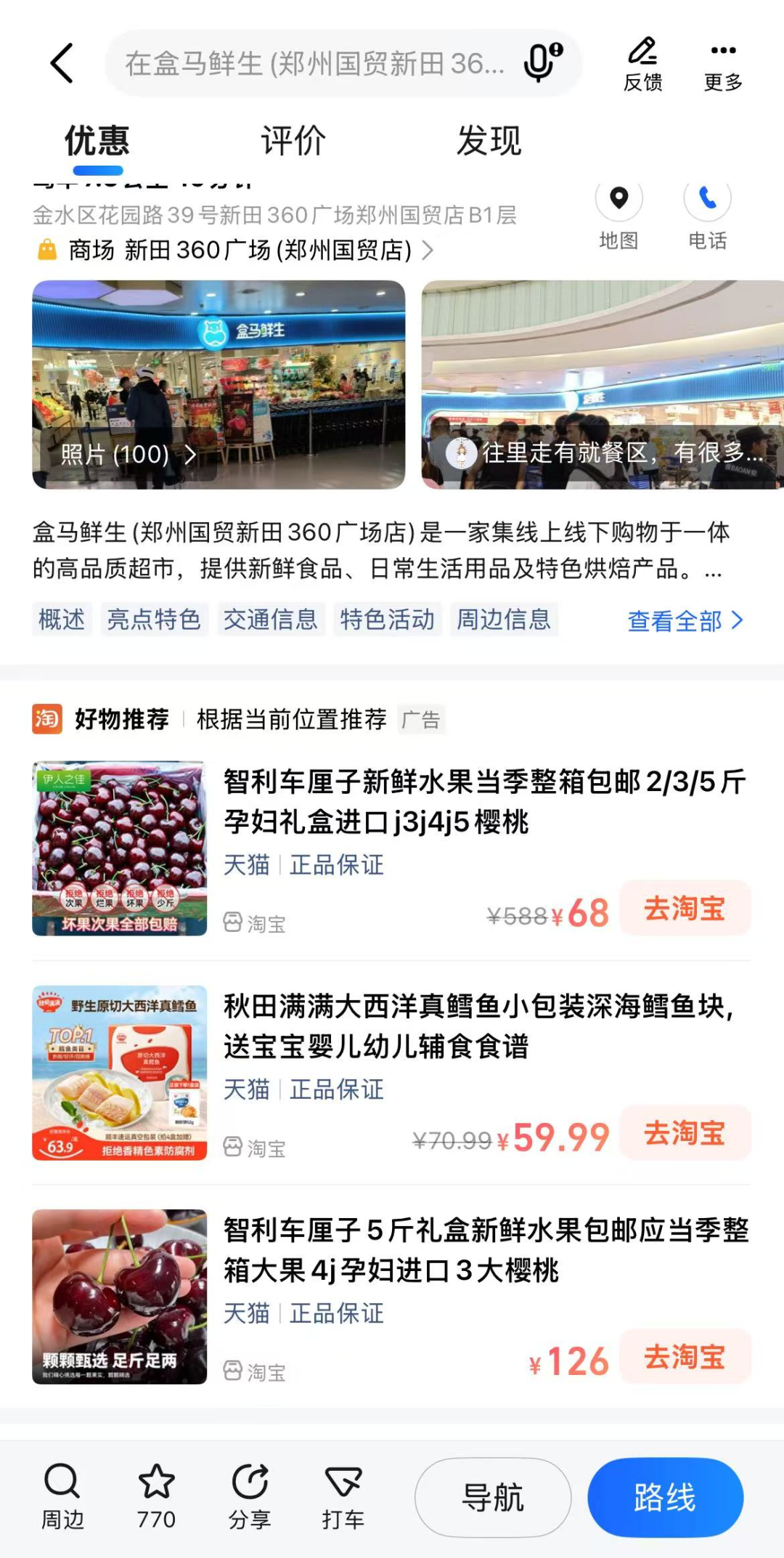

Recently, rumors surfaced that Douyin Group Buying would be integrated into Gaode Maps. Through practical testing, "Entropy" discovered that when searching for certain restaurants or lifestyle service stores on Gaode Maps, a Douyin Group Buying link appears below the store information. Clicking on "Buy on Douyin" redirects the user to the Douyin App. Concurrently, in Douyin Group Buying, clicking on a merchant's address and navigating will label Gaode Maps as "Recommended" in the pop-up map application.

In fact, this is not the first time Gaode Maps has integrated external platform purchase entry points. Earlier, some users noticed that searching for Hema Supermarket on Gaode Maps displayed Taobao product recommendations under the corresponding address, and clicking on "Go to Taobao" redirected to the Taobao purchase interface.

▲Image source: Gaode Maps

However, the page redirect from Gaode to Taobao can be seen as a minor flow within Alibaba's internal ecosystem. The significant difference in this collaboration between Douyin and Gaode is the clear indication of ByteDance and Alibaba's determination to jointly compete in the local business sector.

With over 800 million monthly active users, Gaode Maps has long been dissatisfied with being merely a single-function tool. Beyond its exploration of travel, express delivery, tourism, ticketing services, and other ventures, the local business sector has always been a lingering challenge it strives to conquer.

Will the collaboration with Douyin be the elixir Gaode needs to compensate for its shortcomings in local business?

Gaode Strengthens Local Business

Theoretically, integrating Douyin's store group buying links into Gaode Maps can fulfill each other's needs.

For Douyin, since initiating its local business services in 2018, after experiencing setbacks in its food delivery sector, it has gradually found a suitable path for its local business endeavors.

"LatePost" once reported that in the first quarter of 2024, pre-verification sales of Douyin's lifestyle services (primarily comprising on-site dining, on-site comprehensive services, and hotel and travel businesses) surpassed 100 billion yuan.

Its vast content traffic pool and seeding capabilities are significant contributors to the growth of Douyin's local business. However, the lack of an in-house navigation function and impulse purchases have led to a high verification rate. According to Giant Engine, the average verification rate for Douyin Group Buying is 57%.

After integrating with Gaode Maps, which boasts over 800 million monthly active users, users can search on Gaode, jump to Douyin Group Buying, and then verify on-site. Unlike impulse purchases where users stock up on coupons in advance, this process is more inclined towards immediate consumption needs, leading to a higher verification rate. Additionally, with Gaode's navigation function, users find it more convenient to reach the store.

For Gaode Maps, displaying Douyin Group Buying packages when users search for related stores can, on one hand, supplement the platform's insufficient merchant base and improve the infrastructure of store numbers. On the other hand, Gaode's deeply ingrained tool attribute necessitates frequent display of group buying channels to cultivate users' mindset of consuming within the platform, thereby subtly enhancing engagement.

▲Image source: Gaode Maps

While huddling together for mutual support has numerous benefits, the current collaboration between Gaode and Douyin appears extremely low-key.

On one hand, as of now, the number of Douyin stores integrated into Gaode Maps is not substantial.

A business attraction staff from Gaode Wangpu informed "Entropy" that the current collaboration between Douyin Group Buying and Gaode is primarily open for select cities and categories with better traffic monetization, such as Beijing, Shanghai, Chengdu, Guangzhou, Nanjing, Shenzhen, Hangzhou, Wuhan, Xi'an, Suzhou, Changsha, Harbin, and other high-search-popularity cities on Gaode, focusing on catering and lifestyle services.

On the other hand, merchants do not need to actively integrate their store group buying entry into Gaode, and some merchants are unaware that their store's group buying has been integrated into Gaode.

"Entropy" contacted a restaurant displaying Douyin Group Buying on Gaode, and the owner stated that they did not actively integrate their store's Douyin Group Buying packages into Gaode and had not received any relevant notification beforehand.

The reason for both parties choosing to act low-key may be that the collaboration is still in its early exploratory stage, and the effects remain to be verified.

Another store owner whose Douyin Group Buying is integrated into Gaode Maps mentioned that the current sales boost effect is not yet noticeable. He analyzed that because stores integrated through Douyin Group Buying rank after stores that have paid to enter Gaode, they are not displayed first. Consumers who actively search for specific store names on Gaode and enter the store already have clear consumption needs, thus immediately searching and arriving at the store. Consequently, the store is unlikely to gain additional customers as a result.

Profitability Challenges of a Tool Attribute

In March 2023, at the rally where Alibaba merged its local business "Koubei" into Gaode, Yu Yongfu confidently stated, "Let's work together to excel in local business."

But just one year later, Yu Yongfu stepped down from his management position in the Local Life Group. Concurrently, Gaode's local business, carrying heavy responsibilities, failed to meet the Local Life Group's profitability expectations.

The latest financial report reveals that although Alibaba Group's local business segment revenue increased slightly by 14% in the third quarter of 2024, the adjusted EBITA (earnings before interest, taxes, and amortization) loss was still as high as 391 million yuan. Although Ele.me, also within the local business segment, is one of the sources of losses, Gaode has at least not yet shouldered the heavy burden of segment profitability.

The reason is that its inherent tool attribute makes it difficult to shift consumer mindset, and "consuming on Gaode" is not yet mainstream.

In fact, since its establishment, map navigation has always been Gaode's core business, and it has also achieved good results in the commercialization of travel services.

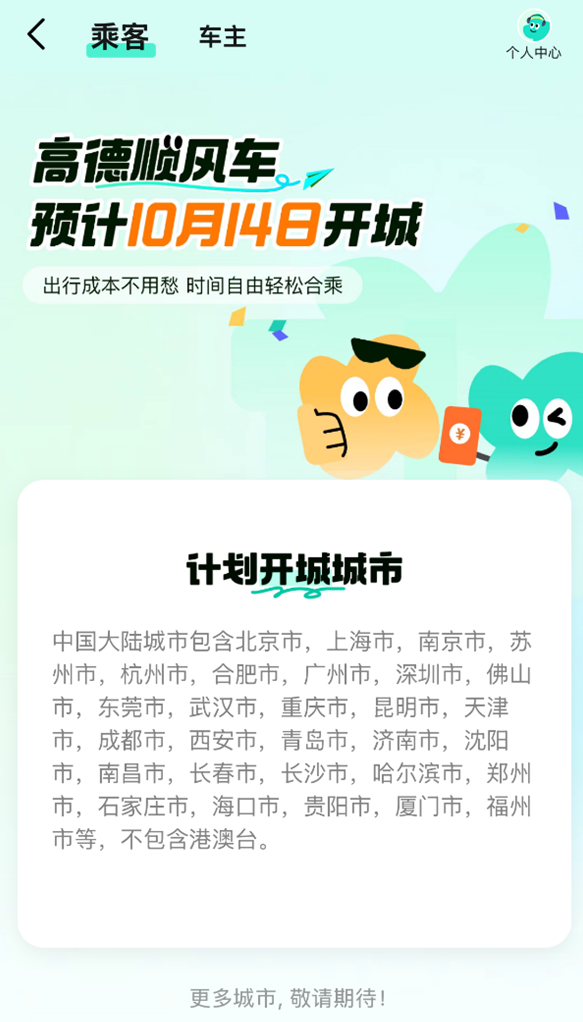

Gaode began to lay out the online car-hailing business in 2017 and quickly established itself as an aggregation platform in the online car-hailing market, making travel services its main commercial revenue besides advertising. In October 2024, Gaode restarted its ride-sharing business, which had been shelved for many years, hoping to find incremental growth in the existing market.

But it's worth noting that whether it's online car-hailing or ride-sharing, Gaode's achievements in the commercialization of travel services are closely tied to the deep connection between travel services and map navigation, which is not the case for local business.

Meituan and Dianping hold a strong leading position in the local business market. Douyin and Kuaishou have caught up by leveraging the characteristics of their short video content ecosystem and price wars. Consumers have numerous options for local consumption. For Gaode, a navigation tool, changing the stereotype in consumers' minds is a lengthy and arduous journey.

In fact, as early as 2019, Gaode Maps had already collaborated with Koubei and Ele.me. When users use Gaode Maps to search for the locations of restaurants, parent-child stores, etc., they can directly access the store pages provided by Koubei and Ele.me with one click. Later, Ele.me's local business officially transferred as Koubei was merged into Gaode. But at that time, Ele.me was already preoccupied with competition with Meituan, and Gaode, after integrating Koubei, did not revitalize its local business as expected.

Furthermore, in August 2024, Gaode was summoned due to issues such as high prices, false repairs, and inaccurate merchant information in home appliance repair information and services, reflecting that it still needs to improve its local business infrastructure.

Challenging Meituan's Dominant Position

One of the reasons Gaode is reluctant to abandon local business is that, unlike the food delivery business, which tests delivery capabilities and has high industry barriers, the asset-light local business is more feasible for new entrants.

Research reports from Zhejiang Merchants Securities indicate that the local business sector as a whole is currently in the early stages of online transformation, with online penetration rates for on-site dining and on-site comprehensive services in 2023 only in the single digits. It is expected to maintain a double-digit growth rate in the coming years, presenting a vast market space.

After the early Thousand Group Wars, the competitive landscape of the local business market led by Meituan has been initially determined. However, the entry of powerful new forces such as Douyin and Kuaishou has intensified industry competition. Against this backdrop, collaboration for mutual support is no longer novel.

In 2022, the Baidu Maps APP launched the "Food Group Buying" function, allowing users to view and purchase packages and coupons directly within the APP without switching or jumping to other apps. This function was developed in collaboration with Dianping. Nowadays, when users open some store group buys on Baidu Maps, they can still see the words "Provided by Meituan".

▲Image source: Baidu Maps

Just as Meituan collaborated with Baidu Maps, Douyin's partnership with Gaode also aims to enhance competitiveness and mutual benefit. However, stronger LBS (Location-Based Services) often plays a supplementary role. For C-end consumers, price power is always the core factor influencing their choices.

Since launching the group buying function in 2021, Douyin has reinforced its low-price mindset through a series of "lowest discount on the entire network" activities. In 2023, Meituan comprehensively followed up and counterattacked from aspects such as reducing commissions for merchants, subsidizing users, low-price group buying, and live streaming short videos. Although the discrepancy between transaction volume and profit forced both parties to slow down their intense competition, users have become accustomed to comparing prices across multiple platforms before consuming.

Currently, Meituan, Dianping, Douyin, and Kuaishou offer varying discounts on local group buys. Amidst them, Gaode's priority is to strengthen its presence in consumers' local group buying needs, regardless of whether it is competitive in terms of price.

Unlike Baidu Maps, which hands over the relevant locations of the local business to Meituan, Gaode still harbors ambitions to develop its own local business. While integrating Douyin Group Buying for some stores into the platform, the local business staff are still vigorously conducting business attraction work for Gaode Wangpu and Shanghutong.

Integrating Douyin Group Buying to expand the coverage of group buying stores has a somewhat indirect significance. Gaode's original intention may be singular: secure a seat at the table, regardless of winning or losing.

Perhaps when more users consider Gaode as one of the price comparison platforms, Gaode's local business path will be halfway through.