Triumph Amidst Challenges: Zhao Ming's Departure Before Honor's IPO

![]() 01/20 2025

01/20 2025

![]() 593

593

Photo Source: Tang Chen

Success often comes after failure.

In recent days, rumors surrounding Zhao Ming's resignation followed a predictable pattern: rumor, denial, re-reporting, re-denial, and finally confirmation.

On January 17, Honor issued an official announcement stating, "Mr. Zhao Ming has resigned from his positions as company director and CEO due to personal reasons. The board of directors has decided that Mr. Li Jian will take over Mr. Zhao Ming's duties."

"Choosing to let go and leave"

Simultaneously, Zhao Ming posted a farewell message on the internal network, saying, "Goodbye, brothers and sisters of Honor. I regret that I cannot lead you all through this transformation."

He cited a commendable reason for his resignation: due to extensive periods of intense work, "there are numerous abnormalities in my medical examination report, and I feel guilty towards my parents and family."

Regarding his future plans, he said, "I will adjust and heal my overburdened body, spend time with my family, read books, and improve myself."

This statement aligns with the "resignation due to personal reasons" mentioned in the official announcement.

According to my information, Honor's official evaluation of Zhao Ming's resignation is also positive, stating, "Mr. Zhao Ming has made an indelible contribution to the development and growth of Honor, and the company and its board of directors hereby express their sincere gratitude to Mr. Zhao Ming."

In a sense, Zhao Ming is leaving at a high point for Honor. As he mentioned in his farewell letter, "In 2024, the company achieved its profit and bonus budget targets, and everyone should have done well in terms of income and sales achievement rates."

He is also making a final effort for the stability of the new Honor, stating, "Mingge's shares are still in the company, and I look forward to Honor reaching new heights in 2025."

Zhao Ming's post on Honor's internal network

For Honor, more than four years after its independence, it urgently needs to complete a 'coming-of-age ceremony', namely an IPO, to justify itself and its team. As the smartphone market enters a competitive period and the era of large AI models, whether Honor can complete its transformation and continue to stay in the game is crucial.

This 'coming-of-age ceremony' was also the grand show Zhao Ming was eager to complete. As one of the three outstanding figures in Huawei's consumer business, leading Honor to an IPO and becoming the CEO of a listed company would be the ultimate accolade for him personally.

However, with the release of Honor's official announcement, the confirmation of the successor, and Zhao Ming's own confirmation, Zhao Ming ultimately failed to continue this 'show' and made "the most difficult decision to let go and leave Honor." He also sent his blessings, saying, "It is my greatest wish for Honor to move forward rapidly."

Zhao Ming's 'Role'

When Zhao Ming was first rumored to be leaving, Honor was at a critical stage of brand remodeling and market expansion, ultimately achieving the second-best annual market share in China, fulfilling his promise of 'making rapid progress' in his rumor denial post.

And now, at a critical juncture for Honor's IPO, the second rumor of his resignation, which was ultimately confirmed, inevitably leads to more uncertain speculation about Honor's prospects and adds variables to its IPO.

Zhao Ming is a pivotal figure in the Honor team. In 2015, Zhao Ming took over as president of the Honor Business Unit and was fully responsible for Honor's business. Under the Huawei system, Honor was positioned as an internet mobile phone brand, and under his leadership, Honor consistently ranked as the number one internet mobile phone brand in China in terms of sales and sales volume for multiple quarters, and once became China's Top 2 mobile phone brand in 2020.

This is reflected in Zhao Ming's farewell letter: "I was in charge of Honor in 2015, when there were hundreds of mobile phone brands, and now there are only a few left. Reverence is a word I have always remembered in these years of doing Honor. When you feel it's easy and you have everything under control, that's when the crisis comes."

In November 2020, Huawei announced its decision to sell its entire Honor business assets to Shenzhen Zhixin New Information Technology Co., Ltd., and Zhao Ming subsequently became CEO of Honor Terminal Co., Ltd.

After splitting from Huawei, Zhao Ming worked tirelessly to actively or passively promote Honor's IPO. These efforts were aimed at telling a compelling story for Honor's IPO and securing a higher valuation.

The first step was to complete the shareholding reform and optimize the equity structure to clear procedural obstacles for the IPO. Rumors of Honor's IPO spread in the market starting from its split from Huawei in November 2020. However, it was not until November 2023 that the company's board of directors officially announced its preparations for an IPO. The announcement stated that to achieve Honor's strategic development in the next stage, the company would continue to optimize its equity structure, attract diversified capital, and promote Honor's listing on the capital market through an IPO.

In the year and a half that followed, changes in Honor's shareholders intensified. On August 5, 2024, Honor also proactively responded to media concerns, stating that it "plans to initiate the corresponding shareholding system reform in the fourth quarter of this year and initiate the IPO process at an appropriate time thereafter."

This vague timetable was intended to show the outside world that Honor was methodically advancing its IPO. On December 28, 2024, Honor announced the completion of its shareholding system reform, and the company name was changed from 'Honor Terminal Co., Ltd.' to 'Honor Terminal Co., Ltd.' After completing the shareholding reform, the shareholder issues within Honor had been basically cleared, and there were no obvious obstacles to its IPO.

In June 2024, during the media communication session after the launch of Honor's foldable phone, Zhao Ming told media including Tang Chen that Honor's IPO was a decision made by the board of directors, and as the CEO, he would focus on products and the market first.

Photo: Taken on site by Tang Chen

Considering Honor's complex shareholding relationship and the expectations of shareholders, dealers, and employees, Zhao Ming's role in the IPO process was more like that of a balancer, needing to navigate relationships between internal and external parties.

Secondly, promoting Honor to become a mainstream brand and telling a compelling new story. The latest move was that Honor launched its new GT brand at the end of 2024 to continue improving its coverage of online and lower-tier markets. Meanwhile, the main Honor brand has expanded its reach into the high-end market by offering the Magic7 RSR Porsche Design at a price of 7999 yuan.

The Honor GT brand is Zhao Ming's 'open strategy.' He said on social media that "no cost will be spared in creating the Honor GT series." This new sub-brand is also his nuclear weapon to push Honor back to the online market. The background is that after Honor's independence, the sales ratio of its offline and online channels has shifted from the past 3:7 to 7:3.

Honor's roots lie in internet branding, originating and growing through internet channels, and it has completed a systematic reconstruction from research and development to channels. 'Honor' and 'Honor GT', one high and one low, as Honor raises and broadens its overall brand style and framework, it tells a brand-new brand story to the outside world.

Zhao Ming's move can also be understood as Honor gradually diluting the traces of an internet mobile phone brand and hoping to become a 'normal' consumer electronics brand like Apple and Huawei, which is also Xiaomi's goal, albeit through a slightly different path.

In addition, globalization and AI are also narratives that Honor is emphasizing. The former does not give Honor an advantage among domestic mobile phone brands. The latter, on the other hand, benchmarks Apple. With the 'order 2000 cups of coffee' viral marketing campaign, Honor has gained recognition from AI users, which may be its most worthwhile story besides the inseparable 'Huawei concept stock.'

Thirdly, striving to sell more Honor phones. Honor has also considered entering the fields of household appliances and wearable smart devices, and even wanted to build robots. But these are all 'stories of the future.' Honor's current biggest reliance is still on mobile phones and some peripheral products. Selling more mobile phone products has become Zhao Ming's biggest quantitative performance indicator and the basis for Honor to attract consumers and investors to 'vote with their wallets' after its IPO.

In this regard, Zhao Ming's work was qualified and even excellent. For example, under his leadership, the new Honor completed an 'extreme march' and built a comprehensive system including R&D, products, supply chains, and markets in just four months, and launched the Honor 50 series 30 days ahead of schedule despite obtaining chips and other components 45 days later than the industry.

Judging from its performance over the past four years, Honor's mobile phones have also performed well in the market, basically stabilizing in the top five positions and revitalizing the supply chain. Even with Huawei's strong return, Honor has shown robust combat effectiveness.

Especially in the high-end mobile phone market, Honor is the best-performing domestic brand after Huawei. According to Canalys data, in the third quarter of 2024, Honor's share in the global high-end mobile phone market (wholesale selling price ≥600 US dollars/approximately 4300 yuan) was 2%, ranking fifth globally.

According to information published on Honor's official website, Zhao Ming, CEO of Honor, last appeared publicly to participate in a cooperation event to enter Indonesia not long ago. According to data released by Honor, in December, the proportion of Honor's overseas sales exceeded 50%.

Honor confronts Huawei directly

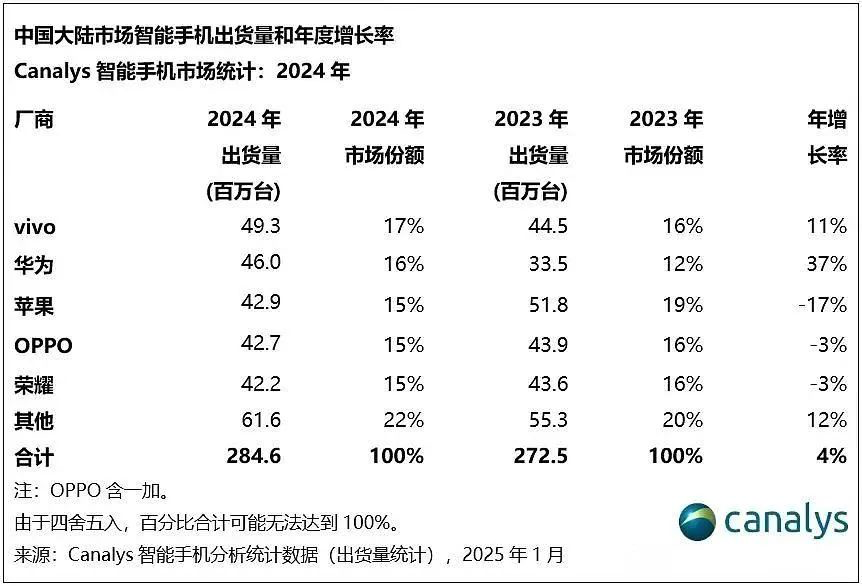

It is worth mentioning that the latest annual statistics from Canalys show that the annual shipments of smartphones in mainland China reached 285 million units in 2024, recovering after two years of decline with a mild year-on-year growth of 4%. Specifically, Apple saw the most significant decline, while OPPO and Honor both had a market share of 15% with a negative annual growth rate of 3%.

As a result, many have been pessimistic about Honor's prospects. However, I believe it's not that Honor is performing poorly, but rather that the newly returned Huawei is performing too strongly, ranking second with a growth rate of 37%, just 3 million units behind the first-place vivo.

Objectively speaking, Huawei is a formidable obstacle for all domestic mobile phone brands and even international mobile phone brands, and it cannot be bypassed.

This is also a clear signal for both Huawei and Honor: Huawei is reclaiming its rightful position in the domestic mobile phone market, and the market shares of major mobile phone brands are undergoing necessary adjustments. After four years of independence, Honor has also returned to being a normal mobile phone brand, truly facing competitive pressure from Huawei.

It should be noted that during this period, the relationship with Huawei has always been unclear. Although he has repeatedly expressed views such as 'the original family is too outstanding, and Honor feels a lot of pressure' in an attempt to convince the outside world that Honor is not really a 'Huawei ecosystem stock' but a brand-new company and brand, he may still intentionally or unintentionally 'guide' the outside world to make relevant associations due to marketing and mobile phone sales needs.

With the IPO looming and Zhao Ming's resignation, this may be a necessary storm before Honor's 'coming-of-age ceremony.' However, to initiate and complete the IPO in 2025, the valuation will undoubtedly be closely related to market performance, and the company must strive for a better ranking. This will be a huge challenge for successor Li Jian, and the work that Zhao Ming did not complete will also be his focus.

Public information shows that Li Jian joined Huawei in 2001 and entered Huawei's board of supervisors in 2017, with experience in strategic management and global layout, and has participated in major reforms and strategic planning at Huawei. In 2021, he joined the new Honor and successively held positions such as core member of the management team, vice chairman, director, and president of the human resources department.

Although the outside world has not yet formed a specific understanding of Li Jian, based on his resume, it is clear that he is also a 'tough guy.' And the complex environment that Honor is currently facing is precisely the time when such a 'tough guy' is urgently needed. However, the distinct Huawei label on him also indicates that he will face the same 'difficult problem' as Zhao Ming: how to confront Huawei and continue to complete Honor's 'coming-of-age ceremony.'

This is also the psychological hurdle that the new Honor must cross to achieve 'glory' and complete its coming-of-age ceremony. As Ren Zhengfei said, the new Honor can compete with Huawei, which holds new 'Hanyang rifles' and 'new broadswords and spears,' with 'foreign guns' and 'foreign cannons.'

If this hurdle cannot be crossed, Zhao Ming's resignation will be a significant loss for Honor.