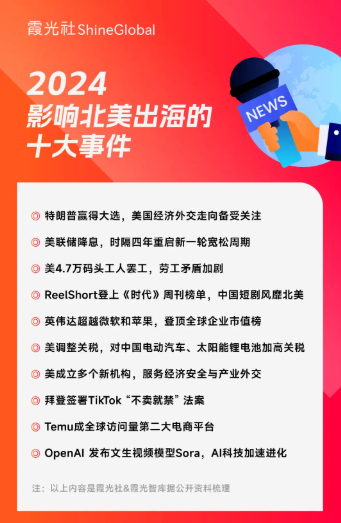

Navigating North American Business: Embracing Risks and Rewards in a Lucrative Market

![]() 01/20 2025

01/20 2025

![]() 626

626

Author | Yang Zi

Did you ever feel overwhelmed in 2024?

For those venturing into North American business, responses would likely include "exhausted, feeling like efforts are undervalued," "too competitive," or "many tough moments, but business is always challenging."

Yet, those who persevered also acknowledge the year's sweet rewards.

Reflecting on 2024, China's export value surged 5.9% year-on-year to $3.58 trillion, marking a 10.5 percentage point increase from the previous year and surpassing 2022's total to set a new record. According to the International Monetary Fund (IMF), after a 2023 downturn, global trade growth rebounded from 0.8% to 3.1% in 2024.

China's top ten export markets include ASEAN, the European Union, the United States, Hong Kong, Latin America, Africa, Japan, South Korea, India, and Russia. With its mature market and robust consumption potential, North America remains a significant export destination for China, serving as an ideal launching pad for Chinese brands' globalization.

Despite geopolitical tensions and trade protectionism, the vast North American market continues to draw ambitious players with its alluring prospects.

In 2024, China's total exports hit a new high, with uncertainty, competition, and ambition defining this year's North American expansion. In December, China's exports grew by 10.7% year-on-year, a significant 4.0 percentage point increase from the previous month and far exceeding market expectations of 7.1%. This figure mirrors the current North American market sentiment: amid heightened bilateral trade uncertainties post-Trump inauguration, many aim to "rush exports" ahead of potential disruptions.

Before the storm hits.

When asked about the top concerns for North American expansion in 2024, tariff changes undoubtedly topped the list.

With Trump's US presidential victory in 2024, he announced on his first day in office a 25% tariff on all Mexican and Canadian products, with an additional 10% specifically for Chinese goods.

Not only did tariff values increase, but the scope of taxed items broadened. For instance, sales tax applies once annual sales volume (e.g., $100,000) or transaction count (e.g., 200) thresholds are met in a state. For goods stored in Amazon FBA warehouses, sales tax is also applicable.

Here are the key details of US tariff changes on China in 2024:

May 14, 2024: President Biden instructed the Office of the United States Trade Representative (USTR) to increase or impose tariffs on various Chinese goods.

May 22, 2024: USTR proposed partial tariff adjustments on Chinese imports, effective August 1.

August 1, 2024: Tariffs on steel and aluminum products rose from 0%-7.5% to 25%; electric vehicle lithium batteries and components, personal protective equipment (including ventilators and masks) increased from 7.5% to 25%; port cranes from 0% to 25%; syringes and needles from 0% to 50%; solar cells from 25% to 50%; electric vehicles from 25% to 100%; and key minerals from 0% to 25%.

September 13, 2024: Based on the "Four-Year Review of Section 301 Action," the US announced phased tariffs (2024-2026) on "strategic products" from China, including steel, aluminum, semiconductors, electric vehicles, lithium batteries, key minerals, solar cells, medical equipment, and port cranes, in addition to existing 301 tariffs.

September 27, 2024: The US imposed a 100% tariff on Chinese-made electric vehicles and a 50% tariff on solar cells.

December 11, 2024: USTR announced that, starting January 1, 2025, tariffs on solar silicon wafers and polysilicon would rise to 50%, and tungsten products to 25%.

The "America First" policy poses numerous challenges to Sino-US trade, an unknown factor for all overseas traders in 2024 and beyond into 2025.

Beyond tariffs, monetary policy changes also significantly impact global trade from a macro perspective.

Exchange rate fluctuations reshape the global trade landscape, potentially intensifying trade frictions and competition. For overseas traders, a depreciating US dollar can relatively appreciate the Chinese yuan, reducing Chinese export products' price competitiveness in the international market. However, if Chinese overseas brands enhance quality, technological content, and branding, high-value-added product exports may remain unaffected, and increased US demand could present new market opportunities.

This presents a new opportunity for Chinese brands.

In 2024, the Federal Reserve cut interest rates three times:

September 18: The Federal Reserve lowered the federal funds rate target range by 50 basis points to 4.75%-5.00%.

November 7: The Federal Reserve cut the federal funds rate target range by 25 basis points to 4.50%-4.75%.

December 18: The Federal Reserve reduced the federal funds rate target range by 25 basis points to 4.25%-4.50%, totaling a 100 basis point cut for the year.

Global logistics, characterized by long chains and numerous links, faced disruptions from human and emotional factors in 2024.

On October 1, 2024, over 47,000 dockworkers at 36 US East Coast and Gulf of Mexico ports went on strike due to compensation and automation concerns. This was the first large-scale strike since 1977, lasting three days and ending with a preliminary agreement.

Additionally, strikes occurred at Canadian ports of Montreal, Vancouver, and Prince Rupert in September and November.

From September 30 to October 3, 2024, two key Montreal Port terminals struck for 72 hours due to labor disputes. Subsequent strikes led to operations suspensions, forcing ships to delay or divert. Major shipping companies announced freight rate increases, with Maersk, CMA CGM, and MSC imposing peak season surcharges on routes to Canada.

In November, large-scale strikes hit Vancouver and Prince Rupert ports, driven by compensation, benefits, and working condition issues. These strikes exposed US maritime industry and port operation issues, potentially increasing logistics costs, delaying transportation, and affecting Chinese overseas enterprises' supply chain stability and cost control.

This year, those relying on maritime transportation must recalibrate inventory turnover and freight costs.

Since 2020, North American market compliance demands have risen, with 2024 witnessing even stricter inspections and crackdowns.

On Amazon, anti-counterfeiting efforts intensified, supporting law enforcement agencies and dozens of brands in over 30 enforcement actions against counterfeit sellers and suppliers, covering sportswear, auto parts, beauty products, luxury goods, 3C digital products, games, and toys, involving brands like Xiaomi, Nintendo, LEGO, and Coach. For instance, Xiaomi, Nintendo, and LEGO collaborated with Amazon to seize over a million counterfeit products.

Fake products also plagued overseas markets. In October, Amazon's Anti-Counterfeiting Crime Unit, with Cisco, dismantled multiple counterfeiting gangs, with products valued at up to $1.5 million.

The US Postal Service also intensified fake shipping label crackdowns. From August 1, it began real-time manifest file verification, with USPS, UPS, and FedEx following suit. The US Postal Service loses millions annually due to fake labels and forged postage.

While overseas trade often has an unspoken "translation" gap, wealth and status come with risks, and long-term prosperity requires stability.

2024 marked significant cross-border e-commerce growth, with more Chinese entrepreneurs focusing on overseas markets, favoring e-commerce.

Aligning with evolving enterprise needs, diverse channels and platform options emerged. Two years after launch, Temu became the second most visited e-commerce platform globally, second only to Amazon. With its low-price advantage, Temu gained a significant North American market share from comprehensive e-commerce platforms. Social platforms also became shopping destinations, with Instagram, YouTube, and TikTok preferred by American adults for direct shopping. On Black Friday 2024, TikTok Shop's daily sales exceeded $100 million, triple last year's figure.

Platform competition manifested in "semi-managed services." Temu and SHEIN launched these models in the US in March and June 2024, respectively, impacting Amazon's FBA warehouses. From February 1, Amazon adjusted its US FBA shipping policy, shortening automatic closure times. Domestic shipments not delivered within 45 days and international shipments within 75 days were automatically closed.

Amazon's pricing anxiety was also evident. On August 14, it increased the "refund only" policy threshold from $25 to $75, expanding coverage. During Black Friday, Amazon launched a low-price mall, Amazon Haul, offering 50% off promotions, competing with main site sellers for traffic and orders. This indicates intensifying price competition in North American cross-border e-commerce.

In 2024, North American consumers shifted more shopping online from physical stores, with AI assisting in finding deals or personalized product recommendations. Amid technological empowerment, consumers also prioritized health and wellness, expanding consumption trends to products promoting physical, mental, and emotional health.

Similarly, this year, businesses faced demanding consumers and platforms struggling with traffic acquisition.

Localization stands as a pivotal keyword in the journey of going overseas. To thrive in the North American market, it becomes imperative to rely on localized product innovation strategies, ensuring a better fit for the needs of target consumers. This year, the emphasis on in-depth localization has extended to the level of industrial chain enterprises.

For instance, manufacturing enterprises across new energy storage, power batteries, and biomedicine have intensified their investments and localization efforts in the United States:

Sungrow Power Supply: In April 2024, Sungrow inked a supply agreement for energy storage products with Tanzanite Energy and Platinum Energy. In August, Spearmint Energy of the United States procured 1GWh of Sungrow's state-of-the-art liquid-cooled PowerTitan 2.0 energy storage system for deployment in Texas.

EVE Energy: In June 2024, ACT Company, the first project under CLS's global cooperation and operation model, commenced construction in Mississippi. It aims to produce prismatic lithium iron phosphate batteries with an annual capacity of approximately 21GWh, with shipments anticipated to commence in 2026. During the Renewable Energy Expo (RE+) in September, EVE Energy showcased its comprehensive energy storage product portfolio, including the Mr flagship series, and forged strategic partnerships with AESI, ABB, and Delta enterprises.

Canadian Solar Storage: In July 2024, Canadian Solar Storage signed a contract with Aypa Power, a subsidiary of Blackstone Group, to supply a 498MWh stand-alone energy storage system for its Bypass project, anticipated to commence production in the third quarter of 2025.

HICHUN ENERGY: In July 2024, HICHUN ENERGY's U.S. subsidiary announced a $100 million investment in Mesquite, Texas, to establish a new factory with an annual capacity of 10GWh for energy storage battery modules and system integration. Production is expected to commence in 2029. Earlier in June 2024, HICHUN ENERGY delivered and deployed a 3GWh battery energy storage system to Jupiter Power by the end of 2025, offering a self-developed new-generation 5MWh HiTHIUM ∞Block liquid-cooled energy storage system solution.

SPI Energy: On September 9, SPI Energy's U.S. subsidiary officially opened its doors in Irvine, California. During the first half of the year, SPI Energy formally signed a 12GWh energy storage cell cooperation framework agreement with the renowned energy storage integrator POWIN.

Guoxuan High-Tech: From September 10-12, Guoxuan High-Tech exhibited multiple American standard energy storage products and full-scenario energy storage solutions at the 2024 American International Solar Energy and Storage Exhibition. The company secured 2GWh of orders on-site and signed strategic cooperation agreements with several local raw material suppliers.

Envision AESC: On December 6, 2024, Envision AESC announced the construction of a power battery superfactory in Florence County, South Carolina, USA, with a planned annual capacity of 30GWh. This factory will supply power battery products for BMW Group's next-generation vehicles.

Henlius Biotech: In 2024, Henlius Biotech shipped its self-developed and produced trastuzumab biosimilar drug Herzuma® from its Songjiang base to the U.S. market, marking its inaugural commercial supply to North America.

TCL: In 2024, TCL established a factory in Tijuana, Mexico, with an annual production capacity of 3 million units, catering to the North American market. The company also partnered with BestBuy to prominently feature its products in 30 stores, hosted a sales competition for 98-inch TVs, and became an official partner of the NFL, North America's premier sports IP.

From July 2023 to July 2024, overseas revenue surged from $6.4 million to $59.7 million, marking a nearly tenfold increase in just one year. In the first half of 2024, the total revenue from overseas short dramas exceeded $230 million, with expectations to reach $400 million for the full year. The U.S. market accounts for over half of the revenue from overseas short dramas, making it a significant contributor to overall earnings.

Multiple Chinese short drama-related companies have garnered recognition:

In 2024, Maple Interactive, the parent company of ReelShort, was named by Time magazine as one of the "100 Most Influential Companies in the World". As of the end of February 2024, the cumulative in-app purchase revenue of "ReelShort" globally approached $80 million, with Q1 2024 revenue growing more than tenfold compared to Q1 2023.

In 2024, ReelShort soared up the ranks of the U.S. iOS top charts with hit short dramas like "Fated To My Forbidden Alpha", a werewolf revenge tale, even surpassing TikTok multiple times, which has long dominated the charts.

At the beginning of 2024, ShortMax, previously known as ShortTV and under Jiuzhou Culture, successfully overtook its competitor ReelShort to become the number one short drama app in the United States due to the popularity of its new drama "I Hope It's You". It topped the download charts in March.

In 2024, ChineseAll introduced its self-developed AI large model "Chinese Xiaoyao" into the production of short dramas, enhancing the efficiency of scriptwriting and facilitating multilingual translation. On November 10, 2024, Kunlun Tech announced that its AI short drama platform SkyReels would officially launch in the United States on December 10.

In December 2023, ChineseAll launched Sereal+, which entered the top 30 of the U.S. iOS Entertainment Bestsellers list in 2024.

In 2024, Kunlun Tech announced a $500 million investment to produce 1,000 overseas local short dramas.

In 2024, a cluster of short drama production studios of a certain scale emerged in Los Angeles, with Chinese companies establishing studios one after another. This attracted numerous international students from leading film and television institutions such as New York University, Columbia University, the University of Southern California, and Chapman University to engage in the production of Chinese short dramas for overseas markets.

This year, Chinese short dramas, predominantly featuring the theme of "overbearing CEOs", were warmly embraced by a user base primarily comprising women aged 20-50 in the United States. Some hit short dramas generated recharge revenue of up to one million dollars, such as "Let's Get Married, My Billionaire", sparking a "Chinese short drama boom" in the United States.

North America has always been a market brimming with both opportunities and challenges. Here, dreams can be realized, but they can also be shattered. However, the market economy consistently welcomes those with ambition to come and pen a new chapter of struggle, competition, and wealth dreams for the new year.