Behind Xiaohongshu's Global Popularity: The Decline of American Social Media Giants

![]() 01/23 2025

01/23 2025

![]() 487

487

From suspension to resumption, TikTok recently staged a remarkable comeback in the American market, captivating the hearts of millions worldwide. However, despite this favorable turn, TikTok cannot rest easy, as policy risks loom large.

While TikTok continues to navigate turbulent waters, Xiaohongshu unexpectedly "wins by default" across the ocean. Starting January 13th, a sudden influx of overseas users "fleeing" TikTok arrived on Xiaohongshu. They cautiously greeted Chinese netizens through images and videos, quickly receiving enthusiastic responses. Thus, separated by screens and aided by third-party translation software, netizens from both countries embarked on an unprecedented interactive frenzy.

Data reveals that in just two days, over 700,000 new users joined Xiaohongshu. Under the hashtag "#TikTokRefugee," there are already 321,000 posts, with a total view count exceeding 360 million and a discussion count reaching 7.809 million.

This "overwhelming traffic" has also attracted numerous overseas social media accounts, MCNs, cross-border e-commerce businesses, and brands, further escalating the interactive frenzy.

As TikTok faces setbacks, no one anticipated that Xiaohongshu, with a minimal presence in overseas markets, would be the first to reap the benefits. But why Xiaohongshu? It's not merely a protest. "Facebook is too old, Pinterest is full of ads, and Instagram has many angry old people and is very sexist," bluntly stated an overseas user, illustrating the current state of American social media.

Domestic Apps "Surround" the American Market

On January 12th, Xiaohongshu ranked only 11th on the free app chart in the U.S. Apple App Store but surged to the top spot the next day. Although this "migration" of traffic may not retain many users due to cultural and linguistic differences, following TikTok's successful global market entry on behalf of Chinese internet applications, Xiaohongshu's surging popularity will undoubtedly become the next "potential stock" heading towards the world.

Whether it's the high-profile TikTok or the unexpectedly popular Xiaohongshu, their development may introduce new variables into the global social media landscape, especially in the American market, long dominated by tech giants.

In the American market, an increasingly evident phenomenon is that Chinese internet applications are constantly refreshing their presence and gaining more initiative.

At the end of 2024, Apple released its list of popular apps and games on the App Store. Temu continued its success from 2023, once again becoming the most downloaded free app in the U.S., followed by Meta's Instagram Threads, with TikTok taking third place, still leading in downloads. Additionally, CapCut, another app belonging to ByteDance, entered the top 10.

This list showcases that Chinese internet applications have secured a place in the two most core areas of American social media and e-commerce.

The same is true on a global scale. According to data from the American research firm Sensor Tower, the Nikkei analyzed new downloads from Google and Apple's app distribution services in the U.S. from January to March 2023. Among the total of 475 apps ranked in the top 5 in 95 countries and regions worldwide, including Japan, China, and the U.S., 156 (equivalent to 33%) were Chinese apps, an increase of about 8 percentage points compared to January to March 2020.

As this rise continues, the strong growth of Chinese internet applications is accompanied by the decline of American internet giants, especially in the social media field.

Taking Facebook as an example, according to Statcounter data, in December 2024, Facebook's global market share was 63.9%, far ahead of Instagram's 13%, Pinterest's 9.39%, X's 6.95%, and YouTube's 4.95%. However, four years earlier, in December 2020, Facebook's global market share was as high as 72.54%.

Facebook's market share in the U.S. is also shrinking. In December 2024, Facebook accounted for only 53.72% of the American social media market, compared to 56.73% in December 2020.

The pressure brought by TikTok on American social media platforms is not only evident in user numbers but also critically affects the substantial social media advertising market. Market research firm Omdia has stated that by 2027, the total revenue of online video advertising will exceed $331 billion, of which TikTok will account for 37% of the market share, and its advertising revenue is expected to surpass the combined total of Meta's social platforms and YouTube.

Originally, if TikTok were banned in the U.S., Facebook, Instagram, and others would likely be the biggest beneficiaries. However, the result was that Xiaohongshu "stole the show".

Local Social Apps "Lose" Innovation

In the past two years, whether it was Musk's revamp of Twitter or Zuckerberg's launch of the "Twitter killer" app, neither seems to have truly revitalized American social media.

In 2023, Threads was launched, and within less than a day, it surpassed 30 million users, exceeding 100 million users within five days. In just six months, the number of monthly active users increased by 50 million, reaching nearly 100 million. The rapid growth in user data made Threads a dark horse in social media, but this high-growth trend did not continue, and Threads did not significantly impact the X platform (Twitter).

Although these Twitter-like social products have never shaken the status of the X platform (Twitter), the X platform itself also faces growth challenges. According to data, the platform's global daily active users have decreased by 15%, with a decrease of 18% in American users.

Social products represented by the Meta family are gradually "aging," and new social "nobles" that can compete with Facebook and Instagram have yet to emerge. This is the current state of local internet social media platforms in the American market. Behind this lies the depletion of innovation in American social products, especially among the top social apps. They have abandoned innovation and become increasingly accustomed to imitation, leading to greater homogenization of the entire social media landscape.

In November 2020, Twitter launched the Fleets feature with much fanfare, but user response to this new feature remained generally lukewarm. This is because this feature is similar to LinkedIn Stories, which was recently launched globally, and LinkedIn Stories are similar to YouTube Stories, WhatsApp Status, and Facebook Stories, which were launched earlier. Going further back, we can trace it to 2016, when there were already functions similar to Twitter Fleets.

The rise and growth of TikTok in the American market more intuitively demonstrate the lack of innovation in American social media.

At that time, facing TikTok's fierce competition, American social giants launched short video functions one after another. Meta introduced the short video product Reels, YouTube launched a short video feature similar to TikTok called YouTube Shorts, and Snapchat also introduced the Spotlight short video feature. However, these actions failed to stem TikTok's popularity. Now that TikTok faces a ban, users have not chosen platforms like Instagram Reels or YouTube Shorts but have instead joined Xiaohongshu across the ocean, which speaks volumes.

In fact, it's not just the social field. Judging from the APP rankings of Google Play and App Store in recent years, the long-time top apps are still Facebook, YouTube, Amazon, Google, and other products that have served users for more than a decade or even two decades. If we trace back the last batch of products born in the U.S. with global influence, we can think of Uber, Airbnb, Pinterest, etc., whose popularity also dates back eight or nine years.

Of course, the birth of ChatGPT has attracted global attention and is more transformative, but it is still immature.

Blind imitation has gradually diluted the unique characteristics of American social media platforms and made them more bloated, leading to user loss. To find the reason for the disappearance of innovation, it may be related to the fact that several giants have long held the discourse power in technology. Especially in the social field, Meta firmly controls American social media through continuous mergers and acquisitions and suppression.

Leveraging the Social Landscape: Hope Lies in AI?

It is undeniable that for tech giants like Meta, Google, and Microsoft, it is difficult to break through the business barriers they have built up over the years through innovation alone. However, the advent of ChatGPT has aroused the imagination of AI technology disrupting the world, and AI has naturally injected new strength into social media.

For example, the interaction between humans and virtual AI. When the human-computer interaction experience relying on the multimodal interaction capabilities of AIGC is unprecedentedly improved, AI chatbots like Character.AI are becoming increasingly popular among young people, and virtual emotional companionship has also become one of the mainstream directions for the application of large AI models.

According to the "2024 Z Generation AIGC Attitude Report" released by the Just So Soul Research Institute, 60% of young people have used AI social products, and their overall attitude towards AI interaction is positive.

Whether in the U.S. or domestically, against the backdrop of stagnation and depleted innovation in the entire social media field, AI social has undoubtedly attracted the attention of young groups. However, does AI social really have the power to change the global social media landscape? Or can AI social create an entry-level product like Facebook or Instagram? From the current AI social products, we don't seem to see hope.

Taking Character.AI as an example, Character.AI is the second most popular AI in the AI circle after ChatGPT, with its core selling point being that users can "establish a virtual relationship" with AI. However, regrettably, Character.AI was well-received but not commercially successful, forcing it to be "acquired" by Google for $2.5 billion.

Another company with a similar fate is Inflection.AI, which develops large models and overlays a chatbot named Pi with the purpose of a "personal AI companion," targeting the emotional companionship market. The Pi chatbot once attracted the interest of many investors but ultimately fell into the hands of Microsoft. In March 2024, Microsoft poached Inflection's founder and almost all of its employees.

The common fate of these two AI social products reveals the biggest challenge that AI social may face in the future, namely commercialization. Traditional advertising monetization is no longer viable, and user paid penetration is relatively limited. As the user base grows, it becomes even harder for the platform to persevere.

This also confirms another issue: the development of AI social may still not escape the control of giants. Because almost all AI applications have to face high chip costs, emerging data costs, and training costs. The lag in commercial monetization makes them prone to falling into the hands of wealthy tech giants. Although tech giants no longer choose direct mergers and acquisitions, by investing in AI startups, they can still exercise control over products, technology, and core personnel.

We see that even OpenAI, the star AI enterprise that sparked the generative AI wave, may not significantly change or shake the balance of power between large technology companies.

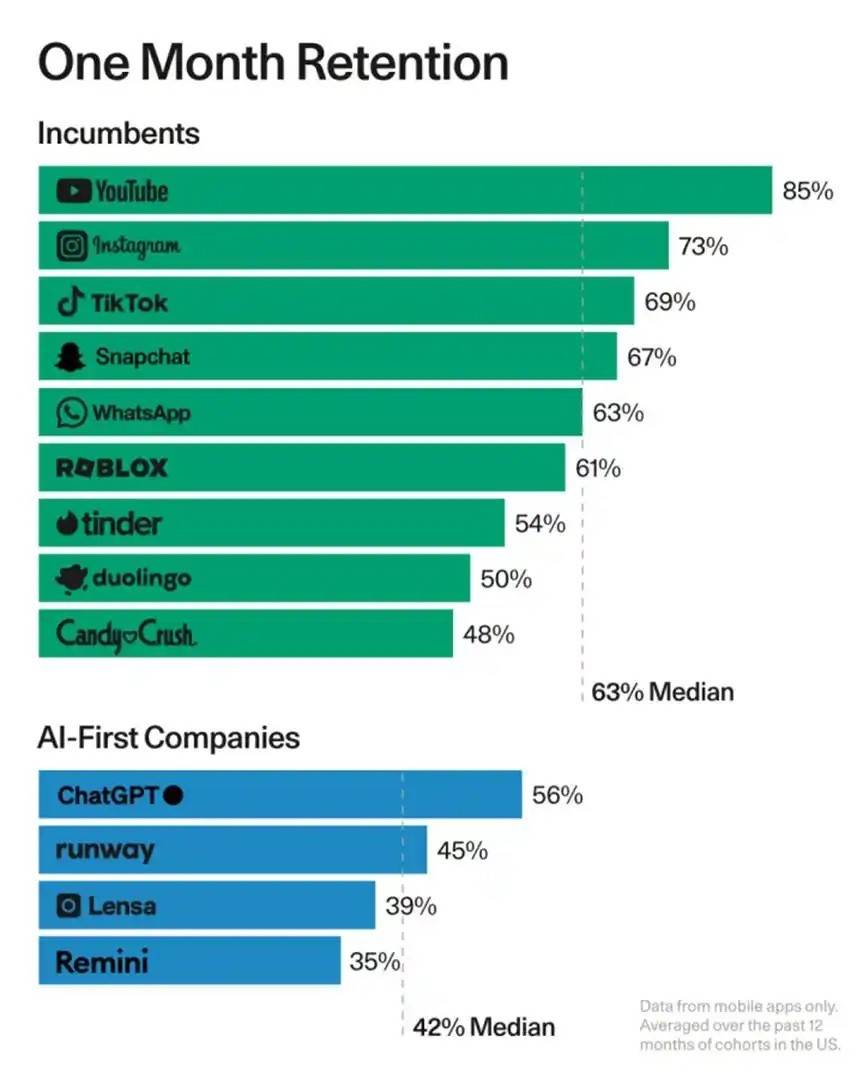

According to data from Sequoia Capital's "The Second Act of Generative AI," AIGC applications, including ChatGPT, are completely outperformed by familiar mobile applications in terms of user retention and activity.

Of course, the future of AI social is not so pessimistic. Current AI social products are actually more of a niche category within the AI sector rather than true social products of the AI era. Perhaps when we truly enter the AI era, it will be the beginning of a transformation in global social media.

Dao Zong You Li, formerly known as Waidaodao, is a new media outlet in the internet and technology circle. This article is original, and any form of reproduction without retaining the author's relevant information is prohibited.