Breaking Ties with Alibaba: Cainiao Steps Out of Its Comfort Zone

![]() 01/23 2025

01/23 2025

![]() 569

569

Following a business restructuring, Cainiao will bid farewell to its identity as a 'technology platform' and shift its focus, potentially allowing it to allocate more resources and autonomy to serving clients beyond Alibaba's ecosystem.

Original content by New Entropy

Sweeping changes are underway within the Alibaba Group.

Recently, rumors emerged that Cainiao Group would undergo a significant organizational restructuring, with certain divisions being transferred to Alibaba's e-commerce business group and Taobao and Tmall Group. This adjustment will effectively strip Cainiao of its label as an 'Internet logistics technology platform', propelling it onto a new trajectory as a dedicated logistics company.

Founded with Jack Ma as its inaugural chairman, Cainiao was initially conceived to support Alibaba's e-commerce ecosystem. Once synonymous with smart logistics, Cainiao was born from the convergence of e-commerce, logistics, and technology. However, due to its initial mandate to serve the group's operations, despite its impressive performance, Cainiao's businesses were heavily intertwined with Taobao, Tmall, and Alibaba International, limiting its ability to stand at the forefront.

Post-adjustment, Cainiao will shed its identity as a 'technology platform', concentrate on the logistics industry, enjoy a more streamlined business, and undoubtedly possess greater autonomy.

Amidst these significant shifts, Cainiao Group, once deemed 'incapable' of handling express delivery, has transformed. However, as Cainiao shifts its focus to logistics, it now faces new risks and opportunities in its subsequent development, having gained more autonomy.

With the spin-off of businesses more closely tied to e-commerce, if Cainiao aims to maintain its position within the group, it must identify new growth avenues. This places a heavier burden on Cainiao's shoulders.

Genetic Recombination

Rumors of 'Cainiao being spun off' first surfaced on January 13. Reports indicated that Cainiao Group held an internal management meeting on January 10, announcing a fresh round of business spin-off plans, followed by detailed discussions on segmented business adjustments on January 11.

However, this news was swiftly refuted by insiders from Alibaba and Cainiao. Relevant personnel clarified that Cainiao is merely adjusting the production relations of certain platform logistics businesses, with its core logistics operations remaining unchanged and continuing to vigorously develop global express delivery, supply chain, and logistics technology.

On January 14, 36Kr elaborated further on the above denial: Cainiao Group will soon complete a round of organizational restructuring.

This adjustment encompasses Cainiao's international and domestic-related businesses.

In international business, the over 400-person team serving AliExpress within Cainiao's international division will transfer to the newly integrated Alibaba e-commerce business group. Ding Hongwei, the Cainiao executive overseeing this business, will report directly to Jiang Fan, CEO of Taobao and Tmall Group and the International Business Group. Since last year, he has reported to both Wan Lin and Jiang Fan.

In domestic operations, Cainiao's two teams responsible for domestic e-commerce supply chain solutions and electronic waybills will transfer to Taobao and Tmall Group.

Moreover, according to Cainiao employees, Cainiao Stations will be spun off and transformed into a group holding company, classified under the 'N' in '1+6+N'.

In summary, post-adjustment, Cainiao's business system will spin off divisions more closely tied to e-commerce, retaining logistics fulfillment-related operations. Cainiao will continue to handle logistics services for self-operated businesses like Tmall Supermarket and Tmall Global under Taobao and Tmall, as well as most warehousing and logistics services for the cross-border e-commerce platform AliExpress.

Following the adjustment, Cainiao's previously emphasized 'e-commerce X technology' genes will undergo recombination, with a diminished technology background and a focus on logistics business emerging as new features.

Regarding this adjustment, Li Chengdong, e-commerce strategy analyst and founder of Dolphin Society, analyzed for 'New Entropy' that this shift is driven by the business development needs of Alibaba and Cainiao. For Cainiao, warehousing logistics and distribution remain consistent. Post-adjustment, Cainiao's business focus may change, potentially enabling it to devote more resources and autonomy to serving clients beyond Alibaba's ecosystem.

▲Image/Good Look Business

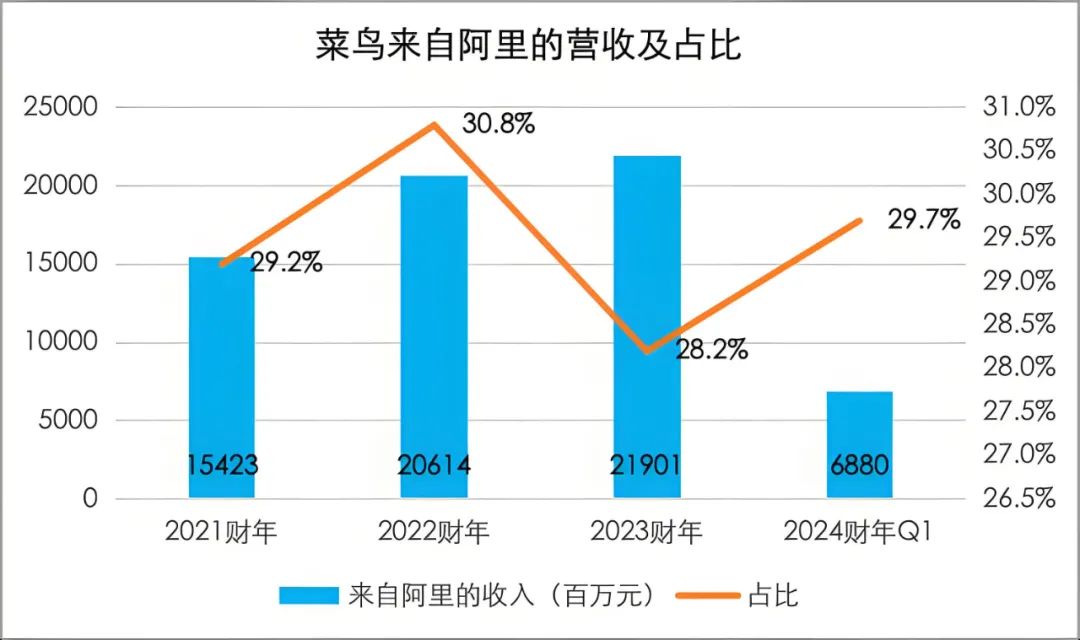

In fact, according to Cainiao's previously disclosed prospectus, from fiscal years 2021 to 2023, the proportion of revenue from Alibaba remained stable at around 30%, with the remaining 70% derived from external clients.

While Alibaba is undoubtedly Cainiao's largest client, the significance of revenue from external clients in Cainiao's revenue structure cannot be overlooked. Post-business adjustment, while strengthening collaboration with Alibaba's e-commerce arm, identifying incremental revenue from external clients may also become a key focus for Cainiao.

Shift in Focus

If one word were to describe Alibaba's state in recent years, 'change' would be most apt. As one of Alibaba's six business groups, Cainiao's business adjustment is part of the Alibaba Group's overall strategic realignment.

On July 21, 2023, Daniel Zhang, then Chairman and CEO of Alibaba Group, announced in an internal letter that Alibaba's business structure would evolve from a single Alibaba business group to a new governance structure with multiple business groups and companies operating independently under '1+6+N'.

Since the historic management transition in September 2023, the Alibaba Group's top priority has been to concentrate on its two core businesses: e-commerce and cloud computing.

While focusing on core businesses, Alibaba has also been continuously divesting non-core operations. In the first nine months of fiscal year 2024, Alibaba completed the sale of non-core assets worth US$1.7 billion; on December 17, 2024, Alibaba sold 100% of its equity in Intime Department Store Group for RMB 7.4 billion; and on January 1, 2025, Alibaba announced the sale of all its equity in Sun Art Retail Group.

From a single business group to '1+6+N', and subsequently to a focus on e-commerce and cloud computing, facing intense external competition, even a formidable company like Alibaba must make choices and concentrate its main efforts on core businesses.

As a crucial infrastructure for Alibaba's key e-commerce business, Cainiao will transfer divisions closer to e-commerce operations to better serve the group's e-commerce arm.

Furthermore, Cainiao has been deeply embedded in Alibaba's e-commerce operations for years, with its business spanning international logistics, domestic logistics, technology, and other services. While its scope is vast, its business focus has been insufficient. This downsizing and streamlining are not only strategies for Alibaba to concentrate on its operations but also enable Cainiao to focus its business on logistics.

▲Image source: Cainiao prospectus

Zhang Yi, Chief Analyst at iiMedia Consulting, also analyzed for 'New Entropy' that Cainiao's current adjustment is essentially aligned with the overall business layout focus of Alibaba.

He noted that in recent years, e-commerce platforms such as Douyin, JD.com, and Pinduoduo have developed rapidly, posing a significant threat to Alibaba's e-commerce business. Alibaba must enhance its e-commerce supporting infrastructure and firmly grasp its core operations.

Additionally, Zhang Yi mentioned that as Cainiao becomes a pure logistics enterprise, whether Alibaba e-commerce's express delivery fulfillment opportunities will be shared with other logistics enterprises in the future, and what new opportunities it can bring to these enterprises, may be the biggest highlights to follow.

Hard to Grow Wings

According to data disclosed in the prospectus, for the six months ended September 30, 2024, Cainiao's revenue was second only to Taobao, Tmall, and Cloud Intelligence among Alibaba's business groups. However, with a narrower business scope, if Cainiao aims to maintain its position among the business groups, it must identify new growth avenues.

As a logistics enterprise re-entering an open market, if Cainiao seeks opportunities beyond Alibaba's operations, it clearly needs to exert more effort.

In international operations, Cainiao previously contributed significantly to AliExpress's logistics fulfillment. After transferring the over 400-person team serving AliExpress in international operations to the Alibaba e-commerce business group, as cross-border e-commerce is not a mainstream shopping method in most countries, Cainiao's international business needs to increase local-to-local services to sustain growth.

In fact, Xiong Wei, Senior Vice President of Cainiao Group and General Manager of the Cross-Border Logistics Business Department, once mentioned in an interview with the media that Cainiao launched '5 USD 10-Day Delivery' in mid-2020, covering many global markets. Later, it introduced '10 USD 5-Day Delivery', now available in about a dozen of the most core markets.

Nevertheless, in local-to-local services in overseas markets, international giants like DHL and UPS clearly have more localization advantages, making it challenging for Cainiao to achieve breakthroughs in performance through this approach.

In domestic operations, the priority of Cainiao Express, a self-operated express delivery service, may increase.

Launched less than two years ago, Cainiao Express was initially established to provide high-value, cost-effective express delivery services, supplementing those of Tongda Express, J&T Express, and SF Express. It mainly offers services such as half-day delivery, next-day delivery, door-to-door delivery, and night pickups, covering full-weight packages including large, medium, and small items.

If Cainiao concentrates on Cainiao Express, it may pose a threat to Tongda Express businesses deeply tied to Cainiao Stations on one hand, and on the other hand, it will inevitably face stiffer competition with SF Express and JD.com's self-operated express delivery services.

Moreover, it's worth noting that despite having a nationwide trunk transportation and transfer network, consumer complaints about Cainiao Express's delivery speed and service quality on social platforms indicate that its service quality still needs improvement.

When previously applying for a listing in Hong Kong, Cainiao's independence was a key concern of the Securities and Futures Commission. It cannot be denied that Cainiao has enjoyed many conveniences under Alibaba's wing. However, as its business becomes more focused, if Cainiao aims to soar high, it needs to quickly achieve independence.