Zhao Ming's Departure: Navigating Honor's Next Chapter

![]() 01/24 2025

01/24 2025

![]() 669

669

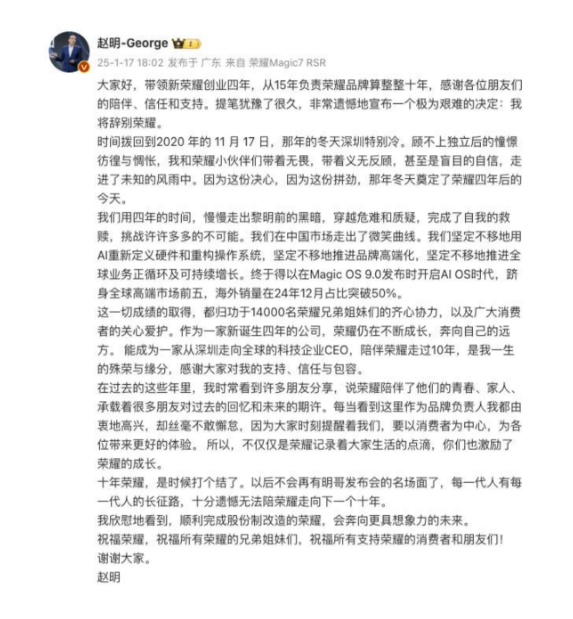

After a whirlwind of rumors and subsequent denials, the resignation of Zhao Ming, CEO of Honor, has finally been confirmed.

On January 17, Zhao Ming sent an emotional resignation letter to internal employees, expressing his regret at being unable to accompany Honor into its next decade. News of his resignation first surfaced online on January 15, with several Weibo bloggers reporting his departure, including one (@I am Da Bin, my classmate) who claimed that "Zhao Ming is leaving with the entire Magic7 team."

Multiple media outlets subsequently reached out to Honor for confirmation, with officials initially denying the news. However, employees at the time noted that Zhao Ming was unexpectedly on vacation.

Ultimately, on January 17, Honor's internal network issued an announcement stating, "Due to health reasons, Zhao Ming has submitted his resignation from positions such as CEO, and it has been decided that Li Jian will assume the role of CEO."

The saga of Zhao Ming's resignation, from initial whispers to official denials and finally confirmation, left the public somewhat skeptical, given his known passion for leading the company. However, in recent years, Honor's sales and market share have undeniably faced downward pressure, challenged not only by Huawei but also by Xiaomi and Vivo.

For Honor, which has just announced its listing plans, this change in leadership could signal a pivotal moment rather than a straightforward "comeback."

1. Significant Changes Prior to Listing

Zhao Ming's resignation is not the only high-profile departure at Honor. Following his announcement, several other executives, including Jiang Hairong, CMO of Honor China, and Zheng Shubao, head of Honor China's sales department, have also stepped down.

As the soul of Honor, Zhao Ming's departure has triggered a significant executive reshuffle within the company. Notably, Zhao Ming, Jiang Hairong, and Zheng Shubao all joined Honor from Huawei, where they had worked together for over two decades.

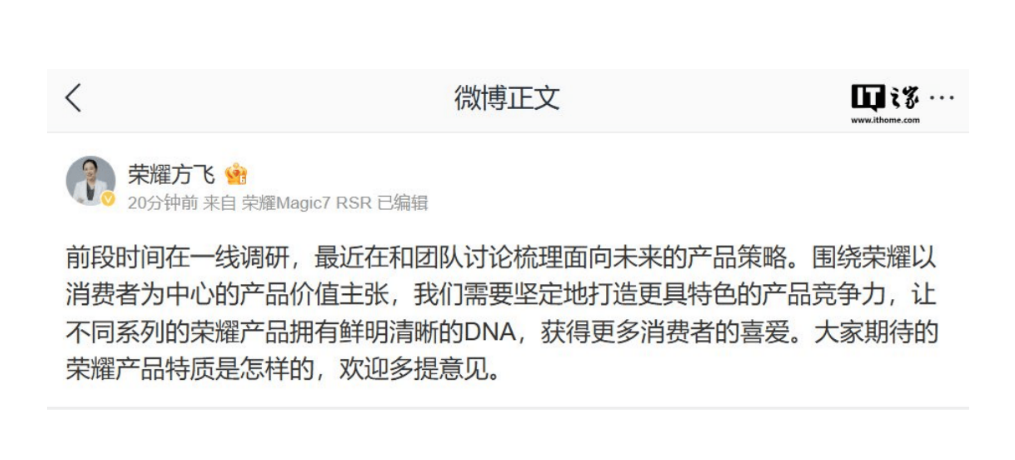

With a group of veterans departing, Honor is poised to embrace a new management style. Fang Fei, president of the Honor product line, recently posted that the team is actively discussing and refining future product strategies.

Over the past decade, Zhao Ming led Honor from its inception to independence. In a media interview, he recalled, "From the first day of Honor's independent entrepreneurship, people constantly told me it was impossible," yet Honor carved its own path.

In 2015, Zhao Ming took over as president of Honor, and in 2016, the brand was elevated to an independent sub-brand. Amidst a rapidly evolving domestic smartphone market, Zhao Ming introduced the concept of AI phones, signaling a commitment to accelerating intelligence development. By the end of 2017, Honor's online and offline sales ratio had reached a balanced 50/50.

From 2016 to 2019, Honor's growth was remarkable, contributing half of Huawei's domestic market share peak of 38.5% in 2019.

In 2017, Ren Zhengfei, chairman of Huawei, personally issued the "Honor Brand Mobile Phone Single Unit Commission Bonus Plan," emphasizing bonuses based on contributions rather than rank or seniority, granting Honor greater autonomy. These incentives and decentralization efforts were unprecedented.

However, in 2020, both Huawei and Honor reached a crossroads. With Honor separating from Huawei, it had to quickly mature.

While Honor was a mature smartphone brand with years of experience, many of its internal systems were intertwined with Huawei's. Post-independence, Honor urgently needed to rebuild its capabilities in products, technology, channels, and beyond.

At Honor's farewell meeting, Ren Zhengfei offered sincere advice, emphasizing the need to restore channel supply and establish relationships with suppliers swiftly, noting that "your (Honor's) difficulties are greater than any new company."

Zhao Ming took on these challenges, first coordinating the supply chain and production. Within 66 days of independence, Honor repaired its relationship with international suppliers like Qualcomm and invested over a billion yuan in Shenzhen Pingshan to build an intelligent manufacturing industrial park, reestablishing cooperation with ODM manufacturers.

Secondly, there was the challenge of product research and development, requiring a break from Huawei's shadow. Zhao Ming acknowledged, "(After independence), whether it's imaging capabilities, energy consumption management, operating systems, etc., they all relied on the relatively stable platform that had been formed. (Honor's) entire development platform and operating system almost had to be rebuilt from scratch."

Yet, in the past four years, Honor has innovated in various areas such as screens, battery life, communications, imaging, and intelligence. For instance, last year, Honor released the Honor Magic V3 series, introducing the industry's thinnest and lightest foldable screen phone, and launched the Qinghai Lake battery technology, promising longer battery life and safer high-performance batteries.

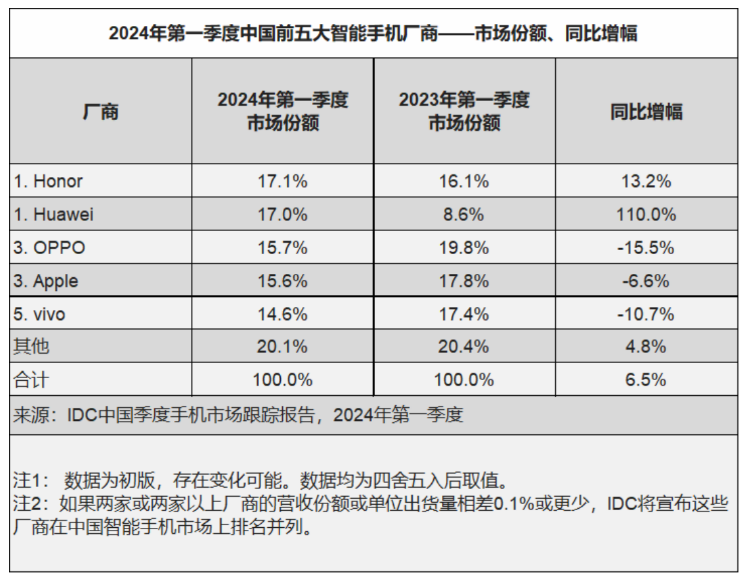

According to IDC data, in 2022, Honor ranked second with a sales share of 18.1%. In 2023, Honor topped domestic mobile phone shipments with a market share of 17.1%, maintaining its first-place position with the same market share in the first quarter of 2024.

2. Navigating a Declining Sales Channel

Recently, Honor has faced fierce competition, particularly from Huawei's strong resurgence, which has significantly impacted its high-end market.

In the first quarter of 2024, Honor was still the top smartphone shipper with a market share of 17.1%. However, in the second quarter, its market share shrank to 14.5%, with shipments declining by 3.7% year-on-year, dropping to fourth place.

This trend continued until the fourth quarter of last year, when Huawei reclaimed the top spot in the Chinese market with a market share of 18.04%, while Honor's market share was 13.26%, dropping to fifth place.

It's worth noting that the smartphone market environment warmed up in 2024, with annual shipments in China reaching 285 million units, a mild 4% year-on-year increase.

As competitors made rapid progress, Honor's sales gradually contracted, leading to speculation about Zhao Ming's resignation. After all, in December 2023, Honor announced the completion of its shareholding system reform and plans to initiate the IPO process at an appropriate time. At this critical juncture, sales volume significantly impacts Honor's IPO price, company valuation, and shareholder interests.

Moreover, according to Lu Jiu Business Review, at the end of 2024, Zhao Ming requested more executive powers from the board of directors but did not receive further results. The inability to secure management rights at this pivotal moment could have contributed to his resignation.

Regardless of the reasons behind Zhao Ming's departure, the focus now shifts to Honor's immediate challenge: reversing declining sales.

Over the past year, Honor's sales have been under pressure for several reasons. Firstly, Huawei's return has had a significant impact. Despite Honor's emphasis on not being a "replacement" for Huawei and its technological innovations in photography, foldable screens, AI, etc., it has struggled to detach from Huawei's influence on the overall smartphone market.

Huawei's strong brand perception has lured back many users who had chosen Honor, OV, and Xiaomi. Hu Boshan, executive vice president of Vivo, noted, "Essentially, Huawei needs to regain the market share that belongs to them."

Furthermore, as Huawei's former sub-brand, even though Honor has fully "independented," there is still overlap in their target customer groups. The similarities in appearance and UI design between the two brands' phones also contribute to consumer "swing."

Secondly, Honor's core advantages are being caught up with. For example, in 2023, Honor launched the industry's "thinnest and lightest" foldable screen phone, the Magic V2, which briefly surpassed brands like Huawei, vivo, and Samsung, becoming the sales champion of the Chinese foldable phone market in the third quarter.

However, in recent years, major phone manufacturers have intensified their focus on the foldable screen market, with Huawei and OPPO also releasing related technology patents. Last year, Huawei introduced the world's first commercial triple-folding screen phone, creating a social media buzz.

According to market research firm CINNO Research, in the third quarter of 2024, sales of foldable phones in China reached 3.54 million units. Among them, Huawei's foldable phone sales were approximately 1.12 million units, ranking first and maintaining the top spot in the foldable phone market share for five consecutive years.

Lastly, success and failure hinge on dealers. One of the key reasons Honor was able to quickly rise after separating from Huawei was its strong tie-up with dealers.

Currently, Honor's shareholders include Shenzhen Zhixin New Information Technology Co., Ltd., jointly invested by dealers. Its new round of investors also includes Jinshi Xingyao, an agent investment platform. Honor's sales are closely tied to their interests, so dealers naturally leverage resources to expand sales channels for Honor products.

However, despite this extensive channel network, Honor's sales have yet to show improvement, compressing dealerships' profit margins and payment cycles, further affecting their investment decisions. Especially in the critical pre-listing window period, it's crucial for Honor to continue attracting dealers.

3. Who Will Steer Honor's Declining Performance?

Therefore, Honor must now prioritize restoring sales through product, brand, and technology innovations. At this critical juncture, Li Jian, a Huawei veteran who previously served as Vice Chairman, Director, and President of Honor's Human Resources Department, will take the helm.

Li Jian also has extensive experience in Huawei's overseas business, having served as President of Huawei's West Africa region, Northeast Europe region, European region, and Americas region.

Compared to Zhao Ming, Li Jian is known for his overseas development experience and strong sales acumen. With a background in communications engineering and practical sales experience, he can observe research and development from a technical perspective. His global experience also provides a broad vision for Honor's overseas expansion.

As of last December, Honor's overseas sales already accounted for half of its overall sales. In the third quarter of 2024, Honor ranked among the top five in the global high-end mobile phone market above US$600. It has established cooperation with the top five European operators and performed well in markets like the UK and France.

Given Honor's solid foundation in overseas markets, its focus on international expansion will continue. Therefore, it needs new leaders like Li Jian to develop strategies and tactics aligned with market trends from a fresh perspective.

It's reported that Honor plans to enter the Indonesian market next, targeting Southeast Asia's largest economy. During this critical period of change and expansion into overseas markets, "changing the leader" means Honor's future will likely be tested by the market.

In Zhao Ming's farewell article, he stated that leaving Honor was "the most difficult decision in life" but hoped to "repair his overwhelmed body" after departure. It's evident that carrying Honor through ten years was no easy feat for Zhao Ming.

Regardless of the reasons behind his departure, Zhao Ming's contributions to Honor cannot be overlooked. Now, this responsibility passes to Li Jian, who is expected to lead Honor on a smoother development path.