Kuaishou E-commerce Maintains Steady Growth, Keling Emphasizes Early Commercialization

![]() 03/27 2025

03/27 2025

![]() 636

636

Having completed its initial traffic accumulation, Kuaishou's strategy was to gradually advance its commercialization, with a particular focus on the potential of e-commerce. For quite some time, e-commerce has served as the ultimate frontier for internet platform monetization.

However, the advent of AI has disrupted this progression. The first wave of impact was heralded by the surge in popularity of ChatGPT at the end of 2022, igniting a continuous discourse and actions around AI. During this period, internet companies have progressively ventured into AI-related ventures, with varying attitudes ranging from aggressive to cautious towards this cutting-edge technology. This was followed by DeepSeek's impact earlier this year, which was subsequently echoed by giants like Alibaba and Tencent, who made it clear that they would heavily invest in AI.

Currently, Kuaishou is also propelling AI to the forefront, driven not only by the "pulling force" of future prospects but also by the pressing demands of the current situation.

Kuaishou's total revenue for the fourth quarter of 2024 amounted to 35.4 billion yuan, marking an 8.7% year-on-year increase. In terms of business composition, online marketing services accounted for 58.3%, live streaming business accounted for 27.8%, and other services contributed 13.9%.

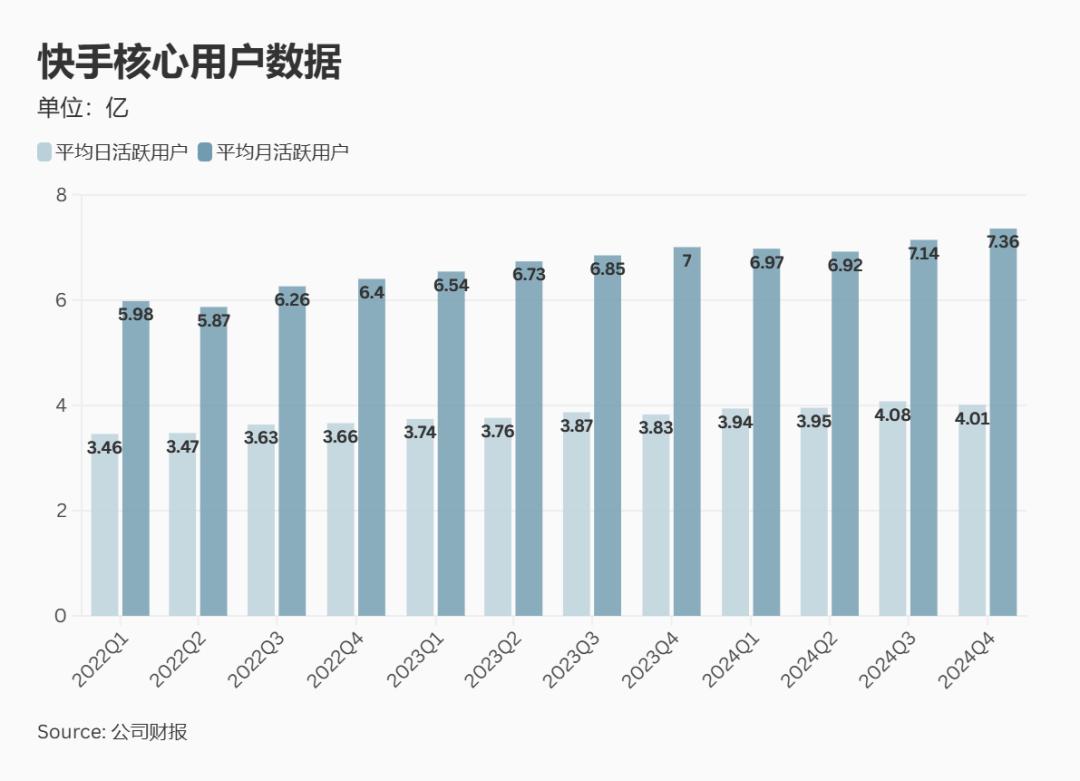

Let's first review the fundamental traffic metrics. During the quarter, the Kuaishou app recorded an average of 401 million daily active users, a 4.8% year-on-year increase, and an average of 735.6 million monthly active users, a 5.0% year-on-year growth. Judging from the slight year-on-year upticks in core user data for several consecutive quarters, there have been minimal fluctuations, suggesting that the traffic scale is nearing its peak.

As the more established advertising business and the highly anticipated e-commerce business compete fiercely in a crowded market, AI products, epitomized by Keling, are essential for breakthroughs. This will enable Kuaishou, which has consistently underscored its identity as a technology company, to seize the opportunity to reshape public perception.

01. Advertising and E-commerce: Steady Wins the Race

Online marketing services, which constitute the largest share of platform revenue, have always been influenced by two key factors: the performance of the main site's community ecosystem and e-commerce. This revenue segment grew by 13.3%, from 18.2 billion yuan in the same period of 2023 to 20.6 billion yuan in the fourth quarter.

Community ecosystem (including user and content ecosystem) management is an area where Kuaishou excels. As we have summarized in previous articles, such management primarily revolves around enriching content and optimizing user experience. Moreover, Kuaishou's community style stands out as one of the few with a distinct and unified identity among numerous content platforms. The platform's proficiency in capturing current events and planning thematic activities is particularly noteworthy.

Notable examples include the Agriculture, Rural Areas, and Farmers Ecology Conference held last November, where programs like "Agricultural Help Group," which specifically addressed agricultural technology issues for users, and events such as "Laotie Fashion Week" and "Rural Super Bowl," focusing on rural entertainment, received positive feedback.

Given the intense competition in the advertising market, the year-on-year growth rate of this revenue segment also tended to slow down during this quarter. External cycle advertising temporarily lacks potent driving forces, but overall performance remains within acceptable standards. This is attributed to the emphasis on feed efficiency and full-site promotion products for several consecutive quarters, which has boosted eCPM. Additionally, highly engaging content consumption, such as games, short dramas, and novels, has provided a solid foundation.

For short dramas, "New Position" believes that they represent the most promising increment for external cycle advertising. As mentioned in the financial report, the marketing consumption of commercialized short dramas increased by over 300% year-on-year in Q4. However, the content production paradigm and monetization framework for short dramas are still in flux, and the platform has yet to establish a leading edge in content supply and monetization efficiency.

What is certain is that Kuaishou will continue to increase its investments in this area. Just a few days ago, Kuaishou and the NBA jointly announced their future collaboration on short dramas. This partnership will not only continue to provide event materials and support for NBA-themed secondary creation by content creators but also jointly produce content encompassing game short videos, self-produced variety shows, micro-dramas, interactive live streams, and more.

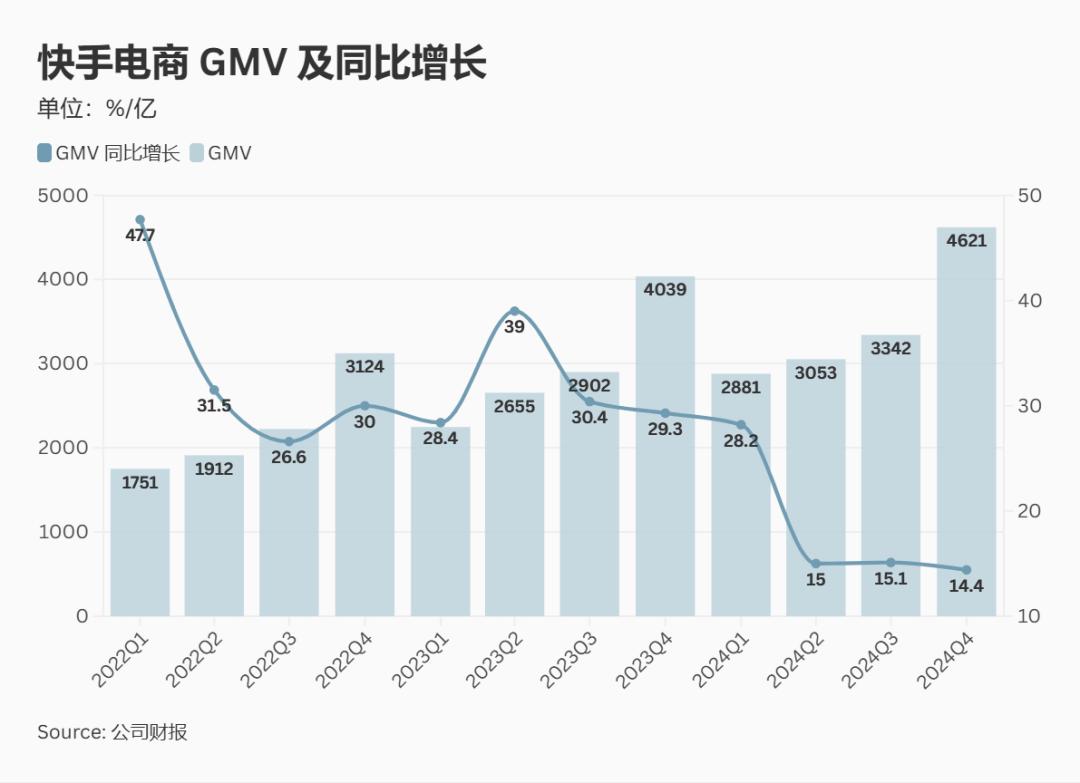

Other service revenue in Q4 increased by 14.1% year-on-year to 4.9 billion yuan, with e-commerce GMV rising by 14.4% year-on-year to 462.1 billion yuan. Since Q1 2024, the growth rate of e-commerce GMV has hovered around 15% for three consecutive quarters, with a slight decline observed in this quarter.

After 2022, content e-commerce platforms have successively embarked on a transformation towards broader shelf offerings. Current data indicates that in Q4 of last year, the GMV of Kuaishou's broad-shelf e-commerce accounted for 30% of its total e-commerce GMV. For Douyin E-commerce, GMV from shelf scenarios surpassed 40% in 2024 (reported by 36Kr).

The transition towards a broader shelf is an inevitable choice to elevate the "upper limit" of the e-commerce business. Against this backdrop, the platform has always prioritized attracting new users, including targeting relatively underserved southern markets for new user acquisition and offering tailored subsidies during promotional sales and other marketing nodes. This approach aims to align the product supply and consumer experience with comprehensive e-commerce platforms. However, the platform's content e-commerce identity remains prominent, heavily reliant on influencer promotion and interest-based recommendations.

Community trust is the cornerstone of Kuaishou's e-commerce strategy. However, in the process of transforming towards a broader shelf, ensuring that this added value extends to a broader consumer base will inevitably progress at a slower pace compared to competitors.

02. Keling Takes Center Stage

"New Position" analyzed Kuaishou's Q4 financial report and concluded that the company might fully focus on AI. This direction is now clearly defined. Catching up with the rapid pace of technological advancement is currently manifested in two business lines: leveraging AI for cost reduction and efficiency enhancement, and accelerating the maturation of Keling's monetization model.

Cost reduction and efficiency enhancement are universal strategies. As mentioned in our previous quarter's financial report analysis, almost all typical e-commerce platforms currently employ AI support in their marketing processes to achieve cost savings, and Kuaishou is no exception. To further deepen this approach, it entails embedding AI more profoundly into various business processes, such as content recommendation and marketing material creation.

CEO Cheng Yixiao stated during the earnings call that the daily average consumption of AIGC marketing materials and virtual digital human live streaming solutions on the Kuaishou platform exceeded 30 million yuan in Q4. According to internal calculations, the AI large model is anticipated to reduce clients' short video marketing material production costs by 60-70% or even more.

Keling's ascension to the mainstream is undoubtedly a more significant highlight. In fact, prior to the fourth quarter, Keling played a more "auxiliary" role within the Kuaishou ecosystem.

At that time, if Kuaishou aimed to integrate AI into its existing businesses, short dramas were the most suitable vehicle. Therefore, following Keling's launch in June, Kuaishou successively introduced China's first AIGC original fantasy micro-drama, "The Mirror of Mountains and Seas: Sailing Against the Waves," supported by Keling's technology, as well as the "Keling AI" movie co-creation plan jointly developed with numerous renowned domestic directors, featuring content entirely generated by AI.

However, entering the fourth quarter, Keling first underwent advanced version iterations, optimizing various generation effects such as motion and camera movement. Subsequently, it officially launched the Keling AI standalone app, with simultaneous web access. Since then, it has become evident that commercialization is on the agenda.

As of December last year, six months after its launch, Keling AI had amassed over 6 million users, generating over 65 million videos and over 175 million images. According to the financial report, since the commencement of monetization until February 2025, its cumulative revenue surpassed 100 million yuan.

Keling currently enjoys some first-mover advantages. AI products focused on video generation were only released intensively in 2024. The evaluation criteria for generation quality encompass alignment with input prompt semantics, the authenticity and aesthetic presentation of the generated video, among others. Based on current practical tests, the videos generated by Keling rank among the top tier in terms of adherence to real-world physical laws, stability of camera movement, and richness of expression, which are prone to creating a "sense of incongruity."

Referring to third-party evaluations, the renowned AI evaluation website Artificial Analysis's global video large model evaluation ranking places the Keling 1.5 Pro version and Google Veo 2 at the top two positions globally.

The monetization schemes for video generation products primarily include C-end subscription fees and B-end API fees. After subscribing, members primarily unlock advanced features or obtain additional generation quotas. In terms of pricing, there is currently minimal variation among various companies, partly because the cost of video generation remains relatively high, making it challenging to engage in large-scale price wars.

Relying solely on generation quality to create a competitive edge, coupled with faster iteration speeds and high-quality databases from short video platforms, Keling is well-positioned to gain an early lead in this field.

Regarding the capital expenditure that the market is most concerned about, management's response is to increase relevant investments within controllable parameters. The specific plans also predominantly revolve around Keling, including ensuring sufficient training computing power, maintaining the technical advancement and leading position of the video large model, and aligning with its commercialization and monetization progress.

With competitors like Sora and Veo2 internationally, and Jimeng and Hailuo domestically, the video generation market is not short of aspirants. Now, it remains to be seen whether Keling can solidify its first-mover advantage into long-term leadership.

03. Final Thoughts

In the long run, although we mentioned at the outset that Kuaishou's current user scale is nearing its upper limit, AI presents a potential opportunity: further lowering the creation threshold and contributing to the vitality of the community ecosystem.

As we all know, the short video economy's explosion began with the disruption of PGC's monopoly, enabling everyone to record the world and leading to an exponential growth in content supply. AI, particularly video generation AI, is expected to further push the boundaries of professional production and introduce unforeseen variables into the community ecosystem. This could serve as an opportunity to transcend the upper limit, of course, requiring the platform to meticulously balance attention allocation between AI generation and independent creation.

Simultaneously, many associate Kuaishou's foray into AI with the compatibility between elite technology and popular communities. However, if we retrace Kuaishou's historical evolution, from the GIF era, it has been innovating in image creation and fostering communities of like-minded individuals. As mentioned earlier, Kuaishou has consistently underscored its technological identity and genes.

There is no contextual disconnect between the "Laotie" economy and cutting-edge technology. Kuaishou has previously leveraged technology to alter perceptions, and now it may be time for it to rekindle its "entrepreneurial mindset" once again.

*The lead image and images in the text are sourced from the internet.