Domestic Mobile Phone Manufacturers' Detours: Foldable Screens as One Example

![]() 03/27 2025

03/27 2025

![]() 499

499

"Garbage Time" Leaves No Winners

Written by Li Wenjie

Edited by Li Jinlin

Typeset by Annalee

At the recent Huawei Pura Vanguard Ceremony and HarmonyOS Smart Ride New Product Launch Event, Huawei unveiled its first foldable screen phone, the Huawei Pura X.

While Huawei expands its foldable screen phone offerings, Apple's first foldable phone remains elusive. Early rumors predicted its release in the second half of this year, but the product has been repeatedly postponed. IDC suggests that development on Apple's foldable phone has nearly stalled. Meanwhile, other domestic mobile phone manufacturers have suspended their efforts to develop foldable phones, with insiders speculating that Honor is one of them.

Since Royole Technology released the world's first consumer-grade foldable screen phone, the "Royole FlexPai," many have doubted whether foldable screen phones will achieve significant breakthroughs or attract broader consumer groups. It is predicted that more manufacturers will adopt a wait-and-see attitude in 2025 and be more conservative.

The racetrack that domestic mobile phone manufacturers once scrambled to bet on can now almost be proven to be a "detour" that is regrettable to abandon but must be persevered with.

This is just a microcosm. In recent years, domestic manufacturers have fallen into collective anxiety, akin to entering the "garbage time" of a game, innovating for the sake of innovating, and making insignificant iterations...

Collectively Placing the Wrong Bets?

Looking back at the time when domestic manufacturers flooded into the foldable screen market, especially amidst declining overall smartphone sales, foldable screens, which grew against the trend, were once seen as the "hope of the entire village".

From 2019 to 2023, global smartphone shipments declined by an average of 4% per year, resulting in a cumulative decline of 16%. However, the niche market for foldable screen phones bucked this trend and maintained growth.

When leading brands like Huawei and Samsung ventured into foldable screens, other manufacturers feared missing out or falling behind. At the same time, with foldable screen phones concentrated in the high-end market, priced between 8,000 and 10,000 yuan, they carried the hope of domestic mobile phones becoming high-end. Notably, Xiaomi's wraparound screen concept phone, the MIX Alpha 5G, was officially priced at 19,999 yuan in 2019, while the Huawei Mate XT started at 19,999 yuan. Due to strong market demand, both were once hyped up on the second-hand market, far exceeding their official prices.

Huawei Mate XT

So, was this path collectively chosen by domestic mobile phone manufacturers the right bet?

The answer may have started to emerge in 2024.

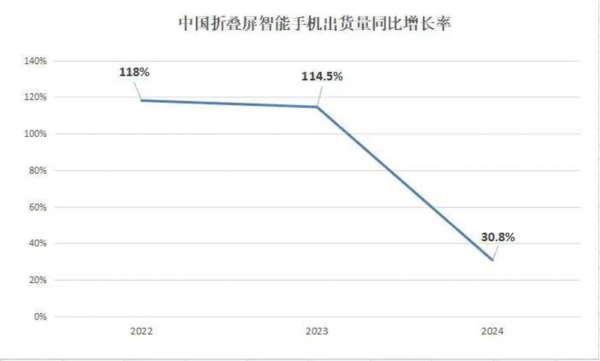

Counterpoint predicts that global foldable screen phone shipments will reach 25 million units in 2024, with a year-on-year growth rate of only 37%. Compared to the 52% growth rate in 2023 and 73% in 2022, this represents a continuous decline in growth. Even Samsung, the leader in the global foldable screen phone market, saw its third-quarter market share decrease by 14% year-on-year, far below the 70% it achieved in the third quarter of 2023. Additionally, Samsung's foldable screen phone shipments also declined by 21% year-on-year.

Image source / Fixed Focus; Data source / IDC

As early as 2024, rumors were rampant that some manufacturers would withdraw from the foldable screen market, with OPPO and vivo being mentioned frequently. Although OPPO responded positively to withdrawal rumors, stating that its foldable series products were progressing as planned, while vivo released a large foldable screen phone as a gesture, the rumors hinted at the many uncertainties surrounding this market.

By the end of 2024, when Huawei's new foldable flagship, the Mate X6, opened for pre-orders, Royole, which had previously raced to be the "world's first dual-foldable phone," was officially ruled bankrupt. Then, at the beginning of 2025, according to foreign media reports, Apple's vertically foldable iPhone project was still being delayed, and blogger "Wisdom Pikachu" revealed that Meizu had stopped development on its large foldable screen phone.

This inevitably reminds one of Li Nan, the former vice president of Meizu, who once stated that the cost of parts for an ordinary 5G mobile phone is approximately 3,000 yuan. After upgrading to a foldable screen, an additional 1,400 yuan is needed for the screen, and when combined with other components such as the battery, the estimated cost of parts for a foldable screen phone is 5,000 yuan. Furthermore, the costs of screen molding, structural molding, hinge design, and software development are amortized to approximately 15,000 yuan per phone, leaving minimal profit margins for foldable screen phones.

But can they let go? It's already difficult. Zhao Ming, CEO of Honor, said in September last year: "We definitely haven't recovered yet, and we're still far from it. It's not just 100 million yuan; we invested 1 billion yuan in the Honor Magic V2."

Therefore, although domestic mobile phone manufacturers flooded into this market in search of "growth," they are now unable to withdraw due to sunk costs. It can be said that the foldable screen market has nearly fallen into a "deadlock" that must be persevered with.

Innovating for the Sake of Innovating

Looking back over the past few years, the domestic smartphone industry has not seen groundbreaking updates for a long time. Major brands are still constantly engaged in internal competition, but the so-called innovation points mostly revolve around cameras, batteries, 5G, and high frame rates.

As "New Media Technology Review" pointed out, the last collective innovation in smartphones dates back to 2018. At that time, in addition to the birth of the iPhone X, major manufacturers also launched their own full-screen phones, improving screen-to-body ratios through designs such as sliders, foldable screens, curved screens, and punch-holes, which can be described as a flourishing scene.

But in just a few short years, revolutionary innovation has become a bubble, and most domestic mobile phone manufacturers can only innovate for the sake of innovating. In search of new innovation points, mobile phone manufacturers have almost iterated and updated every component. However, it is clear that these innovation points do not seem to be working.

As for the reason, the main factor may be that the entire market has entered "garbage time" - a phase where it can neither reverse the situation nor end the game.

In this anxious melee, no manufacturer can stop. If they fail to continuously launch new products, they face elimination, but passive "involution" also fails to yield tangible benefits. For leading manufacturers, they often have the confidence to "ride it out," but many manufacturers fall before the end of the game.

Because of this, not only foldable screens but also many niche markets, such as selfie phones and gaming phones, have attracted bets from major manufacturers. The reason is that for anxious domestic mobile phone manufacturers, even the smallest outlet is an outlet.

Recently, realme also launched a new gaming phone with the selling points of "enduring warrior, super battery life" at a price starting from only 1,530 yuan. The relevant person in charge of realme stated that they would "continue to lead innovation, break the cycle of involution... and achieve product differentiation through gaming phones."

Image source: realme official Weibo account

Zinc Dimension noted that realme's gaming phone still focuses on conventional gaming phone performance such as battery life and frame rates, which have already been explored by Black Shark and Red Magic.

In fact, if the niche market of foldable screens is at least keeping the game going, the gaming phone market is actually getting closer to the end of the game.

Since officially entering the public eye in 2018, gaming phones have indeed been popular for a time, even driving a number of mainstream mobile phone manufacturers to enter the market. For example, Nubia, Lenovo, vivo, ASUS, and even Redmi have successively launched "gaming phones".

Among them, as a pioneer in the gaming phone market, Black Shark's gaming phone topped sales in this sub-category shortly after its launch. In January 2022, there were media reports that Tencent would acquire Black Shark. However, in 2023, the long-silent Black Shark Technology was exposed to be facing operational difficulties, layoffs, salary arrears, and other challenges. The gaming phone market has been questioned as a pseudo-proposition.

Prior to this, Lu Weibing, president of Xiaomi Group and general manager of the Redmi brand, tweeted a prediction: "Gaming phones are doomed to disappear." Even though Redmi's gaming phone was already ranked first in the gaming phone sector with a market share of 45%, Lu Weibing still stated that future Redmi series phones would no longer launch "e-sports editions".

In 2023, cumulative sales of gaming phones from January to September were nearly 3.2 million, down nearly 40% year-on-year; cumulative sales amounted to approximately 7.6 billion yuan, down 39% year-on-year.

Even so, realme is still clinging to this market, which may better illustrate that in "garbage time," most so-called innovations are "forced innovations".

2025: A Year of Fleeting Warmth

In "garbage time," the mainstream market is saturated, and innovation is slowing down. Although major brands are all searching for new points to stimulate users to upgrade their phones, the results have not been significant. But garbage time will eventually end.

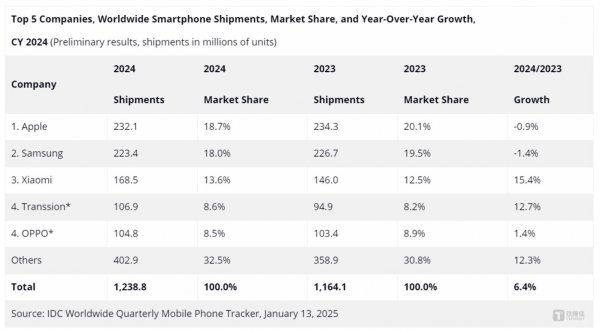

A good sign is that research institution IDC pointed out that since the second half of 2023, the global smartphone market has shown a steady recovery, with shipments growing at a rate close to 7% for the entire year. From a sales volume perspective, the global smartphone market also ended the ten-year low set in 2023, with a year-on-year increase of 4%.

Image source: TMT Post

Nabila Popal, Senior Research Director of IDC's Worldwide Devices Group, stated that manufacturers have successfully adjusted their strategies to drive growth by focusing on promotions, launching new products across multiple price ranges, offering interest-free installment plans, and actively pursuing trade-in policies - continuing to pursue premiumization and increasing the share of low-end products, especially in China and some emerging markets.

However, in 2025, the mobile phone industry may face more new variables.

After all, as Zhu Jiatao, a senior analyst at Canalys, said in an interview, it is unlikely that 2025 will replicate the high growth rate of 2024. This is because much of the growth in the past year stemmed from manufacturers and channels replenishing inventory levels and the recovery of some macroeconomic conditions in the market. Demand fluctuations and macroeconomic uncertainties remain the primary challenges.

In short, 2025 may still be a year of fleeting warmth. Looking back at the past year, AI, price increases, going overseas, and Apple falling from its "pedestal" have all become the focus of attention in the consumer market. As for whether a new wave will truly emerge in 2025, we must still wait and see.