From 'Customer Collusion' to 'User Co-Governance': Who Truly Achieves E-commerce Equity

![]() 03/31 2025

03/31 2025

![]() 602

602

Author | Anyu

Editor | Hu Zhanjia

Operations | Chen Jiahui

Produced by | LingTai LT (ID: LingTai_LT)

Main Image | Provided by the Internet

China's dynamic internet landscape has always nurtured newcomers who achieve business miracles through unconventional strategies.

Around 2015, with JD.com and Taobao dominating the market, many anticipated that China's e-commerce industry would enter a predictable oligopoly era. Yet, a decade later, platforms like Tencent WeChat, Pinduoduo, and Douyin emerged as disruptors, reshaping the established order of the industry.

Coincidentally, on February 13, 2025, Kang Zeyu, head of ByteDance's e-commerce business, revealed at an All-hands meeting that in 2024, Douyin's e-commerce GMV reached approximately 3.43 trillion yuan, a 35% increase year-on-year. Pinduoduo and Douyin are not the only ones thriving; according to comprehensive data from Tianyancha and other sources, Tencent, an internet giant deeply entrenched in e-commerce for years, has also successfully broken through with WeChat. At the 2025 WeChat Open Class, WeChat disclosed that in 2024, the GMV of WeChat Stores increased 1.92 times, the number of orders rose 2.25 times, the number of goods shipped increased 3.83 times, GPM increased 1.5 times, and the number of monthly active merchants increased 1.7 times.

In response, Pony Ma, Tencent's Chairman and CEO, stated at Tencent's annual meeting, "WeChat will take five years or even longer to build an e-commerce ecosystem connector, leveraging the power of social networking and emphasizing slow, meticulous work to create high-quality products."

These newcomers have risen to prominence. How did they do it? What do they have in common? And do they signal the next stage of evolution in the e-commerce industry?

New E-commerce Forces Emerge: 'Three Equities' Reconstruct the Underlying Business Logic

Just as new energy vehicles carve out a new path and disrupt traditional fuel giants with a revolutionary intelligent business logic, new forces in e-commerce can also emerge as unexpected disruptors under the siege of traditional e-commerce giants by reconstructing the underlying business logic of e-commerce through the 'equity concept'.

On the surface, most new e-commerce forces focus on high cost-effectiveness. This can easily lead to the misconception that they primarily rely on simplistic low-price strategies to cater to the 'consumption downgrade' trend and win over massive consumers.

In reality, new e-commerce forces not only sell white-label cost-effective products but also high-priced branded goods. For instance, during the 2024 Douyin Mall's Good Goods New Year Festival, four top brands achieved transactions exceeding 100 million yuan, 193 brands exceeded 10 million yuan, nearly 70 products exceeded 10 million yuan, and 212 products exceeded 5 million yuan.

This, to some extent, reveals the business philosophy of adhering to 'equity' by new e-commerce forces. Specifically, they have achieved consumption equity, rule equity, and supply equity in the dimensions of consumers, operations, and merchants, respectively.

When interpreting the development logic of new e-commerce forces, private equity investor Dai, DEMO, cited a negative example: "An international brand came to China and stuck to old methods, and the premium strategy didn't work. It does match some consumers, like elite individuals in first-tier cities like Shanghai, who are willing to pay for Tmall's brand premium and other aspects. But a large number of 'common consumers' still prefer functional satisfaction. Being forced to buy expensive items is distressing to many Chinese people."

First, new e-commerce forces have achieved consumption equity at the consumer level, recognizing both the consumption upgrade aspirations of consumers in first-tier cities and the high cost-effectiveness demands of 'common consumers,' without believing that one type of demand is superior to the other. Both are worthy of being met.

Based on this understanding, new e-commerce forces have further achieved rule equity, not blindly recommending products that align with platform interests to consumers, but instead striving to meet the differentiated consumption needs of different consumers.

Taking Pinduoduo as an example, when realizing that a person's real need is just thirst, Pinduoduo will not recommend high-priced coffee or beer but will display a bottle of good-quality, affordable mineral water. Similarly, if a person prefers agricultural and organic food while watching live streams, Douyin will not show them trendy accessories sold in fashion bloggers' live streams but will push high-quality, cost-effective local specialties from agricultural courtyards' live streams.

Of course, downstream consumption is only one link in the e-commerce business operation. Achieving demand equity without supplying high-quality products will hinder the long-term survival and prosperity of new e-commerce forces.

Surrounding rule equity, new e-commerce forces have not only achieved demand equity at the consumer level but also supply equity at the merchant level. The core of supply equity lies in the fact that new e-commerce forces do not view merchants through 'utilitarian' lenses such as popularity, scale, and customer unit price, but instead focus on examining whether merchants have sufficient sensitivity and supply capabilities to discern consumer demand and provide more competitive products.

LingTai LT (ID: LingTai_LT) believes that the rise of new e-commerce forces is not accidental but largely due to these platforms adopting a novel 'equity' business logic.

By rationally viewing the needs of all consumers, new e-commerce forces have achieved demand equity; with high-quality satisfaction of consumer needs as the core orientation, new e-commerce forces adopt a supply equity attitude towards merchants. Based on these two equities, new e-commerce forces use rule equity to efficiently connect demand and supply, thereby improving the efficiency of e-commerce transactions and naturally achieving 'surprise success'.

From 'Customer Collusion' to 'User Co-Governance': New Forces Strike Down Traditional Giants in Lower Dimensions

As new e-commerce forces rise, traditional e-commerce giants have not remained indifferent but have attempted to follow suit.

However, instead of inhibiting the growth of new e-commerce forces by simply 'transplanting' similar strategies, traditional e-commerce giants have increasingly faced the problem of 'south orange, north orange,' turning around and retreating to their previous comfort zones. This is largely because the underlying business logic of traditional e-commerce giants is vastly different from that of new e-commerce forces. Simply copying similar business strategies is difficult to reverse the strong inertia of their business model, bringing severe negative impacts on players within the ecosystem.

Comprehensive public information from Tianyancha and other sources shows that around 2015, as the e-commerce industry entered an oligopoly era, traditional e-commerce platforms tacitly 'colluded with customers' and embarked on a development path to maximize platform interests.

In short, the default mindset of traditional e-commerce platforms often revolves around a classic formula: GMV equals traffic multiplied by conversion rate. The core of this model is traffic supremacy, with the platform striving to capture massive traffic and convert it into sales. On this basis, traditional e-commerce platforms use sales as bait to guide merchants to pay huge advertising fees.

Due to the massive traffic held by traditional e-commerce giants and the fierce competition in various vertical commodity sectors, advertising fees for various categories naturally rise. In this context, merchants who can afford huge advertising fees are often giants in their respective verticals. For example, in some traditional e-commerce promotional activities, only top brands can obtain prime advertising spaces on the homepage, exclusive traffic entrances, etc.

This, to some extent, explains why traditional e-commerce platforms shouted the slogan of 'consumption upgrade' around 2015. Because the trend of consumption upgrade can induce consumers to pay for high-premium products from top brands, and the platform can also leverage this to achieve impressive performance.

It is undeniable that the products supplied by brand merchants are relatively reliable, meeting the demands of some aspiring middle-class consumers. However, the 'profit-driven' operation logic of traditional e-commerce giants requires merchants to pay huge advertising fees, which, on the one hand, prompts merchants to raise product prices and pass on advertising costs to consumers; on the other hand, it isolates small and medium-sized merchants and consumers with limited financial resources and consumption ability from the e-commerce ecosystem, not only inhibiting the vitality of small and medium-sized merchants but also failing to meet the diverse needs of ordinary consumers.

In contrast, new e-commerce forces have realized that the profit-oriented business strategy of traditional e-commerce platforms has fallen into a typical prisoner's dilemma and are therefore committed to achieving 'user co-governance' through the 'equity concept' to efficiently connect demand and supply.

In short, the 'user co-governance' of new e-commerce forces based on the equity concept is diametrically opposed to the 'customer collusion' model of traditional e-commerce platforms, no longer excessively focusing on the interests of the platform and major customers, but placing users at the core.

Taking Pinduoduo as an example, it breaks the 'consumption stratification' logic of traditional e-commerce and allows the needs of users at different consumption levels to be seen. On the supply side, it gives equal opportunities to brands, white labels, factories, and individuals, allowing them to gain a foothold on the platform and achieve supply equity as long as they can discern changes in consumption and provide competitive products. In terms of platform rules, it abandons measuring merchants based on single indicators such as GMV and advertising revenue, instead focusing more on transaction efficiency and user demand matching to achieve rule equity.

Under this model, consumers are no longer the objects of 'exploitation' by platforms and merchants but become 'co-governors' deeply involved in platform development. This not only mobilizes the enthusiasm of consumers and merchants but also helps build a prosperous e-commerce ecosystem.

It can be said that the difference between new e-commerce forces and traditional e-commerce platforms is not at the technical level. After more than a decade of development, there are no secrets in e-commerce technology, and the technical capabilities of various platforms are not significantly different. The real difference lies in the underlying mechanism of the platform: whether to choose to safeguard the interests of the platform and a few major customers or to build a fair and open ecosystem centered on users.

Compared to the 'customer collusion' of traditional e-commerce giants, 'user co-governance' can satisfy users' diverse needs and tap into new market potential, so new e-commerce forces are naturally gradually catching up.

The Ultimate Answer for E-commerce Gradually Emerges: 'Equity' Fits the Wave of the Times

The 'equity concept' of new e-commerce forces seems to be merely a business model innovation in the e-commerce sector but actually highly aligns with the development trend of the internet industry.

Since 2023, with the explosion of ChatGPT, AI has gradually become a major trend in the technology industry. Liang Wenfeng of DeepSeek said that what is truly great is never a single model but the ripples of kindness created by millions of ordinary people using it.

Coincidentally, on March 25, 2025, local time, OpenAI launched the GPT-4o image generation function, allowing users to generate high-quality image content by simply entering text commands. Due to the realization of 'creation equity,' GPT-4o's image generation function instantly became a hit on the internet.

Although the e-commerce industry has not yet been completely reshaped by AI at this stage due to the involvement of transactions and complex industrial chain transmission, related enterprises cannot ignore the enlightening significance of 'AI equity'.

By achieving demand equity, rule equity, and supply equity, new e-commerce forces can also create more commercial value by satisfying massive demands. In contrast, the 'customer collusion' business orientation of traditional e-commerce platforms has actually become a negative example of the times due to suppressing a large part of demand.

In fact, some new e-commerce forces are not satisfied with the 'equity' achievements they have made but hope to deeply empower consumers and merchants within the platform through further 'equity'.

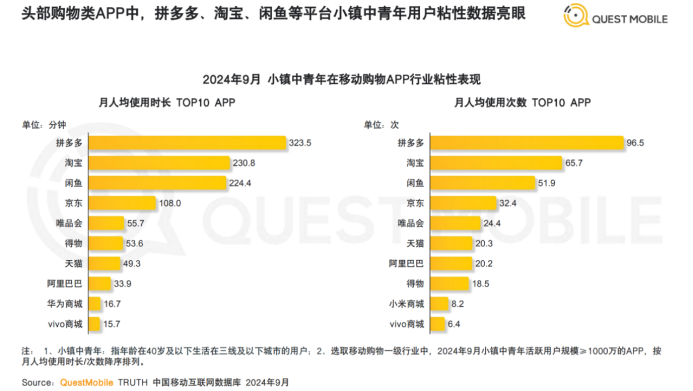

▲Image: QuestMobile

Taking Pinduoduo as an example, data disclosed by QuestMobile shows that in September 2024, it became the first choice for mobile shopping among 'young and middle-aged people in small towns.' Currently, young and middle-aged people in small towns are experiencing a wave of 'consumption upgrade,' with nearly 75% of them willing to pay more for high-quality goods, and 88% recognizing the importance of brands to product quality.

To meet the demands of young and middle-aged consumers in small towns, Pinduoduo has introduced a plethora of brands, including Adidas, Belle, Bosideng, Xiaomi, and Huawei. By promptly identifying and fulfilling the evolving needs of consumers through the equity concept, Pinduoduo's branded goods have successfully tapped into the market. Additionally, from a supply perspective, to further boost merchants' enthusiasm and sense of accomplishment, Pinduoduo has rolled out initiatives such as a 10 billion yuan reduction plan, e-commerce expansion into western regions, and a new-quality merchant support program, aiding tens of millions of merchants in cost reduction and efficiency enhancement.

For instance, in unique beauty industry hubs like Pingdu in Shandong, Cangzhou in Hebei, and Donghai in Jiangsu, Pinduoduo leverages its platform strengths to comprehensively support local businesses in false eyelashes, wearable nails, makeup brushes, and other beauty products. Through the collaborative efforts of industry cluster merchants and Pinduoduo, the local industry scale has expanded rapidly, transforming into a '10 billion industry cluster' within a short span and achieving high-quality growth for the sector.

Overall, by delivering greater value to both consumers and merchants, similar to internet products that embody 'AI equity' being highly sought after, e-commerce newcomers who achieve 'three equities' are gradually increasing their appeal to both consumer and merchant segments.

Not only are vast numbers of users gravitating towards these e-commerce newcomers, but an increasing number of small and medium-sized merchants are also embracing them. According to the 'Data Report on Douyin E-commerce Supporting the Development of Small and Medium-sized Merchants' released by Douyin E-commerce, in 2024, small and medium-sized merchants continued to gain momentum on the Douyin e-commerce platform, with new merchants increasing by 83% year-on-year, platform GMV rising by 46%, self-broadcast sales of small and medium-sized merchants exceeding 659.1 billion yuan, and the number of small and medium-sized merchants with over 300 days of self-broadcasting increasing by 66% year-on-year.

Considering the rapid growth of consumers and merchants, the two most crucial foundations of the e-commerce industry, e-commerce newcomers will undoubtedly foster a virtuous cycle of 'accelerated fulfillment of all user needs - high-quality development of new-quality merchants' in the future.

Written at the End

LingTai LT (ID: LingTai_LT) believes that unlike leading players in industries such as social networking, ride-hailing, and food delivery, who can erect deep competitive barriers leveraging their dominant positions, e-commerce giants cannot afford to rest on their laurels by relying solely on their market leadership. Unlike the 'customer collusion' model adopted by traditional e-commerce giants, the new forces have achieved 'user co-governance' through the equity concept, efficiently connecting consumer demand with high-quality products, thus becoming the darlings of the era. The core development orientation of the grand 'AI Revelation' is also centered around 'equity.' E-commerce newcomers like Pinduoduo, Tencent, and Douyin, who have grasped the pulse of the times, are poised to bring even more surprises in the coming days.