Navigating Tariff Impacts and Asset Revaluation: Strategies of Alibaba, Pinduoduo, and JD.com

![]() 04/07 2025

04/07 2025

![]() 660

660

Since DeepSeek initiated the promotion of Chinese assets, a wave of revaluation originating from Wall Street has swept through China's e-commerce sector.

This year, Alibaba, once silent, has reemerged as a market focus, while platforms like JD.com and Pinduoduo have maintained a cautious growth trajectory.

However, the unexpected imposition of "reciprocal tariffs" has placed unprecedented pressure on the internet and e-commerce sectors. Bank of America highlights that rising prices are affecting discretionary spending, and higher tariffs faced by major trading partners will elevate platform commodity prices.

Can the e-commerce industry sustain its growth momentum post-tariff "storm"?

Amidst accelerating domestic circulation, China's three e-commerce giants are embracing the new cycle in distinct ways. Taobao is attracting influencers, targeting competitors like Douyin and Xiaohongshu, while Pinduoduo is supporting merchants with tens of billions of funding. JD.com, on the other hand, is increasing its investment in instant retail and food delivery scenarios.

At the intersection of Chinese asset revaluation and the e-commerce industry's new cycle, where will Alibaba, Pinduoduo, and JD.com steer their courses?

Alibaba, Pinduoduo, and JD.com are adapting to challenges

In 2025, China's e-commerce industry stands at a critical juncture.

Beyond "reciprocal tariffs," starting from May 2, 2025, EST, the United States will terminate the duty-free treatment for small parcels from mainland China and Hong Kong, directly impacting the cost structure of cross-border e-commerce. From a capital market perspective, cross-border e-commerce has unexpectedly become a double-edged sword for the valuation of e-commerce giants.

Against this backdrop, the domestic market, serving as the foundation for Alibaba, Pinduoduo, and JD.com, has emerged as a crucial pillar supporting their valuations. Dongwu Securities notes that post-tariff implementation, the significance of domestic demand will be reemphasized due to the evident downward pressure on external demand.

However, focusing on the domestic market, the three e-commerce giants are all grappling with the pain of platform economy transformation.

First, let's consider Alibaba. Amidst diminishing traffic dividends and price competition, its core business, Taobao, faces the challenge of merchant loss. As the pioneering platform for influencer cultivation in China, Taobao once nurtured top internet celebrities like Zhang Dayi. However, with the closure of many old stores boasting tens of millions of followers, the crisis behind this wave of closures cannot be overlooked. Alibaba must support new high-quality brands and merchants for growth.

Next, let's turn to Pinduoduo. Unlike Alibaba, which can still tout its "AI" narrative, this e-commerce giant is not only facing impacts on its "second curve" Temu but also witnessing a "active slowdown" in its domestic business. Pinduoduo urgently needs to reassess its supply chain layout and find a new narrative.

Compared to the first two, JD.com benefits more from government subsidies and performs better. However, since the Yang Mi endorsement controversy during last year's Double 11, JD.com has gradually faced severe public opinion pressure, which has also become a growth challenge. JD.com, focusing on products like electronics, home appliances, and mobile phones, is facing a crisis of losing its core customer base. After government subsidies, the source of JD.com's subsequent growth remains a significant question.

Internal competition, tariffs, and public opinion—various crises reflect the current growth challenges in the e-commerce industry. As Ma Huateng once said, "When a giant falls, its body temperature is still warm." Even in times of peace, one must be prepared for danger. The three trillion-level e-commerce giants are adapting to challenges and beginning to establish competitive advantages in new ways.

Alibaba is investing 380 billion yuan in AI, aiming to shed the label of "traditional e-commerce" and adopt a differentiated strategy, empowering brands and influencers through technology to create a new e-commerce ecosystem.

Pinduoduo remains committed to cost leadership and enhances supply chain efficiency with "tens of billions of support." As its founder Huang Zheng stated, low prices are in Pinduoduo's DNA, but efficiency is the essence.

Relying on its focused strategy of logistics infrastructure, JD.com is venturing into instant retail, attempting to replicate Amazon's flywheel effect through monopoly in the "last mile" scenario. Jeff Bezos once said, "Your profits are my opportunity." JD.com's ambition in instant retail leverages the diminishing marginal cost of its logistics network.

Interestingly, the changes in Alibaba, Pinduoduo, and JD.com align perfectly with the methods for enterprises to establish competitive advantages proposed by Michael Porter in "Competitive Strategy"—differentiation, cost leadership, and focused strategy. Behind this lies a profound consideration of the platform's inherent strengths.

Influencers, merchants, scenarios—are the three e-commerce giants diverging?

When a new cycle emerges, past values and capabilities—Taobao's shelves and influencers, Pinduoduo's low-price overseas expansion, JD.com's category advantages—seem to have faltered.

However, a closer inspection reveals that whether it's Taobao betting on "high-quality brands + new-generation influencers," Pinduoduo investing tens of billions to subsidize merchants, or JD.com venturing into the food delivery sector, the strategic shifts of Alibaba, Pinduoduo, and JD.com all indicate that their underlying genes still guide their direction of progress.

For instance, a series of adjustments by Taobao since last year have demonstrated its mindset of deeply connecting stores with users as a shelf e-commerce platform.

Leveraging 20 years of accumulated consumption data and 49 million 88VIP members, Taobao can empower brands to accurately reach users, promote repeat purchases, and enhance live streaming conversions. As Taobao Fashion General Manager Kanshan stated at the 2025 Taobao Influencer Night, "It's easy to make internet celebrities on live streaming platforms, but it's difficult to build brands. However, Taobao can do it. Taobao can help influencers incubate brands and achieve long-term success."

Based on this, Taobao can launch a 1 billion new-generation influencer incubation plan to nurture another batch of young 95s/00s creators. This is also a further integration of content and shelves on Taobao, creating a user engagement loop for repeat purchases through the synergy of content and transactions, and fostering new "brands."

Similarly, Pinduoduo's approach to revitalizing its growth momentum is inseparable from the supply chain logic behind its extreme cost-effectiveness.

Faced with growth challenges, Pinduoduo's response is to increase investment in high-quality e-commerce ecosystem construction. Since launching the "10 billion yuan reduction" last year, the platform introduced the "100 billion yuan support" plan in March this year, planning to invest over 100 billion yuan in funds and traffic resources over the next three years, focusing on promoting the transformation and upgrading of merchants and the construction of a high-quality e-commerce ecosystem.

Pinduoduo's "100 billion yuan support" plan essentially embodies Pareto improvement—enhancing supply quality by subsidizing merchants to form a positive cycle of "low prices without compromising quality," as management expert Peter Drucker said, "The sole purpose of a business is to create a customer."

From Taobao to Pinduoduo, the market can observe that e-commerce giants are "all roads lead to Rome," that is, relying on different resource endowments, the ultimate goal is to achieve a win-win situation for merchants and platforms. As the last of the three giants, JD.com is also increasing its investment in the "food delivery merchant ecosystem," transforming the economies of scale of its logistics network into leverage for scenario expansion.

JD.com's biggest advantage lies in the fulfillment efficiency brought by its extensive logistics infrastructure. Wang Xing, the founder of Meituan, once said, "Talent is Meituan's core asset." This statement can be applied to JD.com. Under JD.com's vast logistics network of 3,600 smart warehouses, 90% of orders can be delivered on the same day or the next day, ultimately due to the role of "people" in every link of the supply chain.

Perhaps because of this similarity, JD.com continues to advance into Meituan's territory. Especially with the agreement to privatize Dada, JD.com now has over 1.2 million active riders and is expected to continuously enrich high-quality supply by recruiting quality merchants.

From Taobao and Pinduoduo increasing investment in the e-commerce merchant ecosystem to JD.com boosting investment in the instant retail merchant ecosystem, they are all rethinking their own strengths. Better merchant ecosystems and richer supply will ultimately drive an increase in core user value.

Looking at the essence through the changes of the three platforms, although they rely on different core capabilities to break through in different directions, the focal point for Alibaba, Pinduoduo, and JD.com is "building a high-quality merchant ecosystem to drive the upgrading of core user value." From this focal point, we can discern changes in the development logic of the entire industry.

In the new cycle of the industry and the moment of capital revaluation, how will e-commerce evolve in the future?

E-commerce platforms and merchants share a "fish and water relationship." Every strategic adjustment made by Alibaba, Pinduoduo, and JD.com targeting merchants actually reflects the platform's own survival and growth aspirations.

From the perspective of the competitive landscape in the stock era, e-commerce platforms replacing policies like "only refunds" with supporting merchants indicates that as platforms like Douyin, Xiaohongshu, and WeChat Video Account rise, traffic becomes increasingly fragmented, and platforms must focus on merchant growth to create a more moderate and open business ecosystem.

Behind the shift in attitude from "price wars" to "anti-internal competition" among Alibaba, Pinduoduo, and JD.com, there is a change that cannot be ignored—they are all constructing a multi-party win-win business ecosystem of "platforms, merchants, and consumers."

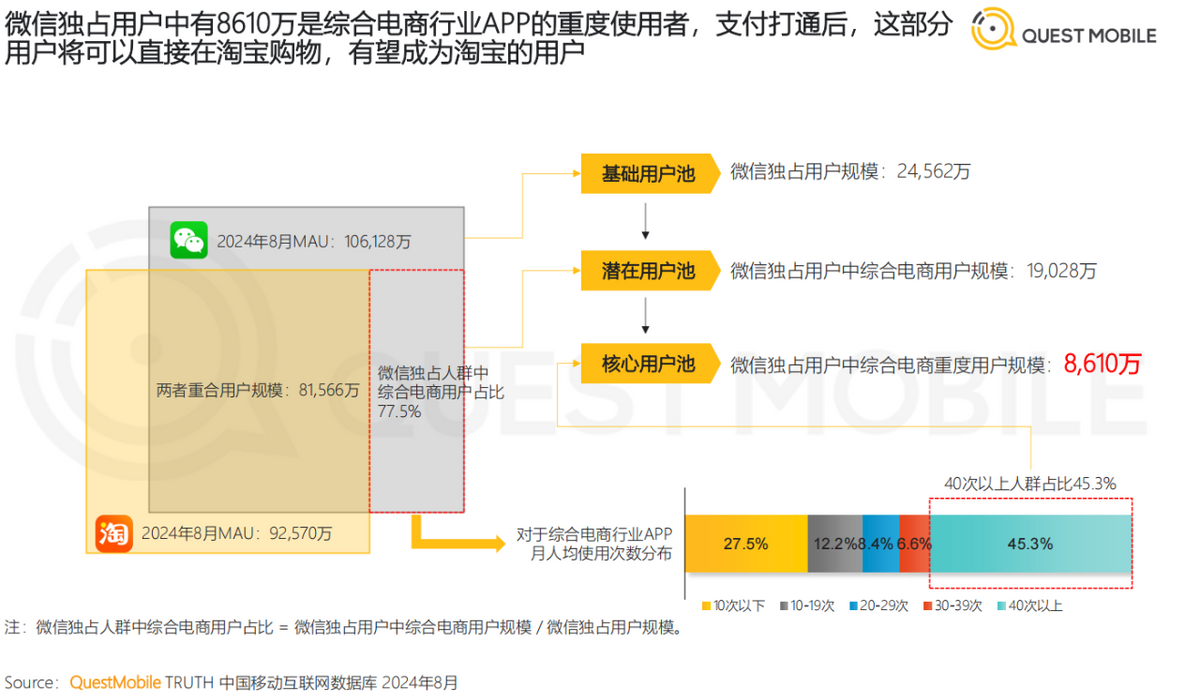

For example, Taobao's integration with WeChat Pay and JD.com's opening up of logistics aim to foster cooperation between platforms to jointly support merchant growth, thereby continuously driving the growth of order volume and GMV. Another instance is Pinduoduo's further increase in resource investment in "new quality supply" to achieve an ecological win-win situation for the platform and merchants.

From the perspective of changes in consumer demand, platforms supporting high-quality brands and new-generation e-commerce influencers who understand "quality + aesthetics + experience" reflect a shift in consumer demand from a single reliance on "low prices" in the past to a dual drive of "quality + experience."

Regarding the value of new e-commerce influencers, Kanshan, the head of Taobao Fashion, revealed the robust development momentum of new-generation influencers: In the past two years, nearly 600 new influencers from outside the platform have flooded into Taobao to open stores, mostly new-generation influencers born in the 1990s and 2000s. Many of them have achieved annual transactions exceeding 100 million yuan within less than two years of joining Taobao.

Taobao's support for new-generation influencers essentially reconstructs the synergy between content and transactions through bilateral market theory, using "brand precipitation" to combat traffic fragmentation.

From a technological perspective, in the current era of AI-driven internet reconstruction, AI e-commerce is the direction of platform evolution. In the future, the logic of platform GMV growth will shift from being driven by price wars to being driven by AI.

E-commerce is no longer an emerging industry. Whether it's platform development needs or capital valuation logic, profitability is paramount. Utilizing AI to reinvigorate e-commerce and even more retail business scenarios is the current core direction for cost reduction and efficiency enhancement.

Apart from Alibaba, which has adopted an "All in AI" stance, JD.com is also continuously increasing its investment in AI. Cao Peng, chairman of the JD.com Group Technology Committee, proposed that currently, AI serves hundreds of scenarios within JD.com, including retail, health, logistics, and finance, serving over 600,000 employees and 350,000 merchants. In the future, the platform is expected to help merchants grasp business growth based on AI's intelligent product selection, precise marketing, and supply chain optimization.

In summary, observing the new cycle of anti-internal competition in the e-commerce industry through Alibaba, Pinduoduo, and JD.com, the three variables of open ecosystems, new-generation IPs/brands, and AI e-commerce are reconstructing the logic of e-commerce growth and driving the industry to accelerate its evolution towards a new pattern.

As these changes unfold amidst the revaluation of Chinese stocks, tariff impacts, and intense multi-front battles, investors are paying closer attention to who will emerge as the alpha of steady growth in the new cycle of the new decade of e-commerce.

Let's see which of the three e-commerce giants in 2025 will effectively respond to changes, grasp the right to speak, and revert to the "growth stock" narrative.

Source: Hong Kong Stocks Research Society