DingTalk's Decade: A Return to Roots

![]() 04/16 2025

04/16 2025

![]() 478

478

A Heavier Burden on Its Shoulders

By Chen Dengxin

Edited by Li Jinlin

Typeset by Annalee

A decade has elapsed, transforming the fortunes of numerous enterprises.

In 2025, coinciding with DingTalk's 10th anniversary, it has emerged as a super app with 700 million users. However, at this pivotal juncture, the founding team has returned to steer its course.

Notably, attendance management has risen to the forefront of their priorities, placing DingTalk under the spotlight.

These developments suggest that Alibaba is dissatisfied with DingTalk's current state and aims to recalibrate its strategic direction, embracing greater responsibilities in the AI era through re-entrepreneurship.

Over the past decade, what challenges has DingTalk confronted? What sacrifices has it made in shifting from scale expansion to profit pursuit? Amidst the competition from Feishu and WeChat Work, how should DingTalk navigate the next decade?

Losing Its Dominant Position

From its inception, DingTalk was met with high expectations.

At that time, Tencent had successfully nurtured WeChat, securing the traffic gateway in the mobile era. Alibaba swiftly followed suit, exploring new horizons in the mobile landscape.

After several twists and turns, DingTalk ultimately shone bright.

Public records indicate that in January 2015, DingTalk, an enterprise instant messaging tool, was officially launched. With distinctive features such as "read/unread" status and "clock in for work," it gradually garnered favor among small and medium-sized enterprises.

Consequently, DingTalk became a "trump card" for Alibaba.

With continuous resource infusion, DingTalk embarked on a fast track: by the end of 2017, the number of registered DingTalk users surpassed 100 million, and by early 2024, it had reached 700 million.

It is evident that DingTalk has grown from a sapling into a towering tree.

However, its competitive edge has waned. Under the intense rivalry from Feishu and WeChat Work, DingTalk has gradually lost its dominant position, which is intricately linked to its deviation from its original aspirations.

On one hand, the founding team was "ousted".

As early as 2017, Chen Hang, the founder and first CEO of DingTalk, candidly stated, "DingTalk has never considered profit issues. Its original mission has always been to assist China's 43 million small and medium-sized enterprises in earning more and achieving efficient, secure, and intelligent office methods."

In layman's terms, DingTalk focused on addressing the pain points of intelligent offices and invested its primary energy in enhancing the user experience to achieve rapid scale expansion. Monetization was not its primary objective.

Regarding this, the American TV series "Silicon Valley" offered a pithy remark: "The key is not how much you earn but how much you are worth. Who is the most valuable? Those companies that are losing money."

The problem lies in Alibaba's differing perspectives.

In Alibaba's view, DingTalk has always relied on financial support for survival, but a company that solely depends on financial aid is unhealthy. Only by achieving self-sustaining capabilities can it advance further.

As a result, conflicts intensified.

When conflicts reached an impasse, the founding members, including Chen Hang, Zhu Hong, and Ren Qing, collectively departed. Subsequently, the focus shifted from scale growth to profit pursuit, and commercialization became a keyword for DingTalk.

Consequently, the annual recurring revenue (ARR) replaced the daily active user count (DAU) as DingTalk's core metric, presenting an opportunity for Feishu and WeChat Work to catch up.

Image source: DingTalk official website

On the other hand, there were strategic misjudgments.

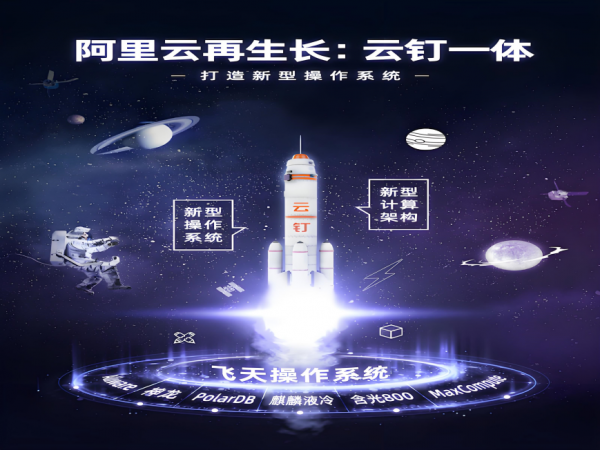

In exploring commercialization, Alibaba launched the "Cloud and DingTalk Integration" strategy, aiming at the synergistic benefits derived from the integration of DingTalk and Alibaba Cloud.

In simpler terms, DingTalk lost its independence and became a "supporting actor".

More crucially, to better collaborate with Alibaba Cloud, DingTalk also adjusted its strategic focus, with resources constantly shifting towards large enterprises, which deviated from its original mission of "assisting small and medium-sized enterprises".

"New Position Pro" stated, "The intelligent approval module custom-developed by DingTalk requires dedicated computing power from Alibaba Cloud. Although the functions precisely align with customer needs, the high development costs lead to slow iterations of standardized products. This 'heavy customization, light platform' strategy boosts DingTalk's commercial revenue in the short term, with large customers contributing over 60% in 2024, but it also harbors hidden dangers. This 'industry-specific' model invisibly weakens its original inclusive advantages."

DingTalk becomes a "supporting actor"

DingTalk has lost its lead, and Feishu and WeChat Work are both vying for it.

Against this backdrop, Alibaba could not remain idle. Allowing competitors to encircle it would be akin to quenching thirst with poison. Therefore, Alibaba abandoned the "Cloud and DingTalk Integration" strategy, listed DingTalk as one of its four strategic-level innovative businesses, and recalled the founding team through acquisition, intending to strike hard on the frontlines.

In summary, the burden on DingTalk's shoulders has become heavier.

Can All-in AI Turn the Tables?

For DingTalk to reclaim its leadership in the next decade, it needs to address three challenges.

First, demonstrating AI advantages is challenging.

The key for DingTalk to return to its peak is to regain a disruptive approach, thereby building a high "moat" for enterprise services and constructing differentiated competitiveness in user experience.

In this regard, Alibaba has provided a solution: increasing investment in AI.

During the third-quarter fiscal 2025 earnings call, Wu Yongming, CEO of Alibaba Group, stated, "Over the next three years, investment in cloud and AI infrastructure is expected to exceed the sum of the past decade, encompassing investments in AI and cloud computing infrastructure; AI foundational model platforms and AI-native applications; and AI transformation and upgrading of existing businesses."

Among them, DingTalk plays a pivotal role and serves as a crucial lever for Alibaba's AI to B strategy.

To bolster its AI capabilities, DingTalk has not only integrated the internal Tongyi Qianwen large model but also external large models such as DeepSeek, MiniMax, Dark Side of the Moon, Zhipu AI, Orion Star, Zero-One Everything, and Baichuan Intelligence.

However, claiming an AI advantage is difficult as DeepSeek has become an industry standard.

"Lan Dong Business" stated, "DingTalk has collected the 'Seven Dragon Balls,' while Feishu boasts the 'Five Little Tigers.' The list includes large models that overlap with DingTalk's team, such as DeepSeek, MiniMax, Dark Side of the Moon, Zhipu AI, Zero-One Everything, and Baichuan Intelligence."

Beyond large models, DingTalk also harbors high hopes for AI agents.

Wu Yongming said, "In the future, there will be numerous scenarios and opportunities for AI to reshape internal collaboration and synergy in enterprises. Internal enterprise systems will no longer be isolated functional modules but dynamic networks interconnected and invoked by multiple AI agents (AI Agents)."

Coincidentally, reconstructing enterprise productivity through AI agents is also a consensus in the industry, far from being exclusive to DingTalk.

Image source: DingTalk WeChat official account

Second, price wars are a double-edged sword.

DingTalk is not alone in embracing AI. Feishu is also promoting the intelligentization of collaborative office work. Both have entered the same river, leading to fierce competition.

As a result, "poaching" has become a keyword.

"Jie Mian News" reported that in the past six months, DingTalk and Feishu have been engaged in a fierce battle for customers, with the intensity escalating. Customers such as Eifini, insta360, Haoxianglai, Proya, Jasmine Milk White, Intime Group, and Luolai Home Textile have migrated from DingTalk to Feishu since last year, while customers like Best Express, Lierda, and Weimai have shifted from Feishu to DingTalk.

An industry insider told "Zinc Carving": "The interconnection between WeChat Work and WeChat is an irreplaceable advantage. Feishu continuously expands AI application scenarios and constructs an AI ecosystem, exerting increasing pressure on DingTalk."

Feishu increases pressure on DingTalk

To combat fierce competition, DingTalk has played the "price card".

On March 21, 2025, DingTalk announced a series of new ecological policies to support AI entrepreneurs and transformers, including waiving commissions, deposit fees, and computing power costs, and providing support in sales, branding, technology, and investment.

Wang Ming, vice president of DingTalk, said, "For DingTalk, which is all-in on AI, the key strategy is to focus on the ecosystem. DingTalk has customers and massive scenarios across various industries, requiring more AI ecosystem partners to explore and serve together."

The problem lies in the fact that price wars are a double-edged sword. While they may yield visible benefits in the short term, they will inevitably undermine the momentum of the industry's virtuous cycle in the long run, ultimately harming both competitors.

Moving from price wars to value wars is the ultimate destination for the industry.

Third, focusing on attendance management is off track.

After the return of the founding team, a series of internal reform measures were introduced, including attendance management policies such as "start work at 9 am, hold morning meetings, and summarize in the evening" and "discipline rectification, the team cannot be too loose, enter work status after 1:15 pm, no mobile phones, WeChat/Weibo/Xiaohongshu during work hours..."

These measures starkly contrast with the mainstream work patterns in the internet industry and have sparked controversy.

In other words, while the intentions were noble, they are not conducive to boosting morale. After all, innovation does not stem from "pumping up," nor can entrepreneurial strength be iterated through attendance management.

"AI Organization Evolution Theory" stated, "DingTalk's move to 'return to entrepreneurship' is essentially a continuation of the old paradigm of 'strong management pressure + unified rhythm'—this may not be suitable for the current organizational state. 'Returning to entrepreneurship' does indeed create a lot of commotion in form, but in reality, it may only lead to tighter processes and a more oppressive atmosphere, not necessarily promoting valuable output."

In conclusion, for DingTalk's next decade, it must fight a crucial AI battle that it cannot afford to lose. Simple patchwork is insufficient. It needs to revert to its original mission of "assisting small and medium-sized enterprises" and seek differentiated competitiveness to potentially reshape DingTalk and fulfill Alibaba's mission of AI to B.

Therefore, DingTalk needs to be reborn from the flames.