BOE Founder's Second Venture: Pioneering Success in the Global Semiconductor Silicon Wafer Market

![]() 04/18 2025

04/18 2025

![]() 715

715

China's semiconductor professionals are making history.

Investor.com, Wu Wei

Recently, Xi'an ESWIN Material Technology Co., Ltd. (hereinafter referred to as "Xi'an ESWIN") updated its prospectus, marking progress in its application for listing on the STAR Market. Led by Wang Dongsheng, the visionary founder of BOE (000725.SZ), this semiconductor silicon wafer enterprise is reshaping the global landscape with significant breakthroughs in domestic substitution of 12-inch silicon wafers.

Supported by over 40 institutions, including the National Integrated Circuit Industry Investment Fund and IDG Capital, Xi'an ESWIN, as the largest 12-inch silicon wafer manufacturer in mainland China, is projected to achieve a monthly production capacity of over 700,000 wafers by 2024, capturing 7% of the global market share. By 2026, it aims to boost its total production capacity to 1.2 million wafers per month, fulfilling 40% of the demand for 12-inch silicon wafers in mainland China and targeting a 10% global market share.

However, as a "challenger," Xi'an ESWIN encounters hurdles such as low domestic substitution rates for raw materials and equipment, a slowing industry growth, and the challenge of gaining customer recognition. With Japanese companies holding over 50% of global production capacity, can Xi'an ESWIN successfully rise and complete a pivotal part of China's semiconductor "supply chain replenishment"?

A Second Act by an Industry Pioneer

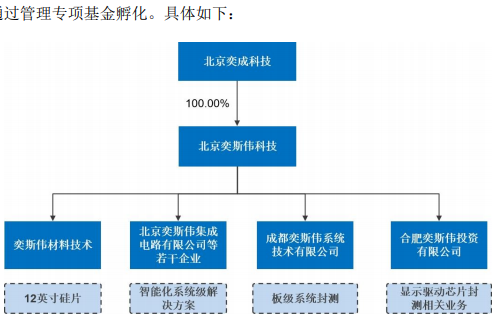

Founded in 2016, Xi'an ESWIN was initially known as Beijing ESWIN Technology. At that time, Wang Dongsheng, who had propelled BOE to breakthroughs in the domestic panel industry, established the Beijing Xin Nengdong Fund with the National Integrated Circuit Industry Investment Fund and BOE, focusing on the upstream and downstream industries of integrated circuits related to display panels and their applications, thereby bridging the entire industry chain from driving to display.

In 2017, due to unfavorable overseas acquisitions, Beijing ESWIN Technology, the precursor of Xi'an ESWIN, began independently nurturing four business segments: 12-inch silicon wafers, intelligent system-level solutions, board-level system packaging and testing, and display driver chip packaging and testing. In 2019, Beijing ESWIN Technology spun off these segments to operate independently; Xi'an ESWIN emerged as the result of the 12-inch silicon wafer business's incubation.

Source: Prospectus

Since its inception, Xi'an ESWIN has focused on domestic substitution of 12-inch silicon wafers. For a long time, the global 12-inch silicon wafer market has been dominated by five companies, including Shin-Etsu Chemical and SUMCO, with a combined market share exceeding 90%. China's local production capacity accounts for less than 5%, and silicon wafers, as the cornerstone material for semiconductor manufacturing, have long been reliant on imports.

After gaining independence, Xi'an ESWIN has garnered support from over 40 institutions, including the National Integrated Circuit Industry Investment Fund and IDG Capital. In the CII round in 2023, it received a capital increase of 2.3 billion yuan from eight investors, including the second-phase fund, pushing its pre-investment valuation to 17.7 billion yuan. From 2021 to present, the company has raised a total of 11.5 billion yuan in funding. With this capital backing, Xi'an ESWIN's production capacity is poised to reach 700,000 wafers per month by 2024, making it the only Chinese 12-inch silicon wafer manufacturer to rank among the global top ten.

Beyond production volume, Xi'an ESWIN's product quality has also garnered customer recognition. The company has achieved mass production of 12-inch polished wafers and epitaxial wafers, with products spanning storage, logic chips, and other fields. It has entered the supply chains of Yangtze Memory Technologies, Micron, and Kioxia, among others. Core technical indicators such as crystal defect density are on par with international benchmarks. In 2024, the proportion of the company's revenue from prime wafers increased to 56%, breaking the perception of being primarily a test wafer supplier. The second factory is planned to have a monthly production capacity of 500,000 wafers and is expected to reach full production by 2026, bringing the total production capacity to 1.2 million wafers per month, equivalent to 15% of global demand in 2023.

Challenges Remain for the Enterprise

While Xi'an ESWIN has made a breakthrough from 0 to 1 and taken a significant step towards self-sufficiency and domestic substitution, the entrenched market positions of industry giants like Shin-Etsu Chemical (30%) and SUMCO (25%) are difficult to displace in the short term. In particular, Xi'an ESWIN's silicon wafer customer recognition is still relatively low in advanced processes.

In terms of end products, Xi'an ESWIN's silicon wafers are currently primarily used for storage chips. For 12-inch silicon wafers utilized in more advanced NAND Flash storage chips, newer generations of DRAM storage chips, and advanced logic chips, the company is still undergoing validation by mainstream customers and has not yet shipped in large volumes. From 2022 to 2024, over 40% of Xi'an ESWIN's revenue was generated by test wafers, and while the proportion of prime wafers has gradually increased, the overall share still needs improvement.

Regarding raw materials, only 4-5 companies globally can reliably supply electronic-grade polysilicon. Although Xi'an ESWIN has procured a substantial amount of products from Xinhua Semiconductor to accelerate domestic substitution, some raw materials still require importation. On the equipment front, the localization rate of core equipment like crystal pulling furnaces and polishing machines is also relatively low. To ensure production, Xi'an ESWIN stockpiled 263 million yuan worth of spare parts and consumables in 2024, accounting for up to 21.13% of the company's current inventory.

Addressing equipment barriers, Xi'an ESWIN stated that "China has made significant strides in the localization of equipment in the semiconductor silicon material field. The company procures production equipment scientifically and reasonably based on production needs and expansion plans. The company maintains a systematic and diversified procurement plan for production equipment and spare parts, ensuring stable supply and meeting daily production requirements."

Beyond these challenges, market expansion poses another hurdle for Xi'an ESWIN. Silicon wafers, especially large-size ones, are a relatively segmented and mature market. After years of development, industry supply and demand are largely balanced, and shifts in terminal demand swiftly impact the entire industry.

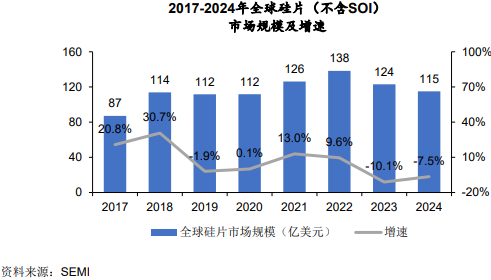

According to Xi'an ESWIN's disclosure, starting from the fourth quarter of 2022, due to waning demand for consumer electronics, the global silicon wafer market declined by 10.1% and 7.5% year-on-year in 2023 and 2024, respectively. On the path of domestic substitution, Xi'an ESWIN also faces competition from rivals such as Shanghai Xinsheng (a wholly-owned subsidiary of Shanghai Silicon Industry Group Co., Ltd. (688126.SH)), Zhonghuan Leading (a subsidiary of TCL Zhonghuan (002129.SZ)), and Shanghai Chaogui. In the previous display panel industry, excessive competition led to low overall profitability, with some companies enduring long-term losses due to significant asset depreciation.

Data Source: Prospectus

Despite still facing challenges such as insufficient domestic substitution of raw materials and equipment, Xi'an ESWIN has firmly established itself with a 7% global market share. With the relentless efforts of domestic semiconductor professionals, this enterprise, tasked with domestic substitution, could become a pivotal player in the reconfiguration of the global silicon wafer landscape. From displays to semiconductors, Wang Dongsheng's second venture is penning a new chapter in China's journey towards self-sufficiency in the chip industry chain. In the crucible of technology and time, the era of Chinese silicon wafers is accelerating. (Produced by Siwei Finance) ■

Source: Investor.com