Jen-Hsun Huang's Visit to China Amidst Sensitive Times: Decoding the Signals

![]() 04/18 2025

04/18 2025

![]() 583

583

Jen-Hsun Huang has seemingly "dismantled" Trump's "platform".

Article | She Zongming

This is undoubtedly a noteworthy event—Jen-Hsun Huang, the CEO of the "AI arms dealer" and a leading figure in today's AI world, has visited China.

Notably, this is not Huang's first visit to China. In late January of this year, he embarked on a five-day trip spanning three cities (Beijing, Shanghai, Shenzhen). However, this visit carries particular significance compared to his previous ones.

1. The timing of Huang's visit is delicate.

The China-US tariff battle is at a stalemate, with bilateral trade entering a "frozen period." On April 16, WTO Director-General Ngozi Okonjo-Iweala stated that China and the US have effectively decoupled economically. Huang's visit at this juncture is bound to elicit various interpretations.

2. Huang's itinerary for this visit is unorthodox.

In January last year, Huang visited mainland China for the first time in four years, becoming famous for his yangko dance in a flowery jacket. This year, he visited again, but both trips were to attend the China regional annual meeting and visit employees before the Spring Festival. Unlike Musk and Cook, who frequently meet with Chinese high-level officials, Huang typically avoids direct contact with "officials." However, this time, he was invited by the CCPIT and met with the Vice Premier.

▲Jen-Hsun Huang's "emergency visit to China." Image source: Yuyuantantian.

3. During the meeting, Huang was directly questioned about the ban on selling H20 to China.

According to reports, when CCPIT President Ren Hongbin met with Huang, he bluntly asked about Huang's views on the US government's indefinite export control on NVIDIA's H20 chips to China.

4. Huang reportedly met with Liang Wenfeng, the founder of DeepSeek.

After DeepSeek caused a "Silicon Valley earthquake" earlier this year, many claimed it had undermined NVIDIA's premium position. However, Huang emphasized Jevons' paradox (DeepSeek would increase demand for inference chips). It is understood that Huang and Liang discussed designing the next generation of chips for China.

▲Reports indicate that Huang and Liang Wenfeng discussed designing the next generation of chips for China during their meeting.

5. Huang did not wear his iconic black leather jacket.

Previously, Huang was often seen in public wearing a "leather-jacketed swordsman" image, but this time, he opted for a black suit, which was quite formal and particular.

Considering Huang's relaxed style of frequenting street stalls and food courts, his latest attire is striking. It's akin to Wang Sicong meeting local leaders without his usual casual attire, as wearing long-sleeved shirts is still Wang's "last stubbornness."

It is foreseeable that Huang's visit to China during this sensitive period will be closely scrutinized and could bring variables to the China-US game pattern caught in the "spiral of extreme pressure."

01

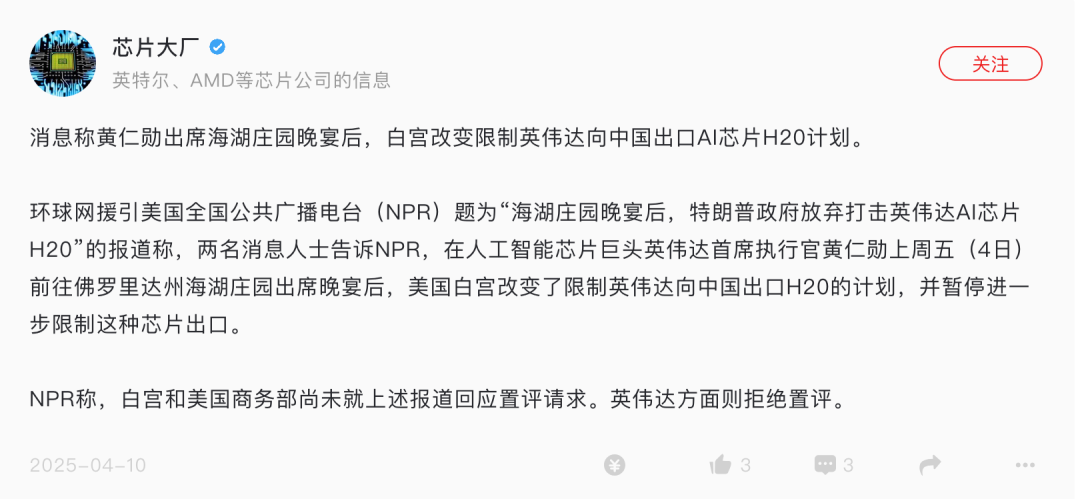

A significant background that cannot be ignored for Huang's "emergency visit to China" is that NVIDIA seems to have encountered a reversal in the Trump administration's stance on exporting the special AI chip H20 to China.

About a week ago, multiple media outlets, including National Public Radio (NPR), reported that after Huang attended the Mar-a-Lago dinner and promised a new investment of $500 billion in US AI data centers, the Trump administration changed its plan for export controls on NVIDIA's H20, which had been brewing for months. This was widely believed to be Huang successfully persuading Trump.

However, the rumor that "Trump allowed NVIDIA's special chips to continue to be sold to China" was soon overturned by new chip export license requirements issued by the US Department of Commerce, prominently listing the H20 chip. Moreover, The New York Times revealed that the Trump administration was considering imposing a technology embargo on DeepSeek and investigating whether NVIDIA had violated regulations by providing it with key technologies.

Huang was clearly caught off guard. Foreign media reported that after receiving official notice on April 9, NVIDIA did not immediately inform its Chinese customers and assured them that H20 would not be affected, believing they had already handled the Trump administration.

▲Previous media reports on Trump's intention to allow NVIDIA to export H20 to China.

According to NVIDIA's disclosure, due to the H20 export license requirements, NVIDIA's material and operating costs, and liquidated damages losses reached $5.5 billion. Professionals analyze that the actual affected revenue in NVIDIA's Chinese market may exceed $10 billion.

If Huang didn't have to rely on Trump, he might feel like "Robert De Niro"—a grain of sand in the game of great powers falling on Huang's head is a mountain. Trump, who promised relief, has instead escalated the situation.

The table at "Huang's Restaurant" was overturned by rogue city clerk Mr. Trump, but the apology must be made by boss Huang. Huang's visit to China will naturally be seen as an apology to major customers.

But if it's just an apology, Huang would only need to face Chinese customers led by BAT. Why did Huang have to engage with the Chinese government in an unusual manner?

The answer may lie in the fact that, with NVIDIA in the eye of the storm of the China-US technology war, Huang cannot "talk business without politics." Those pushed into the geopolitical vortex are not qualified to avoid politics.

Since avoiding politics is a "dead end," one must find an exit in the political arena.

02

It is evident that after being dragged into the torrent of great power games, Huang is still attempting to walk a tightrope—striving to find a balance between China and the US.

This is manifested in two aspects: 1. Making NVIDIA chips comply with the regulatory requirements of both countries as much as possible; 2. Minimizing his contact with officials.

After the US imposed chip export controls, NVIDIA has taken several remedial measures: if H100 cannot be sold, it will introduce a customized Chinese version H800; if H800 is banned, it will tailor a further castrated H20 with an overall performance of only about 20% of the parent H100 for China (tests show that H20's inference performance exceeds that of H100).

Is there an alternative plan beyond H20? NVIDIA says yes and is about to unveil a new flagship AI chip B20 based on the Blackwell architecture developed for the Chinese market.

It's clear that Huang finds it difficult to defy the BIS export control order, but he is also unwilling to lose China, the world's largest chip consumer country. Thus, he repeatedly applies the "shoehorn" principle.

Last December, rumors spread online that NVIDIA's Tmall flagship store had cleared its pages, signaling a complete supply cut, pointing directly to its anti-monopoly investigation. NVIDIA's official Weibo account specifically refuted these rumors and stated that the rumor of a supply cut to China was false.

In dealing with government relations, Huang has also shown great caution. At Trump's second inauguration ceremony, the heads of American tech giants "grouped together" to maintain good relations with Trump, but Huang was not among them—he was attending the NVIDIA China regional annual meeting in China.

▲In January last year, Huang wore a flowery jacket and performed yangko dance at the NVIDIA China regional annual meeting.

The New York Times lamented: "While other large tech companies were busy pleasing the new government, NVIDIA avoided the Washington spotlight." This low-key performance seems to indicate that NVIDIA does not want to take sides between China and the US. The Wall Street Journal also commented that this shows NVIDIA still wants to find a "balance" between China and the US.

Huang's previous visits to China also did not involve him appearing as an official guest, continuing his "politically indifferent" attitude.

However, it is obvious that Huang has realized that continuing to avoid politics is a "dead end."

In January this year, Bloomberg reported that the Trump team was planning the "ultimate killer move" for chip sanctions against China, aiming to completely ban NVIDIA's high-end computing products, including H20. Even the "bleeding" chip H20, which has been cut three times, was to be banned, meaning the buffer zone for supply cuts would also be blocked.

This is obviously not the situation Huang wants to see. For this reason, he met with Trump on January 31 and attended Trump's Mar-a-Lago dinner in early April, hoping to use increased investment as a bargaining chip to obtain an "exemption" for H20.

However, Trump's unpredictable attitude likely disappointed Huang: even what was "agreed upon" can change, making many things untrustworthy.

With no certainty from Trump, Huang naturally turned his hope for certainty to China to avoid the situation from deteriorating.

After Huang's visit to China yesterday, NVIDIA stated, "We regularly meet with government leaders to discuss our company's products and technologies." The meaning is clear.

Rather than being "double-teamed" in avoiding politics, it is better to find some certainty in the political arena.

03

Huang's tightrope walking inevitably evokes comparisons to Su Qin, a strategist during the Warring States period. The essence of Su Qin's horizontal alliance strategy lies in "uniting the weak to attack the strong," aiming to maintain the balance of national power among the seven states through multidimensional constraints.

In terms of playing balance, even Panetta, who proposed the "Asia-Pacific Rebalance Strategy," would have to call Su Qin a teacher.

Of course, Huang is not a strategist and has no political intention of pursuing a "balance of power among great powers." Politics was initially kept at a distance.

Online, some speculate that Huang's dual identity of "Chinese descent" and "American citizenship" makes him intentionally maintain a "relative balance" in AI strength between China and the US by insisting on supplying chips to China.

However, Huang's search for a balance between China and the US is more likely based on commercial considerations rather than political intentions: in the field of AI, China and the US have emerged as the two leading players. For the US government, to prevent China from surpassing the US, it tries every means to block NVIDIA from fertilizing the roots of "Chinese AI"—even if it is low-concentration compound fertilizer. For NVIDIA, allowing both seedlings to use its fertilizer simultaneously is the "self-cultivation of a fertilizer manufacturer."

NVIDIA may have one reason to abandon the Chinese market: the tightening of the chip bill noose. But there are 100 reasons not to abandon it, the most crucial being: China's chip demand is too large.

It should be noted that in fiscal year 2023, NVIDIA's sales in China accounted for about 20% of its total revenue, and last year, the proportion dropped to 13%. However, since January this year, driven by DeepSeek, Chinese tech giants such as Tencent, Alibaba, and ByteDance have increased their purchases of H20.

Because of this, Stephen Witt, author of "Jen-Hsun Huang: The Heart of NVIDIA," recently stated that export controls and tariffs are Huang's biggest pain points.

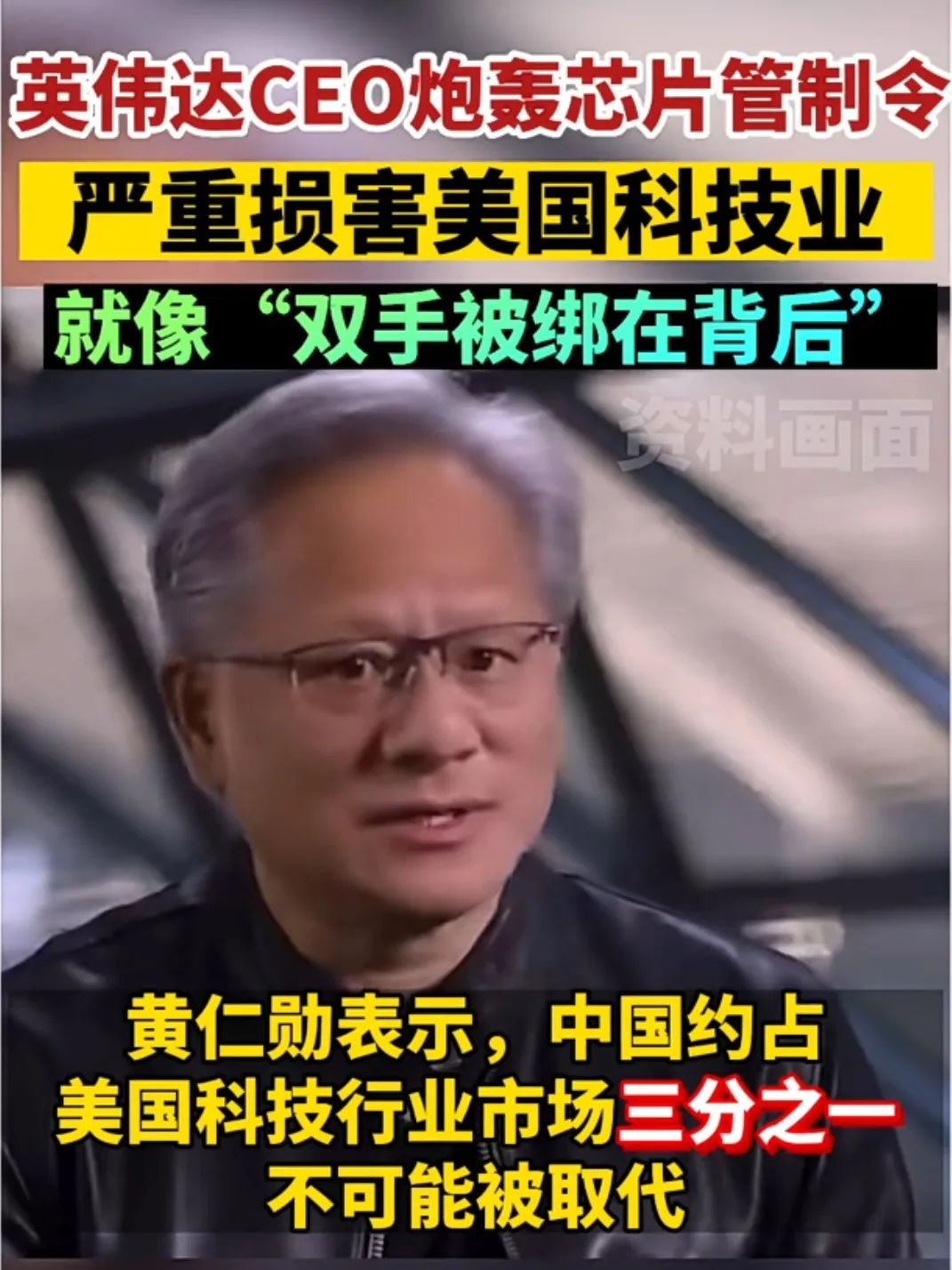

Huang's performance also confirms this: although strictly adhering to US regulatory requirements, he has repeatedly expressed his opposition to chip export restrictions to China, arguing that export control orders will tie NVIDIA's "hands behind its back" and allow Chinese local chip companies to rise. He also said that the US-led restrictions on Chinese tech giants are "messed up."

▲Huang previously lambasted the chip control order for tying NVIDIA's "hands behind its back".

History professor Chris Miller, author of "Chip War," shares a similar view with Huang. He previously stated that the Trump administration's allowance of H20 chip exports to China was a "major victory" for the US—it could promote US economic growth and avoid handing over the Chinese AI chip market to Chinese chip manufacturers.

However, such views are not mainstream in American politics and Silicon Valley. The US House of Representatives' China Task Force is a pioneer in calling for a ban on H20 supplies to China, with one congressman saying, "Export controls are very effective, and we have no time to waste. Every day the US fails to restrict chip exports aimed at circumventing existing controls, our adversaries gain another day to accumulate inventory to defeat us."

Toner, a former OpenAI board member, declared, "If Trump adheres to NVIDIA's stance, China stands to gain significantly." Anthony Levandowski, CEO of AI startup Anthropic, echoes this sentiment, emphasizing the growing importance of export controls on AI chips.

Currently, it appears that the Trump administration has sided with one of these perspectives—not aligning with Jen-Hsun Huang's stance.

04

Against this backdrop, Jen-Hsun Huang's "urgent visit to China" can be viewed as an attempt to counteract Trump's "platform." Trump's tariff measures are accelerating "decoupling," and the H20 supply cut to China further exacerbates tensions. However, Huang's statement of "hoping to continue cooperation with China" serves to reattach the "hook" that was intended to sever ties in the chip sector.

This is encouraging news for both the present and future—when prominent American tech leaders like Jen-Hsun Huang and Musk join the "anti-decoupling camp," it introduces more constraints on the potentially damaging consequences of a transatlantic "fight to the finish."

Given that decoupling is detrimental to the Chinese economy, particularly the technology and foreign trade industries, we should embrace and welcome the "anti-decoupling forces" from American tech giants.

From this, it becomes evident that two common misconceptions in current public opinion require vigilance.

The first is the belief that "NVIDIA needs us, but we don't need NVIDIA." Previously, an "expert" surnamed Xiang claimed that the Chinese market is gradually becoming independent of NVIDIA chips and was pessimistic about H20's market prospects. However, this was contradicted by reality, as Claus Aasholm's data revealed that "the H20 system performs exceptionally well, with a quarter-on-quarter growth rate of 50%, making it NVIDIA's most successful product, whereas the H100's quarter-on-quarter growth rate is only 25%."

Undeniably, China's chip industry is accelerating its independent research and development, fostering a domestic AI chip landscape led by Huawei's Ascend, characterized by a "one superpower and multiple strong players" model. Huawei's Ascend 910B excels in FP16 computing power, while Huawei's CANN framework and MindSpore also shine. Additionally, significant progress has been made by Cambricon's Thinker series, Suiyuan Technology's CloudSui T20 series, Biren Technology's BR100, as well as Baidu's Kunlun and Alibaba's HanGuang chips.

In the first half of 2024, domestic chips accounted for 30% of the Chinese AI accelerator chip market, marking an undeniable rise.

However, emphasizing independent research and development does not negate the need for competition. Chris Miller noted that despite performance reductions due to special modifications, H20 chips still outperform many independently developed chips. A Haitong International research report also pointed out that compared to H20, domestic substitutes face shortcomings in the software ecosystem, with the number of CUDA developers being 200 times that of the domestic ecosystem. Furthermore, Huawei's Ascend chips have a yield rate of only 32%, making it challenging to fully bridge the computing power gap in the short term.

Embracing the Chinese market, as suggested by Jensen Huang, is far preferable to adopting a resistant attitude that "the Chinese market does not need NVIDIA," which could dampen enthusiasm.

▲It is heartening news that Jensen Huang intends to continue supplying NVIDIA chips to China.

The second attitude is "if we decouple, so be it; it's not a big deal." Countering tariff bullying is not about pursuing complete decoupling but rather returning to the negotiating table to better achieve "mutual benefit through cooperation."

While the Earth will indeed continue to spin if we decouple, many enterprises will suffer significantly.

NVIDIA cannot afford the cost of decoupling, which explains why Jensen Huang came to "reconnect." Similarly, many manufacturing and foreign trade enterprises cannot afford the cost of decoupling, and their plight deserves recognition.

Ultimately, Jensen Huang's urgent visit to China demonstrates that even as Trump reverses course, there are still forces within the United States that emphasize cooperation and oppose decoupling, potentially among the people, especially in the corporate world.

Therefore, we should strive to minimize the number of adversaries who oppose us and maximize the number of friends who advocate for cooperation and oppose decoupling.