NVIDIA's Intensifying Focus on the Chinese Market: A Strategic Imperative

![]() 04/27 2025

04/27 2025

![]() 759

759

In January 2025, NVIDIA CEO Jen-Hsun Huang made a low-key return to China after a five-year absence, attending the company's annual meetings in Beijing, Shanghai, and Shenzhen. Photographs circulating on social media depicted him in a vibrant floral coat, a quintessential attire of northeast China, holding a red handkerchief, and dancing yangko with employees, showcasing an uncommonly down-to-earth demeanor. Behind this seemingly relaxed itinerary lay profound implications.

At that time, the US chip export controls against China had intensified, with NVIDIA's flagship AI chip, the H100, banned, and its special edition, the H20, yet to fully penetrate the market. Huang's visit aimed not only to boost the morale of the Chinese team but also to signal to the outside world NVIDIA's commitment to "taking root in China." During interactions with employees, he emphasized, "China is a very important market for NVIDIA" and promised customers, through internal communication meetings, to introduce alternative products compliant with US regulations.

Four months later, in April 2025, Huang hastily flew to Beijing once more. The backdrop this time was even grimmer: the US government abruptly announced an indefinite ban on NVIDIA's H20 chip exports to China, a decision that swiftly and significantly impacted the company. NVIDIA disclosed that it expected to incur a charge of $5.5 billion in the first quarter of fiscal year 2026 due to inventory, procurement commitments, and related services for the affected chips.

This news sparked a massive sell-off in NVIDIA's stock, with share prices plummeting over 6% in the morning and closing down nearly 7%. Industry insiders noted that the H20 sales ban "cast doubt on the company's ability to consistently exceed Wall Street's overly high expectations."

NVIDIA wasn't the only loser. AMD warned that due to expanded export controls on its MI308 products, it could face losses of up to $800 million, and AMD's share price also fell by 7.35%. The share price of Dutch company ASML, whose lithography machines are crucial for advanced semiconductor manufacturing, declined due to lower-than-expected orders. CEO Christophe Fouquet remarked that the Trump administration's tariffs "exacerbated uncertainty."

Asian stock markets, particularly those in Taiwan and Hong Kong, also declined, reflecting concerns about the broader impact on the global technology supply chain.

Huang's trip was described by observers as a "fire-fighting mission" – he had to navigate sudden changes in US policy, a crisis of trust from Chinese customers, and competitive pressures from local chip companies simultaneously. The stark contrast between his two visits highlights NVIDIA's strategic dilemma in the Chinese market: it must adhere to US regulatory requirements while not abandoning the substantial benefits of the Chinese market.

The fate of the H20 chip serves as a microcosm of technological competition. During the Biden administration, the US restricted the export of AI chips in 2022 and updated the rules the following year to prevent the sale of more advanced AI processors. This "downgraded" AI chip, designed specifically for China with only 15% of the H100's computing power, generated revenue of $12 billion to $15 billion in 2024, accounting for 80% of NVIDIA's revenue in China.

In early April 2025, the H20 briefly saw a relaxation of policy. Over the past week, from no ban to embargo, the fate of the H20 has been volatile and uncertain, all stemming from that mysterious banquet at Mar-a-Lago.

Unlike wearing short sleeves and drinking beer in Vietnam or eating street food with suppliers in Taiwan, Huang dressed formally for this dinner, shedding his iconic leather jacket for a business-like suit, similar to the attire he wore at a US congressional hearing.

Huang's presence at the dinner yielded a positive outcome – Trump lifted the embargo on the H20, but at a cost. Huang and NVIDIA committed to investing $500 billion over the next four years, partnering with Foxconn, TSMC, and others to invest in US AI infrastructure, promoting "Made in USA" AI chips and supercomputers. This can be seen as a deal between the US government, Trump, and Huang.

Compared to the $500 billion from OpenAI and SoftBank and the $100 billion from TSMC, these funds solely come from NVIDIA, demonstrating its commitment. The only comparable investment is Apple's $500 billion pledge.

In this matter, Trump was confident and proud, stating, "I want to thank Jensen (Huang) and everyone we dealt with. They are amazing people, smart people, and they wouldn't have done this without tariffs." Trump also posted on his social platform, calling it "exciting big news" and vowing to expedite all necessary permits for NVIDIA.

Everyone knows the final outcome. At least on the surface, this "honeymoon period" lasted only a few days. There was no deal, and NVIDIA did not receive the permit approval Trump had promised. Instead, the H20 directly faced an embarrassing embargo.

Huang's visits were a rational choice for an entrepreneur and a selection by market rules.

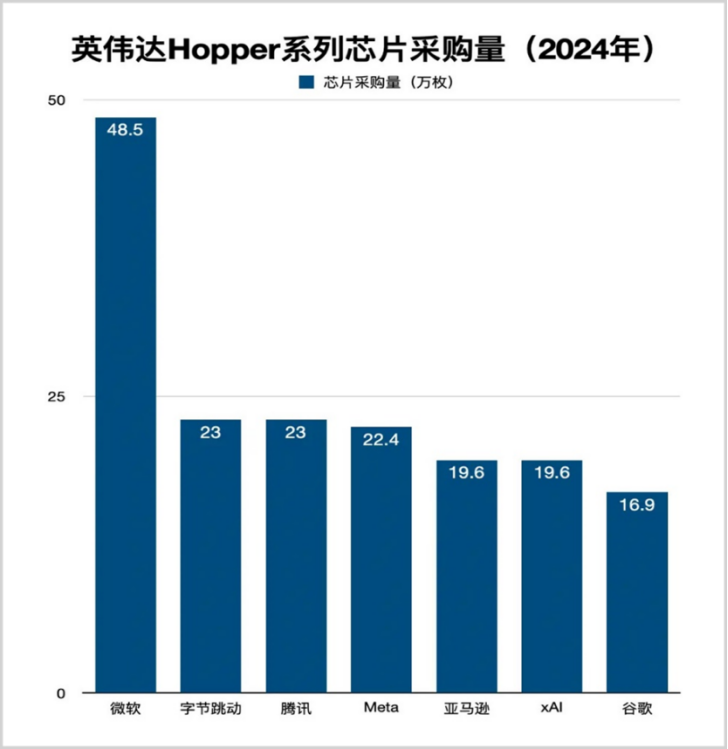

Globally, China and the US are the most active and willing investors in computing power. According to data from international market research firm Omdia, the top five buyers of NVIDIA's Hopper series chips globally in 2024 were Microsoft (485,000 units), ByteDance (230,000 units), Tencent (230,000 units), Meta (224,000 units), and Amazon (196,000 units). Especially with the AI wave of DeepSeek, the demand for H20 has further increased.

From a trend perspective, the prospects and potential for China's investment in computing power far surpass those of the US. In the fourth quarter of 2024, Tencent and Alibaba's capital expenditure growth was impressive, with Tencent increasing by 366% year-on-year and Alibaba by 258%, ranking first and second among the world's major technology companies, respectively. Statistics show that the total capital expenditure of ByteDance, Alibaba, and Tencent is expected to surge by about 69% in 2025; in contrast, Amazon, Microsoft, Google, Meta, and Oracle are expected to see their total capital expenditure increase by only about 29% this year.

Had things developed normally, NVIDIA could have generated substantial profits from the Chinese market annually. However, a series of regressive policies by the Trump administration disrupted this scenario, causing NVIDIA to miss out on significant business opportunities in China.

When mentioning NVIDIA, most people first think of its high-performance graphics cards. However, less known is that the core pillar of NVIDIA's AI empire is CUDA. In 2006, NVIDIA launched the CUDA parallel computing platform and programming model, enabling developers to write code directly on GPUs, significantly enhancing computing efficiency. As the number of CUDA developers grew, its functionality continued to improve, attracting more software to actively adapt, creating a virtuous cycle of "the strong getting stronger." After nearly 20 years of development, CUDA has established a unique advantage that is difficult to replicate.

NVIDIA achieves software and hardware binding through the CUDA ecosystem – using CUDA requires procuring NVIDIA graphics cards, akin to the tight integration of the iOS system with Apple phones. Today, the CUDA ecosystem comprises about 4.3 million developers, of which 1.5 million are from China, accounting for over 30%, and becoming a crucial force supporting its development. Without significant changes, the CUDA ecosystem will continue to grow as developers have deeply adapted to this system, and NVIDIA's leading position in this field is difficult to shake in the short term.

However, if forcibly "decoupled," the situation would be entirely different. In the balance between security and development, security is always the primary consideration. Once losing the Chinese developer community, NVIDIA would suffer substantial losses. What worries Huang even more is that Chinese local enterprises are accelerating their layouts to challenge CUDA's monopoly position.

Many speculate that Huang aims to jointly design chips with Chinese partners that comply with US export restrictions. Both parties may explore jointly developing low-compute density chips (such as 4.8 Tflops/mm) or building open-source frameworks to optimize the co-design of software and hardware, providing Chinese customers with the best chips within US policy restrictions. Simultaneously, this chip must involve Chinese companies in research and development; otherwise, regardless of where it is produced globally, it will be subject to high tariffs as a chip from a US company upon import. This suggests that NVIDIA is likely to collaborate with a company to research and develop a new chip, working with NVIDIA's R&D team in China and deeply integrating with Chinese companies' large model computing frameworks to create a globally unique closed-loop ecosystem.

As of the end of 2024, the number of NVIDIA employees in China had approached 4,000, a significant increase from around 3,000 at the beginning of 2024. Clearly, the development of China's new energy vehicles and AI markets has also driven the growth of NVIDIA's business in China. During this China trip, Huang admitted, "Deep cooperation with Chinese enterprises has also enabled us to grow into a more competitive international enterprise."

Huang's frequent visits to China are also in response to the pressure brought about by the rise of China's local chip industry.

China boasts the world's largest AI application scenarios and data resources. From autonomous driving to cloud computing, the demand for computing power from Chinese enterprises continues to soar, and NVIDIA's GPUs remain the core hardware for training large models. Losing the Chinese market not only means a sharp drop in revenue but also signifies losing the "ticket" to participate in the global AI competition. Huang is fully aware of this and has repeatedly mentioned in Beijing "jointly promoting AI innovation with China," essentially hoping to bind China's development needs and sustain its technological dominance.

In 2024, certain domestic AI chips made breakthroughs in computing density, energy efficiency ratio, and other indicators, replacing NVIDIA's A100 in some scenarios. This replacement is not a simple "import substitution" but an "ecological substitution" reliant on China's vast application scenarios for technological iteration.

Undoubtedly, China's chip industry is accelerating its pace of independent research and development. Significant progress has also been made by Cambricon's Thinker series, Suiyuan Technology's CloudSui T20 series, BiRen Technology's BR100, as well as Baidu's Kunlun chip and Alibaba's HanGuang, and the momentum of the rise of domestic chips is already palpable.

Moreover, during his visit to China, Huang frequently interacted with many Chinese robotics companies and visited the National Embodied Intelligent Robotics Innovation Center. The core objective was to promote the landing and taking root of NVIDIA's Isaac Sim simulation platform and CUDA software ecosystem in China, integrating Chinese developers into its global technology landscape. This series of actions, on the one hand, creates favorable conditions for NVIDIA to further expand the Chinese market; on the other hand, it is also expected to bring new opportunities and vitality to the development of China's AI industry, helping the industry upgrade technology and explore innovative applications.

Standing at the juncture of 2025, NVIDIA's China strategy is facing a critical choice: whether to continue seeking compromise solutions in the policy gap or to bet on technological breakthroughs to achieve "de-Chinalization"? Judging from Huang's frequent visits to China and public statements, NVIDIA has clearly chosen the former. Its logical chain is evident: against the backdrop of exponentially growing demand for AI computing power, any technological route that detaches from the Chinese market will face the dual dilemma of insufficient scale and cost runaway.

Looking back at the technological blockade against China by the 1996 Wassenaar Arrangement, today's chip ban is a historical replay. However, the difference is that China has transformed from a technology recipient to an ecosystem definer. Today, with computing power becoming the new oil and AI reshaping the global industrial landscape, the value of the Chinese market to NVIDIA has risen from a "profit cow" to an "innovation partner." This reconstruction of relations not only concerns the fate of a single enterprise but also reflects that, under the backdrop of the global technological revolution, any political intervention attempting to fragment the market will ultimately suffer from the backlash of industrial laws. When NVIDIA chooses to deeply coexist with the Chinese market, it is not only betting on the continuation of commercial interests but also on the ultimate adherence to the essence that technology knows no borders.