ARM Q1 Financial Report: Record Royalties and Licensing Revenue, AI-Driven Growth

![]() 05/12 2025

05/12 2025

![]() 591

591

Produced by Zhineng Zhixin

In the first quarter of the fiscal year 2026 (Q1 2025), ARM delivered impressive results, with record highs in revenue, royalties, and licensing revenue, underscoring its pivotal role in the AI era, spanning from cloud to edge computing.

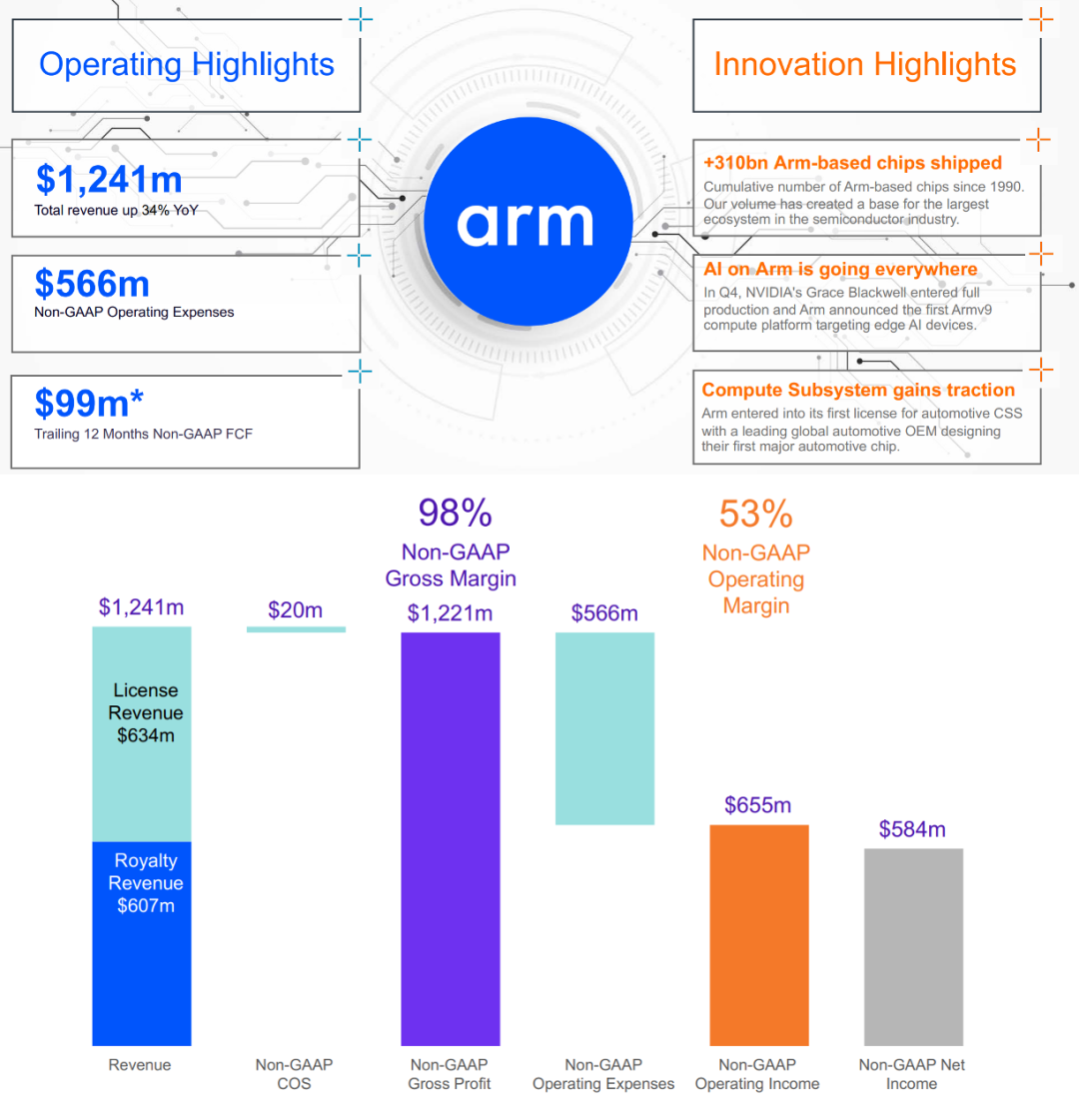

Quarterly revenue reached $1.241 billion, marking a 34% year-on-year increase. Notably, royalty revenue stood at $607 million, while licensing revenue soared 53% year-on-year to an impressive $634 million.

Profit margins were equally remarkable:

◎ Non-GAAP gross margin: 98%

◎ Non-GAAP operating margin: 53%

◎ Non-GAAP net profit: $584 million

Amid global macroeconomic and geopolitical uncertainties, ARM has demonstrated remarkable resilience.

Fueled by the dual engines of surging AI computing power demand and the proliferation of the Armv9 architecture, ARM's custom chip business continued to expand. Its adeptness in identifying and mitigating potential tariff risks further safeguarded its steady growth.

Part 1

AI-Driven Dual-Wheel Growth Engine:

Royalties and Licensing Reach New Heights

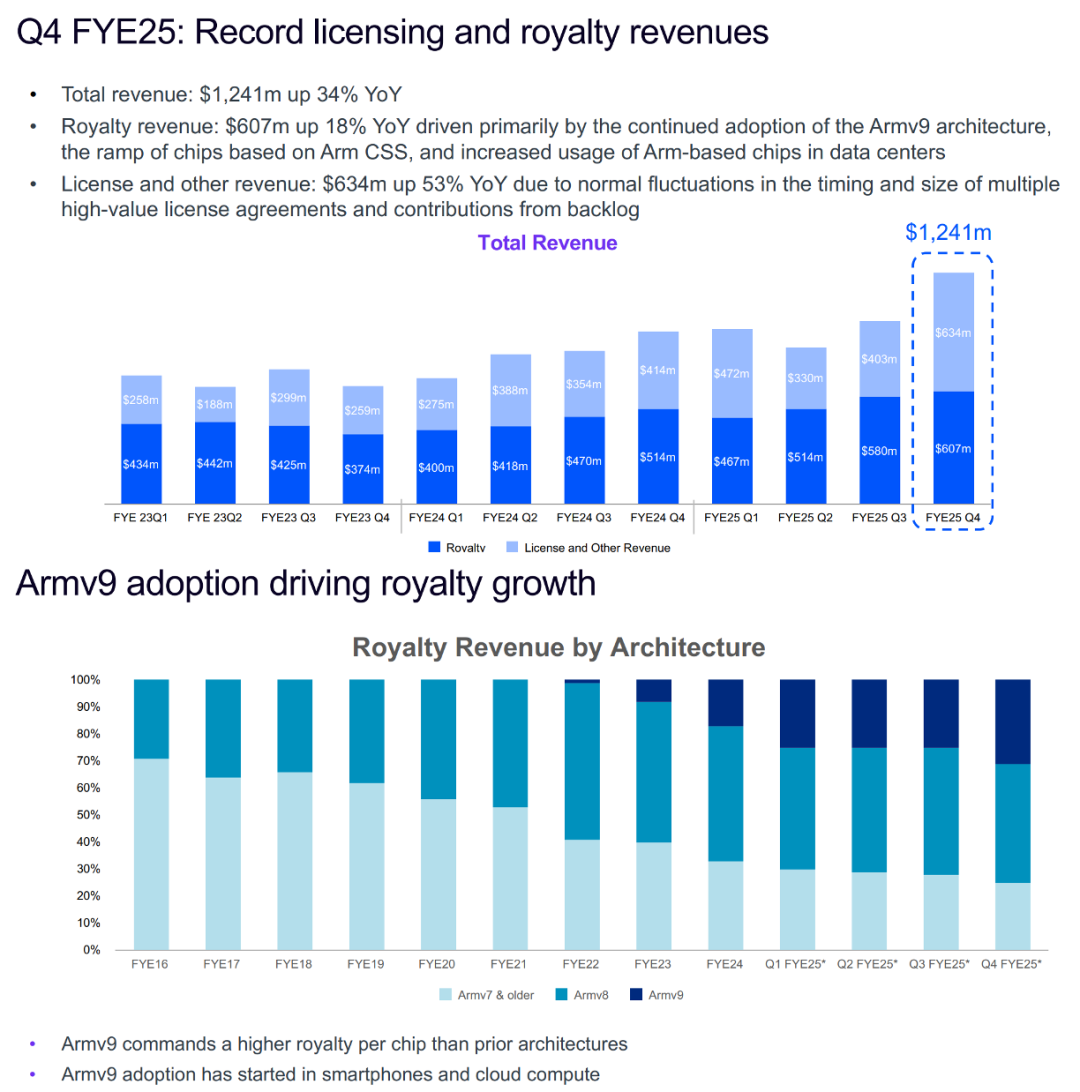

In Q1 2025, ARM generated $1.24 billion in revenue, witnessing robust year-on-year growth, with full-year revenue exceeding $4 billion.

From a revenue structure perspective, ARM is entering a new era where "licensing and royalties are equally important":

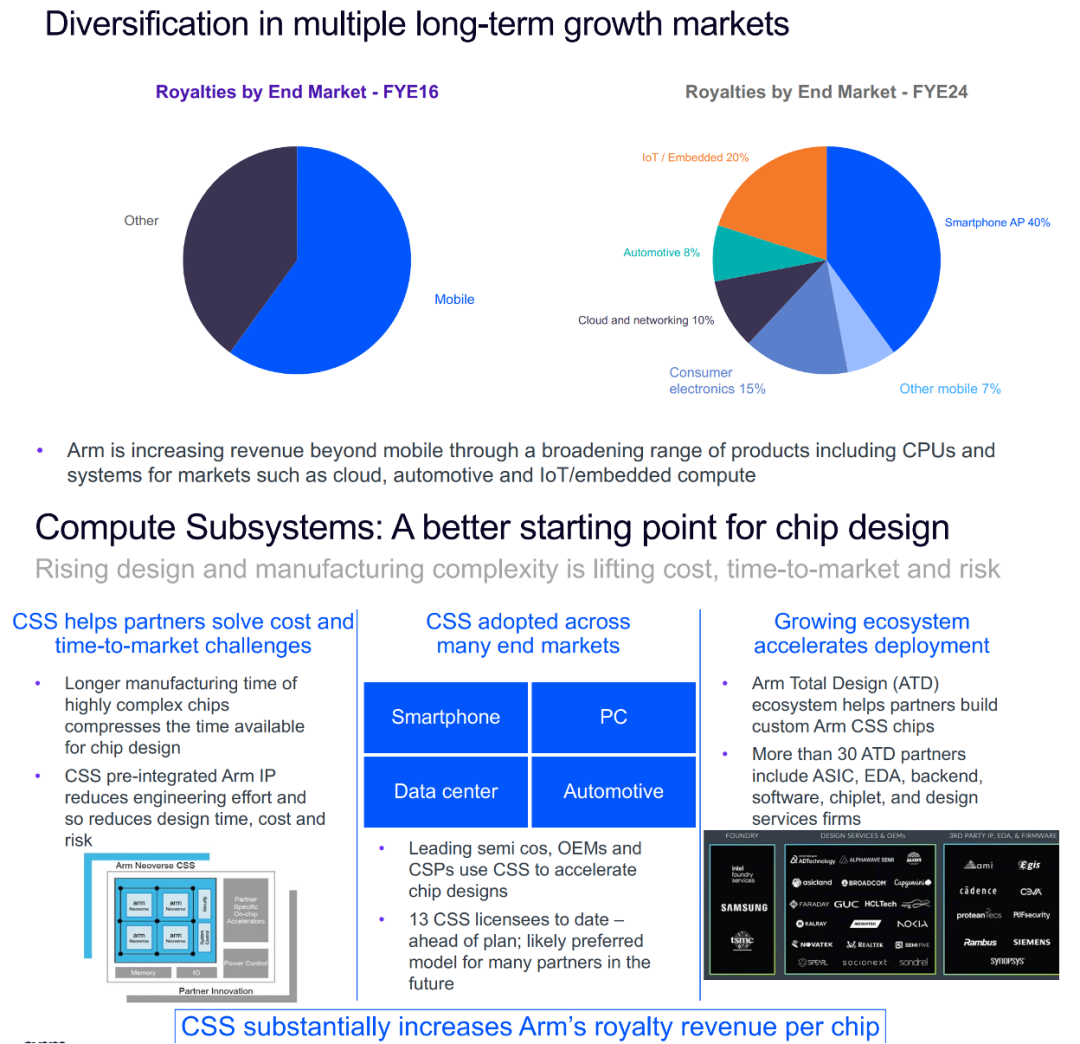

◎ Royalty revenue increased by 18% year-on-year to $607 million, primarily driven by the rapid adoption of the Armv9 architecture in flagship smartphones and server chips, particularly the expansion of CSS (Compute Subsystem) solutions in mobile devices. Smartphone royalty revenue surged 30%, outpacing the modest growth in smartphone shipments, indicating ARM's transition from a "shipment-tied model" to a stage of "increasing per-chip value".

◎ License revenue jumped over 50% year-on-year to $634 million, primarily due to the wave of AI computing power prompting various enterprise customers (especially hyperscalers) to accelerate investments in the development of next-generation ARM-based SoCs. From Grace Blackwell to Cobalt 100 and Graviton, ARM is gradually transitioning from technology licensing to platform solution delivery, with CSS emerging as a new revenue pillar.

The core of this "dual-wheel drive" strategy lies in ARM's construction of an upwardly integrated platform ecosystem.

◎ On one hand, it enhances the structural upgrade of IP (such as the performance and energy efficiency improvements of Armv9). On the other hand, it boosts ASP (average selling price per license) and customer loyalty through hardware and software integration solutions like CSS and edge AI platforms.

ARM's annualized contract value (ACV) increased by 15%, surpassing its long-term target of mid-to-high single-digit growth. The business model of "transitioning from licensing to continuous delivery" is taking shape. Even amidst the slow recovery in smartphone shipments in 2024, ARM achieved such growth, indicating its business is increasingly "decoupled" from downstream cycles.

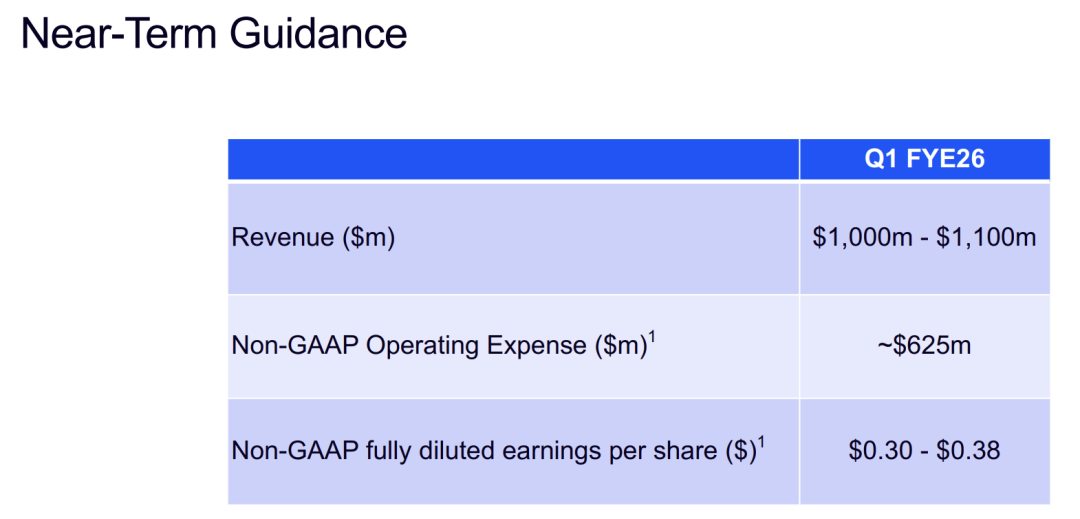

Arm Holdings plc's first-quarter guidance for fiscal year 2026 projects revenue of $1.0 - $1.1 billion. Benefiting from demand growth in cloud, automotive, and IoT sectors, non-GAAP operating expenses are expected to be approximately $625 million!

Part 2

Champion in the Era of AI and Customization:

Full-Stack Penetration from Cloud to Edge

During the conference call, ARM emphasized multiple times that AI is the core driver of its business growth, and this wave extends beyond the model level to a comprehensive explosion in AI infrastructure. Numerous hyperscale cloud service providers have chosen the ARM architecture as the preferred choice for the next generation of server CPUs.

According to ARM, up to 50% of new server chips in 2025 will be based on the ARM architecture. Notable examples include:

◎ NVIDIA Grace Blackwell (based on Armv9) has entered full-scale production;

◎ Google's Arm v9 has been deployed in 10 regions, covering 40 of its top 100 customers;

◎ AWS's Graviton series has contributed over 50% of new CPU capacity.

ARM's exceptional energy efficiency ratio, flexible licensing mechanism, and support for customized design have set it apart amidst the generative AI's high demands for computing density and power efficiency. Especially in server deployments where TCO (total cost of ownership) considerations are paramount, the ARM architecture has emerged as an ideal foundation for many vendors developing their own AI chips.

In Q4, ARM launched its first edge AI platform capable of running billion-parameter models, integrating Cortex A320 and Ethos-U85 MPU. It covers typical application scenarios such as voice, image, and inference and has been adopted by edge computing leaders including Infineon, NXP, Renesas, Qualcomm, and STMicroelectronics. This signifies that ARM is no longer just a chip IP provider but is also establishing an ecosystem for data paths from sensors to the cloud.

ARM's breakthrough in automotive CSS licensing (having signed agreements with an electric vehicle giant) marks the initial success of its strategy in the trend of "intelligent driving + software-defined vehicles".

The consistency of the ARM architecture will aid automakers in constructing an integrated platform spanning from in-vehicle control units to cloud algorithm training.

ARM's AI software stack has achieved over 8 billion device-level installations, with a developer community of over 22 million, making it one of the largest architecture-level developer communities globally. This ecological advantage is gradually challenging the "CUDA barrier" of NVIDIA, Intel, and other vendors in the AI core competition.

ARM clarified that tariffs primarily target end-hardware products, and as an IP licensor, the company is not directly affected. Even if there are indirect impacts in the future (such as increased device costs weakening demand), due to ARM's business model lagging behind the end-shipment cycle, its impact will be significantly weaker than on hardware companies.

Since the licensing business relies on long-term R&D investments rather than short-cycle shipments, macroeconomic slowdowns have a lesser impact on it, as well as potential fluctuations in royalty revenue.

ARM management also expressed a relatively optimistic outlook: even if the demand for end devices in the US market declines by 10%-20%, its impact on the company's overall revenue will be minimal, amounting to just a few percentage points. ARM's growth trajectory aligns more closely with that of a software company than a traditional chip company.

Summary

Amidst the current global semiconductor sector pressures, ARM is leveraging architectural transitions (Armv9), platform strategies (CSS), and the trend of AI custom chips, coupled with effective cost control and a robust cash flow structure, to emerge as a key asset in the "AI infrastructure layer".

In the era of AI and the explosion of customized computing power, ARM's growth is embarking on a new trajectory, with the endpoint of this trajectory being the ultimate competition for discourse power within the architecture ecosystem.