Lenovo's Smart Agent: A Modest Player in a Big Game?

![]() 05/12 2025

05/12 2025

![]() 690

690

Lack of a Natural Traffic Pool

By Chen Dengxin

Edited by Li Ji

Typeset by Annalee

Betting big on AI, Lenovo has taken bold new steps.

Recently, the 2025 Lenovo Innovation Technology Conference officially unveiled the Super Smart Agent Matrix, encompassing the Lenovo Tianxi Personal Super Smart Agent, Lenovo Lexiang Enterprise Super Smart Agent, Lenovo City Super Smart Agent, and the next-generation Lenovo Inference Acceleration Engine.

This underscores smart agents as a pivotal focus for Lenovo.

Over the past year or so, smart agents have emerged as the most prevalent form of AI application, a notion that has gained widespread industry consensus. Players of all sizes have ramped up their investments, and Lenovo has kept pace.

However, in this AI race, Lenovo's "old challenge" seems to have resurfaced.

Ultimately, it's all about the ecosystem.

"Super Smart Agents represent the next frontier in enhancing quality of life and productivity levels."

From Lenovo's perspective, with the advancement of AI capabilities on devices and the seamless end-edge-cloud collaboration across ecosystems, smart agents will evolve into super smart agents.

Lenovo envisions a super smart agent that embodies three core functional attributes: perception and interaction, cognition and decision-making, and autonomy and evolution.

Perception and Interaction: Through multimodal coordination of text, speech, gestures, eye tracking, etc., smart agents can capture user status and environmental information in real-time, accurately interpreting and responding to user intentions across devices.

Cognition and Decision-Making: Leveraging knowledge accumulation, experiential reflection, real-time learning, and efficient feedback, smart agents uncover the underlying logical relationships in events and scenarios, accurately comprehend complex intentions, and apply learnings from one context to another.

Autonomy and Evolution: Combining user intentions with prior knowledge, complex tasks are decomposed into sub-tasks and assigned to respective domain smart agents. These agents then autonomously sequence execution orders, plan steps, invoke cross-ecosystem tools based on smart agent interconnect protocols to actively perform tasks, and continuously evolve and upgrade through self-learning.

At the conference, Lenovo also introduced four intelligent terminal devices equipped with the Tianxi Personal Super Smart Agent: the moto razr foldable phone with AI Yuanqi Edition, the Yoga tablet with AI Yuanqi Edition, the world's first rollable screen AI PC ThinkBook, and the 3D Rescuer.

Currently, smart agents are the "hot potato" in the AI race.

Baidu launched Super Smart Agent Xinxiang, ByteDance began internal testing of Super Smart Agent Kouzi Space, and Alibaba established a smart agent matrix through Quark and DingTalk...

Yang Yuanqing, Chairman and CEO of Lenovo Group, said: "Super Smart Agents represent the next frontier in enhancing quality of life and productivity levels. They are no longer mere tools but the 'cognitive operating system' for individuals and enterprises. They serve as the primary entry point for addressing urgent needs and problems, executing commands instantaneously."

It is evident that smart agents are reshaping productivity and production relations.

Against this backdrop, it's understandable why Lenovo has joined the smart agent fray: It aims to boost the value of smart devices through smart agents, thereby driving sales of mobile phones, tablets, laptops, etc., and achieving greater commercial success.

According to Markets&Markets, the global smart agent market size is projected to reach approximately $5.1 billion in 2024 and grow to $47.1 billion by 2030, with a compound annual growth rate of 44.8%.

Smart Agents: The Most Prevalent Form of AI Application

The challenge lies in standing out.

Li Yanhong once stated: "As basic models become increasingly powerful, developing applications becomes simpler. The simplest of these is a smart agent. By clearly articulating workflows in 'human language' and pairing them with proprietary knowledge bases, a valuable smart agent can be created, simpler than 'making a webpage in the Internet era.'"

In layman's terms, the barrier to entry for smart agents is low.

With such a low barrier, smart agents with identical or similar functionalities will naturally proliferate: Taking Lenovo Tianxi Personal Super Smart Agent as an example, when planning a smart travel itinerary, it can handle complex tasks like hotel reservations and itinerary arrangements, akin to Xinxiang and Manus.

Thus, Lenovo's ecosystem foundation is being tested.

Tianxi Smart Agent Architecture Diagram

Unfortunately, ecosystem competition is the domain of internet giants like Baidu, Tencent, Alibaba, and ByteDance, rather than Lenovo's. Attracting and retaining users will pose a significant challenge for Lenovo's smart agents.

An internet observer told ZnKedu: "In the quest for the 'TikTok' and 'WeChat' of the AI era, Lenovo and internet giants have overlapping AI business functions. Without disruptive innovation, they may fall into the trap of self-satisfaction at the technical level."

In short, Lenovo lacks a natural traffic pool.

More critically, internet giants are actively constructing smart agent platforms, aiming to control the entry points of smart agents and establish a chain of development, distribution, and monetization, aiming to capture public attention and accompany them in work, study, life, and other scenarios, thereby reshaping various industries.

This approach is difficult for Lenovo to emulate.

In fact, Lenovo entered the AI race as early as 2017 and has consistently invested for eight years, at considerable cost, yet it has not ascended to the top tier of the race or occupied center stage in this AI battle.

Regarding this, "Qingcheng Finance" remarked: "Looking back at Lenovo's transformation, a strong start but weak finish has always been the norm for Lenovo. This behavior of 'loud slogans, no action' stems from Lenovo's inertial growth—in the PC era, Lenovo's development strategy was always that scale equals strength, and through channels, mergers and acquisitions, it secured the top spot in global PCs, thus emphasizing marketing and neglecting technological research and development, being dubbed by the public as an 'assembly plant'."

The Core Business Faces "Hunting"

In reality, Lenovo's smart device business, whether it's hardware like chips or software like operating systems, has long relied on partners and sits at the end of the industrial chain. While it has the ability to integrate the industrial chain, it lacks core discourse power within it.

Lenovo's AI capabilities are no exception.

"Decode" noted: "Lenovo's previously high-profile 'AI Twin' was actually a joint creation with Microsoft; Lenovo's ability to run edge-side AI is essentially due to Intel's launch of Meteor Lake. In other words, whether it's underlying computing power chips or upper-layer software applications, Lenovo does not possess core competitive areas."

As such, being big but not strong accurately describes Lenovo.

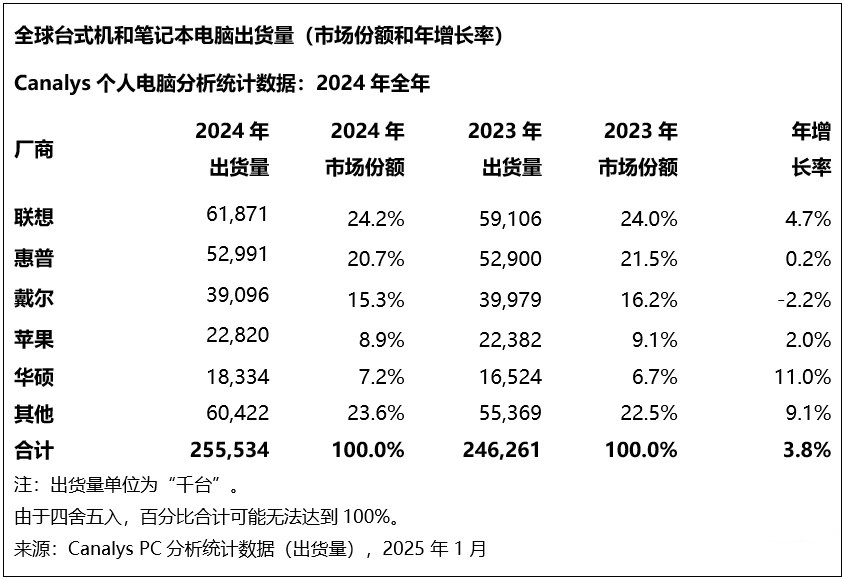

Taking the PC market as an example, Lenovo secured the global top spot in 2024, but the high-end market remains elusive: IDC data reveals that in the PC market with a unit price over $1,000, Apple leads with a 37% share, followed by Dell with 28%, and Lenovo with only 15%; consumer research shows that only 12% of users perceive Lenovo as representing "high-end innovation," compared to 68% for Apple.

This is closely tied to the aftermath of the "trade-industrial-technology" strategy.

In earlier years, Lenovo had a major debate on "trade-industrial-technology" versus "technology-industrial-trade," with "trade-industrial-technology" ultimately prevailing and becoming Lenovo's ideological cornerstone. Since then, Lenovo has also acknowledged the issues and has been striving to rectify them.

After all, the advantage of the "trade-industrial-technology" approach is faster initial development, with the ability to continuously grow and form scale effects through the snowball method; the disadvantage is the difficulty in surging upwards in later stages.

However, Rome wasn't built in a day, and Lenovo's tendency of "emphasizing marketing, neglecting research and development" has not been fully reversed.

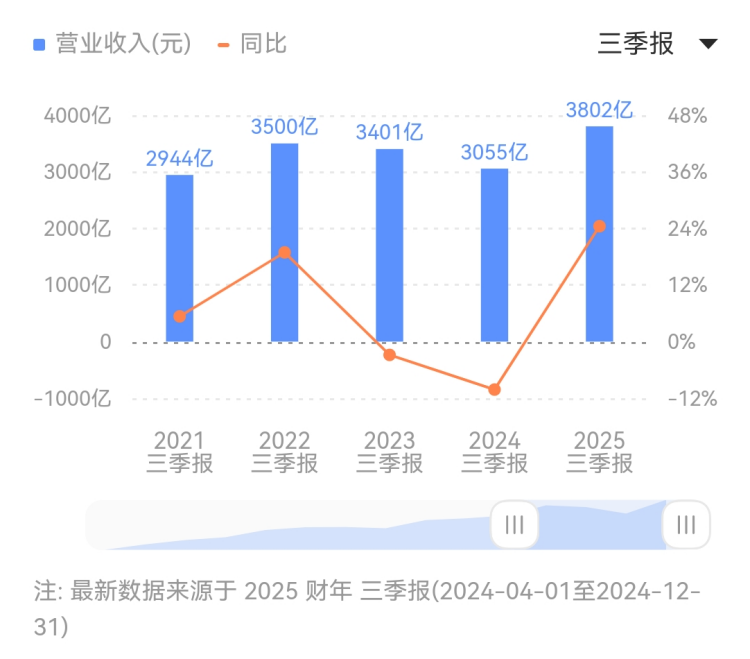

Data from Eastmoney.com shows that from April 1 to December 31, 2024, Lenovo Group's sales and distribution costs amounted to 19.1 billion yuan, administrative expenses were 15.16 billion yuan, and research and development expenses were 11.82 billion yuan. Research and development costs accounted for only 61.88% of sales and distribution costs and 77.97% of administrative expenses.

Image source: Tonghuashun

In other words, a marketing-driven approach is still the cornerstone of Lenovo.

A financial professional told ZnKedu: "Lenovo has long dominated the PC market, but its position in the value chain is not high. Although it has made some efforts in self-developed chips and intelligent terminal systems in recent years, the effectiveness remains to be seen. This is why when most enterprises encounter ceilings, they tend to diversify. Path dependence leads them to wander in the low-to-mid-end of other markets, which is far simpler than leaping up the value chain. Lenovo is no exception."

However, diversification has not lifted Lenovo off the ground.

Taking mobile phones as an example, Lenovo was once a member of "Zhonghua Kulian" and a "leader" in domestic mobile phones, once competing with international top mobile phone brands, but ultimately became marginalized in China and fell into the "other" category.

An industry insider told ZnKedu: "Lenovo's mobile phone strategy did not keep up with the times. In its early years, it was deeply tied to operators, and later it relied excessively on traditional channels, failing to capitalize on the internet sales wave and deeply cultivate brand stores."

In contrast, Huawei, Xiaomi, and others have continued to surge upwards, challenging Apple's dominant position.

CCTV's "Economic Half Hour" once reported that consumers queued offline to buy Xiaomi and Huawei mobile phones, with the scene overcrowded but orderly. Such a scene was once exclusive to Apple stores.

Image source: Canalys

It's worth noting that although Lenovo was the first to enter the AI PC race in China, it cannot afford to be complacent.

Since 2024, AI PC has become a core strategy for Lenovo, regarded as a key growth engine, thus concentrating significant resources and becoming a leader in the AI PC race.

Luca Rossi, Executive Vice President of Lenovo Group, recently stated: "We anticipate the penetration rate of AI PCs to reach 40%-50%, or even up to 80%, in the next 2-3 years."

As a result, hard technology vendors have unanimously rushed to capture the AI PC market.

Apple released its first AI PC product, the M3 MacBook Air, Xiaomi unveiled its first AI PC product, the REDMI Book Pro 2025, and Honor introduced its first AI PC product, the MagicBook Pro 16...

It's worth mentioning that HarmonyOS PCs have officially debuted.

Public information indicates that HarmonyOS PCs adopt the strategy of "domestic chips + domestic operating systems," with full-stack independent research and development at the kernel layer, making them true AI PC products.

"Ifeng Technology" stated: "HarmonyOS AI is an end-cloud collaborative AI, with the cloud-side Pangu large model integrating third-party large models, and the end-side large model achieving localized intelligence through lightweight design. HarmonyOS AI is an open and inclusive AI, allowing third-party applications to deploy AI functions locally, such as Wukong Image and Wondershare Filmora, enabling users to experience rich AI functionalities without an internet connection."

As a result, Lenovo finds itself in a situation of being "hunted."

In summary, by going all-in on AI, Lenovo aims to seize the initiative in the new round of PC renewal cycles through super smart agents and carve out a share of the AI mobile phone market. Whether Lenovo's "smart agent + terminal" strategy will succeed remains to be seen.

The only certainty is that Lenovo needs to redouble its efforts.