618 Prelude: Strategic Alliance between Little Red Book and Taobao/Tmall

![]() 05/13 2025

05/13 2025

![]() 657

657

Little Red Book has officially launched its beta-tested "Direct Grass-planting" feature, while simultaneously announcing a strategic collaboration with Taobao/Tmall under the "Red Cat Plan." Both parties aim to further integrate and open up their platforms.

Key elements of this cooperation include the joint introduction of an "advertising link" function beneath user notes. Early pilot brands will be able to seamlessly transition from content on Little Red Book to Taobao/Tmall. Additionally, Taobao/Tmall will increase investments in grass-planting activities, boosting traffic and investment for merchants' promotional notes. Essentially, Taobao/Tmall will enhance the visibility of Little Red Book advertisers.

Both sides harbor high hopes for this partnership. Conan, COO of Little Red Book, noted that Tmall is a crucial partner in their journey towards openness, with grass-planting serving as the initial stepping stone for full-link operations. Similarly, Jialuo, President of Tmall, believes that the collaboration with Little Red Book marks a significant step in Taobao/Tmall's omnichannel strategy for 2025.

The evolution of internet e-commerce can be categorized into two main models: open-loop and closed-loop. The fundamental difference lies in the completeness of the transaction process and the ownership of data control rights.

These models align with the respective advantages and disadvantages of asset-light and asset-heavy strategies. Open-loop e-commerce monetizes traffic by attracting users through content-based grass-planting, without the burden of logistics, after-sales, or other related links. The platform focuses primarily on content creation and traffic management. Conversely, closed-loop e-commerce boasts higher user loyalty and monetization efficiency, with a comprehensive full-link approach reducing user churn rates.

As a content-driven platform, Little Red Book has enriched its e-commerce business with various semantic prefixes and explored the potential of closed-loop e-commerce several times, aiming to provide a seamless consumption experience within its ecosystem. However, with traffic becoming increasingly scarce and platform interoperability becoming a trend, the distinction between open-loop and closed-loop has become blurred.

01. Little Red Book's "Traffic Siege"

Little Red Book's e-commerce journey has reached several pivotal milestones.

In 2019, the e-commerce department was restructured, integrating the "third-party e-commerce" business into the "Brand Account" content community. Brands could establish flagship stores on the platform, while the previously self-operated "Welfare Society" e-commerce sector developed independently. During this period, Little Red Book was on the brink of a content explosion, with community operations taking precedence over e-commerce.

As the community ecosystem matured, Little Red Book introduced live streaming in April 2020 and added external links to Taobao in August, later achieving interoperability with Youzan. This established a clear path from grass-planting to conversion. However, in August 2021, Little Red Book discontinued external links in notes and launched the "Account-Store Integration," expanding its e-commerce infrastructure through private domain touchpoints such as "Professional Account Certification, Community, Store, and Column."

Content forms the cornerstone of Little Red Book's exploration of closed-loop paths within its community. According to QuestMobile data, as of May 2021, Little Red Book's daily active users/monthly active users ratio was 34%, surpassing Bilibili, with an average daily usage time per user reaching 47 minutes. Officially, by March of that year, the number of notes posted on Little Red Book had surpassed 300 million.

After experimenting with various e-commerce strategies, the establishment of the "buyer's e-commerce" model in 2023 marked another turning point.

Star buyers like Zhang Xiaohui and Dong Jie have emerged as models for live streaming and e-commerce on Little Red Book. At the Link E-commerce Partner Week event in August 2023, COO Conan announced the "era of buyers." Over the next six months, Little Red Book phased out Welfare Society and another self-operated e-commerce sector, "Little Oasis," signaling a focus on building a closed-loop e-commerce ecosystem within the platform.

While TikTok introduced "interest e-commerce" and Kuaishou emphasized "trust e-commerce," Little Red Book, as a content-driven third-party e-commerce platform, could have followed suit. However, at the Little Red Book WILL Business Conference in late 2023, the platform announced an "open ecosystem," allowing off-site traffic diversion and cross-platform data interoperability.

The decision to remain independent or pursue interoperability fundamentally hinges on the platform's confidence in "declaring sovereignty."

According to Little Red Book's Double 11 report last year, during the promotional period from October 12th to 20th, the number of merchants with transactions exceeding ten million, five million, and one million yuan was 3.3, 4.5, and 3.1 times higher than the same period the previous year, respectively.

Although key metrics like GMV were not disclosed, the magnitude of merchant transactions clearly indicates a gap with top platforms. During last year's full Double 11 cycle, 589 brands on Tmall had transactions exceeding 100 million yuan.

Referencing Kuaishou, another content-based e-commerce platform, during a similar period last year (October 12th to 28th), Kuaishou reported over 250 brands achieving transactions exceeding ten million yuan and over 2,800 super products exceeding one million yuan in transactions.

While it takes time for a small but vibrant content-based e-commerce platform to evolve into a consumption hub, Little Red Book's closed-loop e-commerce faces two pivotal questions: when will the heavy-asset aspects of its e-commerce infrastructure (fulfillment and after-sales) mature, and can the balance between its content community and consumption field be precisely maintained?

For context, TikTok's approach to external links has been consistent, adhering to a complete closed loop since 2020. Kuaishou announced in March 2022 that it would discontinue product links from Taobao and JD.com but reopened external links in November of the same year, allowing in-platform traffic to divert off-site for transactions.

02. Targeting the Same Market with Different Strategies

Amidst the fiercely competitive e-commerce landscape, Taobao/Tmall stands out as the optimal ally for Little Red Book.

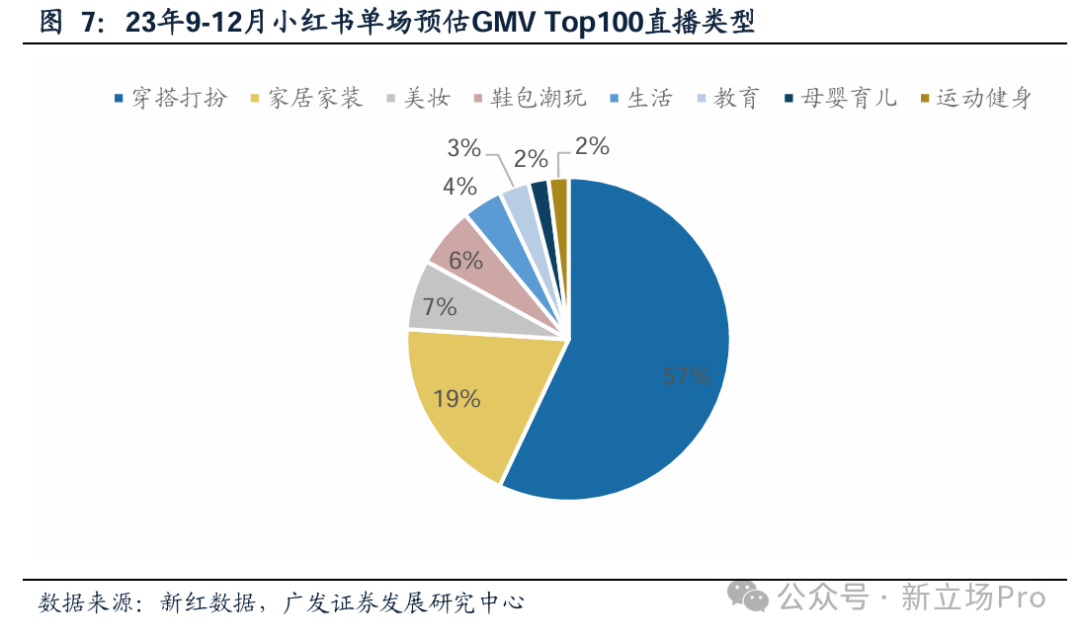

Little Red Book is a quintessential female-dominated community where KOLs/KOCs congregate under fashion and beauty labels, fostering rich discussions. A 2024 GF Securities research report counted the top 13 categories of live streaming and e-commerce GMV on Little Red Book from October 2023 to January 2024, dominated by dressing and grooming, beauty, and home furnishing.

Image source: GF Securities

The term "buyer," previously used by Little Red Book to describe its e-commerce role, originates from a specific job in the fashion industry. Coincidentally, fashion and beauty are also Taobao/Tmall's strongholds.

In beauty products, according to Qingyan Intelligence statistics, Taobao/Tmall accounted for 50.6% of the estimated transaction value of beauty products across the entire network during last year's Double 11, significantly outpacing TikTok (26.6%) and JD.com (11.8%).

With highly overlapping target users, the choices between complementarity or diversion, competition or cooperation, often blur the lines.

Taobao/Tmall's scale advantage is evident, boasting far more fashion and beauty SKUs than Little Red Book, along with a robust fulfillment and after-sales system, making it well-suited to receive consumer demand nurtured by content platforms. Besides attention resources, Little Red Book's e-commerce positioning supports mid-to-high-end merchants and has a significant influence in niche markets like clothing designer brands and specialized skincare brands.

Both parties possess the piece of the puzzle that the other most desires. "Contentization" has been a strategic goal repeatedly mentioned by Taobao/Tmall in recent years. As mentioned, Little Red Book's e-commerce infrastructure, particularly in fulfillment and after-sales, is still maturing.

However, this collaboration will undoubtedly have a profound impact on the future trajectory of Little Red Book's e-commerce endeavors.

Firstly, opening up will attract more advertising budgets. Little Red Book remains a content-driven platform where advertising revenue predominates. According to Gfk data, the platform's advertising revenue reached 21.6 billion yuan in 2024, accounting for 72% of total revenue. Moreover, partnering with the Taobao ecosystem can to some extent address the issue of repurchase in content-based e-commerce. Even though transactions occur off-site, from a merchant's perspective, the return on investment becomes more predictable.

However, it's evident that Little Red Book won't abandon its exploration of closed-loop e-commerce within its platform. Breaking down traffic barriers is one aspect, while data control rights are another. Content platforms excel in capturing a significant portion of users' attention, complemented by rich behavioral tags and algorithmic recommendations. Despite the brevity of the purchase process, it represents the most critical link in the mental chain.

In summary, the platform requires comprehensive user behavior data to refine its information framework, enabling more precise content allocation, marketing investments, and shopping guidance. From an advertiser's perspective, if given a choice, most would opt for achieving "brand-effect integration" within a single channel.

A case in point is Kuaishou's commitment to developing internal cycle advertising in recent years, where in-platform merchants purchase in-platform advertising for exposure. This has evolved from purely content-driven advertising monetization to e-commerce driving closed-loop consumption (involving both users and merchants), now progressing towards shelf e-commerce, aiming to become a stable third-party operating platform. This is a typical path for content platforms venturing into e-commerce.

While TikTok and Kuaishou strive towards Step 3, Little Red Book is still at Step 2. However, compared to the former, which are more autonomously inclined, Little Red Book explores a more compromising route.

03. Final Thoughts

After years of intense competition, "co-opetition" has gradually become the consensus among e-commerce leaders.

The most notable manifestation is the "communalization" of e-commerce infrastructure. For instance, in September last year, Taobao enabled WeChat Pay, allowing consumers to choose "WeChat Pay" and jump to the WeChat App for payment. Shortly after, in October, Taobao/Tmall announced a collaboration with JD Logistics, enabling platform merchants to select JD Logistics as a service provider, with consumers able to track logistics within the App.

In an era of mature markets and scarce incremental growth, it's challenging for platforms to establish barriers through technology and resource monopolies. Consequently, leading enterprises are increasingly inclined towards open cooperation to reduce marginal costs.

The collaboration between Little Red Book and Taobao, which had already begun paving the way, is a case in point. Through the "Little Red Star" cooperation project, brand owners can clearly see user interaction data after grass-planting and subsequent search and order conversions on Taobao/Tmall, optimizing placement strategies.

Official data reveals that over the past year, the click-through rate of grass-planting notes on Little Red Book by Taobao/Tmall brand merchants has increased by 20%, with the interaction rate surging by 109%. Notably, the average daily number of merchants participating in joint investments by Taobao/Tmall has soared by 335% year-on-year.

However, competition is unlikely to disappear entirely and may shift to underlying currents. Especially with the upcoming 618 year-end sales promotion, the strategic alliance between Taobao and Little Red Book is bound to influence the placement plans of numerous advertisers. On one hand, it's about jointly reinforcing marketing integration; on the other, it's about how much each party can benefit from this collaboration.

After all, the essence of co-opetition lies in cooperating during value creation and competing during benefit distribution.

*The title image and images in the text are sourced from the internet.