June Sales Rankings for New-Energy Vehicle Startups Unveiled: Leapmotor Takes the Lead, Followed by Li Auto and Xpeng

![]() 07/02 2025

07/02 2025

![]() 869

869

On July 1, leading new-energy vehicle startups promptly released their June sales reports. Leapmotor retained its top spot, with Li Auto coming in second and Xpeng rounding out the podium in third. Sales figures from other startups are also trickling in. Let's dive in!

Leapmotor, ranked number one, delivered 48,006 vehicles in June, marking a year-on-year increase of over 138% and setting a new record high. From March to June 2025, it maintained its sales crown for four consecutive months, with cumulative deliveries reaching 221,664 vehicles in the first half of the year.

In terms of new models, the 2026 Leapmotor C16 has been launched, pre-sales for the Leapmotor B01 have commenced, and the 2026 Leapmotor C11 is即将上市. Often referred to as the "little Li Auto," Leapmotor has been quietly churning out vehicles and gradually increasing its sales. It has now surpassed Li Auto to become one of the leading new-energy vehicle startups.

Li Auto, in second place, delivered 36,279 new vehicles in June, bringing the total number of vehicles delivered from January to June 2025 to 111,074. As of June 30, 2025, Li Auto's cumulative deliveries reached 1,337,810 vehicles. Li Auto rightfully holds its reputation as a top new-energy vehicle startup, maintaining its lead in cumulative deliveries. However, its sales have been overtaken by Leapmotor in recent months, highlighting the rapid advancements within the industry. Nonetheless, Li Auto still has opportunities ahead, with the Li i8 expected to launch in July, potentially sparking another sales miracle.

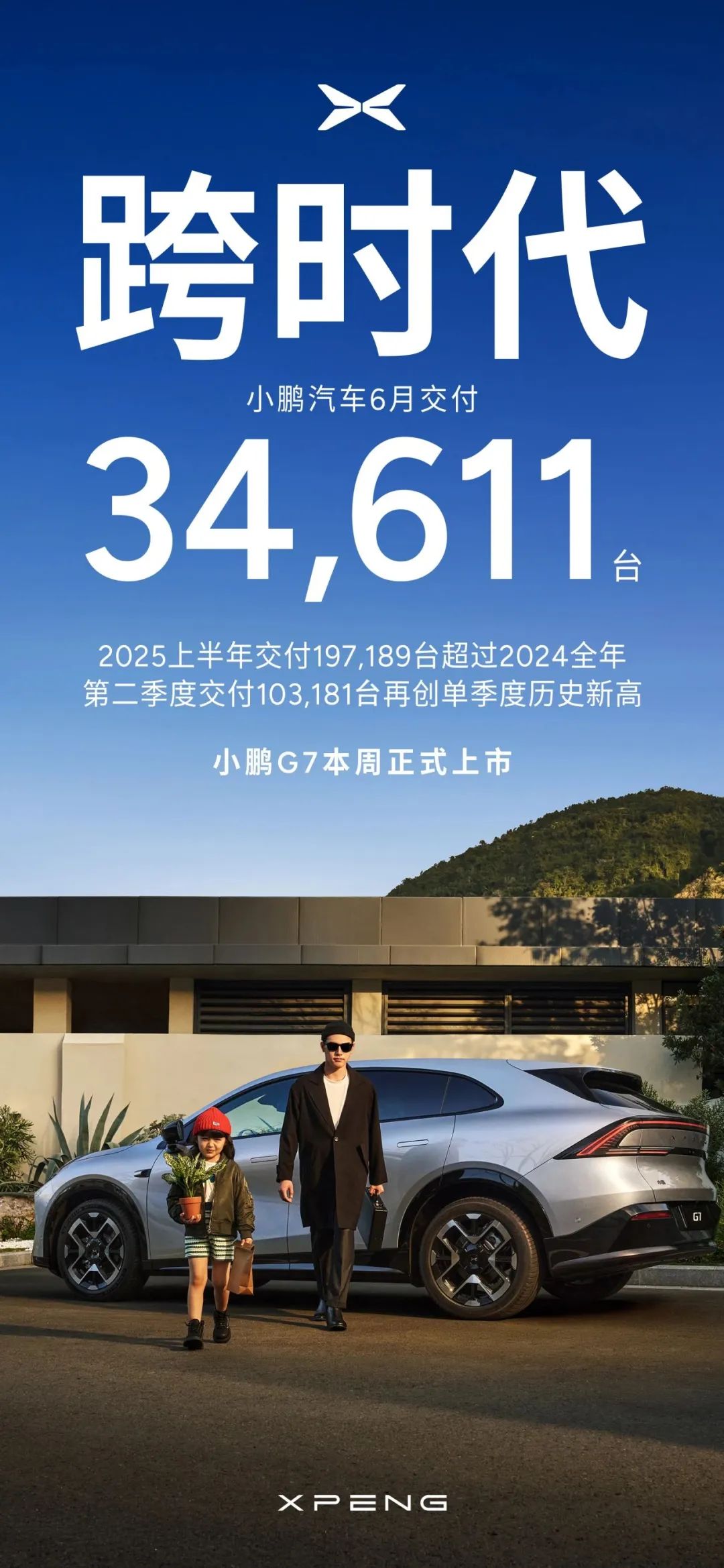

Xpeng, ranking third, delivered 34,611 new vehicles in June, representing a year-on-year increase of 224%. In the first half of 2025, it delivered 197,189 new vehicles, surpassing its full-year deliveries in 2024. The Xpeng MONA M03 continues to drive sales for the company, accounting for a significant portion of its overall sales. Other models like the Xpeng G6, Xpeng P7+, and Xpeng X9 are instrumental in elevating the brand, and the company's overall development is considered quite promising.

Xiaomi Auto, in fourth place, delivered over 25,000 vehicles in June, a slight decline from the over 28,000 vehicles delivered in May. Is this a strategic move to make way for the newly launched Xiaomi YU7? Initially, it was anticipated that with the start of deliveries for the Xiaomi YU7, Xiaomi Auto's sales would surpass those of Li Auto, Leapmotor, and Xpeng, catapulting it to the top of the new-energy vehicle sales rankings. However, based on current trends, it appears that after the Xiaomi YU7's launch, it will inevitably cannibalize sales from the Xiaomi SU7.

So, when do you think Xiaomi Auto will claim the title of top-selling new-energy vehicle startup?

NIO, in fifth place, delivered 24,925 new vehicles in June, representing a year-on-year increase of 17.5%. Among these, 14,593 vehicles were delivered under the NIO brand, 6,400 under the Lido brand, and 3,932 under the Firefly brand. In the second quarter of 2025, NIO delivered 72,056 new vehicles, marking a quarter-on-quarter increase of 71.2%. For the first half of 2025, NIO delivered a total of 114,150 new vehicles, representing a year-on-year increase of 30.6%. NIO has become somewhat of a laggard in the new-energy vehicle startup sector, primarily due to its lackluster sales performance. None of its three brands, NIO, Lido, or Firefly, can keep pace with Li Auto, Leapmotor, or Xpeng.

NIO's peer, Nezha Auto, which has been grappling with low sales, is already undergoing bankruptcy reorganization. While NIO is unlikely to follow suit in the short term, boosting its sales has become a pressing concern for its senior management.

Additionally, in June, Hozon Auto sold 10,053 vehicles, AITO sold 10,153 vehicles (a year-on-year increase of 117%), Zeekr sold 16,702 vehicles, and ARCFOX sold 29,893 vehicles.

These are the June sales rankings for new-energy vehicle startups. What are your thoughts on the performance of each automaker? Share your insights in the comments section below!