Tenzing Aims to Rise Above Being 'a High-End BYD'

![]() 07/09 2025

07/09 2025

![]() 453

453

Tenzing seeks a fresh triumph.

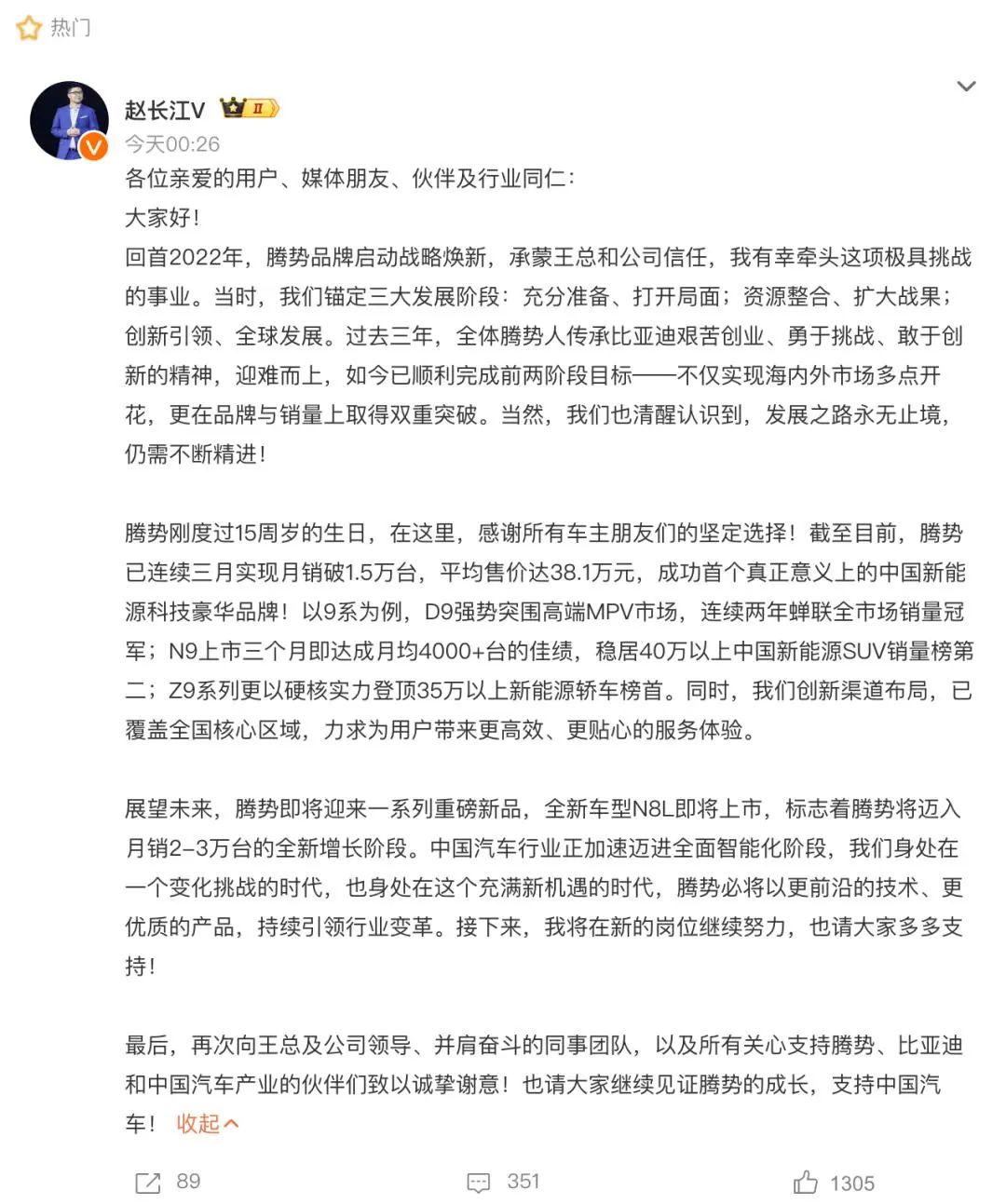

On July 4, Zhao Changjiang announced in a lengthy post that he was stepping down as General Manager of the Tenzing Sales Department and swapping positions with Li Hui, General Manager of the Tenzing FANGCHENBAO Direct Sales Department.

From an external perspective, this position swap might suggest that Tenzing's high-end aspirations have fallen short of expectations. However, under BYD's rotation system, such changes are routine. To diversify management experience, empower different business segments, and further enhance organizational vitality, BYD has long maintained an internal rotation system.

Zhao Changjiang tweeted, "Tenzing has successfully completed the first two stages of its goals—not only achieving multiple breakthroughs in domestic and international markets but also achieving double breakthroughs in brand and sales. As of now, Tenzing has achieved monthly sales exceeding 15,000 vehicles for three consecutive months, with an average selling price of 381,000 yuan."

While these achievements are commendable, it is also a fact that high-end expectations have not been met, as perceived by the outside world.

BYD Chairman Wang Chuanfu once stated, "In BYD's automotive brand matrix, Tenzing has become an important link connecting the various brands under BYD."

On one hand, Tenzing needs to "inherit" high-end users from BYD's Dynasty Network, Ocean Network, and other brands, providing upgrade options for BYD owners. On the other hand, Tenzing hopes to challenge luxury brands such as BBA and secure a place in the high-end market. However, this goal remains unfulfilled.

Tenzing D9 Holds Up the Scene

Zhao Changjiang is a BYD veteran, having joined in 2009 and now possessing 16 years of experience. Years ago, when he was in charge in Beijing, he helped BYD open up important markets. Due to his impressive performance, he achieved rapid promotions within BYD.

In 2017, he became the General Manager of BYD Auto Sales Co., Ltd., from being a regional sales manager, making him the youngest sales leader in BYD. In 2021, he took full responsibility for the operation of Tenzing, a joint venture brand between BYD and Mercedes-Benz, leading the brand's high-end transformation and officially serving as General Manager of the Tenzing Sales Department from June 2023.

It can be said that he was entrusted with an important task.

As the first significant model after BYD took over Tenzing, the Tenzing D9 quickly captured the market upon its launch, relying on the technical barriers built by BYD's e-platform 3.0 and DM-i plug-in hybrid technology. It suppressed established models such as the Buick GL8 and became a rising star in the MPV market. Its upward momentum can be described as 'outstanding.'

In 2023 and 2024, the Tenzing D9 consecutively won the annual sales champion in China's overall MPV market, rapidly establishing a foothold in the high-end MPV market above 300,000 yuan, and even won the 'triple crown' of MPV sales, depreciation rate, and user satisfaction for two consecutive years.

It can be said that the Tenzing D9, with its 'hybrid' attribute of being able to run on both gasoline and electricity, filled the gap in the high-end MPV market for Chinese automotive brands. After the Tenzing D9, the market began to realize that using new energy to capture the high-end MPV market is a path that can be explored.

Data shows that 70% of Tenzing D9 users come from luxury brands such as BBA for upgrades. From the official launch of the first mass-produced vehicle to the delivery of the 250,000th vehicle, Tenzing completed a journey that traditional fuel MPV models need a decade to achieve in just three years.

With the popularity of the Tenzing D9, Wang Chuanfu placed the important task of high-end branding of BYD on the Tenzing brand, using the term 'connecting the past and the future' to express his hopes. The success of the D9 also opened a window for Tenzing's brand to ascend, bringing about a strategic transitional period.

Both the market and Zhao Changjiang originally thought that with the Tenzing D9 opening up the market above 300,000 yuan, relying on the support of BYD's technology, Tenzing would have an easier time in the high-end market. However, things did not go as planned.

From the perspective of model layout, over the past three years, Tenzing's product line has centered on the D9, expanding into the main markets of SUVs and sedans. However, the unexpected imbalance in model structure became the biggest headache for Zhao Changjiang during his tenure.

In 2024, Tenzing sold 126,000 vehicles, with the main model D9 contributing over 75% of sales, at 119,000 vehicles, and maintaining its championship in the segment market. A series of subsequent models such as the Tenzing N7, N8, Z9/Z9 GT 'launched with high expectations but performed poorly,' with combined sales accounting for less than 25% of the brand's total, failing to achieve volume.

From January to June this year, Tenzing sold a total of 79,830 vehicles, a year-on-year increase of 34%. Relying solely on the D9 model, it indeed seems difficult to support the sales figures. Zhao Changjiang also expressed that he was under considerable pressure due to the subpar performance of several consecutive models.

For Tenzing, the top priority is to build new growth poles. Fortunately, compared to models such as the Tenzing N9, N7, Z9, and Z9GT, the Tenzing N9, which was launched in March, achieved a small breakthrough. The 10,000th vehicle rolled off the production line two months after its launch, and it achieved monthly sales exceeding 4,000 vehicles within three months of its launch.

However, this is not enough.

Because Tenzing has high hopes for the N9 to occupy a place in the large SUV market, and the current sales performance is not sufficient. According to insiders at Tenzing, "it has not yet met official expectations."

In addition, the market competition in which the Tenzing N9 operates is extremely fierce, with brands such as AITO and Li Auto deploying powerful models, putting considerable pressure on the N9. At the same time, the advancement of Tenzing's high-end strategy has been slow to meet expectations. To maintain momentum, Tenzing launched the Tenzing N8L just two months after the N9's launch.

In terms of pricing, the market believes that the Tenzing N9 mainly covers the price range around 400,000 yuan. The Tenzing N8L is expected to lower the price to just over 300,000 yuan.

Industry insiders believe that "Tenzing hopes to quickly occupy the high-end mainstream market above 300,000 yuan, so it has successively launched two models, hoping to cover a wider price range and expand market coverage. However, this market is fiercely competitive and not easy to penetrate."

According to a survey by the China Automobile Dealers Association, sedan users pay more attention to the electrified products of traditional luxury brands such as BBA. In 2024, the average transaction price of Tenzing reached 377,000 yuan, aiming to challenge BBA in the '56E' segment, but sales in the sedan market above 350,000 yuan were less than one-tenth of those of the Audi A6L.

However, another piece of data shows that 72% of new energy users above 300,000 yuan prefer SUV models, which is an opportunity for the Tenzing N8L and N9.

This is the situation left by Zhao Changjiang at Tenzing.

A New Victory is Needed

This is also the situation taken over by Li Hui.

Public information shows that Li Hui has been working for BYD since 2004, totaling 21 years of service. She has successively held positions such as Finance Manager and Project Manager at BYD Auto, Director of the Marketing Department and Assistant to the General Manager at BYD Auto Finance Co., Ltd., General Manager of the Cloud Rail Promotion Department, and General Manager of the Rail Business at BYD Group.

After taking over Tenzing, her core goal is to "fight a protracted but rapid high-end battle." However, one question she needs to answer is, "Why has high-end positioning been slow to open up in the SUV and sedan markets?"

Tenzing has not been entirely successful in the high-end market.

The success of the Tenzing D9 also demonstrates that Tenzing's ability to cater to the high-end market is effective. As for other models, why have they not met expectations? The market has also summarized some reasons for Tenzing's challenges.

One is strategic vacillation. Tenzing has wavered between the high-end and mid-range markets, resulting in a lack of clear direction in marketing and product strategy. "The brand heritage is insufficient." Another reason is that Tenzing's market recognition has not yet formed a brand IP distinct from BYD. "In the minds of many consumers, Tenzing is a mid-to-high-end BYD."

Previously, Zhao Changjiang also maintained high-frequency interactions on platforms such as Douyin and Weibo, even personally participating in product testing and emphasizing "absolute advantages in three-electric technology and body safety," but failed to effectively establish a brand tone that matches the 300,000+ price range.

In today's new energy market, having a distinctive brand IP is crucial. For example, Li Auto deeply explores the needs of family users, while AITO, empowered by Huawei, offers a powerful intelligent experience. Xiaomi's biggest label is 'Lei Jun,' and so on. These labels are powerful weapons that allow brands to quickly establish their market position.

Looking back at Tenzing's development over the past few years, its challenges are not caused by a single product shortcoming but are the result of multiple factors such as brand strategy and market positioning. Under various factors, in addition to rapidly launching new models, Tenzing has also put in some effort in shaping its brand identity.

In April this year, BYD announced adjustments to the brand public relations departments of its two high-end brands, Tenzing and FANGCHENBAO. The goal is for both Tenzing and FANGCHENBAO to quickly shed the label of 'high-end BYD' and clearly convey the brand positioning of 'technological luxury' to consumers.

After the adjustment, the public relations teams of the two brands were moved to the BYD Group Brand and Public Relations Department as its second-tier departments, with Li Yunfei, General Manager of the BYD Group Brand and Public Relations Department, as the highest responsible person. As for how to create different marketing labels, it is enough of a test for Li Yunfei and also for Li Hui, who has just taken office.

In 2025, Tenzing's sales target is set at 300,000 vehicles, equivalent to 2.4 times the 126,000 vehicles sold in 2024. This goal is not easy to achieve. In 2023 and 2024, Tenzing failed to meet its sales targets for two consecutive years.

To achieve 300,000 vehicles this year, it means that monthly sales in the second half of the year must reach 36,700 vehicles to meet the target, equivalent to 2.5 times the average monthly sales in 2024. As such, the Tenzing N8L and N9 cannot afford to fail.

However, the industry also worries that Tenzing hopes to equip both the N8L and N9 with third-party technologies in terms of configuration and performance, supporting features such as pivot turning, extreme steering, and intelligent crab walking, as well as being equipped with the 'Celestial Eye' driving assistance and Cloud Suspension system, which can form a combined punch for the N8L and N9, creating a 'game-changing' situation in the market.

Although Tenzing states that the N9 follows a technological flagship route that combines luxury and business/home use, while the N8L leans towards a warm and homely style, differentiated positioning can reduce direct competition. However, in terms of marketing, how to present clear differences requires Li Hui to come up with more specific plans.

Not long ago, at BYD's shareholders' meeting, a shareholder criticized BYD for "only having technology and not knowing how to market" and suggested that executives should attend brand training courses.

"We are increasing our awareness of the Tenzing brand, with the core being how to convert technology into emotion." This was interpreted as Wang Chuanfu being dissatisfied with Tenzing's marketing strategy. The market is also waiting to see if, besides the D9, Tenzing can once again create new blockbuster models to answer this pending high-end proposition.

Tenzing desperately needs a new victory.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.

-END-