Tongchedi Valued at 21.7 Billion Yuan Prepares for IPO, Is ByteDance Winning Big?

![]() 06/11 2024

06/11 2024

![]() 694

694

Is Tongchedi preparing for an independent IPO?

Could Tongchedi's independent listing be ByteDance's first spin-off?

According to media reports, ByteDance plans to raise 700 to 800 million US dollars for its automotive information and trading platform Tongchedi in preparation for an IPO. This round of financing is led by Sequoia Capital China, with shareholders KKR and General Atlantic also participating. After the financing is completed, Tongchedi's valuation may reach 3 billion US dollars (approximately 21.7 billion yuan), which is comparable to that of its competitor Autohome (2518.HK), which is already listed on US and Hong Kong stock exchanges.

Source: Weibo Screenshot

Tongchedi was born from ByteDance's Toutiao in 2017 and has been developing for 7 years. If the listing is successful, it will become the first member of the ByteDance family to spin off and go public.

Amid ByteDance's many high-profile products such as Douyin, Toutiao, and Feishu, why is Tongchedi able to take the lead in preparing for an IPO, even though ByteDance itself has not yet gone public?

01. Content on the left, traffic on the right

It can be said that Tongchedi was born with a "golden spoon".

According to "Qujie Shangye," Tongchedi originally evolved from Toutiao's automotive channel. In 2017, Tongchedi launched an independent app. In January 2018, Toutiao's automotive channel was renamed the Tongchedi channel, and in the same year, it launched the "Sellcar SaaS" service system, using big data algorithms to provide personalized marketing services for dealers.

Currently, Tongchedi provides various services such as Tongchehao, car enthusiasts' circle, evaluation system, model library, and Tongchefen.

Source: Tongchedi official website screenshot

At the Auto Creator Conference in July last year, Tongchedi announced that it has fully integrated its automotive content with Douyin, Toutiao, and Xiguavideo, with Tongchedi serving as the overall operator and coordinating resources across all platforms. After the integration, the daily active users of automotive content on the four platforms reached 310 million, with an average daily browsing volume of over 5.6 billion times, covering more than 6.34 million automotive creators.

According to a report released by data research firm Aurora, in the third quarter of 2023, Autohome, Tongchedi, and Yiche ranked among the top three in terms of DAU (daily active users) among automotive information platforms.

Source: Aurora Data Screenshot

In January 2024, Tongchedi "separated" from Toutiao to become an independent company, which was interpreted by the outside world as "possibly preparing for an IPO or financing" or "independent accounting, cost reduction, and efficiency enhancement." ByteDance responded at the time that the registration of an independent company was based on the normal development needs of the business.

Source: Weibo Screenshot

Now, Tongchedi is once again rumored to be preparing for an IPO. If it succeeds, it will become the first member of the "Byte family" to spin off and go public. This round of financing for Tongchedi may be the last and only one before the IPO, and ByteDance also plans to open up quotas to its minority shareholders.

Some industry insiders believe that ByteDance is accelerating the disposal of unprofitable businesses, while those that are profitable but have low intersection with its main business are being accelerated to spin off and encouraged to go public. Tongchedi's spin-off listing can also "give more opportunities to old investors to make more money."

In terms of "making money," although Tongchedi has not yet released performance data, we can look at the situation in the same industry.

As the "industry leader," Autohome (2518.HK) was listed on the Hong Kong Stock Exchange on March 15, 2021, with an issue price of 176.3 Hong Kong dollars per share. As of the close on June 7, 2024, its share price was 55.2 Hong Kong dollars per share, down 68% from the issue price, corresponding to a total market capitalization of only 26.74 billion Hong Kong dollars (approximately 24.869 billion yuan), which has evaporated by over 60 billion Hong Kong dollars compared to the total market capitalization on the first day of listing.

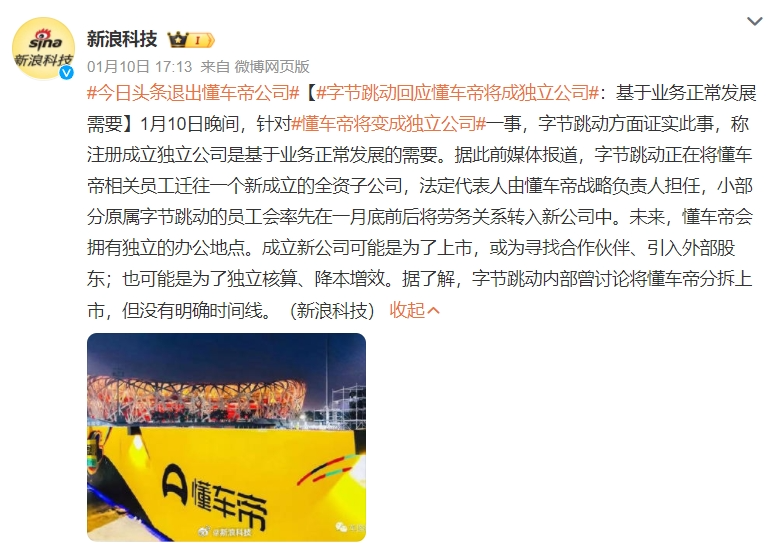

Autohome's total revenue in 2023 was 7.184 billion yuan, representing a year-on-year increase of 3.5%; its net profit attributable to shareholders was 1.88 billion yuan, representing a year-on-year increase of 4.04%; and its net profit margin was 26.17%, representing a year-on-year increase of 0.5%. In the revenue structure of 2023, Autohome's media services, lead services, and online marketing were its main sources, especially lead services, which accounted for 43.3% of total revenue.

Source: Financial Report Screenshot

Specifically, Autohome's lead services help dealers obtain potential customer information and manage their online stores. In addition, Autohome also provides services such as media advertising, new and used car transactions, and automotive finance.

Tongchedi has also shown a similar trend of diversification in its business expansion and is gradually shifting from an online light asset model to an offline heavy asset model. Tongchedi has already deployed offline sales operations for new and used cars, as well as car maintenance services.

Bo Wenxi, deputy chairman of the China Enterprise Capital Alliance, said that there may be synergies between different businesses, such as media services that can drive traffic to trading platforms, and SaaS services that can improve transaction efficiency. Diversified businesses can also diversify market risks, so that even if a certain area encounters challenges, other businesses may still maintain growth.

Bo Wenxi also proposed that business diversification may also lead to more complex management, requiring coordination of relationships and resource allocation across different business lines.

02. Winter testing triggers automakers' "confrontation"?

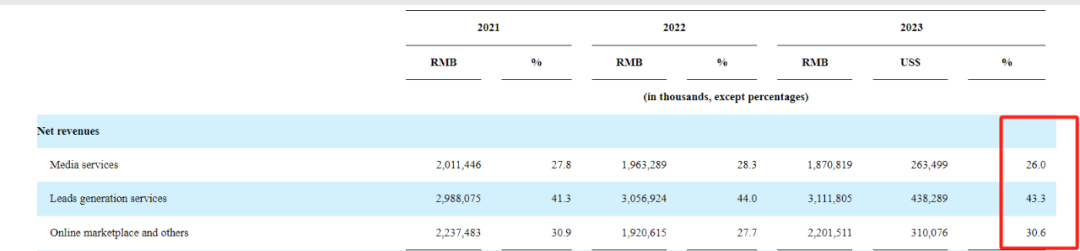

In 2021, a collision test video between BYD Han EV and BAIC ARCFOX Alpha S by Tongchedi quickly went viral. The shocking video attracted a lot of attention from netizens, but it also sparked controversy - was the test really fair?

Source: Tongchedi Video Screenshot

On Xiguavideo, there were comments under the collision test video questioning: "Why pick a Jihu that sells only a few hundred cars a month instead of Tesla? Is there any insider information in this test?"

Source: Xiguavideo Screenshot

In the video, BYD Han EV's spontaneous combustion after 48 hours also sparked discussions. Some netizens pointed out that combustion caused by wiring issues is different from battery explosions and should not be confused. In response, BYD's official also quickly responded, questioning the authority of the experiment and arguing that the testing standards used were not mainstream in the industry.

Two years later in the winter, Tongchedi once again became the focus of the industry. In the extreme low temperatures of Mohe, Heilongjiang, more than 50 mainstream cars are undergoing various tests, which is Tongchedi's comprehensive evaluation of car performance under extreme climatic conditions.

In December 2023, as Tongchedi gradually released the test results of the "2023 Tongchedi Winter Test," a "public opinion storm" quietly brewed. In the ranking of hybrid models' pure electric range achievement rate, the Wenjie M7 extended-range version ranked last with a range achievement rate of 31.6%; several models under Geely and Great Wall also did not exceed 40% in the test.

Source: Weibo Screenshot

This also led to multiple automakers questioning Tongchedi's winter testing. On December 8, the AITO (Wenjie) Automobile official account stated that the relevant test "severely deviated from the real user usage scenario by repeatedly opening the windows and doors for a long time under extreme cold conditions and continuous air conditioning heating." This statement directly pointed to possible unreasonableness in Tongchedi's testing methods.

Yu Chengdong, Executive Director of Huawei and Chairman of the Intelligent Vehicle Solutions BU, slammed it as a "misleading test that deceives the public"; Yang Xueliang, Vice President of Geely, directly stated that it was "unscientific, not rigorous, and the conclusions are not convincing"; Great Wall Motor even proposed an initiative, arguing that Tongchedi's unscientific and不严谨的测试 not only misleads users but also undermines its own credibility.

Source: Weibo Screenshot

From an outside perspective, Tongchedi's approach of "being both an athlete and a referee" is clearly difficult for automakers to trust. Facing automakers' doubts, Tongchedi emphasized that "the testing standards are completely unified, and all models are treated equally." However, based on its business model, Tongchedi has also been questioned about whether it is biased towards promoting certain brands or models.

Car blogger Sun Shaojun tweeted: "Everyone should have doubts about the media's position. Making various performance rankings without suspecting motives and professionalism is ridiculous. At the same time, even if Tongchedi fully complies with the collision test standards of regular institutions, automakers will still reject it extremely. Because Tongchedi, as a major sales channel backed by Toutiao, has completely surpassed all channels this year and become a virtual monopoly in online sales channels."

Source: Weibo Screenshot

Wang Ruoran, the person in charge of Tongchedi's winter testing project, said that Tongchedi hopes that consumers can see not only the content promoted by automakers but also more perspectives from third-party testing, providing more car data on the same scale to provide references for everyone's purchasing decisions.

Bo Wenxi suggested that Tongchedi should disclose its evaluation standards and processes to ensure that all operations can be verified by a third party. Alternatively, it can cooperate with authoritative third-party institutions to conduct evaluations to enhance the credibility of the evaluation results. At the same time, the company should also actively communicate with users and respond to market concerns.

Apart from content controversies, Tongchedi also faces user complaints about its services. On the official website of the "Hei Mao Complaints" platform, searching for the keyword "Tongchedi" reveals 540 related complaints.

Source: Hei Mao Complaints Screenshot

Some users have reported that the prices quoted on Tongchedi's platform are inconsistent with the actual purchase prices, while others have complained that their personal information seems to have been leaked when using services on Tongchedi's platform. These issues have seriously affected users' trust in the platform.

Moreover, it cannot be ignored that as the cost of acquiring customers and marketing increases on platforms like Autohome and Tongchedi, automakers seem to be gradually getting rid of their dependence on "Tongchedis." In recent years, many "new forces" and traditional automaker brands have adopted a combined marketing strategy of "offline direct-sales stores + online channels," and more and more automakers prefer to "self-operate" their car sales.

03. Wanting both online and offline

As there are more and more scenarios and channels for automakers to communicate directly with consumers, Tongchedi urgently needs to find a new way forward.

To this end, Tongchedi has anchored on the automotive aftermarket. According to the "2024-2029 China Automotive Aftermarket Development Trend and Investment Analysis Report" released by the China Business Industry Research Institute, the compound annual growth rate of China's automotive aftermarket industry market size from 2019 to 2023 was 9.2%; it is expected that the market size of China's automotive aftermarket industry will reach 6.2 trillion yuan in 2024.

Source: China Business Intelligence Network Screenshot

According to "Qujie Shangye," ByteDance's automotive aftermarket business is mainly conducted through the Tongchedi and Douyin platforms. Tongchedi's business in the automotive aftermarket sector mainly includes e-commerce and car trading, while Tongchedi also operates Douyin's automotive aftermarket e-commerce.

Last December, Tongchedi launched the offline car maintenance service "Dongdong Car Maintenance" in the form of authorized store cooperation and opened stores in Chongqing in collaboration with local stores, providing services such as car washing, maintenance, and glass coating. This marks Tongchedi's first foray into the offline car maintenance sector, further improving ByteDance's business layout in the automotive aftermarket.

Source: Weibo Screenshot

Before that, Tongchedi had also ventured into offline store car trading services.

According to "Qujie Shangye," Tongchedi launched its car trading service in 2021. As of June 2023, Tongchedi covered a scale of 220,000 used cars, with business covering more than 350 cities, and it took the lead in implementing store operations in Chongqing, Hefei, and other places. At the end of November 2023, Tongchedi's offline trading stores were uniformly upgraded to the first car trading store under the "Tongchedi Auto Mall" brand, which landed in Hefei. The store has an overall area of approximately 8,000 square meters and can provide one-stop trading and automotive cultural experience services for new and used cars.

In addition to competing with automakers' direct-sales stores and