Sales are back but stock prices are collapsing, what can NIO rely on to save itself?

![]() 06/11 2024

06/11 2024

![]() 721

721

NIO Inc. (NIO.N) released its first-quarter financial report for 2024 before the U.S. market opened and after the Hong Kong market closed on June 6, Beijing time. As NIO's sales have continued to rise in the past two months, its stock price has recovered 40% from its lowest point. However, the actual results for the first quarter have once again dampened everyone's spirits! Let's take a closer look:

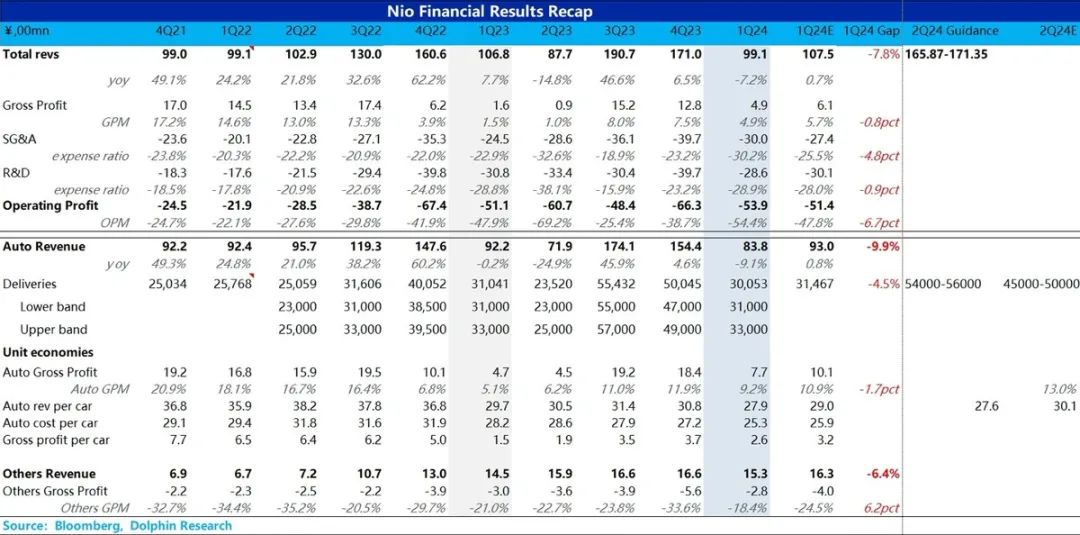

1. Negative revenue growth: Total revenue was 17.1 billion, dropping to 7.2% year-on-year, but due to the clear sales figures, revenue itself is not the market's focus. The key is to look at the average vehicle price and gross margin on vehicle sales.

2. Gross margin on vehicle sales has fallen again: As there were new vehicle deliveries in the last month of the first quarter, and promotions were offered on older models, the market knew that the gross margin might fall, but the actual gross margin on vehicle sales was 9.2%, lower than the market's expectation of 10.9%. The main issue lies in the average selling price of vehicles in the first quarter, which was only 279,000 yuan, down nearly 30,000 yuan from the previous quarter and even lower than the company's implied figure of around 283,000 yuan. The accelerating decline in prices is not only due to promotions on older models but also significantly related to the higher sales proportion of the cheaper ET5 in the model mix.

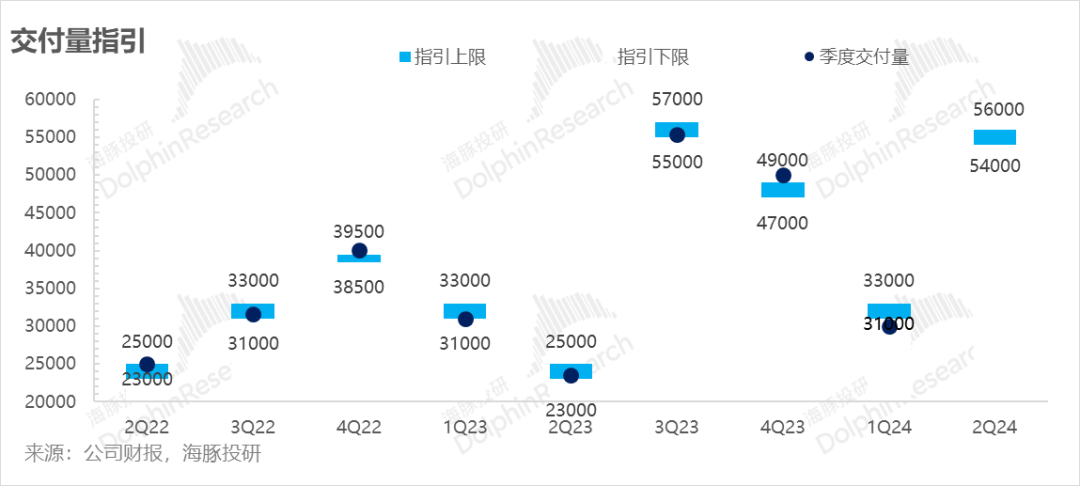

3. An even more serious issue is the second-quarter guidance: As one of the key incremental pieces of information in this financial report, what the market really wants to know is whether NIO's sales can stabilize after the first month following the expiration of BaaS promotional benefits in June. However, on this front, NIO's guidance was a major disappointment: second-quarter sales guidance was 54,000 to 56,000 units. With April and May figures known, this implies monthly sales of 18,000 to 20,000 units in June. Given that weekly sales had already exceeded 6,700 units as of June 2, monthly sales in June are unlikely to exceed 20,000 units, implying that NIO's sales will decline again after the expiration of Baas promotional benefits.

This is effectively telling everyone that this wave of NIO's sales recovery has had the same effect as last year's decoupling of vehicle sales and battery swapping benefits, releasing sales in the short term but failing to sustain them. NIO's current battery swapping benefit promotion is also only a short-term boost to sales, unable to truly drive a steady increase in sales expectations for existing models in the second half of the year.

4. The implied gross margin in the second-quarter revenue guidance is also a problem: NIO's guidance for second-quarter revenue is 16.6 to 17.1 billion yuan, with an implied average unit price of only 276,000 yuan, continuing to decline from this quarter, while the market expects that the second quarter will be dominated by sales of updated models without price reductions, and the unit price should be able to recover to over 300,000 yuan, thus pulling the gross margin on vehicle sales in the second quarter up to 13%.

However, this guidance implies that even after exiting old vehicle promotions, NIO's gross margin per vehicle may still be difficult to recover to market expectations. Dolphin Jun estimates that the main reasons are 1) existing promotional policies (trading in gasoline cars for new NIO cars can enjoy a 10,000 yuan NIO optional subsidy, with a total quota of 1 billion yuan); 2) high sales proportion of ET 5; 3) the discount impact of BAAS mode battery rental fees paying 4 and getting 1 free within five years; and 4) there may be more price reduction promotional policies in the future.

5. Operating expense leverage has not been released: With a gross margin of less than 5%, but an operating expense ratio of 59%, the loss rate is predictable. However, the main reason for the widening loss rate this quarter is the issue of vehicle sales. In terms of absolute expenses, R&D should have converged more significantly after layoffs, but administrative and sales expenses have declined more slowly due to previous channel expansion and the addition of sales personnel.

6. Cash burn rate is high: The company's cash and cash equivalents on the books this quarter were 45.3 billion yuan, a significant decline of 12 billion yuan from 57.3 billion yuan in the fourth quarter of last year. Net cash on the books in the first quarter was only 22.4 billion yuan, mainly due to a 5.6 billion yuan reduction in accounts payable (concentrated repayments to suppliers) and a 4.9 billion yuan loss adjustment in SBC this quarter, consuming approximately 10.6 billion yuan in cash.

Dolphin Investment Research Perspective:

Judging from the first-quarter performance, NIO is indeed struggling - with negative revenue growth and a gross margin falling below 5%. However, given that NIO's sales have been recovering month by month, the market is unlikely to pursue the past sales and performance too closely.

The truly marginal incremental information in this financial report is: a. How sustainable is the sales recovery driven by the price reduction of BaaS and policy adjustments? b. What is NIO's gross margin in the worst season? c. With the recovery of sales, how much elasticity will there be in the subsequent recovery of the gross margin?

Unfortunately, NIO's answers to these three truly important questions are disappointing. First, the second-quarter sales guidance, which implies that after the expiration of BaaS benefits for new vehicle purchases, sales may decline again, indicating that the BaaS benefit subsidy's stimulus to sales is relatively short-term, and NIO's main brand may still struggle to maintain monthly sales of 20,000 units in the second half of this year.

The implied unit price of 276,000 yuan behind the total revenue guidance for the second quarter has not increased compared to the 279,000 yuan in the first quarter, but seems to have declined slightly. The possible implication behind this guidance is that there may be more price reduction promotional policies in the future, making it quite difficult to restore the gross margin on vehicle sales to the range of 15%.

Although NIO has shown signs of adjustment on the operational side: becoming more restrained in spending on Opex and Capex, such as reducing quarterly Non-GAAP R&D expenses to 3 billion yuan, expecting a decline in sales and administrative expenses this year, and reducing capital expenditure by 30%-40% year-on-year in 2024, it is still difficult to make up for the huge gap between gross profit per vehicle and expenses. The key still lies in the recovery of sales.

The market's current sales expectation for NIO in 2024 is still around 200,000 units. Dolphin Jun expects that if the trend of BaaS promoting sales and orders is short-term, the main brand models can only contribute 160,000 to 180,000 units in sales for the full year of 2024. This means that the achievement of sales expectations mainly depends on the incremental sales brought by NIO's second brand, Ledao, in the second half of the year.

For this model, the market is generally optimistic about sales, with expectations for Ledao's steady-state monthly sales after ramping up at around 10,000 to 20,000 units. The current stock price corresponds to a 24-year P/S ratio of 1.4 to 1.6 times (considering only vehicle sales), which is already not low. This valuation already includes expectations for the sales of NIO's sub-brand, Ledao. If Ledao fails to meet market expectations, NIO's stock price still faces further downside potential.

Detailed Analysis Below

I. Making Money from Selling Cars? It's Getting Increasingly Distant!

As the most crucial indicator every time financial results are released, let's first take a look at NIO's profitability from selling cars.

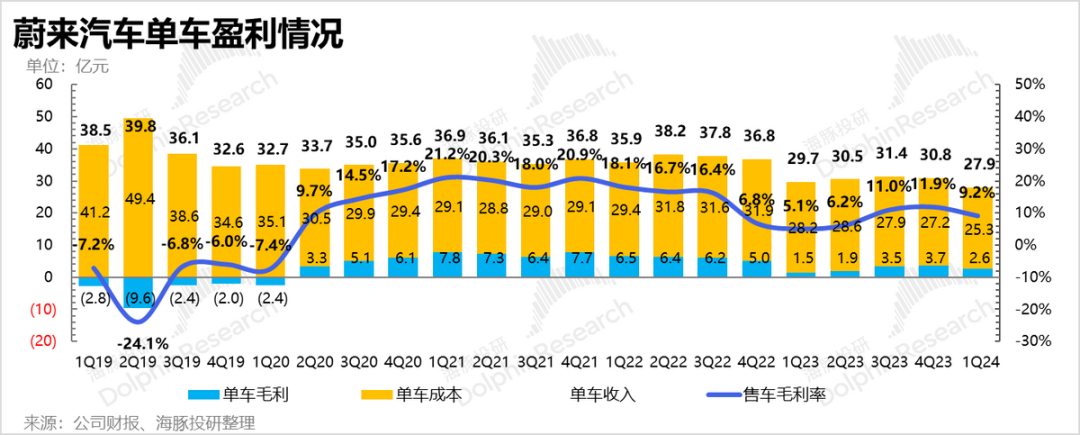

NIO's first-quarter operating bottom has been known to the market, and the market expected that due to NIO's promotional discounts in the first quarter and its sales being at a low point, the gross margin on vehicle sales would decline to 11% quarter-on-quarter. However, the actual gross margin on vehicle sales in the first quarter was 9.2%, lower than market expectations.

And if we look at the economics of each vehicle, it is mainly due to the average vehicle price being significantly lower than market expectations:

1) In the first quarter, NIO's average vehicle price was 279,000 yuan, 30,000 yuan lower than the previous quarter and lower than the market expectation of 290,000 yuan.

The decline in the average vehicle price in this quarter was mainly due to NIO being in a model replacement period in the first quarter, offering significant discounts on older models as early as January 2024. The entire 2023 model line enjoyed discounts ranging from 24,000 to 32,000 yuan (with ET5, ET5T, ES6, and EC6 receiving 24,000 yuan; and ES8, EC7, ES7, and ET7 receiving 32,000 yuan).

Although NIO's 2024 models have the same prices as the revamped older models, the new models only started to be delivered successively in March 2024, so the average price for the first quarter still showed a quarter-on-quarter decline.

At the same time, due to the decline in the proportion of higher-priced ES8 in the model mix and the increase in the proportion of lower-priced ET5, NIO's average vehicle revenue in the first quarter was only 279,000 yuan, lower than the implied average vehicle price of 283,000 yuan in NIO's previous first-quarter revenue guidance and the market expectation of 290,000 yuan.

2) The cost per vehicle in the first quarter was 253,000 yuan, better than the market expectation of 259,000 yuan.

The cost per vehicle for the same period declined by 18,000 yuan quarter-on-quarter, from 272,000 yuan in the previous quarter, which is better than the market expectation of 259,000 yuan.

Dolphin Jun estimates that the decline in the cost per vehicle may be mainly due to NIO obtaining vehicle manufacturing qualifications in December last year, which can save 10% in manufacturing costs. At the same time, due to the increase in the proportion of ET5 in the vehicle mix, but because of the quarter-on-quarter decline in sales, the amortization cost in manufacturing has increased somewhat, resulting in a final decline of 18,000 yuan in the cost per vehicle quarter-on-quarter.

3) The gross profit per vehicle has fallen to 26,000 yuan.

With the vehicle price declining by 30,000 yuan and the vehicle cost only saving 18,000 yuan, NIO earned a gross profit of only 26,000 yuan per vehicle sold in the first quarter, down 11,000 yuan quarter-on-quarter.

And with a gross profit per vehicle of 26,000 yuan, compared to the nearly 270,000 yuan in R&D, sales, and administrative expenses allocated per vehicle in this quarter, it is still difficult to cover the huge gap between gross profit and expenses.

II. The second-quarter sales guidance is隐含雷滚滚, with the unit price guidance significantly below expectations

1) Second-quarter sales guidance of 54,000 to 56,000 units

The market has fully anticipated the operating bottom in the first quarter, and what the market cares more about is whether the stimulus to orders from the adjustment of BaaS mode rental prices will be sustainable and whether the gross margin will rebound from the operating bottom in the second quarter.

The company expects second-quarter sales to be between 54,000 and 56,000 units. Since April and May sales have been announced, this implies that NIO's June sales will be between 18,000 and 20,000 units.

However, in reality, NIO's weekly sales as of June 2 were 6,700 units. If this pace continues, monthly sales exceeding 20,000 units in June should be a certainty. But the sales guidance of less than 20,000 units in June implies a quarter-on-quarter decline in sales compared to May, hinting that with the expiration of BaaS mode benefits (where battery rental service fees pay 4 and get 1 free within five years, equivalent to a 20% discount, expiring on May 31), order volumes have declined again. This is the market's greatest concern that the BaaS model only provides a short-term stimulus to sales and is not sustainable.

2) The implied unit price in the second-quarter revenue is only 276,000 yuan, significantly below expectations

The company's second-quarter revenue guidance is 16.6 to 17.1 billion yuan, corresponding to an average unit price of 276,000 yuan, significantly lower than the market expectation of 301,000 yuan. The market mainly expects that as the 2024 models start to be delivered successively in March, and the new models have the same prices as the older models before price reductions, this will drive the average vehicle price back to the level before promotions on older models and drive a rebound in the gross margin on vehicle sales in the second quarter.

However, Dolphin Jun estimates that the average vehicle price of 276,000 yuan in the second quarter is still slightly lower quarter-on-quarter compared to 279,000 yuan in the first quarter, mainly due to 1) NIO's up to 1 billion yuan gasoline car trade-in subsidy (trading in gasoline cars for new NIO cars can enjoy a 10,000 yuan optional subsidy), 2) the discount impact of BAAS mode battery rental fees paying 4 and getting 1 free within five years (with an impact on the unit price of less than 6,000 yuan), 3) the increase in the proportion of lower-priced ET5, which will pull down the overall ASP, and 4) there may be more price reduction promotional policies in the future.

The market's gross margin expectation for NIO in the second quarter is 13%, but the current expected unit price of only 276,000 yuan is clearly not favorable for NIO's gross margin expectation in the second quarter.

III. First-quarter deliveries were slightly below delivery guidance

NIO delivered 30,000 vehicles in the first quarter, down 40% quarter-on-quarter from the fourth quarter and slightly below NIO's previous first-quarter sales guidance of 31,000 to 33,000 units.

The quarter-on-quarter decline was mainly due to 1) the first quarter being a sales off-season for automakers, with overall new energy vehicle sales under pressure in the first quarter; and 2) NIO's 2024 models only started to be delivered successively in March.

However, NIO's sales have recovered rapidly since March, with sales in April and May rebounding to 16,000 and 21,000 units, respectively. The main reason for this is that on March 15, NIO