Dongchedi wants to fly solo, and its biggest challenge comes from Lei Jun

![]() 06/11 2024

06/11 2024

![]() 686

686

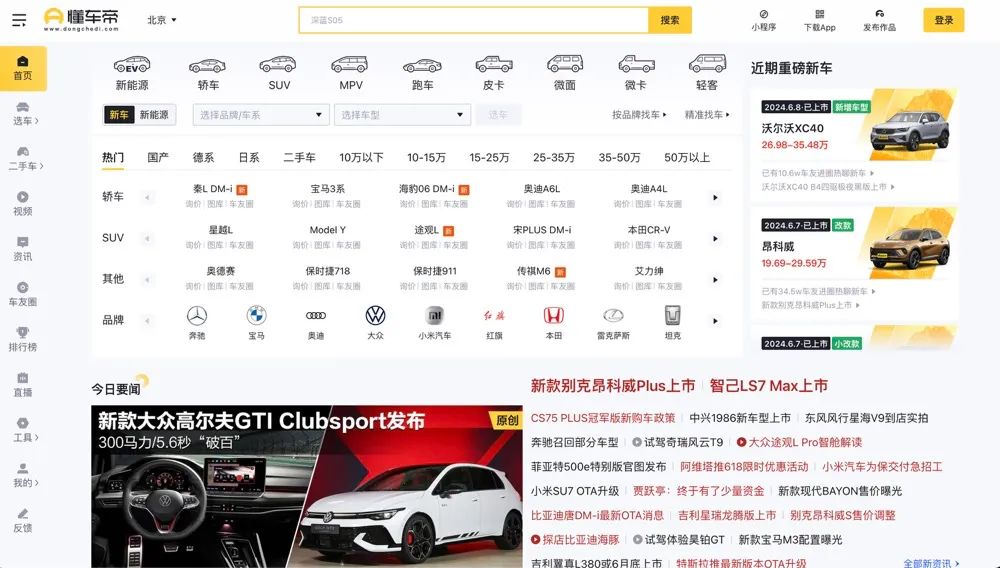

Will Dongchedi be the next Xingfuli? Recently, Dongchedi made another "big news." According to a well-known technology media citing insiders, ByteDance is raising $700 million to $800 million (approximately RMB 5 billion to 5.8 billion) for its automotive information platform Dongchedi to prepare for the IPO (Initial Public Offering) of this business segment. It should be noted that Dongchedi originally emerged from the automotive channel of Toutiao.

After seven years of development, Dongchedi has become a one-stop automotive information, trading, and service platform. Especially in the past two years, Dongchedi has begun to accelerate its business transformation, moving from online to offline, and transforming from a light-asset media content platform to a heavy-asset automotive trading and service platform. For example, in 2023, Dongchedi integrated and upgraded with Douyin's used car business and launched an offline car maintenance brand called "Dongdong Yangche." ByteDance is busy shedding its burdens. In fact, before the news of Dongchedi's external financing spread, it had already begun preparing for its listing. At the end of 2023, Dongchedi underwent changes in its business information, with Toutiao exiting the company's equity structure and being replaced by 100% ownership by the newly established Xiamen Dongchezu Technology Co., Ltd. In January of this year, LatePost revealed that Dongchedi-related employees would be transferred to a newly established wholly-owned subsidiary, with the legal representative being the strategic head of Dongchedi, and a small number of original ByteDance employees would be the first to transfer their labor relations to the new company. In the future, Dongchedi will have an independent office location.

This series of actions indicates that ByteDance is accelerating the spin-off of Dongchedi, transforming it into an independently developed company entity, either to pave the way for its listing or for independent accounting, cost reduction, and efficiency enhancement. Of course, if Dongchedi ultimately succeeds in its listing, it will become the first business unit of ByteDance to spin off and go public. This operation is not uncommon in China. Last November, Huawei spun off its Intelligent Automotive Solutions BU and established a new joint venture with Changan Automobile, injecting businesses, assets, and personnel related to intelligent driving solutions, automotive intelligent cockpits, intelligent automotive digital platforms, intelligent vehicle clouds, AR-HUD, and intelligent headlights into the new company. One of the backgrounds for the cooperation between the two parties is that Huawei's Intelligent Automotive Solutions BU, which has been established for more than four years, has not yet achieved its profit target.

Yu Chengdong once said that Huawei's Intelligent Automotive Solutions BU consumes more than a billion dollars a year and is the only business unit that loses money for Huawei. This is a considerable burden for Huawei, which is still under pressure and experiencing significant declines in net profit and cash flow. Moreover, from Ren Zhengfei to Huawei's EMT (Executive Management Team), they have repeatedly emphasized that "Huawei does not make cars." Ren Zhengfei even went so far as to release a harsh statement internally, saying, "Anyone who suggests making cars and disrupts the company in the future will be transferred to another position or find another job." In other words, based on Huawei's current development strategy, directly entering the automotive manufacturing business would deviate from its main business track.

The same is true for Dongchedi. At ByteDance's annual meeting in March 2023, CEO Liang Rubo clearly identified "information platform" and "e-commerce" as the main business lines. He said that in the next year, ByteDance will focus on investing in these two types of businesses to "strengthen the basics." He also clearly outlined the key points, stating that ByteDance's performance in 2022 failed to meet expectations, and that personnel optimization, cost reduction, and efficiency enhancement would continue. The company would continuously "trim the fat and increase leanness." Liang Rubo also emphasized that "when initiating new business projects, the standards must be raised," and that projects with unclear visions or outstanding value would be cut. He believes that having too many projects would squeeze existing resources, so he requires the team to focus highly on the business itself and emphasizes that "the height of the business is more important than its width."

From a financial perspective, he also required the business team to enhance their operational awareness, focus on financial benefits, and use higher standards to measure whether certain projects are worth investing in. Over the past year or so, ByteDance has accelerated the disposal of unprofitable businesses, such as selling off its securities business and shutting down its independent cross-border e-commerce platform. Meanwhile, for profitable but less relevant to the main business, ByteDance has accelerated adjustments or spin-offs. For example, the game business of Chaoxi Guangnian, which was once prepared for sale, recently welcomed a new leader and will re-incubate the game business, accompanied by significant organizational restructuring. Worth mentioning is Zhang Yiming's real estate dream, which has also been put on hold during this round of adjustments. The latest news shows that ByteDance's real estate business "Xingfuli" and decoration business "Zhuxiaobang" have been merged into Douyin's lifestyle services, and the relevant responsible persons have transferred to Douyin's e-commerce.

In ByteDance's diversified trials, Dongchedi is most similar to its real estate business: leveraging ByteDance's huge traffic advantage, adhering to the belief that "great efforts yield miracles," entering the market through the supply of information content, and ultimately guiding traffic offline. However, over the years, the development of the Chinese Internet has also proven that traffic is not all-powerful. Xingfuli and Zhuxiaobang have not been able to become the next Douyin or Toutiao. Dongchedi neither escaped this business model nor fell within Liang Rubo's planned main business lines. Regarding Dongchedi's independence, ByteDance once explained that it was "based on the needs of normal business development." This can be seen as a "forward-moving retreat" or "ByteDance shedding its burdens,"剥离 non-core businesses within the company to achieve maximum financial benefits.

In other words, Dongchedi's spin-off may be part of ByteDance's larger plan and its abandonment of unsuccessful diversification efforts after real estate, finance, social media, cross-border e-commerce, and Internet healthcare. Dongchedi's biggest challenge, at present, stands at the cusp of the rapid development of new energy vehicles, with a considerable development momentum. According to QuestMobile data, Dongchedi's daily active user count increased by 57% from 2021 to the first half of 2023, reaching 7.32 million. It is also rumored that with ByteDance's strong support, Dongchedi's daily active user count has surpassed established players like Autohome and Yiche, ranking first in the industry, and its revenue growth rate is also higher than the industry average. Even so, Dongchedi still faces significant content and commercialization challenges.

Taking last year's "out-of-the-box" new energy vehicle winter endurance test as an example, according to Dongchedi's published test results, among more than ten plug-in hybrid (including extended-range hybrid) models tested for pure electric endurance achievement rates under severe cold conditions, BYD's Yangwang U8 achieved an endurance rate of 85.08%, ranking first; while the Wenjie New M7 extended-range version only achieved an endurance rate of 31.6%; multiple models under Geely and Great Wall Motor both achieved endurance rates of less than 40% in the test. Other models also had mixed test results.

This result triggered a collective outcry from automakers. Yu Chengdong lambasted Dongchedi as "a misleading test, and science and rigor are the basic rules that should be followed!" Yang Xueliang, vice president of Geely, publicly stated that "the evaluation process was unscientific and不严谨, and the conclusions were not convincing, not only misleading consumers but also damaging Dongchedi's own credibility." Great Wall Motor pointed out that some results were abnormal and questioned Dongchedi's results in the "pure electric endurance test," "fuel consumption test under low battery conditions," and "hill climbing test." Car blogger Sun Shaojun said at the same time: "Everyone should have doubts about the media's position. It's suspicious not to question the motives and professionalism of various performance rankings. At the same time, even if Dongchedi fully achieves the same crash test standards as formal institutions, automakers will still extremely reject it. The reason is simple: Dongchedi, as a major sales channel backed by Toutiao, has completely surpassed all channels this year, becoming a virtual monopoly in online sales channels.

It is not difficult to see that Dongchedi's practice of "being both a player and a referee" is difficult to convince automakers. To some extent, content is the foundation of Dongchedi and its largest source of traffic. This also determines that it cannot fundamentally resolve content-level controversies: as long as its business model cannot clearly separate profit or commercialization factors, Dongchedi cannot escape accusations of "biased toward partner brands or models." The China Consumers Association's report titled "Investigation Report on the Impact of 'Third-Party Evaluation' on Consumer Rights and Interests" also mentioned that after conducting an experiential survey of a total of 350 "third-party evaluation" accounts, it was found that 93.1% of them were suspected of having issues with evaluation standards, with a lack of subjective evaluations with clear standards; 55.7% were suspected of having a model that combines commercial evaluation and evaluation funded by business, making it difficult to ensure fairness; 37.2% of consumers reported quality issues with products purchased after watching "third-party evaluations"; and 35.7% of "third-party evaluations" were suspected of having false evaluation issues.

From another perspective, the latest and biggest challenge Dongchedi faces officially comes from "Lei Jun and Yu Chengdong." The success of Xiaomi's SU7 has activated a new traffic model in the automotive industry. Led by Lei Jun, Yu Chengdong, Zhou Hongyi, Li Bin of NIO, and even Wei Jianjun of Great Wall Motor, who has been behind the scenes for a long time, are all coming to the forefront, reaching out to users, and gathering market traffic. On one hand, they communicate with users through short videos, live streams, and social media platform topic settings; on the other hand, they control the dominance of traffic channels through offline self-operated stores and car company bosses personally serving customers during vehicle delivery.

On April 18th, Lei Jun's personal live stream pushed him to a higher level. According to relevant data, Lei Jun's live stream had a peak of over 1.01 million concurrent viewers, with a total number of likes approaching 200 million, gaining over 830,000 new followers during the live stream, and consistently ranking at the top of the trending list. This cross-industry impact is a reconstruction of the automotive industry's traffic order. Media content platforms, including Dongchedi, are not only facing the division of traffic but also the suppression of information gaps. If major car manufacturers and brands close off a large amount of exclusive information within their own systems, Dongchedi's traffic sources will be cut off.

For example, after the winter test incident, Great Wall Motor issued an "initiative to jointly build new energy test standards," signaling its intention to abandon Dongchedi and establish a new system. Huawei's actions are even more aggressive. After Yu Chengdong's dispute with Dongchedi, multiple Huawei intelligent vehicle brands have stopped cooperating with Dongchedi. There are also rumors that starting from January 2024, Huawei's Hongmeng Zhixing brands Wenjie and Zhijie will stop cooperating with Autohome, Dongchedi, and Yiche. None of their stores have opened memberships on these three platforms, and the store lead generation channels for searching Wenjie models on these platforms have all been removed. Dongchedi's current situation is extremely similar to ByteDance's real estate business. Over the past 15 years, Zhang Yiming placed more importance on the real estate business than the automotive business - after all, his first independent startup project was a real estate information search engine called 99fang - but it still ended with adjustments and mergers. Today, Dongchedi is also standing at the cusp of the new energy vehicle race, which has周期性similar to that of the real estate industry. When Xingfuli fell during the downturn in the real estate cycle, how different can Dongchedi's fate be from Xingfuli?