"Trial and Error at Great Wall Motor, Wei Jianjun's 'Correction'

![]() 06/12 2024

06/12 2024

![]() 472

472

Written by Xiang Zhen

Edited by Ziye

In the first half of this year, Great Wall Motor has been quite active.

On the one hand, Wei Jianjun, the chairman of Great Wall Motor, personally took the stage. After appearing at the Xiaomi SU7 launch event, he frequently appeared on social media, covering short videos, Weibo, and live broadcasts, changing Great Wall's traditional image of only knowing how to make cars but not marketing.

On the other hand, in the first quarter of this year, Great Wall achieved its best historical performance: revenue of 42.86 billion yuan, an increase of 47.6% year-on-year; net profit of 3.228 billion yuan, a year-on-year surge of 1752.55%; sales of 275,300 new vehicles, an increase of 25.11% year-on-year; among which, overseas market sales reached 92,800 vehicles, an increase of 78.51% year-on-year.

It was not easy to achieve such a highlight moment. In fact, if we rewind the clock to three years ago, the situation was completely opposite: starting in 2021, Great Wall Motor failed to meet its sales growth targets for three consecutive years.

This was partly due to Wei Jianjun's misjudgment of the new energy trend. During the two years when new forces in the automotive industry such as NIO, XPeng, and Li Auto emerged, Wei Jianjun believed that "it was not a good time to go electric, and Great Wall would only be a follower in the new energy industry."

As a result, Great Wall did not launch its first true electric brand "ORA" until 2018, and it was a niche model targeted at the female market, which directly led to Great Wall not having a mainstream model to compete with the new forces during the boom years of new energy vehicles in 2018 and 2019.

But the turning point was also here, as Wei Jianjun quickly realized the problem and took swift action.

Great Wall accelerated the filling of gaps in its new energy product line, promoting the new energy transformation of its main brands such as WEY and Haval, while continuously developing in technologies such as motors, batteries, and autonomous driving systems. In 2018, it established Hive Energy to deploy power batteries; in 2020, it launched three major technology brands: Lemon, Tank, and Coffee Intelligence. As a result, Great Wall not only consolidated its underlying technologies but also established a full-chain layout in the new energy field.

Great Wall Motor's booth at the 2024 Beijing Auto Show, image source: Wei Jianjun's official Weibo

This rapid correction and catching-up momentum also originated from Wei Jianjun. In the industry, Wei Jianjun is known for his willingness to self-reflect and self-criticize. In the garden under the office building of Great Wall Motor, there was once a giant stone inscribed with "Lessons from the Past" to remind him of his decision-making mistakes. This style of not being constrained by the past is also evident from his humble learning of marketing from new forces.

2024 marks the 40th anniversary of Great Wall Motor's establishment. Compared to the new forces in the automotive industry that are generally less than 10 years old, Great Wall Motor has gone through several industry cycles. Too many companies have gradually become mediocre during the cycle rotation, which is obviously not what Great Wall Motor desires.

Both Wei Jianjun's personal involvement and Great Wall Motor's relentless efforts are a longer-term expectation for the next 40 years.

1. Wei Jianjun, Learning to Be a "Internet Celebrity"

Entering 2024, Wei Jianjun suddenly became much more "high-profile".

First, at the end of March, Wei Jianjun posted his first Weibo, which even made it to the Weibo hot search; then, on April 15, he made his first live broadcast, testing Great Wall Motor's full-scene NOA in Baoding, Hebei, sparking heated discussions once again; and in May, to promote Great Wall's first motorcycle, "Great Wall Soul," he directly starred in the video short "Wei Jianjun's Motorcycle Day," followed by a self-driving live broadcast titled "Wei Jianjun's Weekend" with a self-media blogger, personally supporting the Haval H6.

Wei Jianjun posted his first Weibo in March 2024, image source: Wei Jianjun's Weibo screenshot

Among traditional automakers, there are not many who push themselves to the forefront, build an IP, and become internet celebrities like Wei Jianjun. It was not easy for him to take this step. Known as a technology fanatic and car enthusiast, Wei Jianjun has always believed in a hard-core marketing approach that speaks through products. Therefore, Great Wall Motor has been "quietly making cars" for many years, and the importance of advertising and marketing has long been neglected.

However, in recent years, the rapid rise of new forces such as NIO, XPeng, and Xiaomi has made Wei Jianjun start to examine Great Wall Motor's problems. "We have such good technology and products, why can't we sell well?" This question that has plagued him for years finally had an answer recently. Wei Jianjun believes that Great Wall needs to learn marketing, even full-scale marketing.

Not only did he personally take the lead, but Wei Jianjun also had the same expectations for Great Wall Motor's senior executives. Under his leadership, a group of Great Wall executives opened Weibo, Douyin, and video channels, taking on a "nationwide mobilization" posture.

Taking the annual shareholders' meeting of Great Wall Motor in May as an example, unlike previous closed-door meetings, this year's shareholders' meeting was broadcast live to all investors, media, car owners, and netizens. Wei Jianjun led all Great Wall executives to participate. The entire live broadcast lasted two hours, and facing sharp questions such as "Is Great Wall's electric strategy too slow?" and "Is Great Wall's intelligent driving lagging behind?" Great Wall executives did not shy away from answering directly.

The on-site exchange at the 2024 Great Wall Motor shareholders' meeting, image source: Wei Jianjun's official Weibo

More representative was a scene that unfolded on Weibo last week: when Wei Jianjun severely criticized the marketing work of Haval H6 at an internal meeting, Great Wall Motor's chief growth officer Li Ruifeng, Haval brand general manager Zhao Yongpo, and others directly posted long reflections on Weibo, stating that "the team did not keep up with Wei Jianjun," effectively moving the internal review online. Executives even publicly set goals, with netizens commenting that "every word and line feels the pressure from the boss."

Wei Jianjun's attitude towards catching up with new forces in marketing is resolute and aggressive. He once said, "Change is necessary. If we don't know the direction and method, we should learn from excellent companies and adopt their experiences, even if it means making rigid, following, or forced changes." As a result, Great Wall's management team is also urgently focused on marketing and rapid implementation.

In addition to taking the initiative to step into the spotlight, Wei Jianjun is getting closer to the front line. According to media reports, now the key models of Great Wall Motor are all personally led by Wei Jianjun. Under this mechanism, Wei Jianjun serves as a project manager overseeing important models, making decisions on resource coordination, prototype testing, launches, and other critical matters. One telling detail is that he personally participated in the quality inspection before the launch of the Tank 700Hi4-T.

The direct oversight of the top leadership not only makes resource coordination for important models smoother, ensuring the rapid and efficient production of Great Wall's key products, but also allows Wei Jianjun to obtain comprehensive first-hand information about the products.

As a result, the "information cocoons" commonly seen in the management of large companies are broken in Wei Jianjun's case. To some extent, he is the most transformative employee of Great Wall Motor, taking the lead in breaking the situation from marketing to products.

2. Wei Jianjun's "Correction" and Great Wall's Restart

If we trace back, Great Wall Motor's speed started to slow down around 2019. Before that, with the long-term popularity of its main brands such as Great Wall Pickup and Haval, Great Wall was undoubtedly the leader in the era of fuel vehicles. In particular, its model, Haval H6, created the record of topping the SUV sales chart for 103 consecutive months, making many foreign automakers look up to it.

However, since 2019, the situation has changed. Although Haval H6 still ranked first in relative terms in 2019, 2020, and 2021, its absolute sales have declined. By 2022 and 2023, Haval H6 stepped down from the throne, replaced by new energy models such as BYD Song and Tesla Model Y.

Behind this, of course, there was Great Wall's misjudgment of the new energy vehicle market, but it was also partly due to Great Wall Motor's failure to create a star product like Haval H6 in the new energy era, resulting in blurred brand and model positioning and significant homogeneous competition between different brands and models within the company.

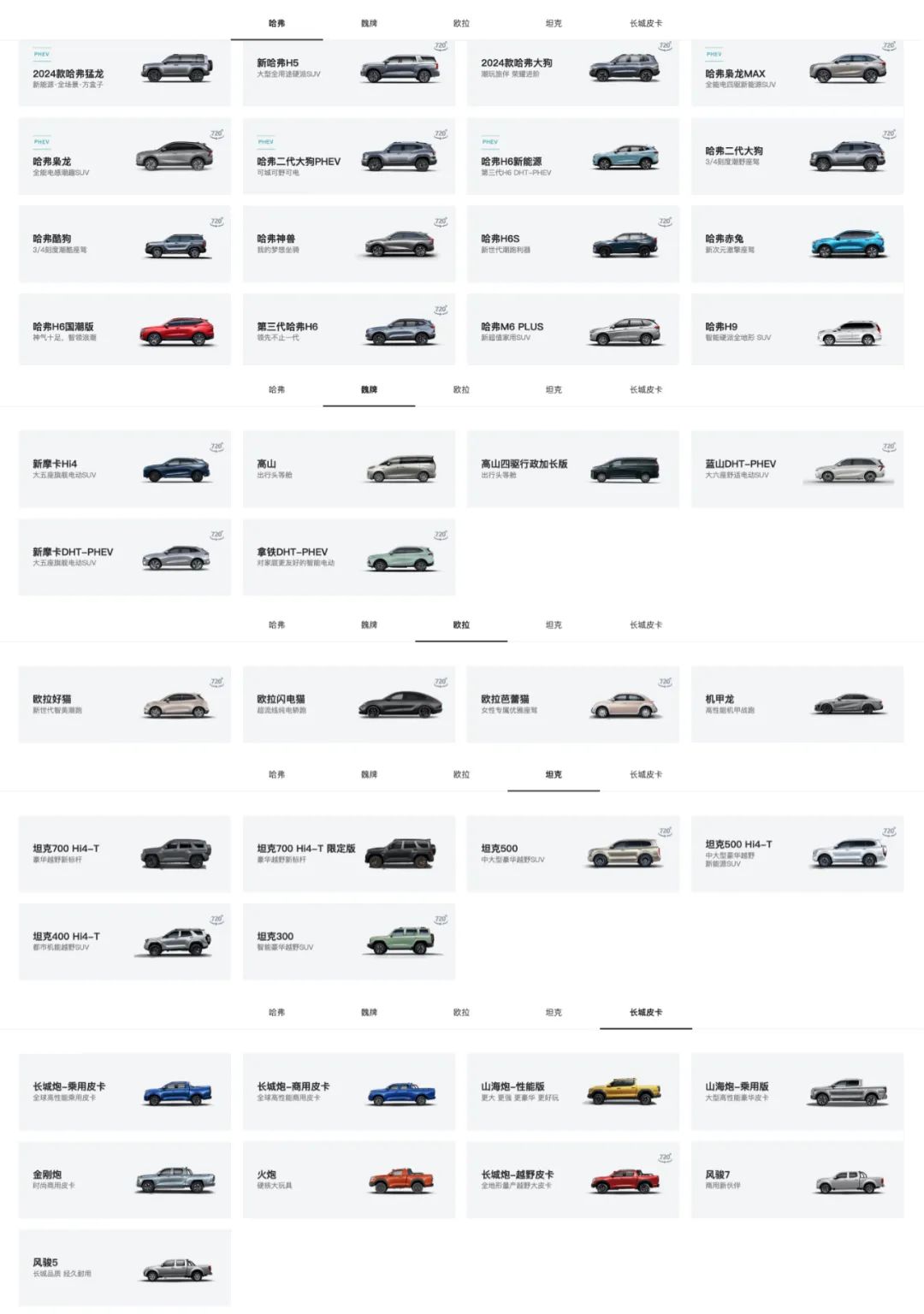

Great Wall Motor's full range of models in 2024, image source: Great Wall Motor's official website

Currently, apart from ORA and Great Wall Cannon, Great Wall's brands such as Haval, WEY, and Tank are all focused on SUV models. The continuous subdivision under SUV models makes it inevitable that the positioning of sub-brands' models will overlap, and the high frequency of new launches by Great Wall further increases the probability of product competition.

In terms of brands, the fuel model VV7 launched by WEY in 2017 was in the same price range of 150,000 to 200,000 yuan as Haval H7. As the backbone of Great Wall's push into the high-end market, WEY's configuration was significantly higher, resulting in a significant decline in Haval H7's sales after the launch of VV7.

Not only that, but there is also "internal competition" between different models of the same brand. The early models of WEY, VV6 and VV7, were very similar in terms of exterior design, interior style, and power system. VV7 was launched first, and although the subsequently launched VV6 was positioned as a compact SUV, its level of luxury was not inferior to VV7, but its price was lower, leading to a decline in VV7's sales.

The problem of product competition, reflected at the organizational level, is that executives and departments of similar models will also have internal competition due to sales and performance pressure.

In 2020, Great Wall Motor proposed the "one car, one brand, one company" model, which involves building a team and brand around a single product. Although this model is conducive to independent brand operation and leveraging respective advantages, it is inevitable that teams overseeing different models and brands will compete, leading to organizational fragmentation. The most direct manifestation is that in the past few years, Great Wall Motor has seen a high turnover rate among executives, including Wang Fengying, Zhang Li, Chen Siying, Li Xiaorui, and other executives from WEY, ORA, Haval, and other brands and subsidiaries.

No longer proud of the era of fuel vehicles, Wei Jianjun and Great Wall finally faced the music. Therefore, a top-down correction and reform initiated by Wei Jianjun is underway within Great Wall Motor, as he attempts to lead Great Wall Motor back onto the fast track.

Great Wall Motor's booth at the 2024 Beijing Auto Show, image source: Great Wall Motor's official Weibo

The first and more important step is the integration of organizational structure. To better address issues such as unclear brand positioning, product competition, and resource waste, Great Wall announced the implementation of the "541" management model at the end of 2022. "5" refers to the establishment of five central platforms for brand, channels, users, digitization, and sales services; "4" refers to four battlegroups for WEY and Tank, ORA and Salon, Haval and Pickup, and overseas markets; "1" refers to achieving unified system management through a unified action plan.

Under this model, the management teams of WEY and Tank, as well as ORA and Salon, have been merged. The effect is also evident. Taking WEY and Tank as an example, both brands are operated by the same dealers in multiple locations. In the past, dealers needed to communicate with two sets of teams from Great Wall, resulting in high communication costs. Now, they only need to communicate with one team, greatly improving decision-making and operational efficiency.

The second step is to reduce product lines, integrate sub-brands, and concentrate on making the main brands and models stand out. From Haval, WEY, to ORA, Great Wall's product line is rapidly shrinking. The H1, H2, H3, H4, H7, and H8 models of the Haval H series have all been cut; WEY's fuel models such as VV6 and VV7 have also announced their discontinuation; and ORA has canceled models such as Black Cat and White Cat.

At the same time, there is an overall planning, reasonable positioning, and layout of its brands. After deciding to fully transition to new energy, Great Wall has divided its brand matrix based on audience segments, with Haval positioned in the mass new energy market and WEY positioned in the high-end new energy market. Based on this, Great Wall also plans to integrate Salon, another new energy brand that also targets the high-end market, under WEY this year to jointly take on the task of opening up the high-end electric vehicle market.

The third step, which is already familiar to everyone, is to comprehensively focus on marketing and getting closer to users at the execution level, making Great Wall better at selling cars. In addition to the chairman and management team collectively stepping into the spotlight, at a deeper level, Great Wall is starting to rethink the logic of channel marketing, shifting from relying on dealer 4S stores to building direct sales channels called "Great Wall Smart Choice".

Wei Jianjun guiding Lei Jun on a tour of Great Wall's booth at the Beijing Auto Show, image source: Great Wall Motor's official Weibo

It is reported that Great Wall's direct sales stores are divided into retail centers, delivery centers, and user centers. Retail centers are mainly responsible for product experiences, test drives, orders, and services; delivery centers provide multi-car comparison test drives and vehicle deliveries; and user centers are responsible for user community activities and vehicle deliveries. Currently, Great Wall Smart Choice plans to open retail centers in first-tier and new first-tier cities, with an expected 200 retail centers by the end of the year.

In the past few years, Great Wall's organizational structure and product matrix have undergone frequent adjustments, with minor adjustments every six months and major adjustments every year. Compared to many traditional automakers, such a high frequency is obviously on the high side. The anxiety brought by the new energy transition in the automotive industry is forcing Great Wall to constantly change its posture and seek solutions.

3. The Next Journey of the "Technology Maniac" Still Relies on Technology

Although Great Wall Motor was slow in launching new energy vehicles, it cannot be denied that, relying on its keen eye for technology, Great Wall, which has always valued technology, has still turned the tide in the new energy field.

In the