"Week 23 New Force Sales Ranking: Ideal Weekly Sales Exceed 10,000, Outperforming NIO and WENJIE

![]() 06/13 2024

06/13 2024

![]() 499

499

The weekly sales ranking of China's new forces for Week 23 (June 3rd - June 9th) was just released this afternoon.

So, how did the electronic cricket fight go this week?

(The weekly sales battle between new forces is jokingly referred to as the electronic cricket fight by netizens)

The contestants are fighting fiercely, and the spectators are cheering with flags in hand, enjoying the spectacle.

Ideal's weekly sales exceeded 10,000, reaching 10,900 units, taking the top spot.

WENJIE ranked second with weekly sales of 8,900 units.

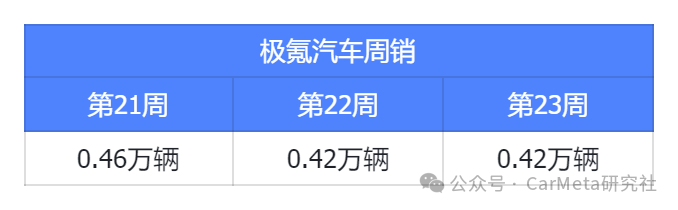

ZEEKR squeezed into the top three with weekly sales of 4,200 units.

Here are the reviews for this week:

1. Ideal and WENJIE, the dual champions of hybrids, with Ideal temporarily leading WENJIE

As of June 9th, based on rough sales calculations, Ideal's cumulative sales have surpassed WENJIE.

In the first quarter, WENJIE had been ahead of Ideal in sales.

In the second quarter, Ideal has a clear advantage. After two months of competition, only the third week of April was slightly lower than WENJIE, with the rest of the weeks exceeding WENJIE.

WENJIE's new M7 orders are promising, and it is predicted that next week's sales will exceed 10,000 units

WENJIE's sales have actually been increasing in April and May, but not as sharply as Ideal. It is probably due to capacity ramp-up, especially with the release of the new M7 at the end of May, which saw orders exceed 10,000 on the day of its release. Both the WENJIE team and Yu Chengdong have stated that the delivery of the new M7 in June will exceed 20,000 units, so it is predicted that WENJIE's sales are likely to exceed 10,000 units next week.

With the help of the new M7, let's see if WENJIE can turn the tables and surpass Ideal next week?

Ideal encountered a public opinion boomerang, but sales are impressive

Ideal has been at the forefront of online public opinion recently. Its Q1 financial report was not ideal, coupled with excessive layoffs, leading to various media criticisms. The power of the public opinion boomerang is quite significant.

Although Ideal has temporarily slowed down its pure electric vehicle (BEV) development due to the failure of the Mega project, the huge orders for the Ideal L6 (predicted to exceed 40,000) are sufficient to support Q2 sales.

However, one should always plan ahead. In my opinion, Ideal's biggest problem is that it places too much emphasis on revenue data and lacks long-term planning.

In the past, Ideal relied on the Ideal One for two years, probably also catching the trend. But now, can Ideal rely solely on the Ideal L6 to last until the end of the year?

Although hybrids are still dominating the market in recent years.

But once the hype fades, where should Ideal go? Is it too late to start transforming?

2. ZEEKR is delighted to take third place, with stable sales trends

In Week 22, ZEEKR also sold 4,200 units, surpassing NIO, another pure electric vehicle brand, to enter the top three.

ZEEKR focuses on the 250,000-300,000 yuan pure electric vehicle market, and ZEEKR's product strength is indeed impressive in this price range.

Coupled with its recent IPO listing, ZEEKR has ample funds and a vibrant team,预示着下半年将大展拳脚。

In the second half of the year, ZEEKR will first launch two major products, the "Baby Bus" ZEEKR MIX, and a brand-new medium to large pure electric SUV.

The ZEEKR MIX, positioned as a pure electric MPV, has already made its debut at the Beijing Auto Show in April, attracting attention with its B-pillar-less design and front seats that can rotate backward.

3. Zero-Run and TangZe have good sales of hybrids

Zero-Run previously focused on pure electric vehicles and had to develop everything in-house, which clearly strained their research and development and cost control. After switching to hybrids, their sales have skyrocketed, rising to fourth place.

Nezha has generally followed a similar path, with Zero-Run and Nezha both targeting the budget version of Ideal. However, Nezha has been lagging behind for quite some time.

TangZe, the popular MVP in the market, is selling quite well, with weekly sales of 2,100 units.

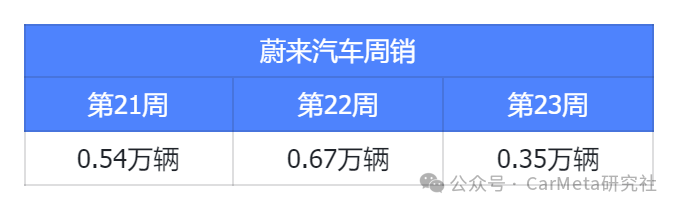

4. NIO's sales momentum is waning, with sales nearly halved

NIO's sales have surged in recent weeks, but the high consumption seems to have strained its production capacity.

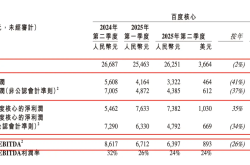

Last week's sales were only 3,500 units, nearly halved compared to the previous week's 6,700 units.

In May, NIO achieved its highest monthly sales since its inception, delivering 20,544 vehicles. With the battery swap incentives, deliveries were booming. However, once the month ended, sales in the first week of June fell significantly.

In May, NIO also launched its new sub-brand, LeDao, with Li Bin and LeDao President Ai Tiecheng both stating that orders exceeded expectations.

The LeDao L60 is scheduled to go on sale in September and will only be delivered at the end of the year. With such a long lead time, there may be many variables. How many other manufacturers are planning to unleash their big moves in the second half of the year? The environment facing the LeDao L60 remains challenging.

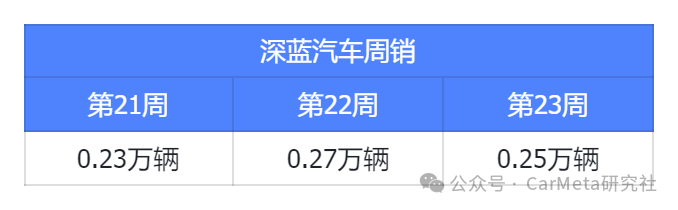

5. Deep Blue and IM Motor both made the sales ranking

Deep Blue and IM Motor are both second-generation brands of established automakers: Deep Blue is a new energy brand incubated by Changan Automobile, while IM Motor is SAIC's new offspring after the failure of Feifan.

Deep Blue has been a regular player on the ranking list, with stable sales of over 2,000 units per week.

The Deep Blue S7 SUV boasts excellent product strength, with a rugged and stylish exterior and sufficient range and power. It is a powerful model in the 150,000-200,000 yuan pure electric vehicle market.

IM Motor, which refuses to hand over its soul to Huawei's HarmonyOS 2.0, also focuses on intelligent driving.

This is the first time it has appeared on the list in the past two months, with weekly sales of 1,500 units.

However, buying an IM Motor car can be risky. The IM Motor L7, which was just delivered last year, saw a price drop of 70,000 yuan, making it a risky purchase.

The newly launched IM Motor S7 has a good design and targets the Model Y.

6. Xiaomi surpassed XPeng

This week, it's not Xiaomi's sales that exploded, but XPeng's sales that fell again.

Xiaomi sold 2,100 units last week, while XPeng sold 1,800 units.

Xiaomi increases production capacity, expecting to deliver over 10,000 units in June

Recently, Xiaomi Automobile officially announced that it will accelerate the delivery of the Xiaomi SU7, with the factory officially starting double-shift production. It plans to ensure the delivery of over 10,000 new vehicles in June.

Currently, the above adjustments have not effectively shortened the new car delivery cycle. The low-end version still requires a wait time of 28 to 31 weeks, while the most popular high-end version requires a wait time of 33 to 36 weeks. Therefore, the current weekly sales of over 2,000 units are already the result of accelerated factory production capacity.

XPeng's second brand has an uncertain future, with the launch of the new XPeng M03

XPeng originally planned to launch its new brand MONA in the second quarter, but according to the latest news, the new car is called the XPeng M03, with a design similar to the figure below, retaining the XPeng family logo.

It seems that XPeng's new brand plan may have been shelved?

With sales failing to pick up, many industry insiders suspect that XPeng is encountering difficulties in corporate governance.

As the year nears its halfway point, XPeng is still mired in difficulties. When will it be able to emerge?

Conclusion

Recently, at the Chongqing Automotive Market Forum, automotive industry leaders have engaged in heated debates about whether the automotive market should "compete" or "not compete".

In particular, topics related to price competition and equal rights for gasoline and electric vehicles have sparked heated discussions.

Do you think the automotive market should compete on price?

Please share your opinions in the comments section. In the next article, I plan to write an analysis on this topic. I hope everyone will actively participate and share your true thoughts with me.

"