Industry leaders debate "involution" in the automotive industry, Yu Chengdong, Lei Jun, and Wang Chuanfu all take the stage

![]() 06/13 2024

06/13 2024

![]() 423

423

Produced by Radar Finance | Written by Li Yihui | Edited by Shenhai

The "price war" is intensifying, and new energy vehicles are struggling to keep up with the competition.

At several industry forums held since June, the heated discussion about "involution" is unfolding in the automotive world. Voices such as "can't keep up with the competition," "if we keep going, we'll lose our capital," and "no company can lose billions," are being heard for the first time from the mouths of industry leaders.

Broadly speaking, the views of automotive industry leaders can be divided into two categories: those in favor of "involution" and those against it. For example, Wang Chuanfu, Chairman and CEO of BYD, pointed out that involution is actually a form of competition, which is the essence of market economy, and the core of market economy is competition. Yu Chengdong, Executive Director of Huawei, Chairman of Terminal BG, and Chairman of Smart Car Solutions BU, also holds a similar view and calls for rolling up value rather than price.

Of course, there are also many voices opposing "involution." Li Shufu, Chairman of Geely Holding Group, said that endless involution and simplistic price wars lead to cutting corners, counterfeiting, and selling fakes. Zeng Qinghong, Chairman of GAC Group, also agrees, believing that the involution in the domestic automotive market has gone too far, and "rolling up prices" should be about passing on benefits rather than cutting costs.

The sharp statements of these leaders point to the sensitive price war. In this regard, some industry insiders believe that the essence of involution is to grab orders from competitors through price wars. As the "price war" in the industry becomes the norm, controversies are also increasing. However, as long as competition exists, involution is inevitable. How to "break the involution" is a problem that many new energy vehicle companies need to solve together.

Leaders discuss involution in the automotive industry

Radar Finance found that this heated discussion, which has swept half of the automotive industry, seems to have started when Yu Chengdong called BYD the "King of Involution."

On June 1, the 2nd Future Car Pioneers Conference was held at the Shenzhen International Convention and Exhibition Center, with industry leaders such as Lei Jun and Yu Chengdong delivering speeches.

"Among smart electric connected vehicles, BYD is the number one King of Involution in the world because of its ability to achieve ultra-low costs. Hongmeng Zhixing is not good at rolling up prices, but it is good at rolling up value, intelligence, and luxury." Yu Chengdong said at the conference.

Regarding the continuous price war in the market since last year, Yu Chengdong said, "We believe that we should roll up value, not price."

What is rolling up value? Yu Chengdong further explained, "It means rolling up intelligence, luxury, comfort, safety, high quality, and excellent and enjoyable user experiences."

If we consider Hongmeng Zhixing's layout in the high-end new energy vehicle segment, Yu Chengdong's speech is easy to understand. In the era of fuel vehicles, due to the late start of China's automotive industry, the domestic luxury market was firmly occupied by foreign brands such as BBA.

In the new energy era, Chinese new luxury brands represented by WENJIE, LIXIANG, NIO, and ZEEKR have rapidly emerged, grabbing market share that was originally occupied by foreign brands. Among them, Hongmeng Zhixing stands out. Data shows that from January to May this year, Hongmeng Zhixing delivered a cumulative 148,000 new vehicles, topping the sales ranking of new forces in China.

At the same time, most of the Hongmeng Zhixing brands are high-priced luxury models. Data shows that the average selling price of the entire WENJIE series of models remains around 400,000 yuan. Therefore, from a price perspective alone, a blind "price war" is not conducive to the high-price sales of Hongmeng Zhixing products.

Also at this conference, Lei Jun, the founder, Chairman, and CEO of Xiaomi Group, pointed out the direction for the current involution, saying, "Everyone shouldn't be involved in small issues anymore, it's not worth it." Lei Jun believes that if all product details are openly shared, Chinese cars will become more user-friendly.

Subsequently, at the 2024 China Automotive Chongqing Forum, which opened on June 6, Wang Chuanfu responded "remotely" to Yu Chengdong's claim that BYD is the "King of Involution." He believes that involution is a manifestation of market competition, and only by actively embracing it can one succeed.

Wang Chuanfu said that in China's new energy automotive industry, there is involution in pricing, technology, and scale, which has now developed into involution among bosses and traffic. He pointed out that there are both challenges and opportunities in industry development, and the core of the current involution is market competition.

Faced with market involution, entrepreneurs should not be anxious but should actively face it. In Wang Chuanfu's view, all entrepreneurs should embrace and participate in competition, develop in competition, and thus build world-class brands.

Zhu Huarong, Chairman of Changan Automobile, holds a similar view on the current market competition. He believes that involution is a normal process of good money driving out bad money and the best way for the industry to quickly return to healthy competition. Involution means pursuing excellence, pushing Chinese brands to new heights, maximizing user benefits, and creating value for users.

Zhu Huarong said that in the next decade, more Chinese brands will "involve" into world-class brands.

Controversy behind the "price war"

However, some automotive industry leaders seem to be unable to bear the excessive "involution" and have voiced opposition to it.

At the above-mentioned forums, Li Shufu said that the degree of involution in China's automotive industry is the highest in the world, and the price war is unparalleled, which is both good and bad.

In his view, if the level of marketization is high, the law is sound, law enforcement is strict, and there is transparent and fair competition, it is a good thing; otherwise, it is a bad thing.

Li Shufu believes that the healthy development of any industry must be reflected in achieving good economic returns in terms of input-output ratio. Endless involution and simplistic price wars will lead to cutting corners, counterfeiting, and unregulated competition that does not comply with regulations.

The Chairman of GAC Group also criticized the severe involution in the industry in his speech. He said that the involution in the domestic automotive market has gone too far.

"What is excessive? Rolling up prices excessively without making money is not normal." Zeng Qinghong said that for price wars, passing on benefits is fine, but cutting costs is a problem. If you can't make 1 million, what kind of business are you running, what taxes are you paying, and what industry are you in? Therefore, everyone should return to a rational price war.

It is worth mentioning that on June 11, the "GAC Group" officially published a document summarizing Zeng Qinghong's views. Among them, regarding the "price war," Zeng Qinghong said that rolling up prices is fine, as it is determined by supply and demand relationships and market laws. GAC does not oppose price wars and is not afraid of price wars, but they must be rational and have a bottom line, not excessive.

It is not difficult to see that the leaders opposing "involution" are not opposed to competition but rather to endless "price wars."

In fact, involution has been a major theme in China's automotive market for a long time. Since 2023, China's new energy industry has been plagued by price wars. Entering 2024, the situation has not improved. Cui Dongshu, Secretary-General of the China Passenger Car Association, introduced that from January to May 2024, nearly 60 electric vehicles have reduced prices, indeed an unprecedented price war.

Cui Dongshu pointed out that the background of the "price war" is the decline in raw material prices for new energy vehicles, the rapid introduction of new models of new energy vehicles, and the penetration rate of new energy vehicles reaching over 40%. "The price war is a manifestation of system capabilities and an inevitable stage of industry development."

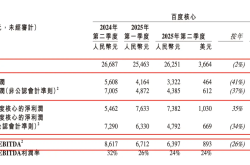

Data also confirms this claim. According to a research report from Guojin Securities, in late February of this year, BYD launched a discounted version of the Glory Edition, but still achieved a double increase in gross margin year-on-year and month-on-month, exceeding expectations. According to calculations, BYD's cost per vehicle in the first quarter was only 102,000 yuan, a year-on-year decrease of 24.9% and a month-on-month decrease of 9.8%.

Financial report data also shows that BYD's gross margin has hit a new high in recent years since last year. According to Tonghuashun iFinD data, BYD's gross margin has risen to 20.21% and 21.88% in the first quarters of 2023 and 2024, respectively, the highest level since 2017.

However, not all vehicle manufacturers can maintain good profit margins. Public data shows that the gross margins of several listed automakers such as Changan Automobile and SAIC Motor have declined to varying degrees in the first quarter of this year.

Where is the path to "breaking the involution"?

Some industry insiders believe that in this market economy environment, price wars are the most conventional means of competition, and it is impossible to completely avoid price wars, but relying solely on price wars has no future.

Therefore, under the premise of continuous price wars and the need for companies to make a profit, how to correctly "involve" is also worthy of attention.

Judging from recent discussions in the industry, opposing and resisting smear campaigns, false propaganda, etc., and shifting from "rolling up prices" to "rolling up value" are consensus views on breaking the involution.

In addition, technological innovation and seeking broader markets overseas are also two major options. At BYD's 2023 Annual General Meeting, Wang Chuanfu said that truly creating high-end brands relies on product strength, and the core of product strength lies in technological innovation. He emphasized, "At BYD, technology is king, innovation is the foundation, and the core is R&D personnel."

Liu Tao, Co-CEO of IM Motors, also proposed that we should rely on innovation to "involve" rather than repetitive and cumulative "involution." All technologies must be based on user experience, thereby enhancing users' preferences for new energy vehicles and further expanding the market share of NEVs.

At the same time, he believes that in addition to involution, we should also look outward, that is, "going overseas." Yang Hong, Chairman of Shenzhen Hangsheng Electronics Co., Ltd., also believes that going overseas is the inevitable path for domestic automakers to "break the involution."

Data shows that in 2023, China's automobile exports surpassed Japan to become the world's largest automobile exporter. Among them, traditional gasoline-powered vehicles are still the main force in China's automobile exports, accounting for nearly 70%, but new energy vehicle exports are growing faster, exceeding traditional gasoline-powered vehicle exports by 9.7 percentage points, which is seen as the core growth point for China's automobile exports in the future.

It is worth mentioning that exports are not a smooth road. According to media reports, as the number of exports increases, the "threat of Chinese electric vehicles" began to spread, and "tariff sticks" followed.

Some analysts believe that whether it is advocating "rolling up value," placing innovation in a more important position, or going overseas in competition, all automakers are striving to break the curse of "price wars" through differentiation and find new development spaces.

According to Cui Dongshu's judgment, the domestic automotive market is expected to return to a normal state dominated by promotions in the future, and it is unlikely that prices will be reduced by 20% at will.