Mercedes-Benz Hits Rough Patch in Transformation: Q3 Profit Tumbles 70%! CEO Issues a Rallying Cry: Full-Scale Recovery by 2027

![]() 10/30 2025

10/30 2025

![]() 547

547

From Porsche to Mercedes-Benz, both automotive giants headquartered in Stuttgart are grappling with the challenges of transformation. "From the impact of tariff adjustments and political unrest to the fierce competition in the Chinese market and the uneven global development of battery electric vehicles, we're navigating an extremely dynamic business landscape," Mercedes-Benz CEO Ola Källenius admitted during the Q3 earnings call on October 29, acknowledging the myriad challenges the company faces.

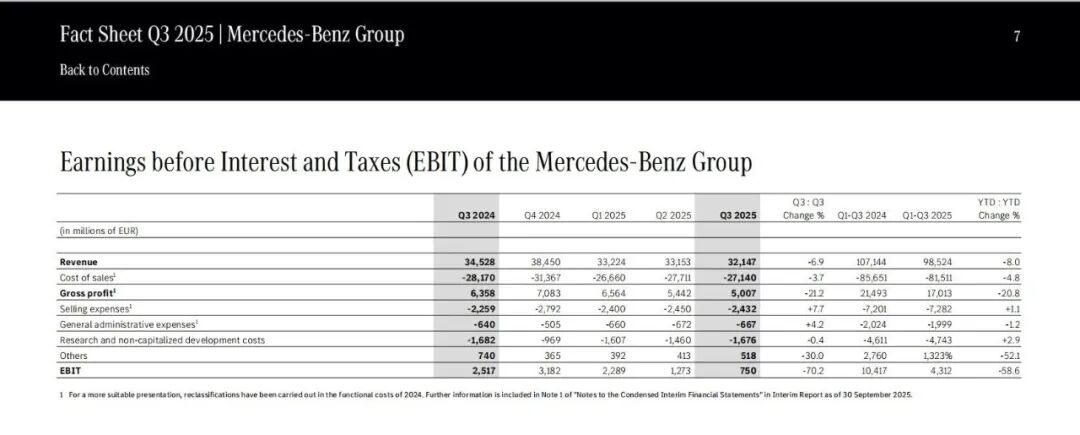

In Q3, Mercedes-Benz reported declines across several key financial metrics. Revenue stood at €32.15 billion, down 6.9% year-on-year; EBIT (Earnings Before Interest and Taxes) dropped to €750 million, a 70% plunge; and adjusted EBIT reached €2.1 billion, down 17%. Nevertheless, cash flow for the quarter hit €1.4 billion, with cumulative cash flow for the first nine months reaching €5.6 billion. Industrial net liquidity stood at €32 billion by the end of Q3, indicating relatively robust financial health.

In terms of segment performance, Mercedes-Benz passenger car sales reached 441,000 units in Q3, a 12.3% year-on-year decline. The company attributed this drop to challenging market conditions in China and inventory adjustments in the U.S. (where refined management strategies helped mitigate tariff impacts), while sales grew in other key markets like Europe, the Gulf States, and South America.

Meanwhile, premium models continued their strong growth trajectory. In Q3, sales of premium models hit 67,800 units, up 10% year-on-year and 5% sequentially, driven primarily by the G-Class, S-Class, and AMG models. This lifted the segment's share of total sales to 15.4% for the quarter. Notably, premium model sales in China surged 13% year-on-year.

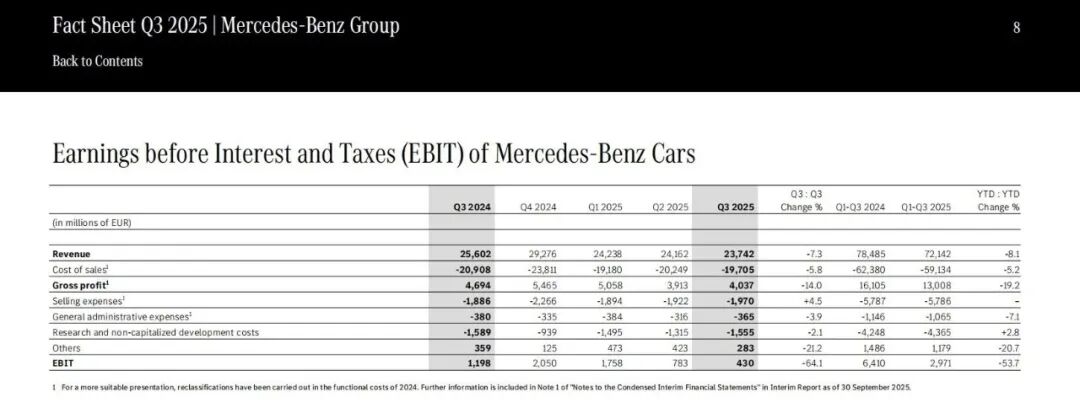

Boosted by a higher share of premium and completely built-up (CBU) models, Mercedes-Benz passenger car revenue fared slightly better than sales volume in Q3. Revenue reached €23.742 billion, down 7.3% year-on-year; adjusted EBIT stood at €1.1 billion, with an adjusted return on sales of 4.8% (or 6.3% excluding tariff impacts).

Concurrently, Mercedes-Benz's Q3 restructuring plan (dubbed "Next Level Performance") involved significant layoffs, incurring approximately €800 million in costs. CFO Harald Wilhelm stated that these investments are expected to yield short return cycles and rapid results, anticipating another round of departures by the end of 2025 or early 2026. Substantial personnel reductions are expected to further lower personnel costs in 2026.

Additionally, Mercedes-Benz achieved cost savings exceeding €1 billion through measures such as material cost reductions, enhanced production efficiency, lower direct sales expenses, and decreased non-capitalized R&D costs. Overall, these optimizations partially offset the impacts of a dynamic market environment. Mercedes-Benz maintained high R&D investment in passenger cars, with Q3 spending at €1.676 billion, down just 0.4 percentage points year-on-year.

For light commercial vehicles, Q3 sales reached 83,800 units, an 8% year-on-year decline but a 25% sequential increase. Financially, light commercial vehicle revenue hit €4.044 billion, down 13% year-on-year; adjusted EBIT stood at €412 million, down 34%. Wilhelm attributed this to factors such as product mix, pricing, and declining aftersales revenue.

Despite these challenges, Källenius provided a positive assessment of Mercedes-Benz's Q3 performance. "Third-quarter results align with our 2025 guidance, with all key performance indicators meeting annual expectations," he stated. Mercedes-Benz maintains a pragmatic view of future challenges and opportunities, pledging 100% focus on preparing for the future and adopting a customer-centric, product-essential strategy in any market environment.

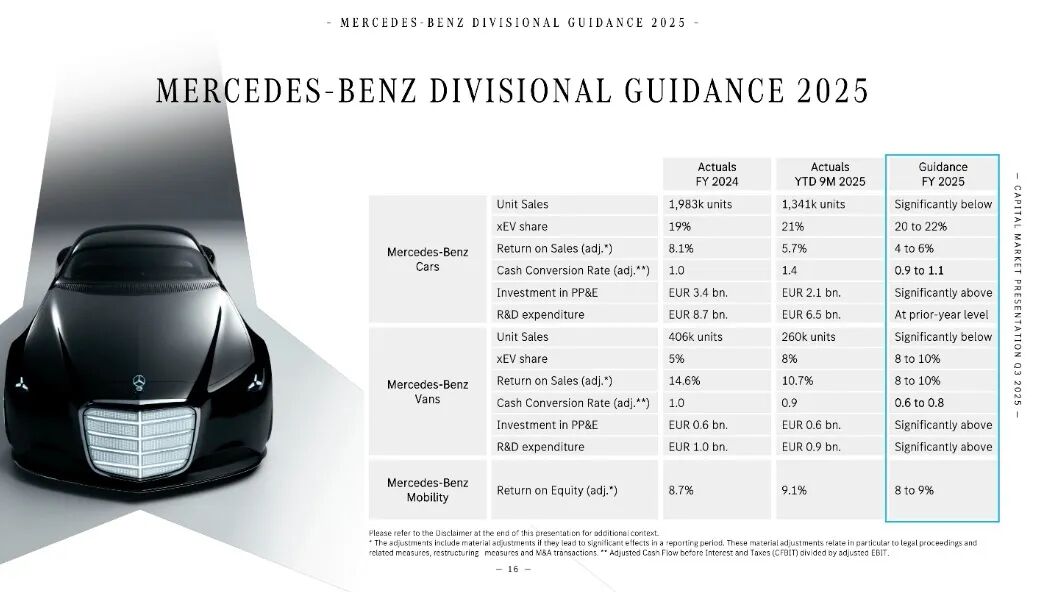

Based on Q1-Q3 performance, Mercedes-Benz offered a conservative forecast for Q4 market performance: full-year 2025 sales are expected to be significantly lower than in 2024, with Q4 sales slightly higher than Q3. Regionally, customer orders in Europe remain healthy, with a steady momentum anticipated to lay the groundwork for 2026; U.S. market Q4 sales are expected to slightly exceed Q3; while in China, fierce competition is expected to keep Q4 sales in line with Q3.

Considering slightly higher Q4 sales, dynamic pricing changes, stable product mixes, seasonal cost factors (including fixed cost capitalization), and rising tariffs, the full-year adjusted return on sales is projected to range between 4%-6%.

01 CLA Launches First Salvo in Electric Vehicle Offensive

Mercedes-Benz has initiated its largest-ever product rollout plan, starting with the CLA. The CLA is Mercedes-Benz's first software-defined vehicle and the first model equipped with the MBUX system. Recognized as the "Best Tested Model" by a renowned German magazine for its exceptional energy efficiency, the CLA has garnered strong market feedback, with orders showing sustained growth. It is gaining traction in Europe and has launched in the Chinese and U.S. markets, with plans to expand to more overseas markets.

In addition to the CLA, Mercedes-Benz introduced the all-new CLA Shooting Brake. This model builds on the CLA's strengths while offering more spacious interiors and is set to launch in Europe in March of next year. Källenius revealed that hybrid versions of the CLA and CLA Shooting Brake will commence production next week.

At the recent Munich Motor Show, the all-new electric GLC made its debut. This mid-size pure electric SUV, built on the MBEA platform, opened for orders on October 29. Källenius expressed high hopes for the model, stating, "I believe the all-new electric GLC will continue the success of this 'sales champion' in the electric era."

By the end of 2027, Mercedes-Benz plans to introduce over 40 new models. Following the all-new CLA and CLA Shooting Brake, two SUV models will be launched in the entry-level segment. The core segment, a major sales contributor and business pillar, will see the electric GLC as just the beginning, with more models like the C-Class to follow. Mercedes-Benz will then complete its full powertrain product lineup in this segment, including battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and internal combustion engine (ICE) models.

The premium luxury segment is another key focus for Mercedes-Benz over the next two years. By 2027, the company plans to launch 10 gasoline and 10 electric models in this segment. "This is the foundation of Mercedes-Benz, our strongest area, and the core supporting our financial strength. Focusing on the premium segment remains the cornerstone of our strategy," Källenius emphasized.

These new models will also feature Mercedes-Benz's latest technologies. For instance, the MBOS system will cover the entire Mercedes-Benz lineup (including ICE models), offering Level 2++ autonomous driving. Additionally, the flux motor and direct-cooled battery, which set a record of over 40,000 kilometers driven in eight days in the AMG GT XX concept car, will enter mass production next year.

02 'Intense Competition in Chinese Market to Persist for Years'

Källenius stated that Mercedes-Benz will continuously adjust its market strategies, particularly in China. The company is responding to fierce competition in the Chinese market by adapting its technologies and products for China and implementing new cost optimization measures.

"The Chinese market is exceptionally competitive, with over 100 players vying for share. Market consolidation will not happen overnight and may take years," Källenius predicted, noting that intense competition in China is unlikely to subside soon. For Mercedes-Benz, this will be a multi-year endeavor.

He acknowledged greater pressure on sales volume and pricing in China, necessitating enhanced responsiveness to additional challenges. Källenius emphasized that the core of competing in the Chinese market lies in a customer-centric approach, stating, "Customers know best what suits them, and we will continue to listen to their voices. With a flexible structure, we will respond to market demands with technically reliable and cost-effective solutions, without compromising on vehicle configurations."

He highlighted Mercedes-Benz's deep understanding of Chinese customer needs: beyond obvious demands like spacious interiors, users also seek intelligent connectivity, entertainment features, and ADAS systems that meet market expectations. In addition to product focus and defensive strategies for the coming years, Källenius mentioned that Mercedes-Benz is optimizing its cost structure and adjusting its business footprint in China, including short-term cost structure refinements and capacity management. Furthermore, the company will focus on high-performing dealers while adjusting underperforming ones in its dealer network.

"Looking ahead, we anticipate a challenging market environment and will maintain a pragmatic approach. However, we are confident in the strength of our product pipeline and the upcoming capacity expansions," Källenius stated. He expects the full effects of these initiatives to gradually materialize after 2026 and be fully realized by 2027.