Q3 Financial Report Unveiled: Traditional Automakers Demonstrate Resilience in a Diverse Market Landscape

![]() 10/31 2025

10/31 2025

![]() 525

525

By 2025, the automotive market has reached a fever pitch of competition, with a relentless barrage of 'price wars' and 'intelligent driving battles' transforming the landscape into a veritable battleground. Paradoxically, while sales figures soar, profit margins continue to dwindle. This dichotomy is vividly illustrated in the Q3 financial reports of traditional automakers.

Among these, Great Wall Motors has achieved unprecedented revenue and sales volume, yet witnessed a decline in profits. Changan Auto, on the other hand, has seen double-digit growth in both revenue and profit during Q3, albeit with profit growth trailing behind revenue. GAC Group has experienced a downturn in both revenue and profit in Q3, yet initial successes have emerged from adjustments under the 'Panyu Initiative'. BAIC BluePark's revenue has dipped, but its gross profit margin has turned positive.

Now, let's delve deeper into the specific situations of these traditional automakers.

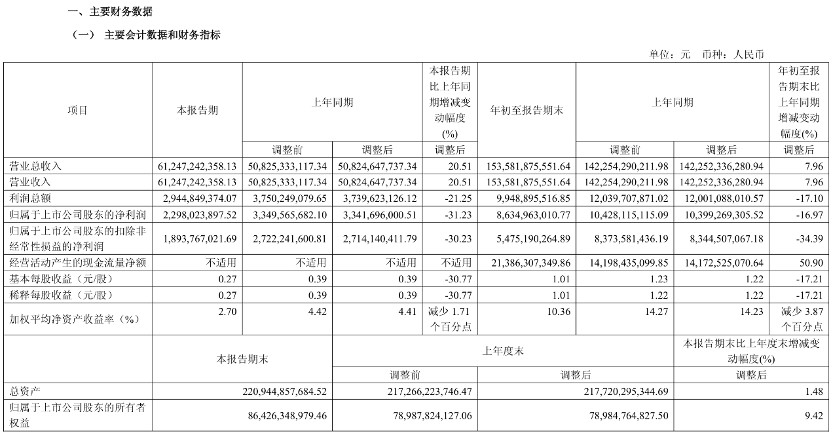

Great Wall Motors: Record-Breaking Revenue and Sales Volume, Yet Operating Efficiency Requires Enhancement

Data reveals that in Q3 of this year, Great Wall Motors achieved revenue of 61.247 billion yuan, marking a year-on-year increase of 20.51% and surpassing the 60 billion yuan threshold for the first time in Q3. During this period, Great Wall sold 353,600 new vehicles, a year-on-year surge of 20.2%, setting a record for the best Q3 sales performance. However, amidst this revenue and sales growth, Great Wall's profits have declined. In Q3 of this year, its net profit attributable to shareholders of listed companies stood at 2.298 billion yuan, a year-on-year decrease of 31.23%.

In response, Great Wall Motors officially attributed the Q3 profit decline to year-on-year growth in sales volume and revenue, coupled with increased investments in accelerating the construction of a new direct-to-consumer channel model and intensifying marketing and brand enhancement efforts for new models and technologies, leading to fluctuations in net profit.

Recent media reports indicate that Great Wall Motors is reconstructing its direct sales channels. Its intelligent selection retail centers will exclusively sell models under the WEY brand, with the TANK brand gradually withdrawing. Additionally, in Q3 of this year, new models such as the all-new TANK 500, Haval Big Dog PLUS, and 2026 Haval Menglong were launched, laying the foundation for Great Wall's sales growth in Q3. Data shows that Great Wall's new energy vehicle models performed exceptionally well in Q3 of this year, selling 118,000 units, a year-on-year increase of 49.21%, becoming the core engine driving sales growth. Models priced above 200,000 yuan sold 101,300 units, a year-on-year increase of 40.83%.

Recently, the Gaoshan 7 was officially launched, with orders exceeding 5,900 within just 24 hours. In November, the Haval H6L will also make its debut. The arrival of these new models is expected to further boost Great Wall's sales in Q4.

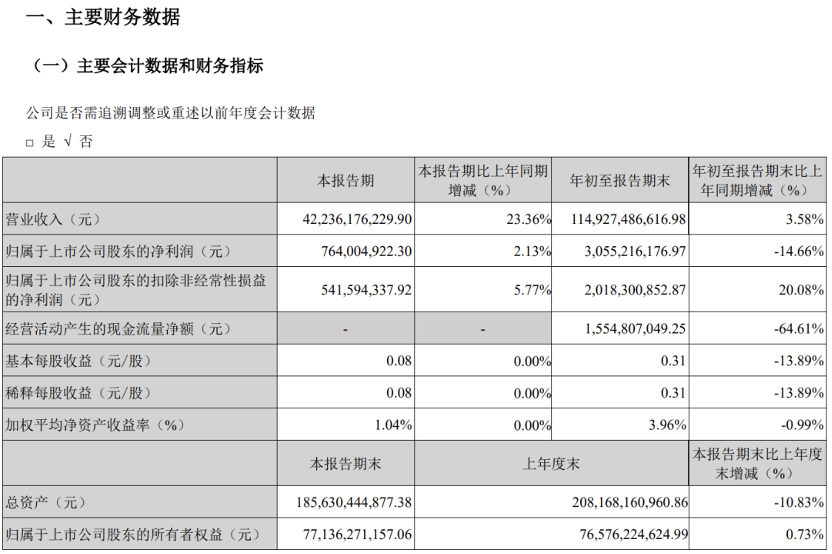

Changan Auto: Q3 Financial Report Reflects Continued Robust Performance

In Q3 of this year, Changan Auto achieved revenue of 42.236 billion yuan, marking a year-on-year increase of 23.36%. Its net profit attributable to shareholders of listed companies stood at 764 million yuan, a year-on-year increase of 2.13%.

Behind this performance, sales volume has been the primary driver of Changan Auto's revenue growth. Data from third-party platforms indicates that Changan Auto's cumulative sales volume in Q3 was 678,100 units, a year-on-year increase of 19%. Among these, the new energy brand performed outstandingly, with Changan Qiyuan selling 106,800 units, a year-on-year increase of 97.7%. Shenlan sold 90,000 units, a year-on-year increase of 77.4%. Avita sold 31,700 units, a year-on-year surge of 169%.

From the financial report data, it is evident that Changan Auto achieved double-digit growth in both revenue and profit, but profit growth lagged behind revenue. Media analysis suggests that Changan Auto's financial expenses in Q3 were -110 million yuan, with reduced exchange gains affecting profit growth. Overseas inventory disposal in Q3 directly reduced profits. Additionally, the company's net profit per self-owned vehicle in Q3 was 1,100 yuan, a year-on-year decrease of 65.8%, limiting revenue growth.

However, Changan Auto is poised to launch new models such as the all-new Changan Qiyuan Q05, Changan Qiyuan A06, and Shenlan L06. These will help Changan Auto continuously enhance its competitiveness and boost profits.

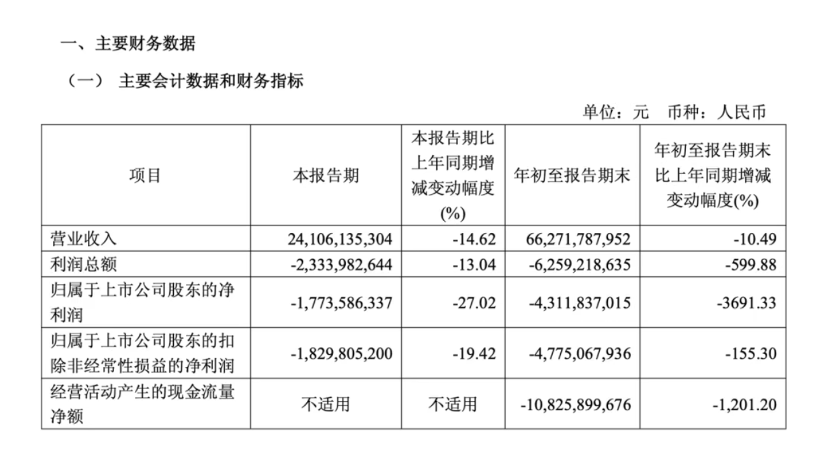

GAC Group: Facing Losses, Yet Initial Successes from 'Panyu Initiative' Adjustments

Data shows that GAC Group achieved revenue of 24.106 billion yuan in Q3, a year-on-year decrease of 14.63%. Its net profit attributable to shareholders of listed companies was -1.774 billion yuan, a year-on-year decrease of 27.02%.

Media outlets have highlighted this as GAC Group's worst performance ever. In response, GAC Group stated that the performance changes were primarily due to fierce competition in the domestic automotive industry, rapid demand structure upgrades leading to declines in vehicle sales and profitability, as well as comprehensive factors such as the valuation premium from the Hong Kong stock listing of Ruqi Travel in the same period last year, resulting in a year-on-year decrease in total profit.

From past market performance, the shrinkage of joint venture brands and sluggish new energy transformation have left GAC Group lacking a sufficiently strong growth point. To reverse this trend, GAC Group has launched a three-year transformation plan - the 'Panyu Initiative'. Currently, the transformation has shown initial results.

In Q3 of this year, GAC Group's cumulative sales volume was 428,400 units. Among these, the combined sales volume of the three self-owned brands, GAC Trumpchi, GAC Aion, and GAC Hyper, exceeded 159,500 units, a quarter-on-quarter increase of 15.09%. Sales volume of joint venture brands represented by GAC Honda and GAC Toyota increased by 9.3% quarter-on-quarter to 267,800 units. This year, GAC Group has launched several new products, including the GAC Hyper HL extended-range version, GAC Trumpchi Yearning S9, and Aion V Home. Next, the GAC Hyper Qijing, developed in collaboration with Huawei, and the 'National Good Car' developed in collaboration with JD.com and CATL, will also be launched. At that time, GAC Group's sales volume is expected to further increase.

It is evident that GAC Group is actively seeking ways to break through. However, whether these measures can enable GAC Group to achieve a 'second takeoff' remains to be seen.

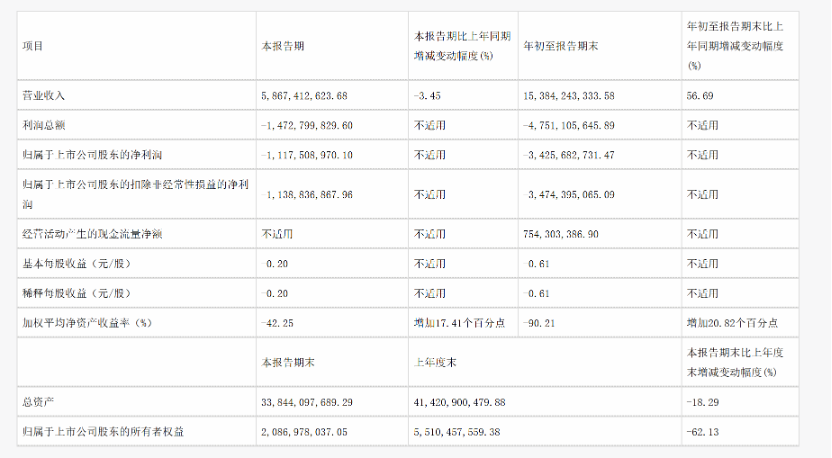

BAIC BluePark: Not Yet Profitable, Yet Showing Signs of Improvement

The financial report shows that BAIC BluePark achieved revenue of 5.867 billion yuan in Q3 of 2025, a year-on-year decrease of 3.45%. Its net profit attributable to shareholders of listed companies was -1.118 billion yuan, a year-on-year decrease of 41.8%.

Officials stated that cost reduction and efficiency improvement, platform-based procurement, and the decline in power battery prices were the main reasons for the narrowing of losses. The slight year-on-year decrease in Q3 revenue was primarily affected by the high base last year.

However, in Q3 of this year, BAIC BluePark's gross profit margin turned positive for the first time, reaching 1.8%, reflecting improved operating quality. Data shows that from July to September this year, the ARCFOX brand delivered 31,000 units, accounting for 82% of BAIC BluePark's total sales volume in the quarter. Among these, the ARCFOX αS5 and Koala Family Edition became the main growth drivers. According to officials, the ARCFOX T1 received over 35,000 firm orders in its first month of launch. The Xiangjie S9T received over 20,000 firm orders within 25 days of launch. Next, the new Xiangjie S9 will be officially launched in November. This is expected to help BAIC BluePark continuously improve its loss situation.

Summary

The Q3 financial reports of traditional automakers generally exhibit characteristics of 'increased differentiation, coexisting challenges, yet hidden resilience.' Among these, the differentiation in profitability is particularly prominent. Great Wall Motors is trapped in the dilemma of 'revenue growth without profit increase.' GAC Group has not yet escaped the loss dilemma. BAIC BluePark is incurring losses but with a positive gross profit margin. Changan Auto has achieved double-digit growth in both revenue and profit but faces pressure from lagging profit growth. Behind this, following price wars to compete for market share has become the biggest factor contributing to the decline in profitability among major automakers.

However, these automakers are also actively transforming to break through. Great Wall Motors is driving sales structure upgrades through new energy and high-end models. GAC Group is promoting month-on-month recoveries in self-owned and joint venture brands through the 'Panyu Initiative.' BAIC BluePark is improving operating quality through models like ARCFOX and Xiangjie. Changan Auto is enhancing profitability through its product matrix.

Currently, the fiercely competitive automotive market has become an unavoidable reality. Traditional automakers are all demonstrating strong resilience and actively transforming. As for who will be the first to break through, time will tell.

(Image source: Internet. Delete if infringement occurs.)