Tesla's Q3 Report: Car Manufacturing Loses Its Glamour, Musk Eyes Trillion-Dollar Payday via 'Humanoid Robots'

![]() 10/31 2025

10/31 2025

![]() 456

456

"Market Cap Plummets by Billions Overnight"

Author: Wang Lei

Editor: Qin Zhangyong

Tesla has released a Q3 performance report that is deeply polarizing.

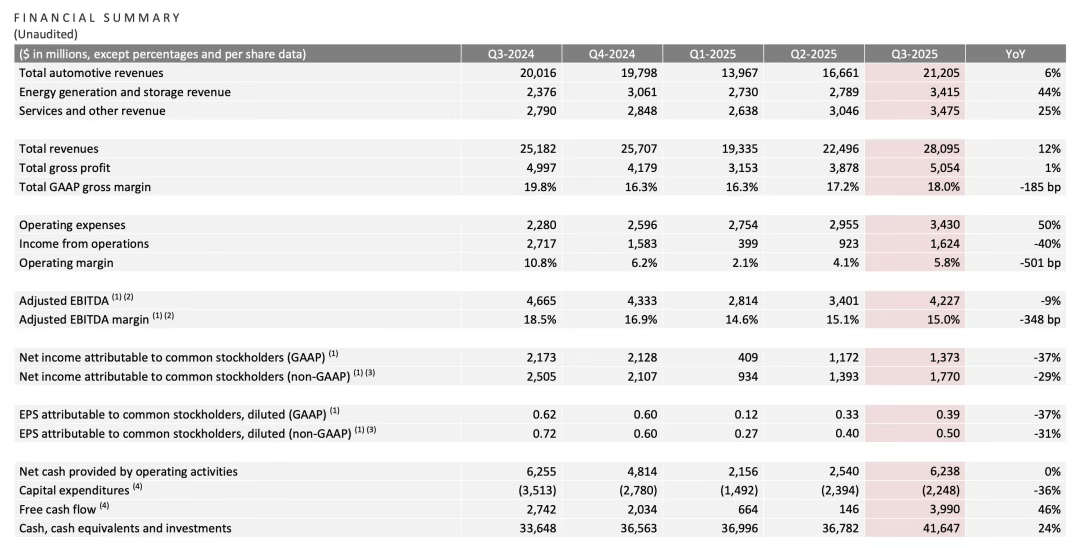

On the bright side, revenue hit an all-time high: operating revenue and vehicle deliveries soared, with revenue climbing to $28.1 billion, an 11.6% year-on-year surge. In Q3, Tesla sold a record 497,000 vehicles, a figure so impressive it made analysts’ estimates look conservative.

However, the capital market wasn’t swayed.

The stock price plummeted in after-hours trading following the earnings release and continued to slide during Musk’s earnings call, with a peak drop of nearly 5%. Based on the day’s closing market cap of $1.46 trillion, Tesla’s value tumbled by nearly $73 billion—roughly 520 billion yuan.

As of press time, pre-market trading still showed a decline exceeding 3%.

The primary reason may stem from "rising revenue but shrinking profits," but a deeper cause lies in Musk’s earnings call demeanor, where he sidestepped poor performance discussions and instead painted an overly optimistic future.

01 Profit Woes Outweigh Revenue Gains

It’s no surprise the market reacted coolly—Tesla’s overall performance fell short of expectations.

On the positive side, automotive revenue alone reached $21.2 billion, a 6% increase from $20 billion in the same period last year. Within this, automotive sales revenue jumped 8.1% year-on-year to $20.359 billion, the first time vehicle sales revenue surpassed $20 billion since Q4 2023.

This was largely driven by record vehicle sales: Tesla delivered 497,000 new vehicles globally in Q3, a 7.4% year-on-year increase, far exceeding market forecasts of 439,600 units. The Chinese market performed exceptionally well, with Q3 sales hitting 169,200 vehicles, a 31% month-on-month surge, including over 90,000 vehicles delivered by the Shanghai Gigafactory in September alone.

Market analysts had anticipated this "sales surge," as the U.S. federal electric vehicle tax credit policy was set to expire on September 30, creating a "last-chance" buying frenzy that propelled Tesla to its highest-ever quarterly delivery volume.

However, the downside was stark: while vehicle sales held steady, profits collapsed, resulting in higher revenue but lower profits.

In Q3, Tesla’s operating profit plunged to $1.624 billion, a 40% year-on-year decline, with an operating profit margin of just 5.8%—nearly halved from 10.8% in the same period last year.

Net profit fared even worse, dropping to $1.37 billion from $2.17 billion a year earlier, a 37% year-on-year decline, marking the fourth consecutive quarter of profit contraction. Earnings per share also fell 37% year-on-year to $0.39, while adjusted earnings per share of $0.50 missed market expectations of $0.54.

The comprehensive gross profit margin slumped to 18%. Excluding regulatory credit contributions, the automotive business’s gross profit margin stood at just 15.4%, slightly below the market expectation of 16.3%.

In contrast, the energy storage business emerged as Tesla’s second growth engine, reaching $3.415 billion in revenue, a 44% year-on-year increase, with a gross profit margin as high as 32%, becoming a key driver of revenue and profit growth this quarter.

Yet, this also underscores that without the energy storage segment’s support, Tesla’s Q3 performance would have been even more dismal.

Tesla attributed the profit decline to several factors: first, the continued erosion of "carbon credit" sales revenue. Regulatory credit revenue from the automotive business dropped from $739 million in the same period last year to $417 million, a 44% year-on-year decrease.

Additionally, tariff impacts loomed large—a point Musk had previously warned about. During July’s earnings call, Musk and CFO Vaibhav Taneja cautioned shareholders that higher tariff costs and the expiration of tax credit policies would weigh on performance.

According to Tesla’s disclosure, tariffs alone added approximately $400 million in costs.

Lastly, and most reluctantly discussed by Tesla, was the internal factor: the decline in average vehicle selling prices due to price wars and the launch of the affordable Model Y, which directly slashed Tesla’s average vehicle profit in Q3.

In Q3, the average vehicle price dropped to $42,700 (approximately 304,000 yuan), a 1.35% year-on-year decline and a 1.65% month-on-month decrease. Net profit per vehicle fell to just $2,800, or $1,100 excluding regulatory revenue.

Furthermore, soaring operating expenses dragged down Q3 profits. These expenses surged 50% year-on-year to $3.43 billion, a 16% month-on-month increase.

Specifically, R&D expenses hit $1.63 billion, a 56.88% year-on-year increase and a 2.58% month-on-month rise, equating to nearly $130 million in daily investment. Selling, general, and administrative expenses reached $1.562 billion, a 31.70% year-on-year increase and a 14.35% month-on-month jump. Tesla stated these expenditures were tied to AI and other R&D projects.

Fortunately, Tesla’s financial reserves remain robust. In Q3, cash, cash equivalents, and total investments reached $41.647 billion (approximately 296.797 billion yuan), a 24% year-on-year increase, while free cash flow soared to $3.99 billion, a 46% year-on-year surge.

02 Musk’s Robot Army Ambitions

In fact, those familiar with Tesla know that whenever its "reality" falters, Musk pivots to the "future"—and this time was no different.

At the earnings call’s outset, Musk declared Tesla at a critical inflection point: "bringing AI into the real world."

The implication was clear: the electric vehicle business alone cannot sustain Tesla’s grand vision or its nearly $1.5 trillion market cap. Hence, Musk barely mentioned automotive profits or sales during the call.

Instead, he shifted focus to artificial intelligence, highlighting four key areas: AI chips, autonomous robotaxis (Robotaxi), Full Self-Driving (FSD), and the humanoid robot Optimus.

First, Musk expressed unprecedented confidence in achieving "unsupervised full self-driving" (Unsupervised FSD). "Given what we’re seeing now and the clear path to unsupervised FSD, I’m confident in expanding Tesla’s production scale," he said, prompting him to accelerate automotive production "as fast as possible."

The vehicles for this expansion are the autonomous Cybercab, slated for production in Q2 2026. Musk projected Tesla could reach a production capacity of 3 million units within 24 months, with the core increase coming from this model.

Regarding FSD’s current progress, Musk remained vague. Paid FSD users now account for roughly 12% of Tesla’s total vehicle owners, and FSD V14 has been opened for autonomous upgrades in the U.S.

However, in other regions, Tesla’s response remains "awaiting regulatory approval."

Nevertheless, Musk didn’t neglect existing users, projecting the release of the FSD V14 Lite version (streamlined) for Hardware 3 models in Q2 2026, expanding coverage to more users.

With FSD’s cumulative driving mileage exceeding 6 billion miles (approximately 9.656 billion kilometers), Musk gained confidence to gradually expand fully autonomous operations.

This is primarily reflected in Robotaxi, with Musk planning to phase out safety drivers over the next few months. By year-end, fully autonomous services will launch in Austin, and Robotaxi’s operational scope will expand to 8–10 regions. These will initially use Tesla’s existing models, while the original plan for truly driverless Robotaxi still relies on the Cybercab without a steering wheel or pedals.

Discussing the upcoming mass production of the AI5 chip, Musk hailed it as a 40-fold improvement over AI4 in certain scenarios. The chip will be jointly produced by TSMC and Samsung to ensure capacity, with excess capacity allocated for AI training.

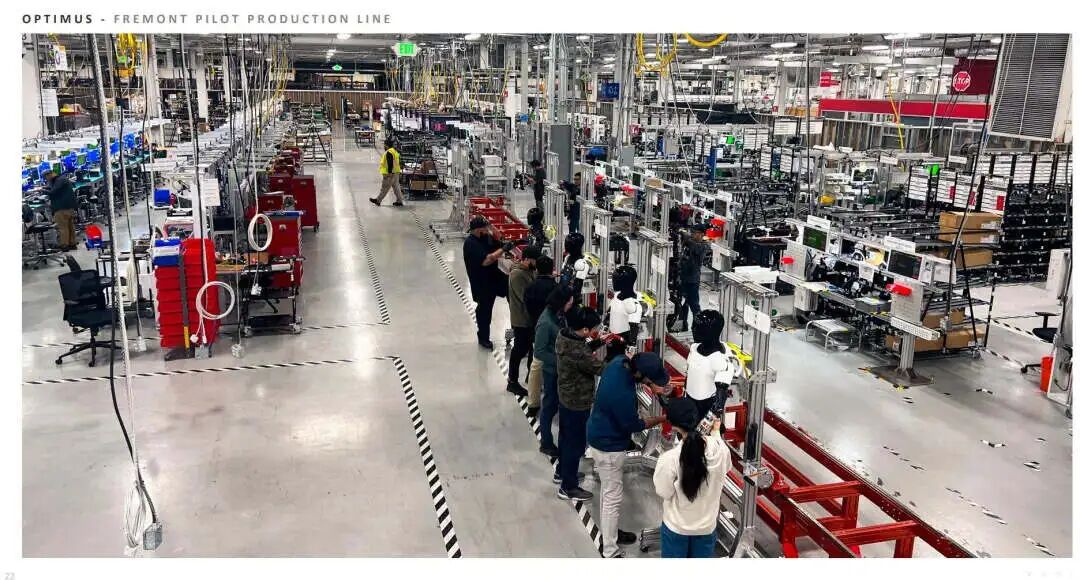

Lastly, the humanoid robot Optimus stole the spotlight. Musk declared on the call that Optimus has the potential to become the "largest" project in history.

Musk even directly tied his $1 trillion compensation plan to Tesla’s Optimus project. During the call, he referred to Optimus’s upcoming scale as the "Robot Army."

He stated, "Without sufficient control, I’m unwilling to advance the Robot Army’s construction."

Musk spoke frankly: "I have a fundamental concern about my voting control at Tesla: if I build this robot army, will I be forced out in the future? This is the only problem I’m trying to solve—whether I still have significant influence. If I don’t, I’m unwilling to build this robot army."

Notably, among the targets Musk must achieve to receive his trillion-dollar compensation is delivering 1 million Optimus robots.

According to the plan, Tesla aims to prepare for prototype production in Q1 next year, building a production line with an annual capacity of 1 million Optimus robots, hoping to start production by the end of next year. However, a production ramp-up will follow. By the Optimus 4 era, annual production could reach 10 million units; in the subsequent Optimus 5 era, it may hit 50–100 million units annually.

Clearly, Musk has high hopes for Optimus—otherwise, he wouldn’t preemptively plan for a "use and discard" scenario.

But will Musk’s envisioned robot era arrive on schedule?