US Auto Loan Delinquencies Skyrocket by 50%: How Close Is Another 'Detroit Bankruptcy' Scenario?

![]() 10/31 2025

10/31 2025

![]() 687

687

As prime auto loans become increasingly financialized, the US auto loan sector has emerged as the next potential crisis hotspot.

When it comes to purchasing a vehicle, auto loans are an inevitable consideration. According to data from the China Automobile Dealers Association, the proportion of new car purchases financed through loans in China surged to approximately 65% in the first quarter of this year, becoming the predominant method of car acquisition.

With economic advancement, the prevalence of loan-financed car purchases has rapidly increased in China. In contrast to less than 30% a decade ago, the majority of domestic consumers now consider loan financing when buying a car. Conversely, automakers have introduced attractive loan policies to lower the entry barrier for car purchases.

As a mortgage-backed form of lending, auto loans have long been viewed as stellar financial products and are considered among the highest-quality financial assets for securitization.

However, on the financial frontlines, Wall Street elites are grappling with a surge in auto loan defaults in the United States. According to Benzinga, the US auto loan market, valued at $1.56 trillion, is facing a 6% delinquency rate.

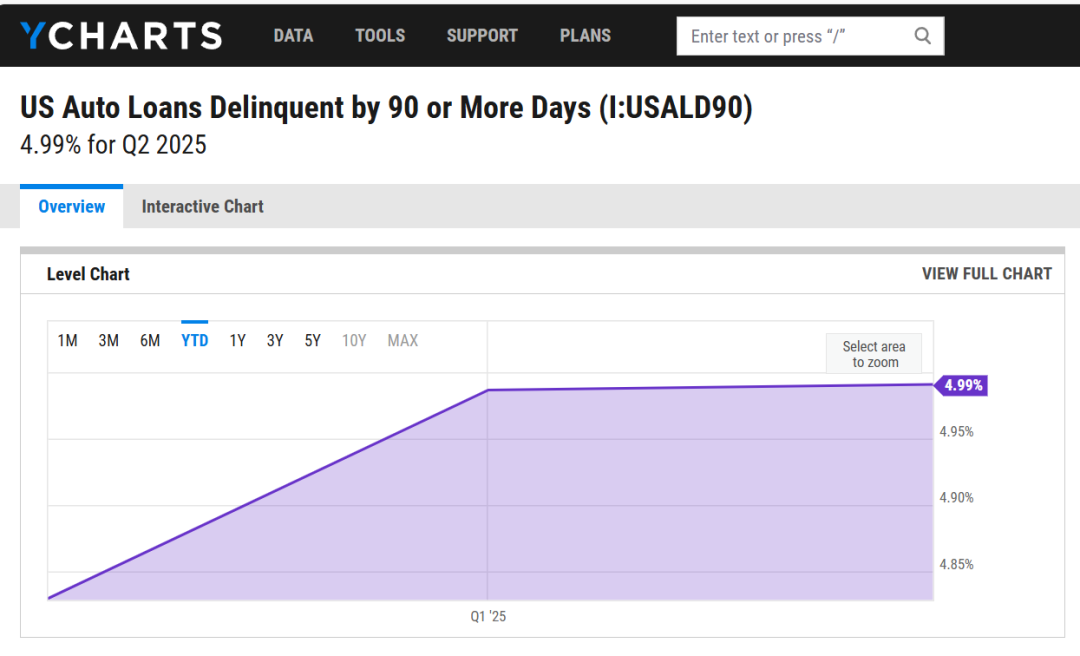

YCharts' report is even more alarming: 5% of the $1.5 trillion in auto loans have experienced severe delinquencies exceeding 90 days, marking a 10% increase over the past year.

Behind this significant rise in defaults are shifts in the US auto market.

Financialization of Auto Sales

Unlike the domestic market, the US auto market, located on the other side of the globe, does not face the same intense competition. Especially after the US vehicle fleet surpassed 283 million units, annual sales have consistently hovered around 15 million units in a mature market. This indicates that the US auto market does not necessitate excessive internal competition.

Without robust internal growth drivers, US auto finance policies appear less favorable compared to those in China. For instance, common financial incentives like three- or five-year interest-free loans in China are absent in the US. Instead, higher auto loan interest rates prevail. Statistics show that the average interest rate for new car loans in the US market was 6.7% in the first half of 2025, while used car loan rates soared to 11.9%.

Meanwhile, lending institutions offer widely varying interest rates based on borrowers' creditworthiness. US credit firms classify borrowers into five tiers based on credit ratings. Super-prime borrowers can secure loans with interest rates as low as 5.3%, while subprime borrowers face rates around 16%.

While it is a standard financial practice for credit institutions to manage risks through high-interest rates, the issue remains that even the lowest loan rates exceed 5%, which is relatively high for a consumer product like a car. Data indicates that the average interest rate for new car loans in the US market was 4.31% between 2019 and 2021.

Faced with rising interest rates, US consumers have had to make new choices. Unlike the maximum loan term of five years (60 months) in China, the US market allows loan terms of up to ten years (120 months). According to information released by the Federal Reserve, the median car loan term in the US exceeds 72 months.

When high interest rates are combined with long loan terms, US auto consumers end up paying significantly more. Data from statistical platforms shows that the average monthly payment for new car loans in the US has risen to $761, an increase of $300 from 2019. This means that purchasing the same new car model five years later would cost 35% more.

As car purchase costs rise, financial institutions have tightened and refined credit checks for borrowers. This is particularly true amid the increasing prevalence of auto loan ABS (asset-backed securities) and securitization. Rising default rates have led to an increase in non-performing assets, impacting the entire financial sector.

Behind this impact are the consequences of loose monetary policies introduced by the US Federal Reserve to stimulate the economy. During 2020-2021, these policies allowed many borrowers to secure auto loans at lower interest rates with extended loan terms, rapidly expanding the overall auto loan market.

As the Federal Reserve began tightening policies in 2022, market interest rates surged, further impacting the market. Many base-level consumers found themselves burdened with high debt, leading to a sharp decline in repayment capacity due to multiple overlapping debts. Statistics reveal that 1.73 million cars were repossessed due to debt in 2024, the highest number since the 2009 subprime mortgage crisis.

Behind this are abnormal changes in the US auto market.

Soaring Car Prices

The various issues plaguing US auto loans point to shifts in market supply and demand dynamics. Over the past five years, the average transaction price of cars in the US has continuously risen, reaching $50,000. The economic pressure on ordinary consumers to purchase a new car has significantly increased.

Especially due to global supply chain disruptions caused by the pandemic, new car transaction prices in the US market have risen by 35% compared to pre-pandemic levels, marking the fastest growth in the past decade.

When high car prices are combined with high interest rates and long loan terms, the result is a vulnerable borrower. Any risk could lead to loan defaults.

It can be said that resolving the US auto loan crisis in the long term requires addressing vehicle prices. Recalling the founding moment of Ford Motor Company, its purpose was to popularize car consumption and make cars affordable for more people. A century later, the US market has entered a new state. While car ownership per thousand people has surpassed 800 units, the average car ownership period has extended to 12.6 years.

This shift has led to increased pressure on new car sales. To maintain sales volumes or reduce inventory pressures, many dealers have lowered loan thresholds, incorporating subprime borrowers into the auto loan system. While this boosted sales in the short term, it increased the overall risk of auto loans.

According to reports, Tricolor Holdings, a lending institution targeting immigrants and individuals without credit histories, officially filed for bankruptcy last month. The company had over 100,000 outstanding loans that turned into bad debts.

Rising prices of new cars have further expanded the used car market. According to interviews, 80% of US consumers consider used cars when purchasing a vehicle due to economic considerations.

However, compared to new cars, used car loans carry higher risks, resulting in significantly higher interest rates for used car loans, which indirectly increases the cost for buyers.

This is why US and European automakers often promise to produce affordable vehicles. Under the current production scale, automakers find it difficult to control manufacturing costs at the source. On one hand, rising import tariffs on various materials have kept local car production costs high.

On the other hand, the trade protectionism pushed by the Trump administration has prevented automakers from manufacturing in regions with lower production costs, forcing them to accept high labor costs.

For automakers, when market demand declines, maintaining sufficient profits requires producing more expensive vehicles. This is especially true during periods of component shortages, such as the automotive chip supply crisis, when maintaining production of high-profit models becomes the norm.

This has led to a vicious cycle: declining demand forces automakers to produce higher-priced, higher-margin models, which in turn drives up car prices and further reduces market demand.

Under this vicious cycle, the US auto market can only reluctantly accept the gradual spiral of auto finance into systemic risk.

In contrast, the Chinese market has maintained a healthy auto finance system amid high car liquidity. According to statistics, the overall non-performing rate of domestic auto finance companies is merely 0.65%, and the cumulative default rate for auto loans stands at 0.47%, still considered high-quality credit.

It can be said that the surge in US auto loan default rates over the past decade reflects the decline of the US auto industry. From being a major player in car consumption and manufacturing, the US has now fallen into a situation where risks in the auto industry continue to escalate. While European and Japanese automakers have expressed intentions to increase investments in the US, these efforts remain insufficient to address the fundamental challenges facing the US auto manufacturing sector.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.

-END-