Who Do You Think Will Be Left Behind in the Electric Vehicle Boom?

![]() 10/31 2025

10/31 2025

![]() 522

522

Guide

Introduction

Without an independent new energy brand, automakers face a tough transformation and remain in a passive position.

Is the shift to new energy vehicles challenging? Absolutely, especially in today's increasingly diverse market. Automakers must not only understand consumer preferences but also create cost-effective vehicles based on their strengths. However, even when these conditions are met, the market may not respond as hoped, as the "new car effect" has faded.

For years, the "new car effect" served as a key indicator for automakers. Many models initially gained popularity and high sales shortly after launch, quickly becoming flagship products for their brands. But this is no longer the case, mainly because manufacturers are launching new models so rapidly that consumers barely have time to familiarize themselves with one before another competitor emerges.

In this environment, the importance of branding becomes clear. When relying on a single hit product can no longer drive long-term growth, automakers must focus on continuous brand building and establishing a strong presence in consumers' minds. This creates a foundation for future success.

However, a new challenge arises. During the transition from gasoline to electric vehicles, large automotive groups cannot rely solely on their traditional brands to lead the charge in the electric vehicle market; they must create a new new energy brand for this purpose. Many automakers recognize this need, but their biggest hurdle lies in execution.

The legacy of gasoline vehicles has become a burden, and the new new energy brand must start from scratch—a fact that makes many automakers hesitant. But the current market offers no room for indecision; only those groups willing to make a clean break can succeed.

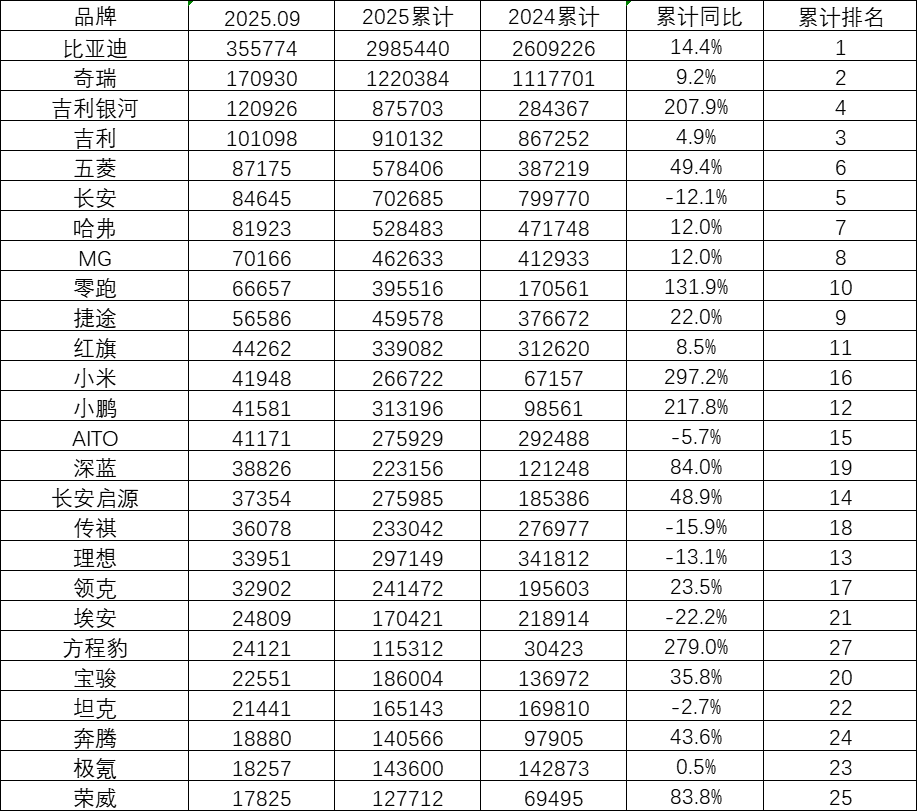

From brand performance in 2025, it is clear that companies like BYD, Geely Galaxy, and Changan Qiyuan, which have decisively separated their brands and fully committed to the new energy sector, have shown strong sales and growth momentum. In contrast, some traditional brands that have been slow to transform generally face sluggish growth or even declining sales.

01 Can Gasoline and Electric Vehicles Coexist Successfully?

Sales data provides the clearest evidence of the current market reality, showing increasing polarization. On one hand, brands like BYD, Geely Galaxy, and Changan Qiyuan have successfully broken through by embracing a clear new energy identity and undergoing decisive brand reconstruction.

On the other hand, numerous traditional brands long dependent on the gasoline vehicle market, such as Wuling, Haval, MG, Jetour, Hongqi, Baojun, Bestune, and Roewe, are struggling with an identity crisis. They hesitate between gasoline and electric vehicles, leading to consumer confusion and a steady decline in market share.

BYD, a well-known brand, has successfully tied its identity to new energy through its long-term focus on electric technology. With cumulative sales nearing 3 million units in 2025 and a 14.4% year-over-year increase, it firmly holds the top market position. Its success comes not only from technological advancement but also from establishing a clear image as a professional electric vehicle manufacturer in consumers' minds.

Geely Galaxy and Changan Qiyuan entered the market with entirely independent brand identities, avoiding confusion with their original gasoline brands. The former achieved a cumulative year-over-year growth rate of 207.9%, while the latter saw a 48.9% increase, proving the effectiveness of the new brand strategy and securing a place in the highly competitive market.

These success stories reveal a key pattern: Establishing a fresh and pure brand perception is more effective during the electrification transformation than trying to adapt existing gasoline brands. In contrast, traditional brands like Haval, MG, and Jetour face severe transformation challenges. The strong brand images they built during the gasoline vehicle era have become obstacles in the electrification era.

As a traditional leader in the SUV segment, Haval's image as a gasoline SUV expert is deeply ingrained. However, when the market shifted toward electric SUVs, consumers preferred brands "born electric." Haval's 12.0% growth primarily came from habitual purchases of gasoline vehicles, with little breakthrough in the pure electric segment.

This dilemma is also faced by brands like MG, Jetour, and Hongqi. Their vague positioning of selling both gasoline and electric vehicles rarely makes them a top choice for new energy consumers. The root issue lies in consumers' cognitive path dependency.

Once a brand establishes a strong perception in the gasoline vehicle sector, reversing it requires tremendous effort. More critically, the competitive landscape in the new energy vehicle market is solidifying. Leading brands are building increasingly high competitive barriers through scale effects and technological accumulation, narrowing the opportunity window for latecomers.

As consumers' perceptions of electric brands mature, it will become increasingly difficult for latecomers to change the market landscape. Traditional brands still hesitating between gasoline and electric vehicles must recognize the urgency of the situation. While the transformation road is difficult, the cost of inaction is far greater.

Of course, many have noticed that in the sales tables mentioned earlier, regardless of whether they are gasoline or electric vehicle brands, traditional or emerging, the vast majority have seen cumulative sales growth this year. So why claim that brands selling both gasoline and electric vehicles face transformation difficulties? Shouldn't they perform well in both segments?

One well-known reason is this year's automotive market stimulus policies, which have driven many automakers to act hastily. While these policies may have provided temporary relief, once the market returns to rationality, competition among automakers will revert to the most fundamental aspects: brand, product, marketing, channels...

02 Would a New Brand Name Be More Effective?

Given this trend, the new energy vehicle market this year has already begun to enter such a scenario. After all, when all automakers benefit from policy dividends, this external factor becomes a standard condition. Beyond that, competition among automakers reverts to the most basic operations.

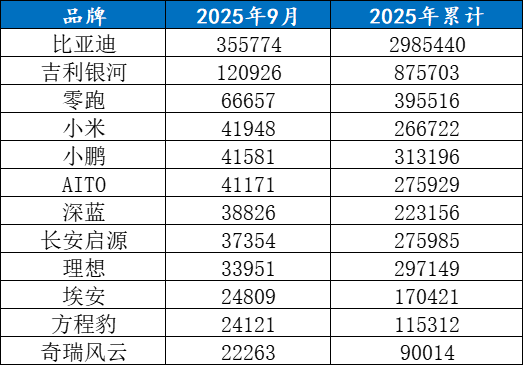

Analyzing September 2025 sales data, we can clearly observe three representative market phenomena: brands selling over 20,000 units monthly, those selling between 10,000-20,000 units, and those selling under 10,000 units. Notably, traditional giants' efforts to launch new brands appear weak, the mid-to-high-end segment faces false prosperity, and new energy breakthroughs remain generally difficult.

Starting with new energy brands launched by traditional manufacturers, if Geely Galaxy and Changan Qiyuan are considered proactive brands, then Chery Fengyun's situation appears delicate. Especially given Chery Automobile's popularity this year, the outside world pays close attention to whether Chery Fengyun can become a backbone force like Geely Galaxy or Changan Qiyuan.

Data shows Chery Fengyun sold 22,263 units in September, with a cumulative total just over 90,000 units—still slightly behind Changan Qiyuan, even with nearly 10,000 units sold by the Fengyun A9 in September. Thus, it is evident that other models under Chery Fengyun need to boost market sales.

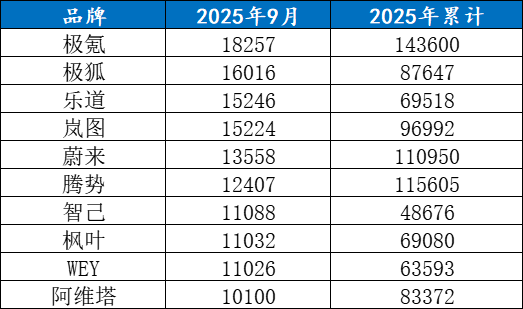

Now consider brands like Zeekr, VOYAH, NIO, and Denza, with monthly sales concentrated between 10,000-18,000 units. This segment seems like a high-end brand arena but is actually trapped in a low-level, mutually destructive competition. As many say, within a narrow price band and similar positioning, they engage in homogeneous competition.

When everyone's promotional rhetoric revolves around high-end intelligent electric vehicles, true brand differentiation and core competitiveness remain unestablished. Limited sales are divided among numerous brands, preventing any from achieving scale breakthroughs. This is essentially a no-win war of attrition, where their competition resembles vying for limited existing customers in a rapidly red oceanizing niche market rather than exploring new growth markets.

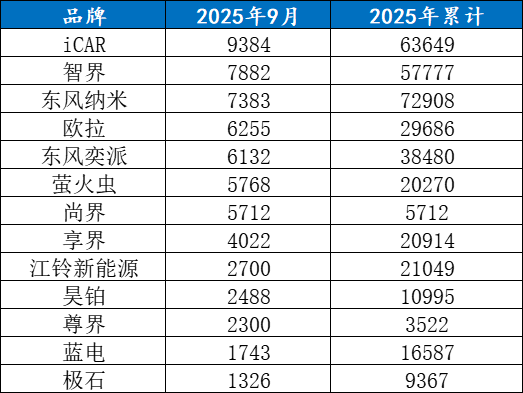

In fact, there are even more brands selling under 10,000 units monthly. After weaker gasoline vehicle brands are eliminated, the remaining are mostly new energy brands. This group includes numerous brands selling thousands of units monthly, some launched by powerful traditional automakers, such as Luxeed and eπ.

This reveals a harsh reality: In the new energy vehicle market, relying solely on a parent company's brand endorsement or a single technological highlight is insufficient for success. Even powerful backers cannot easily overturn the automotive industry's inherent laws. A weakness in any link can lead to mediocre market performance.

Regardless of whether they are oil-electric coexisting brands or pure new energy brands, as market consolidation accelerates, limited resources will increasingly concentrate toward leading brands. Unless these brands can identify highly precise differentiated niche markets and efficiently reach target users, their long-term survival prospects will be extremely bleak.

As the saying goes, the new energy vehicle market has bid farewell to being a blue ocean and entered a mature competitive stage governed by the Matthew effect, where the strong get stronger. At this stage, any strategic hesitation, positioning homogeneity, or disregard for market laws will be mercilessly amplified by the market.

Editor-in-Chief: Shi Jie Editor: He Zengrong

THE END