Maximum Tax Rate of 48.1%, EU's Tariff on "Made in China" Electric Vehicles to Take Effect

![]() 06/13 2024

06/13 2024

![]() 544

544

After more than half a year of negotiations, the EU's policy of imposing tariffs on Chinese electric vehicles is about to be implemented.

On June 12, the European Commission announced that, as part of an ongoing anti-subsidy investigation, it has reached a provisional conclusion that the Chinese electric vehicle industry benefits from unfair subsidies, causing harm to EU electric vehicle manufacturers, and has therefore disclosed in advance that it will impose temporary punitive tariffs on electric vehicles originating from China.

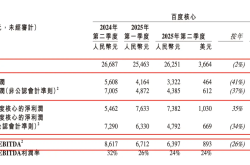

The European Commission announced that it will impose temporary countervailing duties on electric vehicles imported from China, with an average tax rate of 21% for companies cooperating with the EU, and a maximum tax rate of 38.1% for non-cooperating companies. This tax rate will be imposed on top of the previous 10% tax rate, reaching a maximum of 48.1%.

▍Imposition of Tariffs May Trigger Countermeasures

The European Commission stated that, according to procedure, if no effective solution can be reached with the Chinese government, this tariff policy will be implemented from July 4.

Among them, three sampled Chinese automakers, BYD, Geely, and SAIC Motor, will be taxed at 17.4%, 20%, and 38.1%, respectively. Other Chinese electric vehicle manufacturers that cooperate with the investigation but are not sampled will be taxed at a weighted average tariff rate of 21%, while other Chinese electric vehicle manufacturers that do not cooperate with the investigation will be taxed at 38.1%. The above tariff policies will be imposed on top of the existing tariff rate of 10%.

Image source: European Union

Before the official entry into force on July 4, China and the EU can still reach a solution through negotiations. After the implementation of the temporary tariff policy, if China and the EU still fail to properly resolve the tariff dispute within 4 months, the temporary tariff policy will be converted into a long-term tariff policy for a period of 5 years.

For Chinese electric vehicle manufacturers, the tariff rate imposed by the EU this time exceeds the 20% expected by the outside world. Even for BYD, which was given the lowest tax increase by the EU, its final figure also reaches 27.4%. SAIC Motor, which has the highest sales in Europe, will have to bear a total tax of 48.1%.

Sun Xiaohong, the Secretary-General of the Automobile Internationalization Professional Committee of the China Chamber of Commerce for Import and Export of Machinery and Electronic Products, told Auto Insight that the EU adopted data provided by enterprises or alternative data based on different degrees of cooperation, combined with other factors, and ultimately gave different tax rates that exceeded the industry average. In fact, from a practical perspective, the export of pure electric vehicles from China to the EU has not caused substantial damage to the local market or enterprises, and such tax rates may not be solely based on commercial considerations.

The China Association of Automobile Manufacturers also issued a statement, hoping that the European Commission will not regard the current staged phenomenon of vehicle trade in the industrial development as a long-term threat, nor politicize economic and trade issues, abuse trade remedy measures, and avoid damaging and distorting the global automotive industry supply chain, including the EU, to maintain a fair, non-discriminatory, and predictable market environment.

Unlike last year when the investigation was just announced, European media were generally concerned about cars imported from China. Before and after this announcement of the tax increase, most foreign media focused on the possibility that the EU's move would trigger countermeasures from China and its impact on the European automotive industry itself.

The EU's tariff increase has two main purposes. One is to promote the return of the automotive manufacturing industry to Europe and increase employment. The other is to prevent Chinese automakers from "occupying" the European market too quickly.

Although the European Commission insists on imposing tariffs, it does not mean that the EU has reached a consensus on this issue internally. On the 12th, the Norwegian Finance Minister explicitly stated that he does not support the European Commission's decision. In addition, Germany, Hungary, Sweden, and other countries have also expressed opposition.

Image source: BYD

Meanwhile, at a press conference on the evening of the 12th, the Chinese Ministry of Foreign Affairs expressed strong opposition, dissatisfaction, and high concern to the global media.

The Wall Street Journal reported that if the EU chooses to impose a 100% tariff on Chinese electric vehicles, as the US has done, China could easily retaliate by imposing counter-sanctions on more than 300,000 luxury cars imported from the EU each year. The Wall Street Journal said that this tariff policy may trigger Chinese countermeasures, which in turn may further cause a decline in sales of traditional luxury imported brands in China, affecting multiple multinational automakers.

Currently, relevant business staff from automakers such as SAIC, Geely, and NIO have all expressed to Auto Insight that they will actively respond to the EU's anti-subsidy tariff measures and take all legal and commercial measures when necessary to safeguard their legitimate rights and interests as well as the interests of global customers.

▍From "Made in China" to "Made in Foreign Countries"

The White House announced this May that the tariff rate on Chinese electric vehicles will be increased from 25% to 100%, and this measure will take effect on August 1.

Combined with the EU's tariff increase measures, it will significantly affect the layout of vehicle manufacturers in the EU. Sun Xiaohong said that the high tax rates and other restrictive measures in the European and American markets will have a comprehensive impact on Chinese automakers' overseas plant construction, and the key lies in the strategic planning of enterprises for overseas markets.

Image source: SAIC Motor

Local industry experts in Turkey said that due to the current pressure of the trade deficit, Turkey hopes that Chinese automakers will invest and build factories in Turkey. Turkish Minister of Industry and Technology Mustafa Varank revealed in May this year that they have been negotiating with some Chinese companies for a long time regarding investment in Turkey.

Meanwhile, Chinese automakers have not stopped investing in Europe. German news channel Deutsche Welle reported on the 12th that despite facing EU tariffs, many Chinese automakers still insist on their European business plans. The British Broadcasting Corporation reported on the 11th that BYD and NIO are currently building factories in Hungary; SAIC and Great Wall have also announced that their European factories are in the "site selection stage." Leapmotor will utilize the existing production capacity of its French-Italian partner Stellantis and choose the Tychy factory in Poland as its manufacturing base.

At the same time, Chinese battery companies including CATL and EVE Energy have also established production capacity in Europe, and the overseas expansion of China's new energy vehicle industry chain is accelerating. In addition, the production capacity deployed by Chinese automakers in Southeast Asia and other regions can also be exported to European and American markets. In this case, it also involves the localization of upstream supply chains such as power batteries in the region.

Moreover, according to a survey report from the EU Chamber of Commerce in China, electric vehicles exported from China to Europe account for only about 5% of total production, and most of the electric vehicles exported to Europe are European and American brands. The market share of Chinese local electric vehicle brands in the European market is actually not high. In recent years, European automakers such as BMW and Volkswagen have seen the huge market potential and supply chain advantages of China and have continuously increased their investment in China.

Image source: Brilliance BMW

Although most media did not mention the tax rate issue when joint venture automakers produced in China resell to Europe, the EU's preliminary ruling clearly stated in the table imposing a 21% tax rate on cooperating companies that European luxury brand vehicle manufacturers such as BMW and Tesla were also included in this category for their production and export activities in China. Judging from the current tax increase results, it is evident that the EU has not given more attention to the demands of countries within the alliance.

Sun Xiaohong mentioned that the development of automotive companies going overseas has been relatively normal in recent years, facing various challenges in the external environment, but adhering to long-termism and not engaging in unhealthy competition. "Correctly grasping the relationship between sales and service, strengthening the construction of market control capabilities, adapting to the international competitive environment, and enhancing the ability to respond to emergencies, I believe there is still room for export growth."

Edited by Yang Guo

Typeset by Yang Shuo