"The strictest" new vehicle and vessel tax policy will be implemented in July, and Hongguang MINI may have "no way to avoid"

![]() 06/13 2024

06/13 2024

![]() 472

472

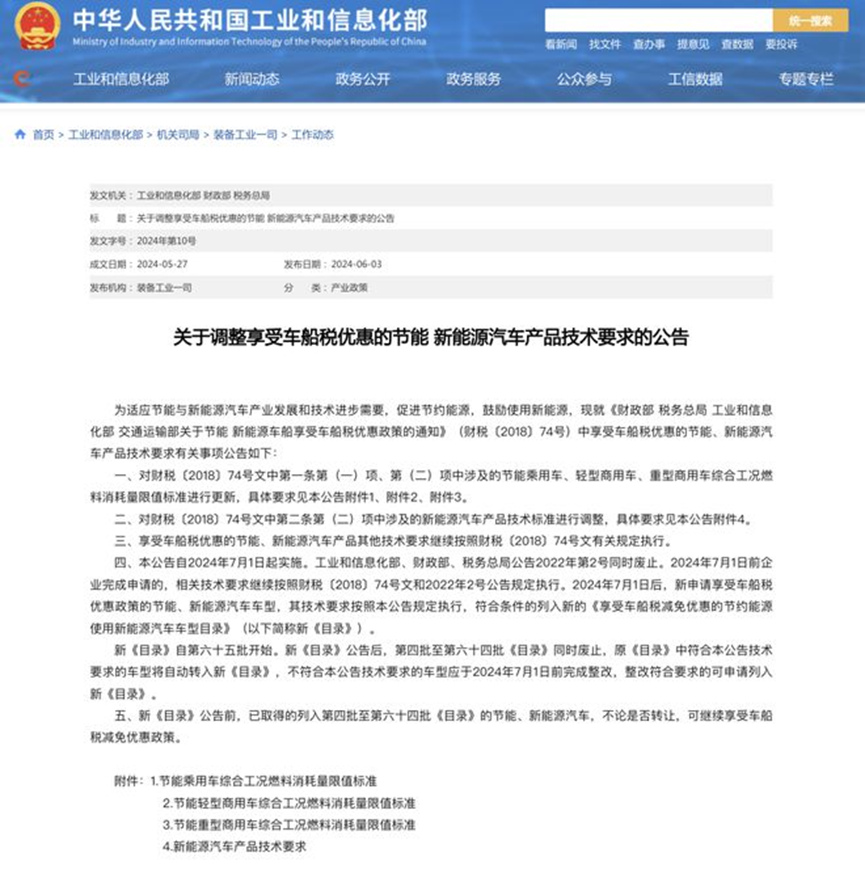

If your car is a traditional fuel vehicle, you will usually pay a vehicle and vessel tax along with your car insurance every year. However, if your car is a new energy vehicle, whether it's a pure electric vehicle, an extended-range vehicle, or a plug-in hybrid, there is a high probability that you will not need to pay this tax. But recently, the Ministry of Industry and Information Technology officially announced that the strictest new vehicle and vessel tax policy will be implemented on July 1.

According to the new regulations on vehicle and vessel taxes for automobiles, the tax-exempt condition for the pure electric driving range of plug-in hybrid and extended-range passenger vehicles has been raised to no less than 43 kilometers, while the driving range of pure electric buses (slow charging type) needs to be over 200 kilometers. As long as the driving range is below the specified standard, even new energy vehicles will need to pay the vehicle and vessel tax annually, which will无形之中increase the cost of ownership for some new energy vehicle owners who cannot enjoy tax exemptions.

New energy vehicles may start paying vehicle and vessel taxes

In order to promote the development of new energy vehicles in China, China has provided various policy incentives for pure electric vehicles and hybrid vehicles, including exemption from vehicle and vessel taxes. However, as the new energy vehicle industry gradually matures, relevant policies are also being gradually adjusted.

The new vehicle and vessel tax policy imposes higher requirements on tax exemptions for new energy vehicles. The pure electric driving range of plug-in hybrid and extended-range passenger vehicles should be no less than 43 kilometers, and the driving range of pure electric buses should not be less than 200 kilometers. The pure electric driving range of plug-in hybrid (including extended-range) buses should also reach 50 kilometers, while the driving range of pure electric trucks should reach at least 80 kilometers. These standards have significantly improved compared to previous ones, and some low-end plug-in hybrid models may need to start paying vehicle and vessel taxes during future annual inspections.

In addition to the requirements on pure electric driving range, the new policy also sets new regulations on the fuel consumption of plug-in hybrid and extended-range passenger vehicles under certain conditions of battery charge. Specifically, for models with a curb weight of less than 2510 kilograms, their fuel consumption should be 60% lower than that of traditional models; for models with a curb weight of 2510 kilograms or more, the fuel consumption needs to be 65% lower. This is a strict standard, and models that do not meet this standard will not be eligible for policy incentives. In short, plug-in hybrid and extended-range passenger vehicles need to be more energy-efficient than pure electric passenger vehicles to be eligible for tax exemptions.

Hydrogen fuel cell vehicles will be the most affected by the new policy, as their pure hydrogen driving range must exceed 300 kilometers to enjoy tax exemptions. Unfortunately, most hydrogen fuel cell vehicles on the market currently do not meet this standard. However, due to limitations in refueling, the market share of hydrogen fuel cell vehicles is not high.

The new regulations will make "old and broken" vehicles nowhere to hide

It is worth noting that the implementation of the new policy will not be achieved overnight. Currently, the official has not provided clear information on the tax rates for new energy vehicles. Starting from July 1 this year, only models that newly apply for vehicle and vessel tax incentives will need to comply with the new policy requirements. Models that have already been included in the preferential directory before that date can still continue to enjoy the original tax incentives. This transitional arrangement undoubtedly gives the market and automakers some time to adapt and adjust.

In other words, even if a new energy vehicle does not meet the new regulations, as long as it is registered and licensed before July 1, it can still continue to enjoy vehicle and vessel tax exemptions. For example, previous mini electric vehicles such as the Wuling Hongguang MINI EV, Geely Panda MINI EV, and Chery QQ Ice Cream, although their driving range does not meet the 200-kilometer standard, as long as they are registered and licensed before July 1, they will not need to pay vehicle and vessel taxes throughout their entire usage cycle.

The new vehicle and vessel tax policy plays an important role in promoting the development of new energy vehicles. By setting higher standards for new energy vehicles, the new policy not only promotes technological innovation but also guides the healthy development of the market. This policy adjustment will further compress the survival space of low-end new energy vehicles, forcing automakers to increase their investment in research and development of new energy vehicle technologies to enhance product performance and quality.

The implementation of the new policy means that only new energy vehicles that meet certain technical standards will be eligible for tax incentives. This will undoubtedly encourage automakers to continuously improve the driving range and reduce energy consumption of new energy vehicles to meet or even exceed policy requirements. Such technological progress will not only help enhance the market competitiveness of new energy vehicles but also eliminate many poorly made "old and broken" new energy vehicles from the market.

Some industry experts believe that the implementation of the new vehicle and vessel tax policy will have a profound impact on the new energy vehicle industry. It will not only accelerate the elimination of low-end new energy vehicles but also push the entire industry towards higher technical standards and better product experiences. This is undoubtedly a major benefit for the development of the new energy vehicle industry and will also help achieve the goal of green and sustainable transportation.