Tongbao Optoelectronics Hits Record Low Gross Margin: Over 90% Dependence on SAIC-GM-Wuling, Patents Purchased for RMB 40,000

![]() 11/13 2025

11/13 2025

![]() 549

549

Harbor Business Observation, by Zifu Shi and Lu Wang

On November 13, Changzhou Tongbao Optoelectronics Co., Ltd. (hereinafter referred to as Tongbao Optoelectronics) will undergo its debut listing hearing on the Beijing Stock Exchange, marking a critical juncture for its IPO.

In late April this year, Tongbao Optoelectronics officially submitted its prospectus, with Soochow Securities serving as the sponsor. Over the past six months, the company has undergone two rounds of review inquiries and provided responses.

According to the prospectus and Tianyancha, Tongbao Optoelectronics was established in November 1991. Positioned as a manufacturer of automotive electronic components, its main business includes the R&D, production, and sales of automotive electronic components such as automotive lighting systems, electronic control systems, and energy management systems.

1

Slowing Net Profit Growth, Record Low Gross Margin

The company uses automotive lighting systems as its cornerstone business and has long served renowned automotive OEMs and component manufacturers. Its automotive lighting products have been applied in multiple popular models from automotive brands including SAIC-GM-Wuling, GAC Aion, GAC Trumpchi, Dongfeng Nissan, and SAIC Volkswagen.

In terms of financial data, from 2022 to 2024 and the first half of this year (the reporting period), the company achieved revenues of RMB 390 million, RMB 529 million, RMB 588 million, and RMB 329 million, respectively, showing a sustained growth trend, with a compound annual growth rate (CAGR) of 22.81% from 2022 to 2024. Among them, the main business accounted for 99.02%, 99.62%, 99.36%, and 99.70% of the revenue, respectively, with automotive lighting systems contributing over 80% of the revenue.

During the same period, the company's net profits were RMB 36.6929 million, RMB 62.2485 million, RMB 83.0935 million, and RMB 33.4505 million, respectively, with a CAGR of 22.81% from 2022 to 2024.

From January to September 2025, the company achieved revenue of RMB 488 million, a year-on-year increase of 30.51%. Net profit attributable to shareholders of the parent company was RMB 51.7902 million, a year-on-year increase of 5.41%. Net profit attributable to shareholders of the parent company after deducting non-recurring items was RMB 51.2359 million, a year-on-year increase of 6.62%.

Tongbao Optoelectronics stated that from January to September 2025, the company's revenue scale increased significantly, while net profit levels grew slightly. The revenue growth rate was higher than the net profit growth rate, mainly due to the company's expansion of its subsidiary Guangxi Tongbao and the new product business of charging and power distribution assemblies based on long-term strategic considerations. The subsidiary Guangxi Tongbao has not yet commenced mass production, and fixed costs such as depreciation of right-of-use assets, depreciation of fixed assets for newly built production lines, and lease liabilities were relatively high in the early stages, resulting in periodic losses for the subsidiary. The new product, charging and power distribution assemblies, was still undergoing cost optimization and capacity ramp-up from January to September 2025, with a temporarily negative gross margin that is gradually turning positive.

Based on current order conditions, operational status, and market environment, the company expects to achieve revenue of approximately RMB 680 million to RMB 780 million in 2025, representing a year-on-year change of 15.69% to 32.70%. It anticipates net profit attributable to shareholders of the parent company of RMB 79 million to RMB 89 million, representing a year-on-year change of -4.93% to 7.11%. Net profit attributable to shareholders of the parent company after deducting non-recurring items is expected to be RMB 76 million to RMB 86 million, representing a year-on-year change of -6.29% to 6.04%.

Clearly, the company's revenue has maintained double-digit growth this year, while net profit growth has slowed sharply. Meanwhile, Tongbao Optoelectronics' gross margin has also come under pressure, with figures of 21.46%, 22.43%, 24.07%, and 20.43% during the period. In other words, the company's gross margin has decreased by 3.64 percentage points over six months.

The company stated that changes in gross margin are mainly influenced by factors such as changes in the sales mix of various products, cost-reduction measures, and pricing strategies. The gross margin level and changes align with the company's business operations.

Some IPO observers believe that although the company's revenue has maintained good growth, the slowing net profit growth and poor gross margin performance indicate that the company may be be caught in (Note: ' be caught in ' is Chinese for 'falling into' and has been kept as is for context, but should ideally be translated or replaced in final English text if not part of a direct quote) a state of 'increasing revenue without increasing profit.' Investors are also concerned that the company's performance may deteriorate after listing.

2

Over 90% Dependence on SAIC-GM-Wuling

Tongbao Optoelectronics has faced external question (Note: ' question ' is Chinese for 'doubts' and has been kept as is for context, but should ideally be translated or replaced in final English text if not part of a direct quote) regarding its reliance on its top five customers, particularly its heavy dependence on its largest customer, which may pose risks in the future.

During the reporting period, sales revenue from the company's top five customers accounted for 94.65%, 98.42%, 96.57%, and 99.11% of the total revenue, respectively. Among them, SAIC-GM-Wuling, the largest customer, accounted for 66.83%, 63.99%, 83.35%, and 93.45%, respectively. The company's business is, to a certain extent, dependent on SAIC-GM-Wuling.

Currently, the company's cooperation with SAIC-GM-Wuling continues to expand, but its existing production capacity remains limited. Expanding to other customers requires going through essential processes such as supplier system audits, project negotiations, design and development, and mass production. Given these factors, the current situation of high customer concentration is expected to persist for some time.

The company admitted that if, in the future, its competitiveness in terms of products and services declines, leading to adverse changes in the stability of its cooperation with SAIC-GM-Wuling, or if it encounters difficulties in upgrading product tiers in areas such as headlamp assemblies and charging and power distribution assemblies, or if SAIC-GM-Wuling reduces its product purchases from the company due to its own operational deterioration, and the company fails to promptly expand to other new customers and products, it will adversely affect the company's operating performance.

The review inquiry letter pointed out that according to SAIC Motor's annual reports, SAIC-GM-Wuling's capacity utilization rates from 2022 to 2024 were 90%, 80%, and 77%, respectively. Its sales revenues were RMB 81.138 billion, RMB 76.009 billion, and RMB 77.934 billion, respectively. Production volumes decreased by 5.07%, 11.51%, and 3.71% year-on-year, while sales volumes decreased by 3.62%, 12.31%, and 4.49% year-on-year. Inventory levels changed by -38.5%, 5.42%, and 54.28% year-on-year.

In other words, despite the lackluster performance of its largest customer, Tongbao Optoelectronics' revenue increased by 57%, 36%, and 11% year-on-year from 2022 to 2024, respectively, raising market question (Note: same as above).

3

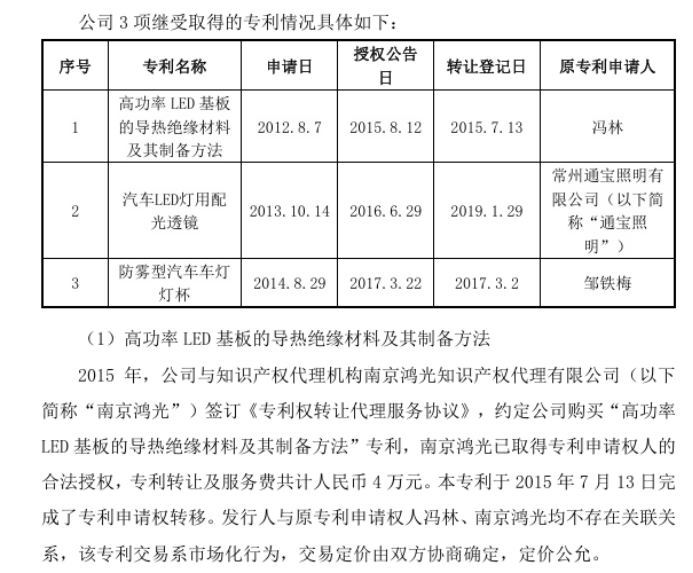

Doubtful Value of Patents Purchased for Over RMB 40,000, R&D Expenditure Ratio Lags Behind Peers

Furthermore, according to the response to the first round of review inquiries, among the company's 18 invention patents, three were purchased. The invention patent 'Thermally Conductive Insulating Material for High-Power LED Substrates and Its Preparation Method' was purchased by Tongbao Optoelectronics through the intellectual property agency Nanjing Hongguang, with a total patent transfer and service fee of RMB 40,000. The invention patent 'Anti-Fog Automobile Headlamp Cup' was purchased by Tongbao Optoelectronics through the intellectual property agency Changzhou Pengbo, with a total patent transfer fee of RMB 45,000.

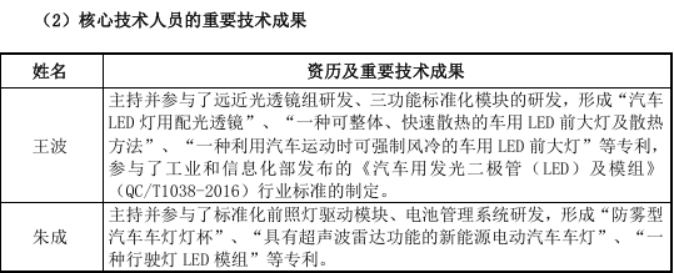

In the prospectus, the company stated that both 'Light Distribution Lens for Automotive LED Lamps' and 'Anti-Fog Automobile Headlamp Cup' were acquired through assignment. However, in the introduction of important technical achievements by core technical personnel, they are listed as proprietary patents with company participation.

The aforementioned IPO observer believes that while it is generally normal for companies to purchase patents, information disclosure must not be misleading.

As of the end of the reporting period, the company had obtained a total of 79 patents, including 18 invention patents. It led the drafting of the industry standard 'Automotive Light-Emitting Diodes (LEDs) and Modules' (QC/T1038-2016).

During each period of the reporting period, the company's R&D expenses were RMB 13.3833 million, RMB 20.1309 million, RMB 23.8602 million, and RMB 12.0149 million, respectively. The R&D expenditure ratios were 3.43%, 3.80%, 4.06%, and 3.65%, respectively, mainly consisting of employee salaries, material costs, and depreciation.

During the same period, the average R&D expenditure ratios of comparable companies in the same industry were 7.31%, 6.59%, 5.42%, and 5.50%, respectively. Tongbao Optoelectronics lagged behind the industry average in all periods.

In terms of compliance, on June 26, 2024, Tongbao Optoelectronics announced that it had received an administrative regulatory measures decision from the Jiangsu Regulatory Bureau. The company had made errors in the accounting methods for certain business revenues and inaccurate calculations of finished goods inventory depreciation reserves during the accounting process, leading to misstatements in items such as revenue, operating costs, asset impairment losses, and net profit. This resulted in inaccurate information disclosures in the company's 2021 annual report, 2022 annual report, and 2023 semi-annual report. The Jiangsu Securities Regulatory Bureau decided to issue a warning letter to the company as an administrative regulatory measure and record it in the securities and futures market integrity archives. Administrative regulatory measures, including regulatory talks, were taken against Liu Guoxue, the company's chairman, Liu Wei, the general manager, and Wu Yan, the financial officer.

For this IPO, the company plans to raise RMB 330 million, all of which will be used for projects involving intelligent LED modules for new energy vehicles, charging and power distribution systems, and control modules.

Tongbao Optoelectronics also exhibits a pronounced family-style management. As of the signing date of the prospectus, Liu Wei, Liu Guoxue, and Tao Jianfang collectively held 78.75% of the company's shares directly. Liu Guoxue and Tao Jianfang are spouses, and Liu Wei is their son. Liu Guoxue serves as the company's chairman, Liu Wei as the vice chairman and general manager, and Tao Jianfang as a director, collectively exerting significant influence on the company's daily operations. (Produced by Harbor Finance)