ByteDance's Push: Can Tencent Music Remain 'Niche yet Beautiful?'

![]() 11/13 2025

11/13 2025

![]() 501

501

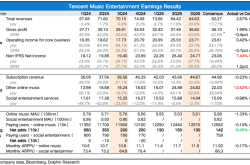

On November 12th, Beijing time, after the market close of Hong Kong stocks and before the opening of U.S. stocks, Tencent Music (TME.N; 1698.HK) released its financial report for the third quarter of 2025. Overall, it exceeded expectations, especially with the partial unfolding of the second growth curve narrative.

However, there were flaws—namely, the continued slowdown in subscription net growth, indirectly confirming market concerns about intensified competition ahead of the report. Currently, there is still a notable difference between Tencent Music's core users and ByteDance's (Tencent Music vs. ByteDance = high-tier music essential users vs. sink [lower-tier] Douyin viral song users), providing Tencent Music some time for adjustment and consolidation. How will they respond specifically? Stay tuned for insights from the upcoming earnings call.

Let's dive into the financial report:

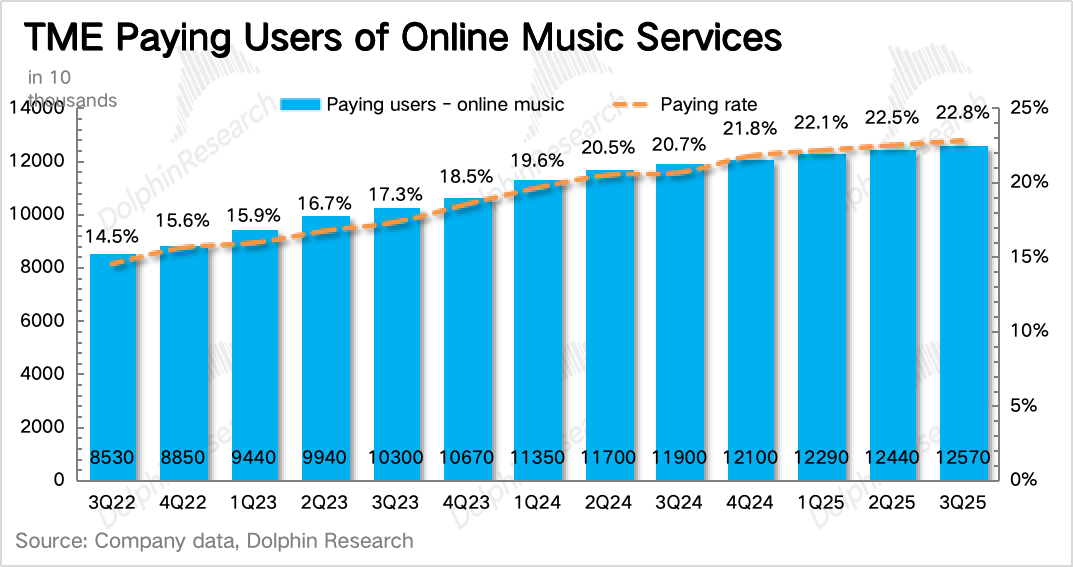

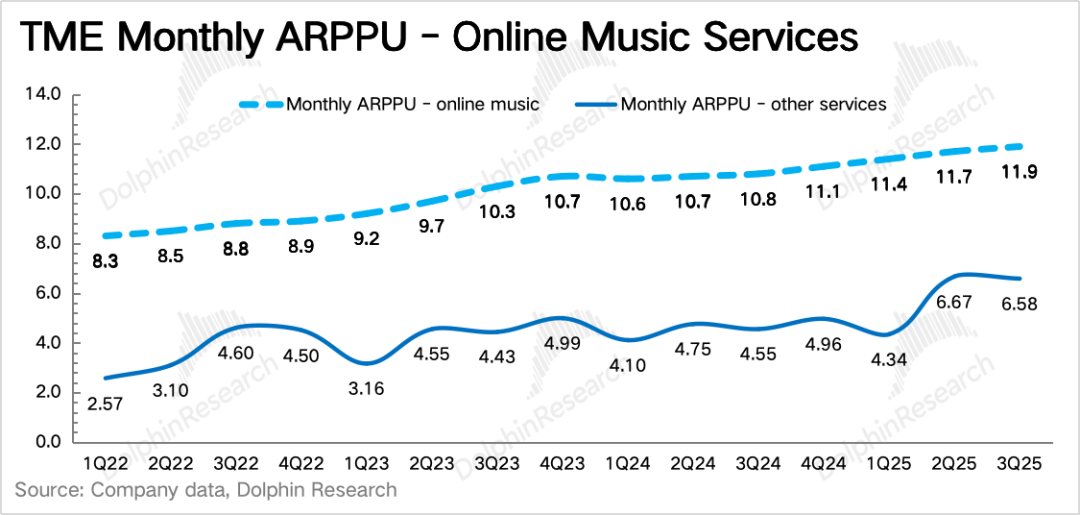

1. Can the steady growth in subscriptions be sustained? In Q3, subscription revenue grew by 16%, with a net increase of 1.3 million subscribers and an average revenue per user (ARPU) of RMB 11.9/month. Growth drivers shifted further from 'volume' (+6%) to 'price' (+10%).

This reflects one of the core growth drivers—SVIP (Super VIP) penetration, which drives user premium payments by enriching membership benefits (content, features). This growth logic is sound. As previously mentioned by Dolphin Research, when competition is stable, whether driven by volume or price, the company holds the initiative and can adjust flexibly across seasons.

However, the persistent decline in new subscriptions still reflects issues of ecosystem saturation or even attrition, fundamentally driven by competition. This was a key reason for Tencent Music's stock price adjustment before the report, as stable subscription revenue growth (long-term 10%-15%) is crucial for supporting a 20x PE valuation in the long run. With significant moves by ByteDance in Q3, attention should be paid to management's views on competition and countermeasures during the earnings call.

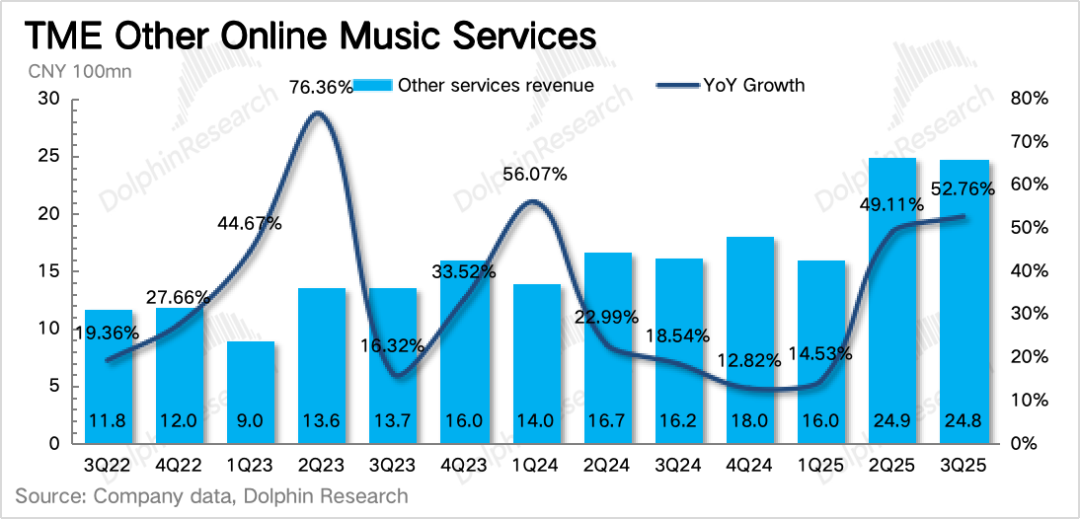

2. Is the second growth curve taking shape? Other music-related revenue exceeded expectations again in Q3, accelerating by 53%, primarily driven by offline concert ticket sales and merchandise from multiple artists. Additionally, advertising, album sales, and the June launch of Bubble likely contributed significantly.

Expanding value coverage along the music industry chain, both upstream and downstream, is Tencent Music's main strategy. IP derivatives, including concerts, albums, and fan economy initiatives, are key focuses and represent Tencent Music's second growth curve beyond subscription services.

3. Social entertainment continues to recover: Revenue from live streaming, karaoke, etc., declined by 3% in Q3, with the sequential decline trend slowing further, pointing to a potential gradual return to positive growth. However, given regulatory and industry downturn trends, this segment is no longer a priority, with stability as the main goal. Profit margins can be boosted by reducing revenue sharing.

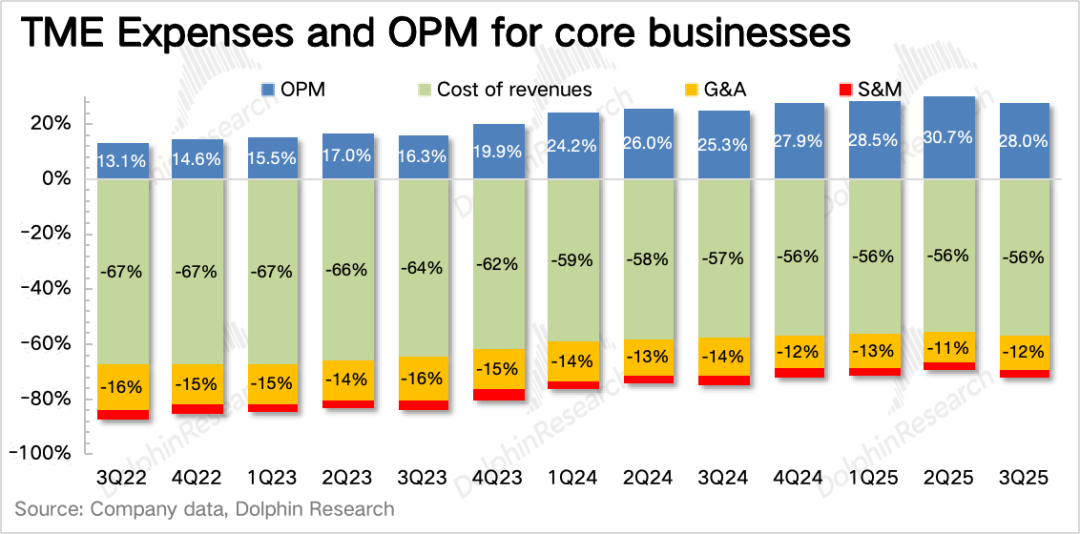

4. Slowing profit margin improvement? After three years of restrained operating expenses, this quarter saw a 'resurgence.' However, overall growth remains low at 8% YoY. The increase is mainly driven by administrative expenses (including R&D). Dolphin Research believes this reflects Tencent's strong desire for a second growth curve, manifesting in recruitment and expansion spending.

Ultimately, while operating profit from the core business still grew by 34% YoY, profit margins ceased improving and instead declined by 2 percentage points sequentially. Adjusted profit reached RMB 2.48 billion, slightly exceeding market expectations.

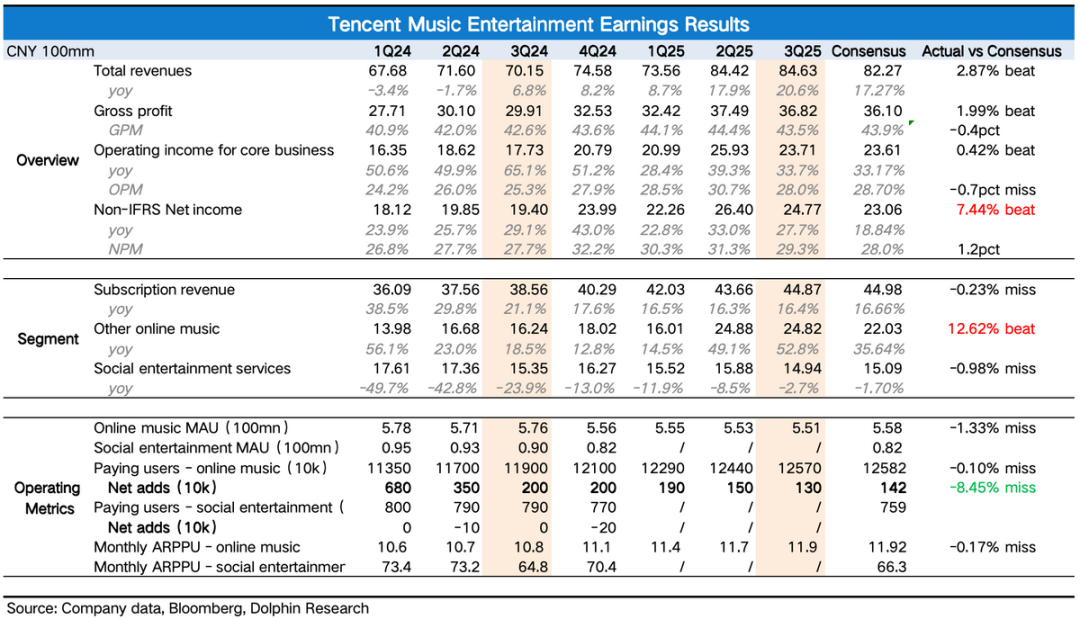

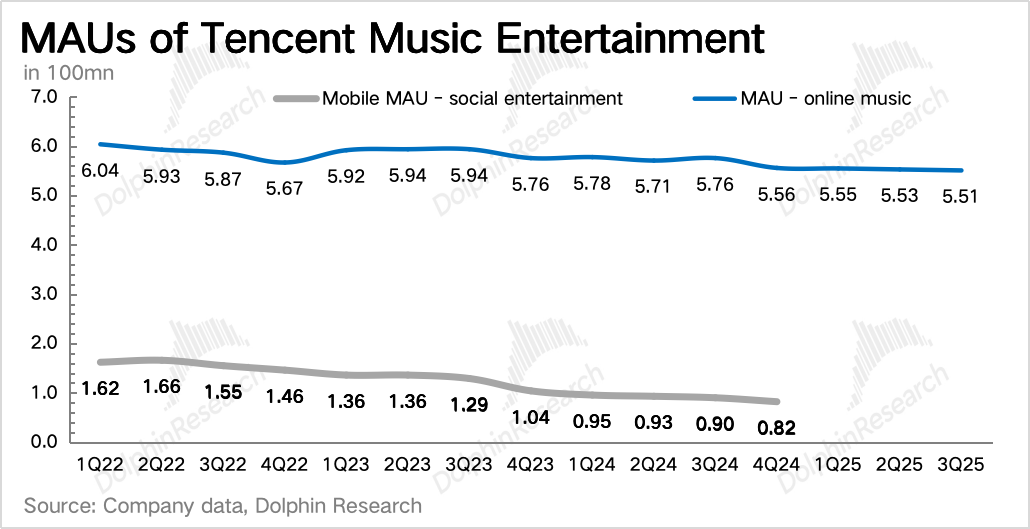

5. Will long-form audio break out of the current ecosystem? Finally, let's examine the user base. In Q3, MAU reached 551 million, a sequential decline of 2 million users. Qishui Music (ByteDance's music app) continued its counter-trend growth, particularly accelerating in Q3. By the end of Q3, its MAU surpassed 120 million (source: QM). While average user duration lags behind Tencent Music's platforms, it now aligns with Cloud Music and continues to rise slowly.

6. Cash remains abundant: As of the end of Q3, Tencent Music held RMB 22.3 billion in net cash (cash + short-term investments - long/short-term interest-bearing debt), equivalent to $3.2 billion. The $1 billion share repurchase program announced in March saw no new disclosures in Q3.

7. Detailed financial data overview

Dolphin Research's Perspective

After Q2 earnings, Tencent Music's market cap peaked at $41 billion within a month before declining, dropping 20% by yesterday's close, with skepticism resurfacing. 'Industry growth saturation' and 'marginal changes in competitive dynamics' are the primary controversies, with the latter—competitive shifts—being the core trigger for the recent month-long adjustment.

1. Industry growth concerns: Not a priority currently. This is a recurring issue tied to consumer downgrades, peaking in mid-2024. The catalyst was Tencent Music lowering its Q3-Q4 paid subscription net growth guidance, with net additions falling from 3-5 million per quarter (excluding Q1's promotional spike to 6.8 million) to 1-2 million.

Meanwhile, ARPPU growth slowed to low single digits, indicating that even with moderated 'price hikes,' paid user growth did not accelerate.

The leader faces this; the runner-up (Cloud Music) does too. While Cloud Music stopped disclosing operational data last year, third-party data (QM) shows stalled MAU growth, coupled with simultaneous price hikes and slowing subscription revenue growth, suggesting Cloud Music has also exhausted its easiest monetization phase and is now seeking a second growth curve like Tencent Music.

Similarly, after peaking post-Q2 earnings, Cloud Music's stock corrected by 30%. Beyond liquidity and exchange market differences, Cloud Music's decline may stem more from competition, our next point.

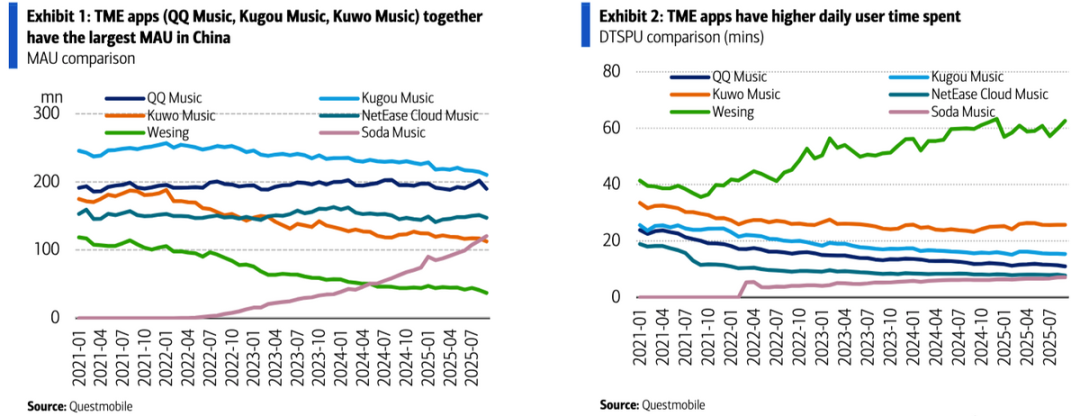

2. Marginal changes in competitive dynamics: Concerns rise. In our Q4 2024 review earlier this year, we highlighted competition as a key focus for music streaming in 2024. Why? QM data showed Qishui Music reaching 90 million users by early 2024, accumulating this base in just three years.

On a half-year basis, net additions accelerated significantly in 2024, particularly from H2 2023 to H2 2024, with a 50% sequential growth rate.

Generally, for platform businesses, reaching 50 million DAU signifies ecosystem stability and long-term monetization potential. With Douyin referral traffic, Qishui Music achieves 30% DAU/MAU engagement, implying 50 million DAU corresponds to 150 million MAU.

Our initial assumption was that if net additions maintained this growth trajectory (50% sequential), Qishui Music could add 70 million users in H1 2025, reaching the milestone. Further investment and Douyin referral traffic could even see its scale surpass Cloud Music by year-end.

In reality, Qishui Music added only 25 million users in H1 2025, slightly easing competition concerns. However, user growth surged again in August-September, with over 20 million net additions in Q3 alone.

Dolphin Research attributes this acceleration to increased marketing spend, Douyin exposure referrals, and collaboration with Jay Chou (who joined Douyin in July, granting MV rights to the platform).

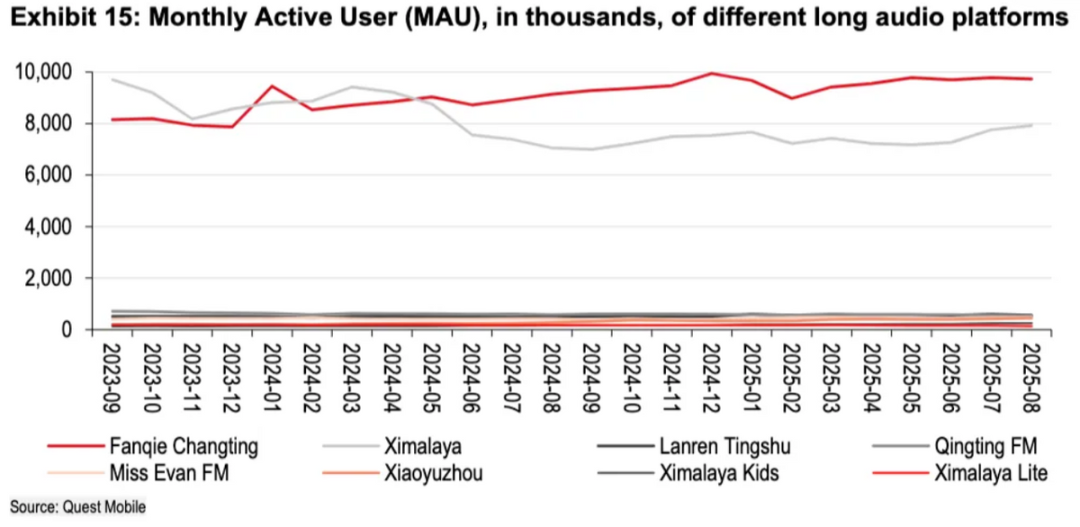

On November 7th, ByteDance launched 'Tomato Music,' a standalone app spun off from its 'Tomato Audiobook' platform. Like all ByteDance apps, it emphasizes free access.

The difference between 'Tomato Music' and 'Qishui Music' lies in their core user demographics. Qishui Music targets young users (18-35 years old, 47% students, with audiences for Douyin viral songs and niche music as key segments). In contrast, 'Tomato Music' appears to focus on middle-aged and elderly users, featuring older songs and a mix of short dramas and audiobooks.

In other words, ByteDance is leveraging its app factory model and Douyin's traffic engine to attack competitors on multiple fronts:

1) Qishui Music vs. Cloud Music: Qishui Music avoids direct competition in licensed music (where Cloud Music holds an edge) by capitalizing on Douyin's viral song advantage, signing niche artists and composers. This not only cuts costs but also deepens industry chain integration.

This strategy resembles Cloud Music's strength in independent artists and niche recommendations. Both platforms also overlap significantly in their student-dominated user bases. Thus, Cloud Music is likely to feel Qishui Music's impact first.

2) Tomato Music vs. Tencent Music: Tomato Music emphasizes licensed oldies, overlapping partially with Tencent Music's Chinese classic song library. While Tomato Music has a disadvantage in catalog size (e.g., Tencent Music's strength in K-pop), Tencent Music is not without risks.

At the very least, ByteDance's low-price advantage could hinder Tencent Music's efforts to boost paid conversions and 'price hikes.' Additionally, ByteDance is penetrating Tencent Music's missing lower-tier market MAU segment.

Overall, while industry growth concerns remain unproven in the short term (despite macroeconomic impacts on consumer spending), there is still room to improve paid rates and ARPPU by bundling more content and enhancing membership benefits for core users.

However, competition warrants attention. With ByteDance now active, further disruptions are likely. We advise monitoring developments while acknowledging persistent differences in core user spending habits. Thus, while long-term impacts should not be underestimated, short-term effects may be overstated.

Currently, Tencent Music is pursuing three new growth narratives—SVIP, fan economy, and long-form audio. In Q3, the first two progressed steadily. SVIP drove higher monetization of core users, while fan economy-driven revenue accelerated.

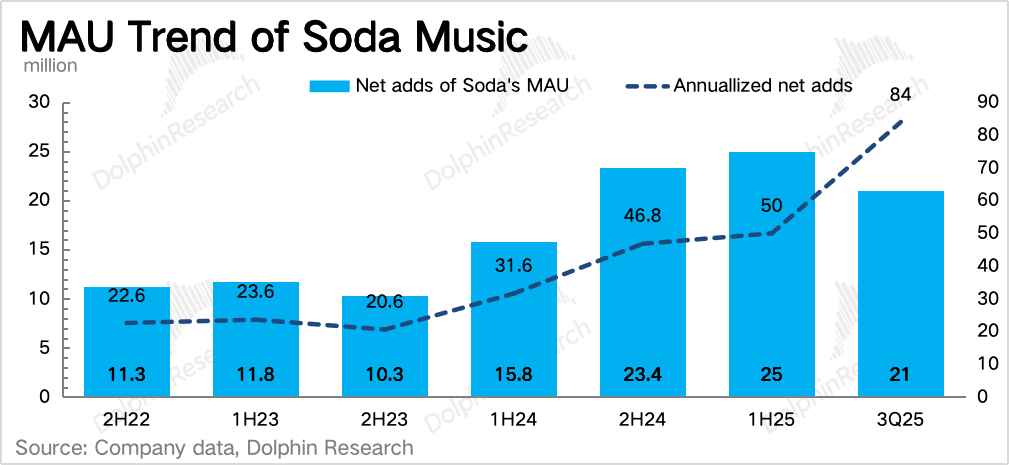

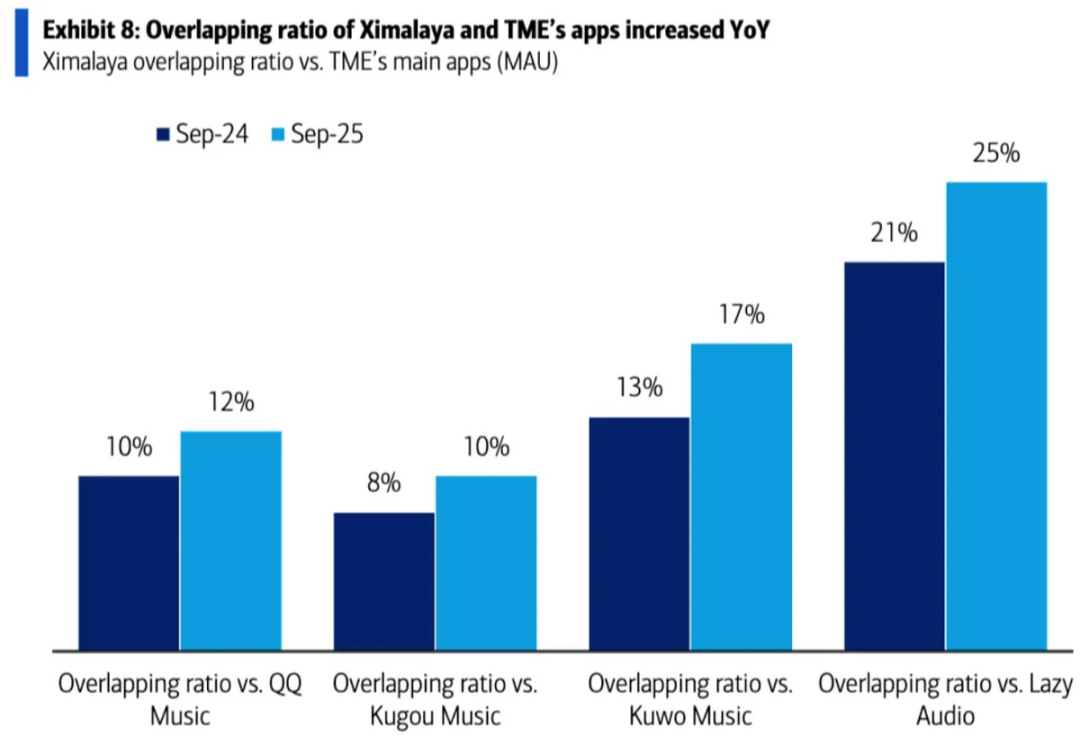

Competition may slightly disrupt SVIP penetration but is unlikely to affect fan economy initiatives due to differing industry strategies and commercial goals. For long-form audio, Ximalaya's acquisition (pending regulatory approval) could bring incremental users despite its current lower user overlap (10%-15%) with Tencent Music.

Given regulatory and integration uncertainties, market expectations do not yet factor in this potential. For a detailed valuation analysis of Tencent Music, refer to the same name [same-titled] article in the 'Insights' section of the Longbridge App.

Detailed Analysis Below

I. User Ecosystem: MAU Decline Continues, Paid Net Growth Slows

In Q3, MAU declined by 2 million to 551 million. Paid music subscribers grew by 1.3 million to 126 million, with a 22.8% paid rate (slightly higher sequentially). However, as MAU trends downward, the paid rate increase reflects the loss of non-core users, rendering isolated paid rate comparisons less meaningful.

Within the industry, ecosystem attrition is more pronounced. Meanwhile, Qishui Music defied trends with accelerated growth in Q3, reaching 120 million users by late September. While these are primarily new, referred users, their average daily engagement remains low but now aligns with Cloud Music.

II. Online Music: Subscription Concerns Persist, Second Growth Curve Emerges

1. Subscriptions: SVIP Penetration is Key, Ecosystem Expansion Matters

Q3 subscription revenue grew by 16%, with 1.3 million net subscriber additions and an ARPU of RMB 11.9/month. Growth shifted from 'volume' (+6%) to 'price' (+10%), driven by SVIP penetration (15 million users, or 12% of total subscribers, last quarter; estimated at 13% this quarter, pending confirmation).

As a revenue pillar, stable subscription growth (long-term 12%-15%) is critical for sustaining a 20x PE valuation. However, if Q3's sequential 'price hikes' persist, ARPPU growth could slow to 5%-10% next year, limiting overall subscription revenue growth to around 10%.

This growth contradiction reflects ecosystem saturation or attrition, fundamentally driven by competition. Potential remedies include refining products to enhance user experience (as Spotify did against competitor platforms) or anticipating user growth from a potential Himalaya merger. With only 10%-15% user overlap between the platforms, bundling opportunities (e.g., adding RMB 1-2 premiums to existing memberships) could easily boost paid conversions.

2. Other Music Services: Increasingly Significant Growth Contribution

In the third quarter, other music services experienced an unexpected acceleration in growth, increasing by 53% to reach 2.5 billion, accounting for 30% of total revenue.

This segment includes advertising, digital album sales, copyright sublicensing, value-added services, etc. The growth in the third quarter was primarily driven by the staging of offline concerts by multiple artists. This falls under the category of IP-derived peripheral businesses centered around monetizing fan value. Although the audience size is much smaller than that of core music consumers, the value per individual is very high. The spending power of core Chinese users in this area is comparable to that in Europe and the United States.

3. Social Entertainment: Continued Recovery, Stability Expected Moving Forward

Revenue in the third quarter declined by 3%, with the sequential decline continuing to slow, indicating a potential gradual return to positive growth. However, this segment is subject to regulatory and industry downturn trends, and thus will not be a focal point in the future. The priority will be on maintaining stability, but comprehensive gross margins can be boosted by reducing revenue shares.

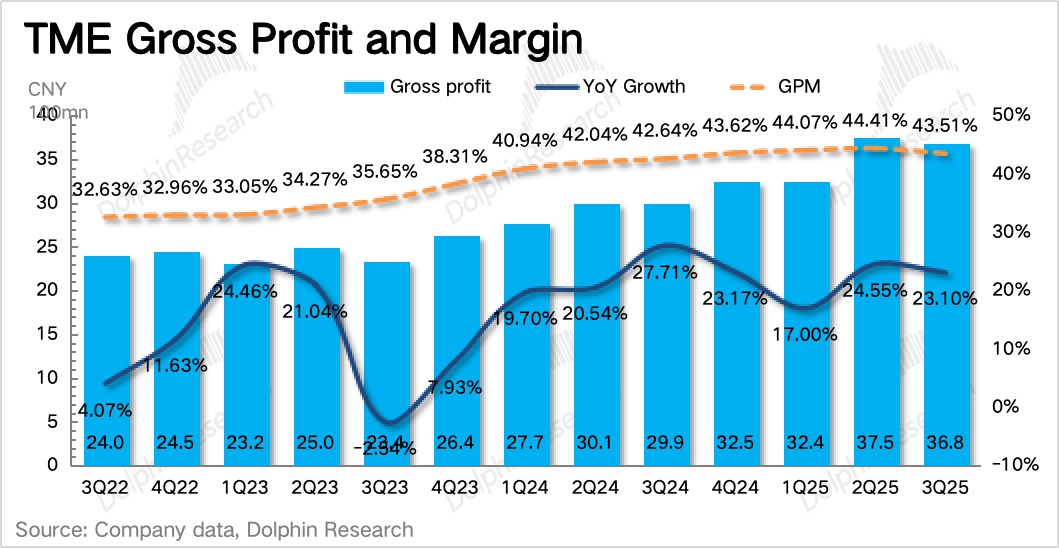

III. Profit: Profitability Improvement Paused, Investment in New Growth Avenues More Critical

Gross margin in the third quarter saw a slight sequential decline, possibly due to the inherently lower gross margin of other music services. However, this segment experienced the fastest growth rate this quarter, leading to an increased revenue share.

On the expense side, growth was “finally” observed, with an 8% year-over-year increase. In absolute terms, this was primarily driven by an increase in administrative expenses (including R&D). Although the improvement in profit margins has temporarily halted, Dolphin Research leans towards not interpreting this phenomenon negatively.

The current stage calls for strengthening the narrative around the second growth curve. Although the profit margins of the second curve itself cannot be directly compared to those of subscriptions, once the investment phase passes, Tencent Music can leverage upstream and downstream linkages in the industry chain to reduce intermediate friction and move towards becoming a global music giant.

Ultimately, while operating profit from the core main business continues to grow at a high rate of 34% year-over-year, the profit margin has ceased to improve further and instead declined by 2 percentage points sequentially. Adjusted profit reached 2.48 billion. Considering miscellaneous items such as interest, the overall result exceeded market consensus expectations.

- END -

// Reprint Authorization

This article is an original piece by Dolphin Research. Reproduction requires authorization.

// Disclaimer and General Disclosure

This report is intended solely for general comprehensive data purposes, designed for general reading and data reference by users of Dolphin Research and its affiliated entities. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making any investment decisions based on this report. Any person making investment decisions using or referring to the content or information mentioned in this report does so at their own risk. Dolphin Research shall not be held responsible for any direct or indirect liabilities or losses that may arise from the use of the data contained in this report. The information and data presented in this report are based on publicly available sources and are intended for reference purposes only. Dolphin Research strives to ensure, but does not guarantee, the reliability, accuracy, and completeness of the relevant information and data.

The information or views expressed in this report shall not, under any jurisdiction, be construed or regarded as an offer to sell securities or an invitation to buy or sell securities, nor shall they constitute advice, solicitation, or recommendation regarding relevant securities or related financial instruments. The information, tools, and materials contained in this report are not intended for, nor are they proposed to be, distributed to jurisdictions where such distribution, publication, provision, or use of the relevant information, tools, and materials would contravene applicable laws or regulations, or would result in Dolphin Research and/or its subsidiaries or affiliated companies being subject to any registration or licensing requirements in such jurisdictions, nor are they intended for citizens or residents of such jurisdictions.

This report merely reflects the personal views, insights, and analytical methods of the relevant creators and does not represent the stance of Dolphin Research and/or its affiliated entities.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual shall (i) produce, copy, duplicate, reproduce, forward, or create any form of copies or reproductions in any manner, and/or (ii) directly or indirectly redistribute or transfer to any other unauthorized persons. Dolphin Research reserves all relevant rights.