Ideal, NIO, XPeng: Diverging Performances, Each Seeking Their Own Path

![]() 06/14 2024

06/14 2024

![]() 634

634

In the fiercely competitive first quarter of price wars, did Ideal, NIO, and XPeng hold their ground?

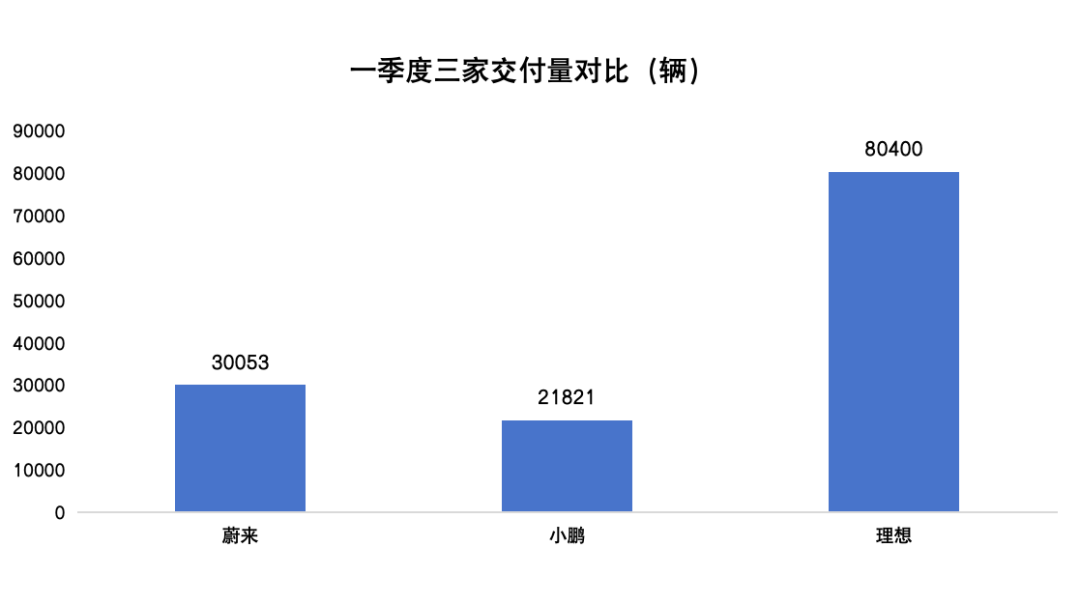

From the perspective of deliveries, NIO delivered 30,053 vehicles in the first quarter, a year-on-year decrease of 3.2%; XPeng delivered 21,821 vehicles, a year-on-year increase of 19.7%; Ideal delivered 80,400 vehicles, a year-on-year increase of 52.9%.

Comparison of deliveries among the three automakers in the first quarter, chart by Insight

Judging from this, Ideal and XPeng's sales growth is better than NIO's. Sales are closely related to revenue and profitability.

Judging from the performance reports of the three companies, Ideal and XPeng's total revenue showed an upward trend, while NIO saw a year-on-year decline. From a profitability perspective, in the first quarter, under Non-GAAP, NIO lost 4.903 billion yuan, XPeng had a net loss of 1.41 billion yuan, while Ideal made a profit of 1.3 billion yuan, still the best among the three in terms of profitability.

Amid the intense competition in the first quarter, each company was also adjusting its strategy, with all three launching price cuts and embarking on a new round of investments.

From a market competition perspective, the new energy vehicle industry has entered a crucial stage of competition, with the market accelerating into a cycle of survival of the fittest; from a technological perspective, intelligent driving has become an important factor influencing people's decision-making, with high-level intelligent driving accelerating its implementation, and end-to-end large models also accelerating their integration into vehicles.

In other words, driven by both the market and technology, automakers are facing a competition of comprehensive strength. They must not only compete for current sales but also grasp the upcoming new vehicle layout and launch rhythm, compete in profitability, and compete in technological strength.

Therefore, how to make money in the future depends on how automakers spend their money now and where they focus their energy and resources. This year is destined to be a year of fierce competition, and every penny of automakers must be spent where it matters most.

1. In the fiercely competitive first quarter, Ideal, NIO, and XPeng's performances diverged

From the main financial data, Ideal performed the best among the three.

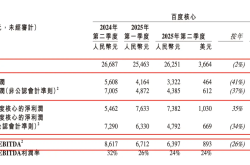

On the revenue side, Ideal recorded revenue of 25.63 billion yuan in the first quarter, a year-on-year increase of 36.4%; NIO's revenue was 9.909 billion yuan, a year-on-year decrease of 7.2%; XPeng's revenue was 6.548 billion yuan, a year-on-year increase of 62.3%.

On the profit side, in the first quarter, Ideal achieved a net profit of 1.3 billion yuan. XPeng and NIO are still in the red.

From the trend of net profit changes, NIO's losses are further expanding, with net losses increasing by 18.1% year-on-year; Ideal's net profit has declined slightly, down by 1 billion yuan from 1.4 billion yuan in the first quarter of last year; XPeng's net loss has narrowed year-on-year, down from 2.21 billion yuan in the same period last year.

Comparing the three, NIO's current situation is the most severe, XPeng is showing signs of recovery, and Ideal is relatively stable.

Stretching the timeline, Ideal has achieved profitability for six consecutive quarters, while NIO lost 20.72 billion yuan in 2023, a year-on-year increase of 43.5%; XPeng lost 10.38 billion yuan in 2023, a year-on-year increase of 13.6%.

Financial conditions affect their cash flow, and Ideal currently has relatively abundant cash flow, reaching 98.9 billion yuan as of March 31st. As of March 31st, NIO's cash flow was 45.3 billion yuan, while XPeng's was 41.4 billion yuan.

Based on the above situation, the performance of the three companies in the capital market has also diverged:

From a market capitalization perspective, Ideal maintains a market value of around 21 billion US dollars, NIO's market value is 9.851 billion US dollars, and XPeng's market value is 7.492 billion US dollars.

Looking back, the divergence in performance among the three automakers essentially stems from differences in their product strategy, business strategy, and business concentration.

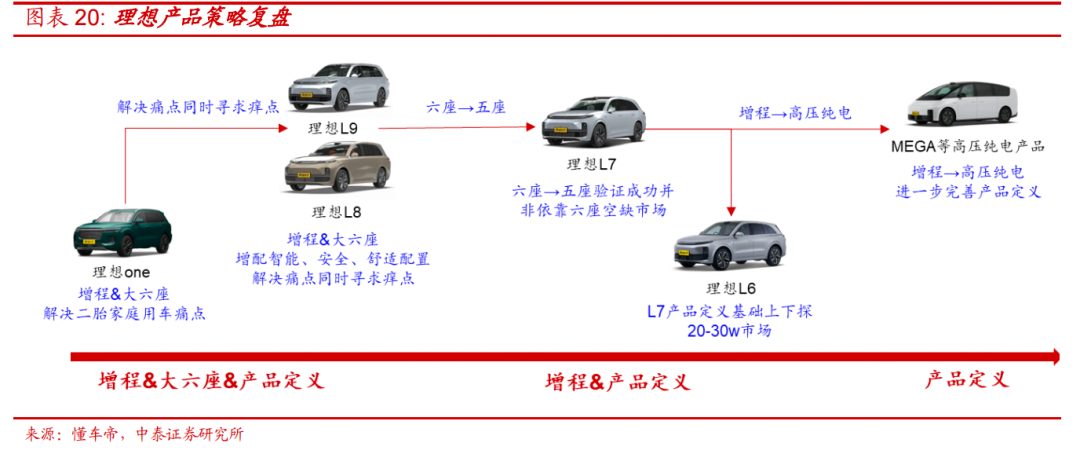

Let's start with Ideal. Ideal maintains a good profitability status due to its initial choice of an extended-range route and attracting a large wave of family car buyers.

In the early stages of new energy vehicle development, neither the extended-range hybrid technology route nor the home use scenario were favored by the market. However, Li Xiang, the founder of Ideal Auto, found at the time that family users accounted for 81% of the car market above 200,000 yuan, and the market was still growing rapidly. At the same time, Li Xiang believed that in the early stages of industry development, pure electric vehicles would face energy replenishment shortcomings. He broke down family users' car usage scenarios into two main categories: urban and long-distance, and the extended-range route could accommodate both scenarios, i.e., "using electricity in the city and oil for long distances".

In terms of business strategy, Ideal has also chosen a more cautious and stable strategy compared to industry players.

It was not until June 21, 2022, that Ideal launched its second mass-produced model, the Ideal L9. During the same period, NIO had successively released and delivered multiple mass-produced models such as the ES8, ES6, EC6, and ET7, including mid-sized and large SUVs and sedans, while XPeng had also released and delivered multiple models such as the G3, P7, G3i, and P5.

Source: CITIC Securities

Ideal's advantages are obvious, which is why it was able to quickly adjust its strategic focus and stabilize the situation this year. After experiencing setbacks in the launch of its first pure electric model, the MEGA, Ideal timely slowed down the launch pace of pure electric models and focused its product emphasis back on the Ideal L series.

Looking at XPeng, XPeng improved its financial situation by relying on partners.

Last year, XPeng signed a technology framework agreement with Volkswagen, and the cooperation between the two has already generated revenue. In the first quarter of this year, XPeng's service and other revenues were 1 billion yuan, related to technology research and development services regarding platform and software strategic technology cooperation.

XPeng Chairman He Xiaopeng said in an earnings conference call that the first quarter recorded hundreds of millions of yuan in platform software service revenue from Volkswagen cooperation, which is recurring and has a high gross profit margin. Therefore, it is expected that such platform and software technology service revenue will continue to be recorded in every quarter in the future.

With this method, XPeng has found a new revenue stream, gaining more capital to invest in new businesses. Currently, XPeng has launched a sub-brand called "MONA" and is continuously investing in flying cars.

Among the three, NIO faces greater pressure. Amid the price war, NIO's cars are selling at lower prices. Therefore, in the first quarter of this year, NIO's revenue per vehicle dropped to 279,000 yuan, while NIO's other businesses, including battery, charging pile, and other supporting businesses and services, have not yet reached the profitability point, with a negative gross profit margin.

From NIO's differentiated service - battery swapping business, NIO founder Li Bin mentioned in the first-quarter earnings call that "if the battery swapping station can handle 60 orders per day, it can achieve break-even, and currently, it handles around 30 orders per day."

NIO is also adjusting its strategy by reducing prices and improving computing power and intelligent driving capabilities. In April and May this year, sales have rebounded somewhat. At the same time, it has also launched a cheaper sub-brand called "LeDao".

NIO's financial pressure remains considerable, and it still needs to raise funds for a period of time in the future. In December last year, NIO received strategic investment of approximately 2.2 billion US dollars from the Abu Dhabi investment institution CYVH Holdings. In the future, it will continue to tell stories to attract new investors.

2. Sales Competition: Who is Leading, Who is Recovering?

From a horizontal comparison of deliveries, Ideal's performance is also better in the first quarter of this year.

In the first quarter, Ideal sold 80,400 vehicles, NIO sold 30,053 vehicles, and XPeng sold 21,821 vehicles.

Breaking down each company's sales trend, Ideal is in the lead, XPeng is accelerating its recovery, and NIO is in a period of pain.

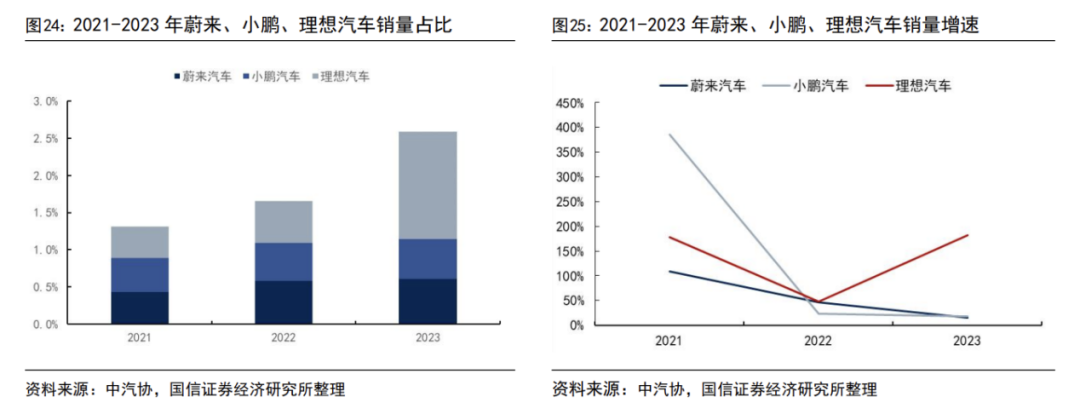

In the first quarter, Ideal had the largest year-on-year growth rate in sales, at 52.9%, XPeng also grew by 19.7%, while NIO declined by 3.18%; from a month-on-month perspective, all three companies saw significant declines, with Ideal declining by 39.00%, NIO by 39.95%, and XPeng by 63.74%. Of course, to a large extent, this is directly related to the high base of car deliveries in the fourth quarter of last year.

Overall, in terms of deliveries, Ideal has now entered a virtuous cycle of stable growth, while NIO and XPeng are still fluctuating.

However, judging from the sales in April and May, NIO and XPeng have shown clear signs of recovery. NIO sold 15,620 and 20,544 vehicles in these two months, while XPeng sold 9,393 and 10,146 vehicles, respectively.

It is worth noting that from a longer perspective, this situation among the three companies has persisted for some time - after Ideal delivered models such as the L9 and L8 in the second half of 2022, its sales advantage began to accelerate. Before that, the three companies' deliveries were overall alternating leaders.

Sales growth rates of the three automakers, source: Guosen Securities

Taking 2023 as an example, Ideal delivered a total of 376,030 vehicles, more than the combined deliveries of NIO and XPeng.

In fact, due to their different market positions, the intensifying divergence in sales among the three automakers has realistic factors.

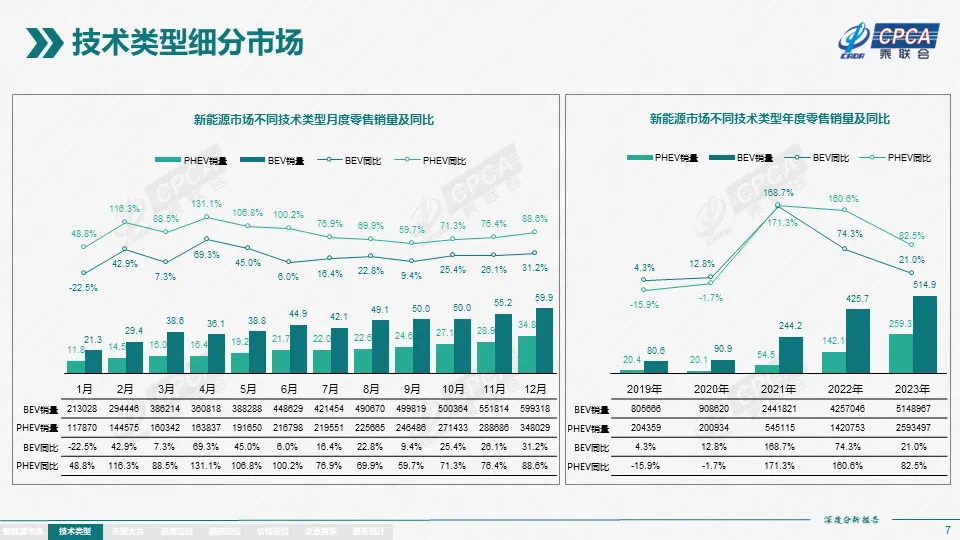

On the one hand, over the past two years, the sales growth rate of plug-in hybrid electric vehicles (including extended-range models) has been much higher than that of pure electric vehicles. In 2022, the year-on-year growth rate of plug-in hybrid vehicle sales reached 151.6%, 70 percentage points higher than pure electric vehicles; in 2023, plug-in hybrid vehicles grew by 84.7% year-on-year, while the growth rate of pure electric vehicles was 24.6%.

Behind this, in 2022, the pure electric vehicle market encountered challenges such as soaring upstream battery raw material prices, and the gradual withdrawal of new energy vehicle purchase subsidies; in 2023, the new energy vehicle fiscal subsidies were further completely withdrawn, and the advantages of plug-in hybrid vehicles became apparent.

On the other hand, although the sales scale of pure electric vehicles in the Chinese new energy vehicle market is larger, for example, in 2023, the domestic sales of pure electric vehicles were 6.685 million, compared to only 2.804 million for plug-in hybrid vehicles, the competition among automakers in the pure electric market is more intense.

Source: CPCA

Against this background, Ideal Auto has been able to reap the benefits of the track, while NIO and XPeng have to compete for market share in a more intense competitive environment.

However, from another perspective, the intensifying divergence in sales among the three companies is also closely related to their own operations.

Simply put, under the unstable competitive situation in the industry, Ideal has shown strong resilience.

Ideal encountered its biggest competitor, Huawei. In the three days after Huawei launched the Wenjie M7 in July 2022, the order volume exceeded 60,000, which directly affected Ideal's sales performance. In August of that year, Ideal's sales fell to 4,571 vehicles, a decline of over 50%. However, Ideal quickly responded by taking measures such as indirectly reducing the price of the Ideal ONE, delivering the new model L9 ahead of schedule, and advancing the release timing of the Ideal ONE successor model L8, stabilizing the situation and delivering strong sales in 2023.

In contrast, NIO and XPeng have been in the cycle of model updates for some time, but XPeng fell into a period of low sales after encountering the G9 incident, and NIO also experienced a period of "nothing to sell" during the product renewal period from April to May last year, with sales almost halving month-on-month, falling below the 10,000-vehicle red line.

These situations have eased this year, and with new sub-brands and more models, XPeng and NIO are also accelerating again, which means that in this year's battlefield, the competition between Ideal, NIO, and XPeng will unfold in more dimensions, and the race will become even more intense.

3. In the Future, It's Still a Technological Battle of R&D Investment

Since entering 2024, "intensive competition" has been the core keyword in the new energy vehicle industry.

From a short-term perspective, the endless price competition in the industry is an important factor affecting automakers' sales trends and profit margins; but from a long-term perspective, technological competition may be the key to driving the industry's structural changes.

The core of technological competition is the battle for intelligent driving.

Huaxi Securities previously pointed out in a research report that intelligent driving has already effectively influenced consumers' car purchasing decisions. In the future, leading automakers that can accurately identify differentiated selling points and technological leadership will form differentiation in the era of "standardized intelligent driving" and maintain a leading advantage for more than two years.

Around the development of autonomous driving technology, over the past 20 years, a group of players worldwide have invested significant resources and explored multiple different technological paths, but have not yet crossed the L2 level of assisted autonomous driving.

This year, the intense competition among automakers surrounding intelligent driving has mainly focused on urban NOA (Navigation on Autopilot), which is considered the final battle of L2-level assisted autonomous driving and a crucial step for autonomous driving to cross from L2 to L3.

Source: BOC International Securities

At this level, Ideal, NIO, and XPeng are also in a stage of catching up with each other.

Judging from the progress of urban NOA implementation, XPeng is currently in the leading position. In March this year, XPeng's XNGP urban NOA was opened in 246 cities.

<