"Will NIO be able to turn around in the second quarter after its sales and revenue fell short of expectations in the first quarter?

![]() 06/14 2024

06/14 2024

![]() 791

791

Written by Dawei | Edited by Kaixuan

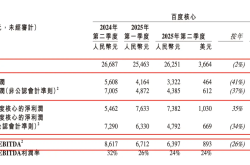

On June 6, NIO Inc. released its financial report for the first quarter of 2024, ending March 31, 2024. The report showed that the company's total revenue for the quarter was RMB 9.9086 billion, a year-on-year decrease of 7.2% and a quarter-on-quarter decrease of 42.1%. The net loss reached RMB 5.1846 billion, an increase of 9.4% year-on-year and a decrease of 3.4% quarter-on-quarter. Gross profit was RMB 487.7 million, an increase of 200.5% compared to the first quarter of 2023; gross margin was 4.9%, up 3.4 percentage points year-on-year; and vehicle gross margin was 9.2%, up 4.1 percentage points year-on-year. This is mainly attributed to the decline in unit material costs.

From the financial report data, NIO's current financial situation is still in an unhealthy state - losses are increasing, and gross profit continues to fail to improve.

However, regarding NIO's financial performance in the first quarter, Li Bin remained optimistic and gave a strong second-quarter guidance: NIO's delivery volume in the second quarter is expected to reach 54,000 to 56,000 units, an increase of 129.6% to 138.1% year-on-year; second-quarter revenue is expected to reach RMB 16.59 billion to RMB 17.14 billion, an increase of 89.1% to 95.3% year-on-year.

Increasing Financial Pressure

From various indicators, NIO still faces tremendous financial pressure, and this pressure is only increasing.

Total revenue of RMB 9.91 billion, down 7.2% year-on-year and 42.1% quarter-on-quarter

Automobile sales of RMB 8.38 billion, down 9.1% year-on-year and 45.7% quarter-on-quarter

Net loss of RMB 5.18 billion, up 9.4% year-on-year and down 3.4% quarter-on-quarter

Gross profit of RMB 490 million, up 200.5% year-on-year and down 61.9% quarter-on-quarter

Gross margin of 4.9%, compared to 1.5% in the same period last year and 7.5% in the fourth quarter of last year, an increase of 3.4 percentage points year-on-year but a decrease of 2.6 percentage points quarter-on-quarter

Vehicle gross margin of 9.2%, compared to 5.1% in the same period last year and 11.9% in the fourth quarter of last year

As of March 31, 2024, cash reserves were RMB 45.3 billion, compared to RMB 57.3 billion at the end of last year

During the same period, XPeng Motors had revenue of RMB 6.55 billion and a net loss of RMB 1.37 billion; Li Auto had revenue of RMB 25.6 billion and a net profit of RMB 590 million. In comparison, NIO's revenue is in the middle range, but its net loss is much higher than XPeng and Li Auto.

In terms of sales, NIO delivered a total of 30,053 vehicles in the first quarter, including 17,809 high-end intelligent electric SUVs and 12,244 high-end intelligent electric sedans, a decrease of 3.2% year-on-year and 39.9% quarter-on-quarter. Compared to the stable monthly sales of over 15,000 units in the second half of 2023, NIO's sales in the first quarter of this year fell far short of expectations.

Compared with competitors, XPeng delivered 21,821 vehicles, an increase of 19.7% year-on-year; Li Auto delivered 80,400 vehicles, an increase of 52.9% year-on-year, both higher than NIO.

The decline in sales has a very direct impact on revenue. Throughout Q1, NIO's deliveries hovered around 10,000 units per month, coupled with price wars among automakers in the first quarter, NIO also took some price cuts and promotional activities, leading to a decline in average selling prices.

In 2023, NIO set new highs for both revenue and net loss. NIO achieved revenue of RMB 55.6 billion, an increase of 12.9% year-on-year; profits continued to be in the red, with a net loss of RMB 20.72 billion for the full year, an expansion of 43.5% year-on-year. From 2018 to 2023, in six years, NIO's total revenue exceeded RMB 170 billion, but the total net loss also reached RMB 86.631 billion. Now with another loss of RMB 5.1 billion in the first quarter, when will NIO be able to break the curse of "the more you sell, the more you lose"? Only hope lies in bringing about a revenue turnaround in the later stages.

Hopeful for the Second Quarter

After announcing the first-quarter financial report in early June, NIO actually already had a grasp of the sales and revenue for the first two months of the second quarter. This is why NIO is so confident about its second-quarter performance.

Data shows that NIO's deliveries in April and May increased significantly, with monthly sales exceeding 20,000 units again. Among them, NIO delivered 15,620 vehicles in April, an increase of 134.6% year-on-year; and 20,544 vehicles in May, an increase of 233.8% year-on-year. That is to say, if NIO wants to meet its second-quarter business expectations, it needs to achieve at least 17,836 sales in June. For the current NIO, the pressure to achieve this goal is not too great.

Moreover, Li Bin mentioned that the orders received in May have exceeded NIO's production capacity, mainly due to the second brand Leyao. On May 15, NIO officially launched the second brand Leyao and its first model L60, while announcing a pre-sale price of RMB 219,900 for the L60.

Li Bin said on the earnings call that Leyao has received far more orders than expected even before opening a single store. Leyao will have 100 stores in September, with an investment of RMB 1 million to RMB 2 million per store. Next year, Leyao will also launch a second product, a medium to large SUV.

Li Bin said, "Leyao will not have too many products. We want to ensure that each car has sufficient competitive advantages. Leyao's long-term goal is to maintain a gross margin of over 15% and achieve a sales scale of 20,000 to 30,000 units per month, which will enable it to reach break-even."

The good sales expectations of the second brand have led to insufficient production capacity at NIO, and NIO has already started building a third factory to expand capacity. NIO currently owns two vehicle factories, the Hefei Advanced Manufacturing Base (F1) and the NIO Second Advanced Manufacturing Base (F2) in the Xinqiao Smart Electric Vehicle Industrial Park, both with a designed annual production capacity of up to 300,000 vehicles. Due to the recent popularity of the NIO brand and long-term strategies, NIO's existing two factories have already reached their designed single-shift production capacity. With the subsequent launch of new products, the production capacity of existing factories will no longer be able to meet market demand.

On June 5, Qin Lihong, co-founder and president of NIO, revealed that NIO's third factory (F3) is located in the Xinqiao Smart Electric Vehicle Industrial Park in Hefei and has recently started construction, with a single-shift production capacity of 100,000 vehicles. It will be used for the subsequent production of NIO and Leyao brand products. It is understood that the follow-up NIO brand, the third brand Firefly (internal code name "Firefly"), will start delivery in the first half of 2025, and the current sales network will be shared with NIO. Firefly is positioned as a high-quality compact car priced in the tens of thousands of yuan.

If Firefly is successfully launched, NIO's product matrix will cover the 100,000, 200,000, and 300,000 yuan levels. The main brand is a high-end brand targeting business and family users, Leyao is a mass brand targeting the high-end family market, and Firefly is an economical and high-quality compact car. This is also the multi-brand strategy that NIO is currently promoting.

Li Bin said, "Despite increasingly fierce market competition, NIO's established high-end brand positioning, industry-leading technology, and innovative 'chargeable, swappable, and upgradable' energy replenishment experience have gained market recognition, demonstrating superior competitiveness. Our delivery volumes have been steadily increasing in recent months. In April, we launched the 2024 ET7 Executive Edition, further enhancing our competitiveness in the high-end sedan market. In May, we officially launched our new smart electric vehicle brand ONVO Leyao and its first product, the L60. With ONVO Leyao joining our brand lineup, we are ready to enter a broader mainstream mass market and embark on the next stage of high-quality growth." With the release of the first-quarter earnings report, NIO is expected to catch up in the second quarter and meet its targets.

NIO Energy is No Longer a "Bottomless Pit"

Looking into the future, NIO's continuous heavy investment in NIO Power has now seen the dawn of hope, and it is time for NIO Power to monetize and help NIO generate cash flow.

On May 31, NIO Energy received RMB 1.5 billion in strategic investment from institutions such as Wuhan Guangchuang Fund. This round of strategic investment will be used for technology research and development, manufacturing, operation and maintenance in areas such as charging, battery swapping, energy storage, battery services, and energy internet, as well as the layout and development of NIO Energy's charging and battery swapping infrastructure, and to support investments in innovative vehicle-grid interaction businesses.

Partners of Wuhan Guangchuang Fund include Wuhan Optics Valley Industrial Investment Co., Ltd. and Wuhan Optics Valley Industrial Investment Fund Management Co., Ltd., both subsidiaries of Hubei Technology Investment Group Co., Ltd., with the ultimate controlling shareholder being the Wuhan East Lake New Technology Development Zone Management Committee.

NIO's acquisition of this investment is a concrete measure taken by Wuhan to establish a government-guided fund, introduce and cultivate new energy vehicle industry chain enterprises, and promote the development of the new energy vehicle industry. It also demonstrates the commercial value of NIO's battery swapping business.

To date, NIO has reached cooperation with multiple automakers such as GAC Group, Changan Automobile, Geely Holding, Chery Automobile, JAC Group, and Lotus in the field of battery swapping, as well as with energy and power companies such as Sinopec, CNOOC, Shell, State Grid, China Southern Power Grid, and Waneng Group. NIO has also achieved charging interconnectivity with automotive brands such as Changan, Geely, SAIC-GM, XPeng Motors, Jiyue, Lotus, and ZM.

After the completion of the first round of financing, NIO still holds about 90% of NIO Power's shares and is open to external investors. NIO executives believe that the battery swapping business has a clear profit path, with the break-even point for a single battery swapping station being approximately 60 swaps per day. Currently, NIO's stations provide an average of about 30 swaps per day. Li Bin said that considering investments in areas such as energy storage and flexible upgrades, its profitability is undoubted.

This round of financing has alleviated some of NIO's financial pressure. As of March 31, NIO had a total of RMB 45.3 billion in cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits, a decrease of RMB 12 billion from the fourth quarter of last year. The injection of state capital can greatly alleviate NIO's short-term financial pressure.

In fact, NIO also intends to promote the independent listing of NIO Power. Li Bin revealed that NIO Power has independent financing plans and will continue to open up investments in the future. "NIO Energy is currently in the investment stage and needs to establish a network first, requiring some advance investments, but the overall profitability is very clear." Once NIO Power goes public, NIO's hundreds of billions of investments in charging and battery swapping businesses will receive expected returns, which can be said to be a victory for NIO's long-termism.