The market has been revitalized, but who lost the game?

![]() 06/14 2024

06/14 2024

![]() 398

398

If the consumption potential of "eliminating outdated products and introducing new ones" and "trade-in updates" can be unleashed, it may gradually "revitalize" the automobile market in the coming months.

The Chinese automobile market has undergone subtle changes this year, which can be explored through the latest production and sales data released by the China Passenger Car Association recently.

In May of this year, the retail sales of passenger cars nationwide reached 1.71 million units, a year-on-year decrease of 1.9%. However, the cumulative retail sales since the beginning of this year have reached 8.073 million units, an increase of 5.7% year-on-year. Among them, the retail sales of conventional fuel vehicles in May were 910,000 units, a year-on-year decrease of 23%; while the retail sales of new energy vehicles in May were 804,000 units, an increase of 38.5% year-on-year.

According to the analysis of the China Passenger Car Association, the price war in the automobile market started early this year, spanning from after the Spring Festival in February to the end of April, with a large number of models participating in price reductions approaching the total number of models last year. This led to consumers temporarily observing prices extremely, which instead inhibited the upward trend of the market.

However, the main reasons for the 6% month-on-month increase in the fuel vehicle market and the 18.7% month-on-month increase in the new energy vehicle market in May are the immediate effect of the trade-in subsidy policy, which has enabled the domestic automobile market to start moving up.

In addition, the preferential policy for vehicle purchase tax for new energy vehicles, which excludes entry-level models such as micro-electric vehicles with a range of less than 200 kilometers from June 1, has also promoted the continuous growth of the new energy market due to the rush to register vehicles before the vehicle purchase tax preferential policy expired in May.

From Price War to Technological War and Verbal War

At the beginning of this year, the Chinese automobile market was just a price war and technological war, but later, there was a verbal war among the big players.

Data from the China Passenger Car Association shows that a total of 70 electric vehicles participated in price reductions in 2023; from January to May 2024, a cumulative total of 56 electric vehicles have reduced prices. "The 'price war' has evolved to the point where it is no longer simply about price competition, but rather a competition of the automaker's system capabilities," said Cui Dongshu, Secretary-General of the China Passenger Car Association.

In fact, since May, the number of models participating in the "price war" has suddenly decreased, from 54 models in April to 10 models. "The 'price war' in the domestic automobile market has stabilized," emphasized Cui Dongshu. He noted that the "price war" is a product of a specific period and that with the adjustment of new product prices in place, future market competition will return to focusing on promotions.

As the price war subsided, however, during the China Automobile Chongqing Forum in early June this year, the big players resumed their "mutual bashing" mode.

For example, BYD, currently ranked first in sales, said that "competition leads to technological breakthroughs, industrial upgrades, and the birth of excellent products." Li Yunfei, General Manager of BYD's Public Relations Department, even believes that "if this game is lost, there will be another one." Zhu Huarong, Chairman of Changan Automobile, also stated that "competition is a process of eliminating inferior coins with good coins, and competition itself means pursuing excellence, which will roll out a new height for Chinese brands."

Li Shufu, Chairman of Geely Holding Group, believes regarding the price war: "The healthy development of any industry must achieve good economic benefits in terms of input-output ratio. Endless internal competition and简单粗暴的价格战 (brutal and simple price wars) will result in cutting corners, counterfeiting and selling fakes, and unregulated competition. For the automotive industry, only legal and healthy competition can achieve sustainable high-quality development, consolidate the achievements China has made in electric vehicles, and earn respect."

Zeng Qinghong, Chairman of GAC Group, which has performed poorly due to the decline in sales of joint venture brands, stated, "This kind of competition is not a solution. The purpose of an enterprise is to make a profit, and profit can contribute to society."

Yu Chengdong also implicitly criticized BYD, saying, "BYD should be the number one 'king of competition' in the world of smart electric networked vehicles because of its ability to achieve ultra-low costs. However, we are not good at competing on ultra-low prices; we are good at competing on value, intelligence, luxury, comfort, and safety."

But if one really loses in the competition, can they still compete in the Chinese market in the next round?

Actually, the likelihood is not high. For example, joint venture brands are currently facing significant challenges at the table and have no countermeasures.

In May of this year, the retail sales of mainstream joint venture brands decreased by 21% year-on-year, reaching only 490,000 units. Among them, in May, the retail share of German brands was 18.6%, a year-on-year decrease of 2 percentage points; the retail share of Japanese brands was 14.8%, a year-on-year decrease of 3.2 percentage points; and the retail share of American brands reached 6.7%, a year-on-year decrease of 1.4 percentage points.

In contrast, the retail sales of independent brand passenger cars continued to maintain a high growth trend in May, reaching 980,000 units, achieving year-on-year and month-on-month growth of 12%, and a retail share of 57.6%, an increase of 7.3 percentage points year-on-year. From January to May this year, the cumulative retail share of independent brand passenger cars was 56%, an increase of 6.6 percentage points compared with the same period last year.

In Cui Dongshu's view, the rapid growth of independent brand passenger cars is mainly due to their significant increase in the new energy vehicle market and export market, as well as the excellent performance of leading traditional automakers in transformation and upgrading.

Looking at the retail sales ranking of domestic narrow-sense passenger cars in May, four of the top five automakers are independent brands, namely BYD (268,000 units), Geely Automobile (124,000 units), Changan Automobile (96,000 units), and Chery Automobile (89,000 units).

It is worth mentioning that while consumer demand has indeed been released and driven the sales of the automobile market, it is backed by favorable policies that have played an important role in promoting the new energy market.

Is Trade-in a Good Remedy?

The trend of "trade-in" has once again blown into the automotive industry.

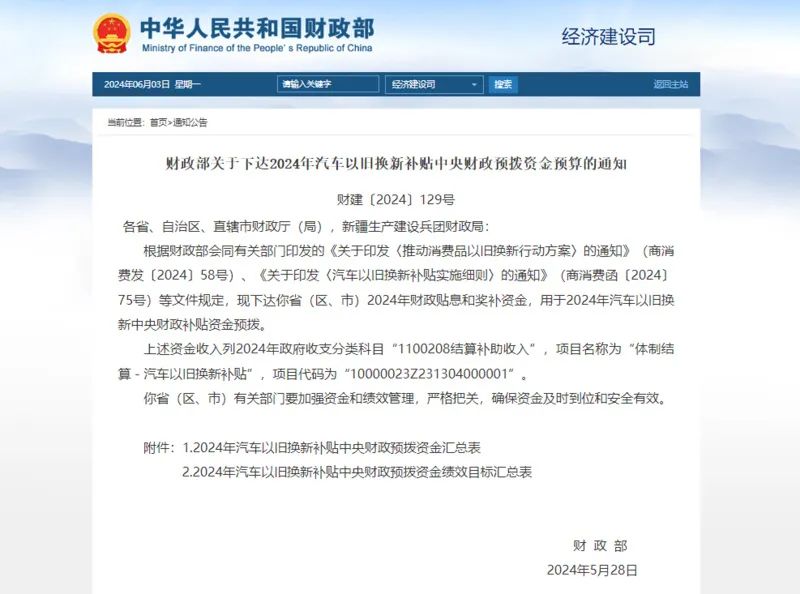

At the end of April this year, the Ministry of Commerce, the Ministry of Finance, and six other departments jointly issued the "Detailed Rules for the Implementation of Automobile Trade-in Subsidies." In response to this policy, many automakers have already taken action, introducing incentives such as high-value trade-in subsidies to fully enhance consumers' willingness to trade in their vehicles. The large subsidy amounts immediately captured the hearts of many consumers.

According to preliminary estimates by the Passenger Car Association, every 1 yuan invested in subsidies can drive a ratio of 1:15 in output value; while for every 1 yuan of fiscal subsidies, the tax-driven ratio for private scrapping and updating is 1:3.

Taking Hubei as an example, for car purchases priced above 300,000 yuan, Wuhan provides a maximum subsidy of 8,000 yuan, which is relatively high among similar cities. Although many new energy automakers have always had trade-in subsidy policies, this time, government departments at all levels have also introduced trade-in subsidies for automobiles, and the multiple superpositions have ignited consumers' enthusiasm for trading in their vehicles.

"We directly offer a trade-in subsidy of 10,000 yuan for other brands and 15,000 yuan for our own brand on top of government trade-in subsidies and car price discounts. Consumers can trade in their old cars for new ones at our stores," said a sales director of Xiaopeng Motors in Shandong. With the support of the trade-in policy, the number of inquiries at major stores has increased significantly, and many consumers who were originally on the fence have placed orders.

According to incomplete statistics from Fengkou Finance, more than 50 automaker brands have currently introduced trade-in subsidy policies, including new force brands such as NIO, Xiaopeng, WENJIE, and BYD, as well as traditional brands such as Mercedes-Benz, Haval, Tank, Dongfeng, FAW-Volkswagen, and Beijing Hyundai. The subsidy amounts range from several thousand yuan to tens of thousands of yuan.

Obviously, as the market enters the stage of stock competition, this round of trade-ins is also a breakthrough for the automobile market to enter high-quality development.

However, it will also have some "negative" impacts.

For example, while increased subsidies are indeed conducive to improving the trade-in rate, some leading companies can increase the trade-in rate to around 35%. However, for automakers, this is tantamount to participating in an indirect price war and may even affect profits. According to data from the China Passenger Car Association, the profit margin of the automobile industry in April was 4.6%, which is still relatively low compared to the average profit margin of 5% for the entire industrial sector.

"The automobile market has entered an era of stock competition, with relatively slow overall growth and difficult consumer stimulation," said Gao Ying, an industry analyst from Yiche Research Institute. Under such circumstances, if automakers solely rely on subsidies to stimulate sales, it will undoubtedly accelerate the internal competition and elimination of automakers.

On the other hand, the price war in the new car market has previously affected the price of used cars, causing harm to used car dealers. The implementation of the trade-in policy will accelerate the elimination of old vehicles, which are often the main source of vehicles in the used car market. According to industry insiders, with the expansion of used car inventory, there may be a situation of oversupply in the market in the short term, which will lead to a decline in used car prices.

On the positive side, the implementation of trade-in policies will provide the used car market with more high-quality new energy vehicle sources. By optimizing the used car trading process, improving transaction transparency, and establishing a sound evaluation and certification system, it will help enhance consumer trust in used new energy vehicles and the used car market, stimulating market potential.

Therefore, if trade-ins can "ignite" the domestic automobile market, the automobile consumption market is expected to usher in new changes.

However, even if it is difficult to present a situation where the off-season is not dull, the China Passenger Car Association believes that the passenger car market will enter the half-year closing period in June, and automakers' willingness to strive for sales performance will be even stronger. At the same time, with the update drive of trade-ins, the cooling down of new car price wars, and the issuance of Beijing new energy vehicle quotas, the enthusiasm for car purchases in June will continue.

After all, the country's overall consideration and detailed grasp of "promoting consumption and boosting domestic demand" are becoming increasingly clear and precise. If the consumption potential of "eliminating outdated products and introducing new ones" and "trade-in updates" can be unleashed, it may gradually "revitalize" the automobile market in the coming months.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.