VOYAH's Pre-Listing Showdown: Taishan Enters the Six-Seater Flagship Arena, Securing Over 10,000 Orders in Just 21 Minutes | Feiling

![]() 11/19 2025

11/19 2025

![]() 517

517

Before its market debut, VOYAH was keen to address consumer concerns about its 'investment potential,' and the answer lies in its latest flagship offering: the Taishan.

On November 18, the VOYAH Taishan made its grand entrance in Shenzhen, boasting four variants with prices ranging from RMB 379,900 to RMB 509,900. The vehicle comes standard with a 65kW high-capacity battery, delivering a CLTC pure electric range of 350km and an extended combined range exceeding 1,400km. It also supports 5C ultra-fast charging. In terms of intelligence, the new model is equipped with Huawei's cutting-edge Qiankun Intelligent Driving system (ADS Ultra) and HarmonyOS Cockpit 5.0, featuring four LiDAR sensors and a computing platform with over 1,000TOPS of processing power, laying the groundwork for L3-level autonomous driving capabilities.

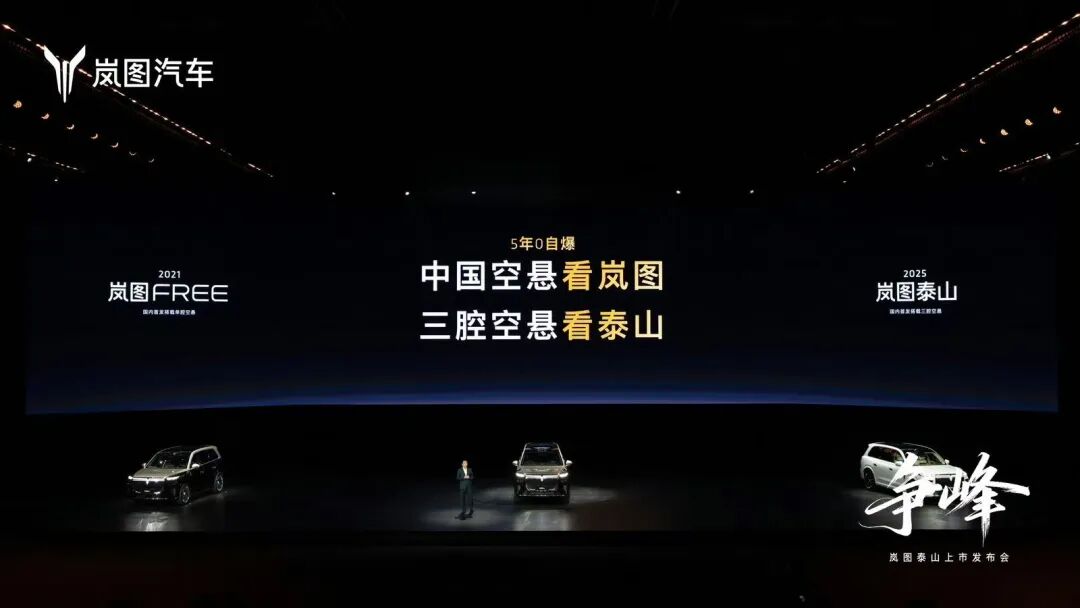

From a product standpoint, the car's standout feature this time is its standard triple-chamber air suspension and EDC Magic Carpet Chassis. This makes the Taishan one of the world's top five and China's first mass-produced vehicles to be equipped with triple-chamber air suspension. The suspension system supports a 110mm adjustment range, five-level height customization, and four-level stiffness settings, paired with seven driving modes. Additionally, the Taishan is fitted with an EDC Magic Carpet Chassis, a bidirectional 16° rear-wheel steering system, and the Qingyun Driving Platform 2.0, which incorporates an aviation-grade all-aluminum chassis, front double-wishbone and rear multi-link suspension, and Bosch's IPB2.0 intelligent control system. These features contribute to an 80km/h moose test score and a remarkable 100km/h braking distance of just 34 meters.

By pricing the Taishan below RMB 400,000, it's evident that the previously touted starting price of RMB 450,000 was merely a strategic move. Pricing the Taishan within the RMB 400,000 range is a pragmatic decision. This year, the market has seen a surge in domestically produced flagship six-seater SUVs, including models like the Lynk & Co 900, Zeekr 9X, IM LS9, and Tengshi N9. Had VOYAH set the Taishan's starting price above RMB 400,000, it would have struggled to compete. The variants launched this time can be seen as the Taishan Qiankun Edition, with the core models being the MAX+ priced at RMB 409,900 and the Ultra at RMB 459,900.

For VOYAH, there's still room to explore lower price points in the future by introducing a Kunpeng version equipped with its in-house autonomous driving and cockpit systems. Currently, VOYAH's strategy is to swiftly establish a strong brand presence through the 'Qiankun Edition' models developed in collaboration with Huawei. This approach was a key lesson learned from the Dreamer. On the 2026 Dreamer, orders for the Qiankun Ultra version, developed jointly with Huawei, accounted for over 50%. During the Taishan launch, VOYAH did not mention the in-house developed version, completely discontinuing the previously entry-level Kunpeng variant. Whether a subsequent launch will be considered remains unconfirmed.

In fact, VOYAH has been fully leveraging Huawei's market influence with its last two products. For instance, on stage, it boldly proclaimed: 'The Most Dominant Chinese SUV.' At a test drive event held a few days before the Taishan's launch, VOYAH's top executives directly stated, 'In the future six-seater SUV market, just watch VOYAH Taishan and AITO M9,' placing the two models on equal footing. The AITO M9 is Huawei's most successful product. What is less known is that Dongfeng is actually the second-largest shareholder of Seres. Therefore, in a certain sense, the AITO M9 is also a product under Dongfeng's umbrella.

This statement can also be interpreted as: For six-seater SUVs, look to Dongfeng. This strategy has garnered significant attention and traffic for the Taishan. By continuing the 'blockbuster approach' from the Dreamer, the Taishan has adopted an aggressive pricing strategy. The market responded positively, with the Taishan securing over 10,000 firm orders within just 21 minutes of its launch. Of course, the final monthly sales data will be revealed in December, but this gives the Taishan a strong start.

VOYAH is currently at a critical juncture in its listing process. In October of this year, VOYAH submitted its listing application to the Hong Kong Stock Exchange. This marks a crucial step in VOYAH's rush to list on the Hong Kong stock market, following its announcement of the listing plan in August and the completion of its joint-stock restructuring in September. VOYAH's listing should proceed smoothly, as its approach is relatively rapid, utilizing the 'introduction listing + privatization' method. Simply put, on August 22 of this year, Dongfeng Group privatized and delisted, transferring its listed shell resources to VOYAH. This move is vividly described as 'replacing the bird in the cage with a new one.'

Through this swift approach, VOYAH aims to preemptively complete its listing and vie for the title of the first central enterprise-backed new energy stock. Following VOYAH, Changan's Avatr is also aggressively pursuing a listing. Previous reports indicate that Avatr plans to submit its listing application to the Hong Kong Stock Exchange in the fourth quarter of this year and aims to complete its listing in the second quarter of next year. The market believes that VOYAH is expected to complete its listing within this year. For VOYAH, the challenge lies not in listing but in effectively communicating its investment value to potential investors.

According to VOYAH's prospectus, the standout feature of its listing this time is its relatively mature financial position—specifically, its profitability. Among the newly listed new energy vehicle brands, VOYAH is the only one that has achieved profitability before listing. Adjusted net loss (non-IFRS measurement): VOYAH reported profits of RMB -1.5245 billion in 2022, RMB -1.4567 billion in 2023, RMB 246 million in 2024, and RMB 479 million from January to July 2025.

Currently, the newly listed new energy vehicle companies include NIO, Li Auto, XPeng, Zeekr, and Leapmotor, but only Li Auto, Leapmotor, and Zeekr have achieved profitability. Moreover, all six companies reported substantial losses at the time of their listings. VOYAH's ability to achieve profitability primarily stems from its positioning in the high-end market above RMB 200,000, allowing it to reach profitability with monthly sales exceeding 10,000 units.

From 2022 to 2025 (January-July), VOYAH's operating revenues were RMB 6.0518 billion, RMB 12.7494 billion, RMB 19.3606 billion, RMB 8.2954 billion, and RMB 15.7815 billion, respectively, with a compound annual growth rate of 78.9% from 2022 to 2024 and a year-on-year growth rate of 90.2% for the seven months ending July 31, 2025. The prospectus reveals that VOYAH's gross profit margin increased from 8.3% in 2022 to 21.0% in 2024 and further rose to 21.3% during the seven months ending July 31, 2025.

However, VOYAH's current core profit source comes from the Dreamer model. VOYAH still needs to demonstrate its potential for sustained growth and improved business performance. Compared to the refreshed Free+ and Ziguang L, the new product Taishan clearly has more potential. Priced at the RMB 400,000 level, the Taishan is more likely to generate higher returns. For VOYAH, launching a best-selling product priced at the RMB 400,000 level on the eve of its listing can provide consumers with a positive outlook on its investment potential.

It's worth noting that Seres, centered around the M9, has already achieved first-tier profitability. Financial reports indicate that in the third quarter of 2025, Seres achieved revenue of RMB 48.133 billion, a year-on-year increase of 15.75%; net profit attributable to shareholders of the listed company was RMB 2.371 billion, a year-on-year decrease of 1.74%. For the first nine months, revenue was RMB 110.534 billion, a year-on-year increase of 3.67%; net profit attributable to shareholders of the listed company was RMB 5.312 billion, a year-on-year increase of 31.56%. So, can VOYAH become the second benchmark in Huawei's ecosystem?

The launch of the Taishan this time is likely to be VOYAH's final new car introduction before its listing. Therefore, the significance it carries is even more profound. As such, the Taishan is a model that 'must succeed.'