Are you still considering buying a fuel-powered vehicle? Its sales in May fell by another 23%

![]() 06/14 2024

06/14 2024

![]() 634

634

Author | Zhen Yao

Editor | Li Guozheng

Produced by | Bangning Studio (gbngzs)

On June 11, the Passenger Car Market Information Joint Conference (hereinafter referred to as the CPCA) released the sales figures for May. The data shows that despite various incentive measures adopted by automakers, such as promotions, subsidies, and trade-ins, the overall market performance was not too impressive and was slightly sluggish.

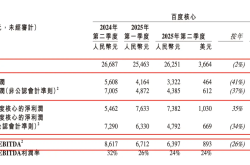

Specifically, the retail sales of passenger cars in the national market in May were 1.71 million vehicles, down 1.9% from the same period last year. From January to May, the cumulative retail sales were 8.073 million vehicles, representing a year-on-year increase of 5.7%.

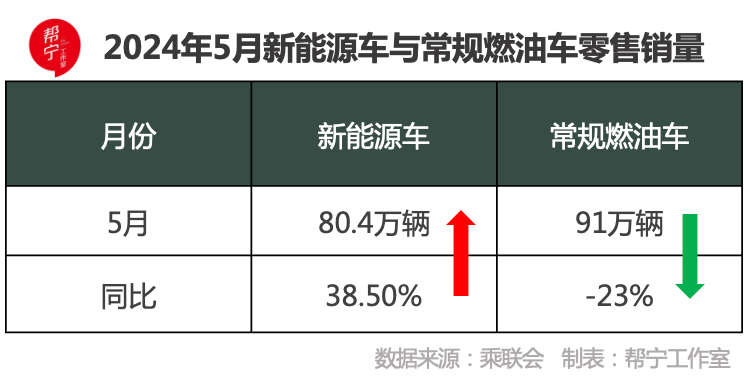

One set of data is particularly eye-catching: In May, the retail sales of conventional fuel-powered vehicles were 910,000, accounting for approximately 53.2% of the retail sales of the passenger car market, with a significant year-on-year decline of 23%, despite a 6% month-on-month increase. Moreover, from the beginning of this year to May, the total retail sales of conventional fuel-powered vehicles were 4.82 million, accounting for 59.7%, representing a year-on-year decline of 9%.

New energy vehicles contrast sharply with this. The data shows that in May, the retail sales of the new energy vehicle market were 804,000, representing a year-on-year increase of 38.5%.

In terms of year-on-year comparison, in May's retail sales, conventional fuel-powered vehicles declined by 23%, while new energy vehicles grew by 38.5%.

Moreover, the sales gap between the two narrowed to less than 110,000 vehicles, indicating that new energy vehicles are catching up quickly. At this rate, overtaking conventional fuel-powered vehicles in sales seems imminent.

Comparing the data is like a clash between ice and fire, highlighting the strong growth and broad prospects of the new energy vehicle market on the one hand, and revealing the severe challenges and irreversible decline facing the traditional fuel-powered vehicle market on the other.

This has brought a series of negative effects to the fuel-powered vehicle market.

First, the price system of fuel-powered vehicles is on the verge of collapse.

"Now, you can buy a base model Audi A4L for just over 190,000 yuan. You can make installments." said the sales manager of an Audi 4S store located in Chaoyang District, Beijing. She revealed that the Audi A4L series offers discounts of over 100,000 yuan, and there is still room for concessions if customers are willing to come in for detailed discussions.

The price of the Audi A6L has also dropped. The manager specifically mentioned: "The base model Audi A6L, with a bare car price of only 299,500 yuan, can now provide a cash subsidy of 10,000 yuan if you trade in an old car."

Under the high-value promotion policy, the bare car price of the Audi A4L has entered the "100,000 yuan" range, while the Audi A6L has dropped to the "200,000 yuan" range. The Audi A4L was originally positioned as a B-class luxury sedan in the 300,000 yuan category, with a manufacturer's suggested retail price ranging from 321,800 to 400,800 yuan. However, the current terminal price reduction is as high as 120,000 yuan, with the bare car price falling below 200,000 yuan, equivalent to a 6.2% discount.

The significant price drop of Audi models not only indicates that the brand is adjusting its market strategy but also suggests that the entire fuel-powered vehicle price system is accelerating towards collapse.

This trend is not unique to Audi. Lexus ES models, which were in short supply a few years ago and required additional payments of tens of thousands of yuan to take delivery, are now also facing market pressure, with terminal discounts reaching over 50,000 yuan.

In addition, there is a popular saying in the market that goes, "five-fold Cadillac, six-fold Land Rover, and seven-fold Jaguar," referring to discounts of 120,000 yuan for the Cadillac XT5, 190,000 yuan for the Land Rover Range Rover Evoque, and 150,000 yuan for the Jaguar XEL.

These significant discounts reflect both the fierce competition in the fuel-powered vehicle market and the strong impact of new energy vehicles.

Statistical data shows that in May this year, the price reduction in the auto market exceeded 90% of the total price reduction scale for all of last year, surpassing the overall price reduction in 2022.

At this point, the terminal prices of fuel-powered vehicles from joint venture brands have almost reached the cost bottom line, with little room for further reductions. However, on the other side, new energy models are still frequently launching "electricity cheaper than oil" offensives. It can be foreseen that the fuel-powered vehicle price system will be forced to continue to recede.

Second, high inventory.

In addition to price collapse, high inventory is also one of the major challenges facing fuel-powered vehicles.

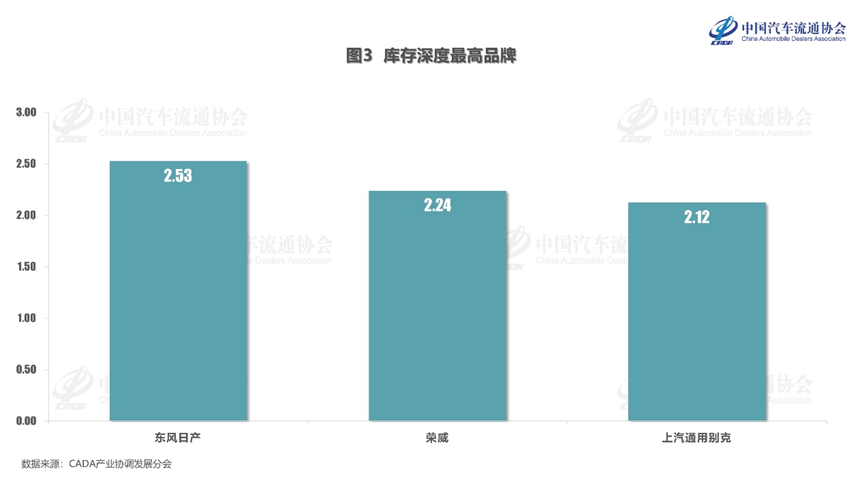

According to the latest data released by the China Automobile Dealers Association, at the end of May, although the total inventory of car dealers decreased by 6% compared to the end of April, it still remained at a high level of approximately 2.5 million vehicles.

This undoubtedly brings tremendous pressure and challenges to automakers.

From the perspective of brands and attributes, joint venture brands that primarily sell fuel-powered vehicles have an inventory coefficient of 1.66, which is at a high level. In May, the top three brands in terms of inventory depth were Dongfeng Nissan, Roewe, and SAIC-GM Buick, with inventory coefficients of 2.53, 2.24, and 2.12, respectively.

High inventory puts dealers under severe sales and inventory management issues. "The pressure on our store to digest inventory vehicles is quite significant," said a sales manager from an SAIC-GM Buick 4S store candidly.

Third, used fuel-powered vehicles have become a hot potato.

"The used car market may be completely ruined. The current vehicle prices are only valid at the time of quotation! You might wake up after sleeping, and the price has changed, even if it's just a short nap during the day." complained a used car dealer with a worried look.

He said that the used car market this year is miserable, with cars purchased last year shrinking by 10,000 to 20,000 yuan this year. Even with price reductions, it is difficult to find buyers, especially for cars that originally cost 20,000 to 30,000 yuan, where losses are even more severe.

Especially with the continuous decline in new fuel-powered vehicle sales, it has exacerbated the sharp price drop in used fuel-powered vehicles. Even Japanese cars, which once prided themselves on high resale value, are now experiencing significant price declines.

On June 3, the China Automobile Dealers Association released the "China Automobile Resale Value Report for May 2024," stating that due to the impact of adjustments in automakers' product layouts, the resale values of various models across all levels generally declined in May, especially for fuel-powered vehicles, which account for the vast majority.

Meanwhile, the resale value of used new energy vehicles has gradually stabilized, and the resale value of high-end MPV models has shown an upward trend.

This is undoubtedly adding insult to injury for fuel-powered vehicles.

Since the new fuel-powered vehicle market is shrinking at a visible speed, does it still make sense for automakers to launch brand-new fuel-powered vehicles?

This is a major challenge facing fuel-powered automakers.

To alleviate this contradiction, some automakers have adopted a diversified strategic combination.

The preferred strategy is direct official price reductions.

Guangqi Toyota recently launched the 2024 Highlander, which reduced prices while upgrading configurations, with a maximum price reduction of 53,000 yuan. After considering various discounts, the price range is from 229,800 to 305,800 yuan.

Beijing Hyundai is similar. The eleventh-generation Sonata, which went on sale at the end of March this year, lowered the starting price to 139,800 yuan, setting a new low for the guidance price of joint venture B-class cars, almost on par with A-class cars.

Another strategy is to offer concessions.

On June 7, the large five-seat SUV from the SAIC-GM Buick brand, the Buick Envision Plus, was launched, introducing three models with a price range of 229,900 to 259,900 yuan.

To attract consumers, the new car offers generous purchase benefits, including full exemption from purchase tax, a trade-in subsidy of up to 10,000 yuan, and an additional 10,000 yuan repurchase value preservation subsidy. These measures significantly reduce the cost of car purchase and increase the cost-effectiveness of the new car.

SAIC Volkswagen recently launched the Tiguan L Pro, with a price range of 236,800 to 266,800 yuan. To further enhance the attractiveness of the product, SAIC Volkswagen announced a 20,000 yuan reduction in purchase tax and a special policy of "80% repurchase after three years."

However, whether it's official price reductions or concessions, from the actual market response, the effects are not significant and have failed to impress consumers. An industry insider admitted that despite amazing discounts, fewer consumers are paying attention to fuel-powered vehicles now, and many people don't even consider them as an option when buying a car, "no matter how big the discount is."

In a world of fierce competition, "no breakthrough, no establishment."

Multiple industry experts have predicted the future market landscape.

"Two years ago, my prediction was '443'—40% hybrid + extended range, 30% pure electric, and 30% fuel-powered." said Li Xueyong, Deputy General Manager of Chery Automobile Co., Ltd. Based on the data received in May, hybrids account for 31.5%, pure electric for 39%, and fuel-powered for 30%, which is infinitely close to the proportion he proposed. In the future, hybrids and extended-range vehicles will become the mainstream.

Another industry expert predicts that by 2030, the competitive landscape in the automotive market will evolve into "433," with new automotive forces accounting for 40% of the market share, successfully transformed domestic brands accounting for 30%, and foreign brands, including joint ventures, also accounting for 30%.

Although these two predictions differ in detail, they are highly consistent in their views on the future fate of fuel-powered vehicles, believing that the market share of fuel-powered vehicles will gradually decrease.

Fuel-powered vehicles are not dead, but gradually fading.

Under the tremendous changes of the times, would you consider buying a fuel-powered vehicle?