Nio's Sales Soared in Q2, but It's Still Difficult to Overcome the Crisis

![]() 06/14 2024

06/14 2024

![]() 473

473

Image Source: Nio's official Weibo

Has Nio Completed its "Deep Squat"?

In 2022, Li Bin, still the leader of the "new forces" of Nio, Xiaopeng, and Li Auto, was full of energy and enthusiasm. At the beginning of that year, he proposed that "we hope to achieve full-year profitability by the 10th anniversary of Nio's establishment in 2024." It was also in this year that Li Bin boldly set the goal for Alpine (now Ledo): "This time, we will be the ones to turn over the table. We will do whatever sells well, whatever model or car is selling well."

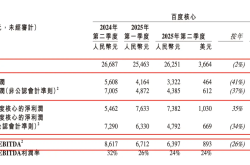

However, the current results seem very far from achieving full-year profitability, and Li Bin's anxiety likely outweighs his disappointment. Judging from the first-quarter financial report, Nio's revenue in the first quarter was 9.91 billion yuan, a decrease compared to the previous quarter and the same period last year, down 42.1% quarter-on-quarter and 7.2% year-on-year. Nio's gross margin for vehicle sales in the first quarter was 9.2%, escaping the low-margin stage, but this is obviously not an ideal level for Nio.

In terms of vehicle deliveries, Nio delivered 30,053 new vehicles in the first quarter, a year-on-year decrease of 3.2%. Coupled with the switch to the 2024 model and terminal promotions for older models, this affected Nio's gross margin and vehicle sales revenue, further expanding losses. Vehicle sales revenue was 8.381 billion yuan, down 9.1% year-on-year and 45.7% quarter-on-quarter. Net losses were 5.185 billion yuan, an increase of 9.4% year-on-year and a decrease of 3.4% quarter-on-quarter.

Image Source: Nio's official Weibo

Those who firmly believe that Nio is doomed have seen various bad signs, such as Nio burning hundreds of millions in模仿ing BYD's vertical integration R&D model, the heavy burden of its battery swapping network, and its cash flow and debt repayment ability being in a dangerous range in these two years. However, these issues have not emerged overnight, and Nio is not without its merits. On the contrary, we have seen some different changes in Nio. If the battlefield of new energy vehicles is judged solely by success or failure, it would be both boring and superficial.

Nio may have the best brand reputation among the new forces, but its sales have been stagnant, hovering around 10,000 to 20,000 vehicles per month for nearly three years, with no breakthrough. According to Huxiu Miaotou's calculations, under the current sales and service network and current manufacturing costs, Nio needs to achieve six times its current sales volume, which translates to 84,000 vehicles per month and 1 million vehicles per year (even considering the decline in manufacturing costs after production scale expansion, the monthly sales demand is unlikely to be lower than 70,000 vehicles, equivalent to about 850,000 vehicles per year), in order to achieve operating profit balance.

That's why Nio has suffered a loss of 50 billion yuan over the past three years. Fortunately, Li Bin, known as "Bin Ge," has been actively seeking financing worldwide. The Middle Eastern tycoon and Abu Dhabi government-backed investment company CYVN Investments have issued a targeted issuance of 2.95 billion US dollars in shares, combined with Nio's own issuance of 1 billion US dollars in convertible preferred bonds. Nio achieved actual capital injections of 27.663 billion yuan in 2023. With the largest amount of financing since 2020, Nio's net cash flow at the end of 2023 reached 38.622 billion yuan, even surpassing the level at the end of 2020. However, relying solely on the CEO to raise financing worldwide is a stopgap measure, not a long-term solution.

In the past, people questioned that Nio only had good service, and most of its other technologies came from suppliers. Li Bin took this criticism to heart. In recent years, Nio has built up almost the most comprehensive technological map in China, covering motor, 800V, silicon carbide, chips, battery R&D and manufacturing, as well as intelligence, which have all been clearly laid out on Nio's R&D tree.

At the end of last year, Li Bin conducted a marathon-style live broadcast, driving the Nio ET7 alternately with Shen Fei, Nio's Vice President of Power Management, from Shanghai to Xiamen, covering 1,044 kilometers without charging or swapping batteries. With 3% battery left, they set a new record for the actual driving range of pure electric vehicles, shocking the automotive industry and subsequently sparking a wave of interest in solid-state batteries. Both GAC Motor and IM Motors announced that they would soon launch solid-state batteries.

Image Source: The Internet

However, advanced technology does not necessarily translate into market advantages. There are still many difficulties to overcome from small-batch laboratory testing to large-scale mass production. The 150 kWh battery was the key to this test. It has a capacity that is more than 50% higher than most current electric vehicle battery packs, but its cost has doubled to reach 3 million yuan. Industry insiders estimate that a similar 150 kWh battery from Nio would require an investment of about 1 billion yuan from testing to small-scale mass production, which is twice as high as mainstream batteries. Whether users will buy into the high cost and difficult mass production remains uncertain. If technology cannot be converted into an advantage, it will become a disadvantage.

In contrast, BYD's fifth-generation DM hybrid technology has achieved three "global firsts," with its 2.9L per 100km fuel consumption under power loss directly hitting the pain points of many netizens and significantly stimulating sales growth for the Qin L and Dolphin 06 models. In particular, the operation of increasing value without increasing price or even reducing price has directly ignited the automotive market, greatly reducing user selection costs.

In the past, not only the media but also the new forces themselves felt that they were far ahead, but now in terms of capabilities such as infotainment systems, intelligence, and assisted driving, the significant lead of the new forces has turned into a small lead. Autonomous automakers can erase this gap with pricing alone, not to mention products directly empowered by collaborations with Huawei and other super partners. Therefore, Li Bin's current focus is narrowed down to two areas: battery swapping and new brands, Ledo and the unlisted Firefly.

Ledo Will Not Easily Save Nio

One of the points that Nio has often been criticized for in the past is its battery swapping, which has been described as a "typical case of stupid people with lots of money." Tesla couldn't make it work, so why does Nio think it can succeed? To solve the sales problem, it would be better to focus on extended-range models. However, extended range is not a sales magic bullet, and pure electric is not unbeatable.

According to data from the China Passenger Car Association (CPCA), pure electric models accounted for 58.6% of cumulative sales in the new energy vehicle market from January to April, while plug-in hybrid models accounted for 29.9%, and extended-range models accounted for 11.5%. Some might say that this seems different from online sentiment, but it is true that the overall market share of extended-range models is small, with rapid growth mainly concentrated in third- and fourth-tier cities. As of April this year, the sales growth rates of pure electric, plug-in hybrid, and extended-range models were 37%, 93%, and 218%, respectively. Nio's current sales and service are mainly concentrated in first-tier and new first-tier cities, so hastily entering other markets may not be suitable.

Moreover, the extended-range market has become fiercely competitive. In December last year, there were a total of 19 extended-range models sold in the Chinese passenger car market; by April this year, this figure had grown to 25, an increase of 31.6%. Currently, only NIO and WJEV are doing well in extended-range models. Extended-range models, which have long been seen as a transitional route, may bring sales growth, but what about future technological development? NIO's answer is a less successful attempt at the mega pure electric route. Therefore, Li Bin wants to create products with an endgame advantage, aiming for sweet success after hardship.

But can it really be so?

Li Bin revealed during the first-quarter earnings call that Ledo L60 will be launched and delivered in September this year, and a second product, a medium-to-large SUV, will be released next year. "Ledo will not have too many products, and we want to ensure that each car has sufficient competitive advantages. Ledo's long-term goal is to maintain a gross margin of over 15% and achieve a sales volume of 20,000 to 30,000 vehicles per month, which will allow us to reach a break-even point." In addition, Li Bin made it clear that "Ledo cannot be described as cost-effective, but rather the optimal choice in terms of experience and cost for family users."

Image Source: Ledo Automobile Weibo

Nomura Securities noted in a research report that in the Chinese SUV market ranging from 180,000 to 250,000 yuan, where Ledo operates, only two of the top 15 models in April 2024 were pure electric SUVs, namely the Model Y ranked first and the BYD Song Plus EV ranked seventh. There were four plug-in hybrid models (including extended-range models). This is because most of the models in this market segment are family-oriented, and the products cannot have obvious shortcomings in terms of space, energy replenishment, and price. Pure electric models do not have a solid position in this segment due to their long energy replenishment time.

According to Ledo sales representatives, compared to space and software/hardware configuration, every Ledo owner can use Nio's existing energy replenishment system, which has become the real trump card for Ledo to boost sales.

Leaving aside the issue of battery swapping and energy replenishment, the market targeted by Ledo is the most fiercely competitive in terms of price wars. The penetration rate of new energy vehicles priced between 200,000 and 300,000 yuan is 56%, much higher than the overall penetration rate of 43.7% for new energy vehicles. This is not necessarily a bad thing, but a high penetration rate also means more competition. Xiaomi, Xiaopeng, and WJEV are all releasing volume in this price range, and "increment without profit" is also the norm in this segment.

The biggest question facing Ledo is how different it is from Nio. Some netizens have commented, "Since the price difference is so small, why not just buy Nio?" "Buying Ledo is like telling others that I'm a few tens of thousands short of buying Nio?"

During the 2023 earnings call, Li Bin clarified Ledo's position in Nio's battery swapping network. He said that Nio's battery swapping network will be divided into "dedicated network" and "shared network" in the future. The former is a dedicated network for Nio users and cannot be used by Ledo users; the latter is a shared battery swapping network used by Nio and other brands.

According to public data, as of May 10, Nio has cumulatively built 2,414 battery swapping stations, including 797 expressway stations, and 3,832 charging stations with 22,312 charging piles. Among them, approximately 1,000 third-generation battery swapping stations are partially available for Ledo, and fourth-generation stations are under construction. This means that Ledo will need to build some battery swapping stations on its own, which will pose a challenge to Nio's cash flow in the next few quarters.

Image Source: Nio's official Weibo

According to calculations by Shen Fei, Nio's vice president, each battery swapping station can achieve a break-even point by handling 50 to 60 swaps per day. However, according to Nio's official website data, the average daily number of battery swaps at swapping stations is approximately 70,000, which translates to about 28 swaps per station per day, still a considerable distance from profitability.

Nio's response to these questions has always been that the battery swapping network is still in its early stages, and expecting it to make money is unrealistic. Referring to Tesla's situation, it is currently dominant in the North American market and has attracted automakers such as General Motors and Ford to join. Goldman Sachs estimates that when Tesla's global charging pile count reaches 500,000, the annual revenue of its charging network will reach 25 billion US dollars. If Nio's battery swapping network reaches its full potential, there is hope for profitability.

Therefore, Nio has formed its own battery swapping alliance, which includes eight allies such as Changan Automobile, GAC Group, Chery, Geely, and FAW. They all appear to be mainstream players with capital. However, there is still a considerable distance from Nio's desired comprehensive battery swapping network that achieves break-even. Because battery swapping itself has a certain impact on vehicle structure, space utilization, and overall vehicle design, these automakers need to specifically build cars that meet Nio's battery swapping standards. Currently, not many models actually support this, and if battery swapping models do not sell well, they may become a burden.

Will the Second Quarter "Bring Nio Back to Life"?

Nio has not been immersed in the downturn of the first quarter but has been hyping its strong comeback in the second quarter.

The second quarter will be over after June. As of now, Nio's second quarter is obviously stronger than the first quarter. In the just-ended May, Nio delivered 20,544 new vehicles, setting a new record, while the average sales volume for the entire first quarter was just over 10,000, with a total delivery of only 30,053 vehicles.

In its financial report, Nio provided guidance for second-quarter deliveries of 54,000 to 56,000 vehicles, representing a year-on-year increase of over 120%. Judging from the current sales trend, as long as sales are maintained in June, this goal can be achieved.

It remains to be seen whether this growth rate can be sustained, as the second-quarter sales growth mainly relied on reducing BaaS prices and incentive benefits.

Nio recently adjusted the fees for its BaaS battery leasing program, reducing the monthly rental service fee for standard-range battery packs from 980 yuan to 728 yuan and for long-range battery packs from 1,680 yuan to 1,128 yuan. At the same time, it supports using part of the rental fee to offset the battery buyout cost. This adjustment has made the previously unpopular BaaS program the mainstream car purchase option. Li Bin revealed that after adjusting the monthly battery rental price, the proportion of battery leasing now exceeds 80%.