Net profit of 150 million in Q3, Leapmotor to continue soaring next year, aiming to sell 1 million units and earn 5 billion

![]() 11/21 2025

11/21 2025

![]() 632

632

Dark horse becomes the new king

Author: Wang Lei

Editor: Qin Zhangyong

This year, Leapmotor has been running incredibly fast.

Leapmotor's Chairman Zhu Jiangming just announced the achievement of the 2025 delivery target of 500,000 units ahead of schedule and set a flag to sell 1 million units annually next year.

The Q3 financial report, which shows all-around positive results, has also arrived, with record-high sales and profits and revenue reaching 19.45 billion yuan; deliveries reached 174,000 units. Both figures are roughly double those of the same period last year, with the former increasing by 97.3% year-on-year and the latter by 101.9%.

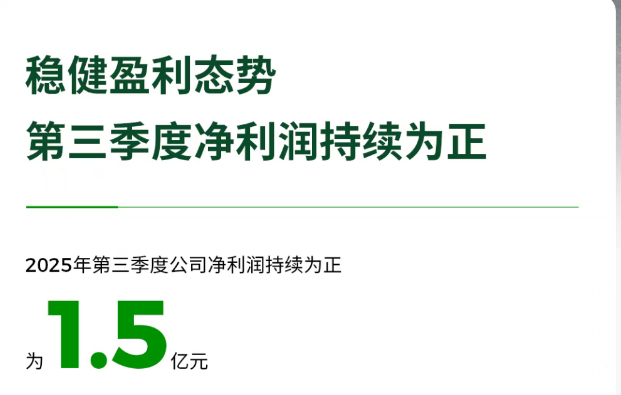

The net profit for the first half of this year was only 30 million yuan, but by the third quarter, the net profit attributable to the parent company reached 150 million yuan, indicating that Leapmotor's profit model is healthy and sustainable.

More importantly, at the subsequent financial report communication meeting, I saw Leapmotor's greater ambition, not just to sell 1 million units annually and achieve 100 billion yuan in revenue but also to earn 5 billion yuan next year.

01

Intensive launch of new cars

Next year, we will focus on both quantity and quality.

How exactly will this be achieved?

Firstly, through the intensive launch of new products. Leapmotor has two new series to be released: the flagship D-series models and the volume-oriented A-series compact cars.

The first model of the D-series, the D19, was unveiled in October and received positive market feedback. Li Tengfei, Vice President and CFO of Leapmotor, stated that the D-series exceeded expectations, saying, "The blind order volume for the D-series is the highest among all products we have offered blind orders for during the same period."

Li Tengfei also teased that when Leapmotor announces the pricing for the D19, it will surely surprise everyone, and the D19 will definitely be a product that makes people scream.

According to the plan, the D19 will be officially launched in the first half of 2026. Moreover, the D-series will not be limited to just one model. In 2026, Leapmotor will also release the second product in the D-series, an MPV model.

Although the D-series models carry the flagship attribute and are positioned higher, Leapmotor still aims to achieve high sales volume. Previously, Zhu Jiangming said that the D-series is not oriented towards pursuing high profits but continues Leapmotor's consistent cost-based pricing strategy while achieving leading levels in technology, configuration, and performance.

Li Tengfei also mentioned at the meeting that the D-series does not pursue an extremely high gross profit margin. The overall product pricing will float around the 15% level, adhering to a high cost-performance ratio pricing strategy and not pursuing an excessively high gross profit. It is estimated that the gross profit margin for the entire D platform will be between 15% and 20%.

Next up is the soon-to-be-unveiled A10, the first model of the A-series. According to Leapmotor, it is a "smart, high-quality, long-range SUV" targeting the global market and is expected to be officially launched in the first half of 2026.

At the same time, the A-series will have another product, the A05, which will also be launched for sale in 2026. No further information was disclosed at the financial report meeting.

In addition, the all-new compact sports car "Lafa 5," which is already available for pre-sale and will be officially launched on November 27, will also be introduced to the global market in the second quarter of 2026 as a global model.

Besides, the existing main models, such as the C-series products C16, C10, and C11, and the B-series products B10 and B01, will all have product upgrades next year.

In summary, Leapmotor's product lineup next year will include four new models: two from the A-series and two from the D-series, along with at least ten existing models from the C-series, B-series, and Lafa 5, to support Leapmotor's sales target for next year.

With an increase in the number of car models, the scale of the sales channels naturally cannot be overlooked. Leapmotor's sales channels will exceed 1,000 by the end of this year and will surpass 1,500 by the end of next year, with Leapmotor centers accounting for over 50%. The overall trend is to expand into fourth- and fifth-tier cities. As of October, 80% of dealers achieved cumulative profitability from January to October.

Another significant growth factor supporting the sales target of 1 million units is overseas expansion. From a layout perspective, two localization capacity projects in Malaysia and Europe are entering the implementation stage. The Malaysian project will be implemented in the first half of 2026, while the European project will be implemented in the second half of 2026. The first model to be launched in Malaysia will be the C10, and in Europe, it will be a B-platform model.

These overseas bases have reserved production capacity. In terms of both the number of models and production volume, Li Tengfei stated that based on the positive momentum in the fourth quarter of this year and the successive launch of Lafa 5 and A-platform products in overseas markets, as well as the launch of new products in countries in South America and the Middle East, the estimated overseas sales target for next year is expected to be in the range of 100,000 to 150,000 units.

Regarding profitability overseas in 2026, Li Tengfei stated that Leapmotor International will adopt a low-gross-profit-margin model for the first three years, conceding more gross profit to Leapmotor International to better explore the market. The overseas gross profit next year will not be too high, basically remaining the same as this year.

It is worth mentioning that Li Tengfei also mentioned that Leapmotor is developing a "new species." Currently, the strategic planning has been discussed, and the product direction, brand direction, and channel direction are all very clear. The team is being formed, and product development is proceeding in an orderly manner.

However, product information cannot be disclosed at present, but Li Tengfei stated that this "new species" will be different from domestic and overseas products, representing an innovative product from Leapmotor that will open up a new category and will be unveiled in 2027-2028.

Finally, the progress of the cooperation between Leapmotor and FAW was mentioned. Li Tengfei stated that the first project between the two parties for overseas models has been implemented, with mass production and overseas sales to be introduced in the second half of next year. Cooperation in other areas is also progressing in an orderly manner.

02

Continuous improvement in profitability

Returning to the present, let's examine Leapmotor's actual performance in the third quarter that just passed.

Firstly, there is sustained profitability. The net profit attributable to the parent company in Q3 remained at 150 million yuan. Although the scale is not large, it at least proves that the first profitability achieved in the first half of the year was not a flash in the pan but a solid advancement. More importantly, the company's operating profit margin turned positive from -7.5% in the same period last year to 0.3%, achieving a true turnaround from losses to profits.

In terms of core data, the revenue in Q3 reached 19.45 billion yuan, roughly double that of the same period last year. The absolute main contributor to the revenue was the significant increase in vehicle sales.

A total of 173,852 new cars were delivered in the third quarter, a year-on-year increase of 101.77% and a nearly 30% increase quarter-on-quarter. Among them, over 66,000 units were delivered in September, and more than 70,000 units were delivered in October, maintaining the first place in sales among new energy vehicle brands for eight consecutive months.

Delving deeper into the reasons, Leapmotor has taken "low profit, high sales volume" and "increasing revenue and reducing expenditure" to the extreme.

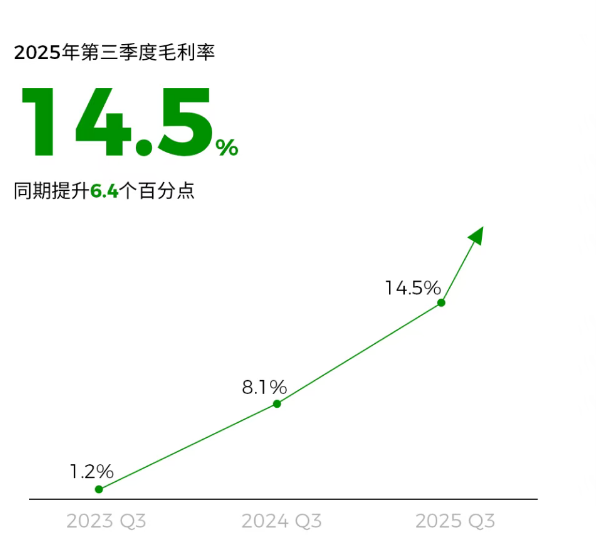

As we all know, adhering to a "cost-performance" strategy is one of the core driving forces behind the rapid increase in sales of Leapmotor's new cars. However, under the strong scale effect, Leapmotor's gross profit margin in Q3 was pushed to 14.5%, compared to only 8.1% in the same period last year, and it also increased by 0.9 percentage points compared to the second quarter.

This also means that although Leapmotor follows a low-profit, high-sales-volume model, its profitability per car sold is gradually increasing. In other words, Leapmotor earns approximately 860 yuan in net profit per car sold.

Behind this is not only a simple expansion of scale but also the result of product structure optimization. In the third quarter, the launch of deliveries for high-gross-profit-margin models such as the new C11 and C16 from Leapmotor had a positive impact on the increase in gross profit.

On the other hand, the "increasing revenue" aspect, namely carbon credit income, also provided a positive supplement to the profits. In the third quarter, Leapmotor obtained 250 million yuan in additional income through carbon credits. Although this part of the income has policy cyclicality, it still plays a role in stabilizing the gross profit within the current financial structure.

Moreover, the fourth quarter may see even higher income. Li Tengfei stated during the conference call that since carbon credits are directly related to sales volume, especially in the EU and Asia-Pacific regions, it is expected that carbon credit income in the fourth quarter will reach approximately 500 million yuan.

"Reducing expenditure" is reflected in cost control. In terms of expenditures in the third quarter, research and development accounted for the largest portion at approximately 1.21 billion yuan, sales expenses were 950 million yuan, and administrative expenses were 630 million yuan. Although Leapmotor's research and development expenditure is not the highest among new energy vehicle manufacturers, the results are significant. Wei Jianjun, Chairman of Great Wall Motors, once said that research and development expenditure is not necessarily higher the better; the key is to invest in the right technologies.

The relatively modest expenditure has ultimately reduced the total expense ratio to 14.3%, a decrease of 2.6 percentage points compared to the same period last year.

On one hand, the gross profit margin is increasing, and on the other hand, the expense ratio is decreasing. As a result, Leapmotor has entered a virtuous cycle of earning profits through scale and efficiency.

In addition to profit figures, there is another noteworthy indicator in the financial report: cash flow. In Q3, the net cash generated from operating activities of Leapmotor reached 4.88 billion yuan, with free cash flow of 3.84 billion yuan, and cash reserves on the balance sheet reached 33.92 billion yuan.

As the saying goes, having ample resources brings peace of mind. This provides sufficient financial support for the upcoming intensive launch of new cars and global expansion.

This year, Leapmotor's remarkable performance proves a fact: even without following a high-end route, it is possible to carve out a path through ultimate efficiency and scale.