辅助驾驶新黑马深蓝L06登场,地平线HSD成为爆款“加速键”

![]() 11/21 2025

11/21 2025

![]() 450

450

If the automotive industry in 2024 was still debating 'whether to incorporate intelligent driving capabilities,' the answer in 2025 is already reflected in sales figures.

On the evening of November 18th, the Deepal L06, priced starting at 132,900 yuan, officially hit the market. Just one hour later, Deepal Auto announced on Weibo that 'cumulative orders have surpassed 20,000!' Beyond its 'aggressively priced' strategy, the Deepal L06's most memorable label is undoubtedly 'intelligent driving dark horse.'

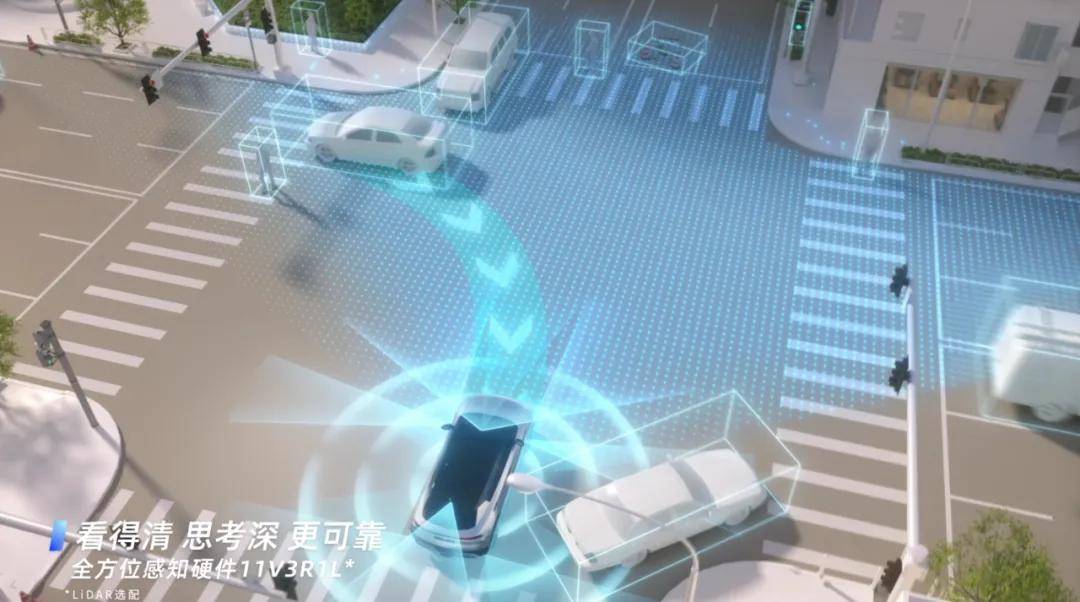

Intelligent driving capabilities such as LiDAR, one-stage end-to-end intelligent driving assistance algorithms, and urban navigation assistance, previously found only in vehicles priced above 200,000 yuan, have been introduced by Changan to its new 150,000 yuan-level model, bringing 'high-level intelligent driving' from premium configurations back to the mainstream market.

Deepal Auto is not the only automaker prioritizing 'intelligent driving.'

According to data disclosed in XPENG's Q3 financial report: The MONA M03 delivered a cumulative 45,400 units in a single quarter, accounting for 39.14% of total deliveries. As XPENG's sales leader, the MONA M03 also emphasizes intelligent driving capabilities, once dubbed the 'top student' in the A-class pure electric market.

Even the high-end MPV, VOYAH Dreamer, achieved over 10,000 pre-orders within 18 hours of its launch, with over 50% of orders for the intelligent driving version...

It seems easy to draw a conclusion: The leverage of high-level intelligent driving on sales has evolved from a 'value-added feature' to a 'core selling point.' Led by a series of 'intelligent driving dark horses,' 2025 is destined to be a watershed year for the 'democratization of intelligent driving.'

01 S-shaped surge in penetration rate: Intelligent driving becomes an 'entry threshold'

What better illustrates the point than a set of macro data released by the Ministry of Industry and Information Technology?

From January to July 2025, cumulative sales of passenger cars equipped with combined driving assistance functions (Level 2) in China reached 7.7599 million units, with a penetration rate of 62.58%, a year-on-year increase of 21.31%. This means that for every 10 new vehicles sold, over 6 possess a considerable degree of intelligent driving capability.

Extending the timeline reveals a classic 'S-shaped curve' in the popularize (popularization) of intelligent driving functions: When a new technology's penetration rate exceeds 15%, it enters the early mass adoption phase; at 50% or even 60%, it becomes an 'entry threshold' for the industry.

Why is this happening? The answer points to the 'universal intelligent driving' wave in early 2025.

First to 'take the lead' was Changan, which released the 'Beidou Tianshu 2.0' plan in the form of 'more features, same price,' accelerating the popularize (popularization) of intelligence in the lower-end market. It also announced that all new models in the next three years would come standard with intelligent driving interfaces, enabling high-level intelligent driving to be equipped on more cost-effective models.

BYD followed with a 'blockbuster,' unveiling three versions of its 'Celestial Eye' intelligent driving system, declaring that all its models would feature high-level intelligent driving capabilities, covering vehicles priced above 200,000 yuan, 100,000-200,000 yuan, and below 100,000 yuan. Even the 69,800 yuan Seagull comes equipped with an intelligent driving solution.

It cannot be denied that due to the relatively vague concept of intelligent driving assistance, some automakers have engaged in 'wordplay,' possibly excelling in only one or two scenarios yet eagerly promoting them at product launches. This led the Ministry of Industry and Information Technology to publicly solicit opinions on the mandatory national standard 'Safety Requirements for Combined Driving Assistance Systems of Intelligent Connected Vehicles' in September, attempting to establish compliance boundaries for the industry.

These 'hiccups' will not hinder the popularize (popularization) of 'universal intelligent driving.'

Because 'universal intelligent driving' has subtly reshaped consumer expectations, making high-level intelligent driving no longer an 'expensive toy' but a standard feature of national cars. As Deng Chenghao, CEO of Deepal Auto, stated in a media interview earlier this year: 'In the future, consumers will not consider cars without intelligent driving capabilities. Intelligent driving is not a multiple-choice question but a must-answer for future mobility.'

To capture consumer mindshare, automakers must deliver certainty in intelligent driving experiences that are 'ready to use and improve with use.'

A direct example is the newly released Deepal L06, which comes standard with LiDAR, is equipped with Horizon Robotics' dual Journey 6 chips, and features a one-stage end-to-end + reinforcement learning algorithm co-developed with Horizon Robotics. This achieves a 'human-like' experience with ultra-low latency across all scenarios: Lane changes, turns, and detour (detours) are seamless, with over 90% reduction in the frequency of gentle braking, heavy braking, and swerving, and defensive driving capabilities to proactively anticipate risks and make smooth evasive maneuvers.

Numerous examples can be found.

SAIC, seeking to regain ground in the new energy market, collaborated with Huawei to create the new brand Shangjie, advocating the concept (philosophy) of 'making high-end intelligent driving no longer price-dependent.' Another established automaker, Chery, launched the new 150,000 yuan-level model Exeed ET5, proclaiming at its launch event its ambition to become China's 'FSD'...

The speed at which high-level intelligent driving is penetrating the market has evidently exceeded many expectations, while also sparking new doubts: Will the automotive industry's price war extend from electrification to intelligence?

02 Era of equal access to intelligent driving: Consumers only pay for experience

The question of a 'price war' is not difficult to answer, as the smartphone industry has already set a precedent.

Back around 2015, the smartphone market was filled with diverse players, and price wars became the norm: Flagship features like fingerprint recognition, high refresh rate screens, and multi-camera systems quickly trickled down to 'budget phones' within a few months.

The outcome was not a 'bad money drives out good' scenario but the complete exit of counterfeit phones and the extinction of feature phones, with market share continuously concentrating towards leading brands.

A similar scene is unfolding in the smart car market.

Beyond specifications, consumers care about whether intelligent driving can handle rush-hour intersections, brake in time for 'ghost probe ' (sudden appearances) by food delivery riders, or confidently change lanes when a large vehicle encroaches on their lane on the highway... What awaits the automotive industry is not so much an escalating 'price war' but a 'value war' where 'good money drives out bad,' shifting focus from hardware stacking to experience and safety.

And when consumers only pay for genuine experiences, no longer for spec-heavy performance, automakers will be compelled to alter their survival strategies.

A clear trend is emerging: More and more automakers are embracing mature, efficient, and leading intelligent driving solutions, with experience becoming the 'greatest common denominator' in the market.

Take Horizon Robotics, for example, whose partner list already includes over 40 automakers like Changan, Chery, Volkswagen, and NIO, as well as Tier 1 suppliers such as Bosch, Continental, and Denso. By the first half of 2025, Horizon Robotics' market share in the Chinese self-owned brand assisted driving computing solution market had grown to 32.4%, meaning 'one in every three smart cars is equipped with a Horizon Robotics solution.'

The reasons behind this can be found in professional evaluations by several automotive bloggers.

First, a deep dive into Horizon Robotics' HSD by Quasar Channel highlighted the differences between two-stage and one-stage end-to-end systems: The latency from perception to trajectory output is around 400ms for two-stage systems, while one-stage systems achieve under 200ms. Whether in lateral trajectory control or longitudinal acceleration and deceleration, HSD can be considered the 'king of gaming' among assisted driving systems.

Second, Tim Ying's Horizontal evaluation (horizontal comparison) of multiple high-level intelligent driving models in China concluded that HSD excels in generalization, passability, lateral and longitudinal comfort tuning, scene understanding, and defensive driving.

Third, AutoLab's comparison between Horizon Robotics' HSD and Tesla's FSD, in a test scenario blocking LiDAR and relying solely on vision, reached a straightforward conclusion: Horizon Robotics' HSD resembles a Chinese version of FSD, even demonstrating finer performance in certain scenarios.

When consumers no longer obsess over specifications and vote based on experience, automakers' choices become increasingly pragmatic. Reflected in the intelligent driving market, those who can deliver 'high-level experiences' and forge a 'mass-market hit' reputation will secure automakers' orders.

Following the evolutionary trajectory of the smartphone market, when intelligent driving ceases to be an expensive 'show-off' feature and becomes as standard as airbags and ABS in every vehicle, smart cars will complete their transformation from 'transportation tools' to 'intelligent terminals,' bringing intelligent driving truly into the homes of ordinary people.

03 From rivalry to symbiosis: The 'Android model' of intelligent driving

'Universal intelligent driving' has not only changed automakers' attitudes but also reshaped industry collaboration paradigms.

The autonomous driving narrative has spanned over a decade, constrained by the necessary time cycles of technological innovation and the 'detours' taken by the automotive supply chain: When automakers sought to incorporate intelligent driving functions, Tier 1 suppliers would package chips and algorithms into unmodifiable 'black box' solutions, severely lacking flexibility. Moreover, the Tier 1 model's long development cycles and difficulty in forming effective data loops pushed automakers towards 'in-house development.'

However, the path of 'in-house development' is arduous, with high investment, long cycles, heavy barriers, and significant risks. Only a handful of automakers possess full-stack in-house development capabilities in terms of funding, talent, technology, and data. In the fast-paced automotive industry, open collaboration has gradually become the mainstream paradigm.

Against this backdrop, third-party intelligent driving suppliers have rapidly emerged, initially forming a leading trio in China comprising Horizon Robotics, Huawei, and Momenta.

Unlike the 'black box model' of suppliers like Mobileye, Chinese companies represented by Horizon Robotics offer more flexible collaboration modes: Automakers can purchase intelligent driving solutions or opt for algorithms, chips, or toolchains alone. If automakers wish to develop their own chips, Horizon Robotics even opens up its BPU chip architecture.

For instance, the intelligent driving capabilities of the Deepal L06 are a product of collaboration among Horizon Robotics, Deepal, and Changan: Horizon Robotics provides its HSD based on a one-stage end-to-end architecture and Journey 6 chips. Deepal Auto co-developed the latest one-stage end-to-end + reinforcement learning architecture with Horizon Robotics, using millions of kilometers of daily data from Changan Auto for initial training, achieving a Tesla FSD-like anthropomorphic intelligent driving experience.

If full-stack in-house development is likened to the 'Apple model,' Horizon Robotics' open collaboration bears resemblance to the 'Android model':

Through a full-stack solution encompassing chips, algorithms, software, and development tools, ranging from IP open licensing to flexible delivery of solutions, it transforms capabilities previously mastered only by a few leading automakers into 'bottom-layer standards' that any automaker or Tier 1 supplier can quickly adopt, verify, and mass-produce, eliminating the need to reinvent the wheel each time and significantly shortening the cycle from laboratory to mass-produced vehicles.

It should be noted that the intelligent driving industry has yet to form unified software and hardware architectures, unified development toolchains, or unified mass production verification systems, still falling short of the Android ecosystem.

However, against a backdrop of Synchronous tightening (simultaneously tightening) policy regulations, increasingly clear regulatory boundaries, and rising demands for functional safety and liability attribution, the industry is shifting from early 'route rivalry' to 'system convergence': Those who can form standardized capabilities in key areas like algorithms, chips, toolchains, and functional safety certification will cross regulatory thresholds faster and achieve Large scale implementation (scaled deployment) sooner.

It is not unlikely that a symbiotic system similar to Android will emerge, where various automakers adopt the same supplier's software and hardware architectures and development platforms, calibrate experiences on the same algorithm set, and complete adaptation and verification in the same development environment. Automakers can then avoid redundant investments in foundational capabilities and focus on algorithm iteration for user experience and after-sales service, thereby reducing technological costs and enabling users to equally enjoy the benefits of intelligence.

04 Conclusion

Reviewing the century-long evolutionary history of the automotive industry, features like airbags, rearview cameras, and cruise control have all undergone transitions from 'luxury exclusives' to 'national standards.'

As high-level intelligent driving penetrates the 100,000-200,000 yuan vehicle price range, transforming from a 'nice-to-have' to a 'must-have' feature, it signals that 'equal access to intelligent driving' is an irreversible trend. After all, automakers like Deepal and XPENG have already demonstrated with tangible sales figures a structural shift in consumer purchasing logic: The better the intelligent driving experience, the better the product sells.

This is not just a sales frenzy but a victory for 'technological equality.' Intelligent driving is no longer a 'privilege' of a few models but a 'standard feature' of the era within reach.