Vanke Shareholders' Meeting: No Clash in Sight, New Chairman Huang Liping from 'Shenzhen Metro Group' Maps Out Risk Mitigation Strategy

![]() 11/21 2025

11/21 2025

![]() 529

529

By Lead Reporter Zhong Kai, Shenzhen

On the afternoon of November 20, Vanke convened its inaugural extraordinary shareholders' meeting for the year 2025.

Vanke was on full alert. The entrance to the Vanke Center in Dameisha, Shenzhen, was teeming with security personnel and reception staff. Yet, only 26 shareholders and their authorized representatives attended, representing less than 1% of those who cast their votes online.

During the meeting, the 'Resolution on Entering into a Framework Agreement for Shareholder Loans from Shenzhen Metro Group to the Company and Guarantees Provided by the Company' sailed through with a 98.6371% approval rate. The hour-long session proceeded without any hiccups or 'battles'.

Liquidity Pressures Linger, Support Quotas Tighten

Beneath this tranquil exterior lies Vanke's urgent need for major shareholder support amidst mounting liquidity pressures. Vanke's operations continue to grapple with challenges, with Standard & Poor's previously cautioning that without timely and adequate loans from Shenzhen Metro, Vanke could face debt default risks.

Hence, Shenzhen Metro plans to extend a loan quota of no more than RMB 22 billion (mainly unsecured loans) to Vanke within 2025 and up until the 2025 shareholders' meeting. This move is undoubtedly a much-needed 'lifeline' for Vanke's management and shareholders.

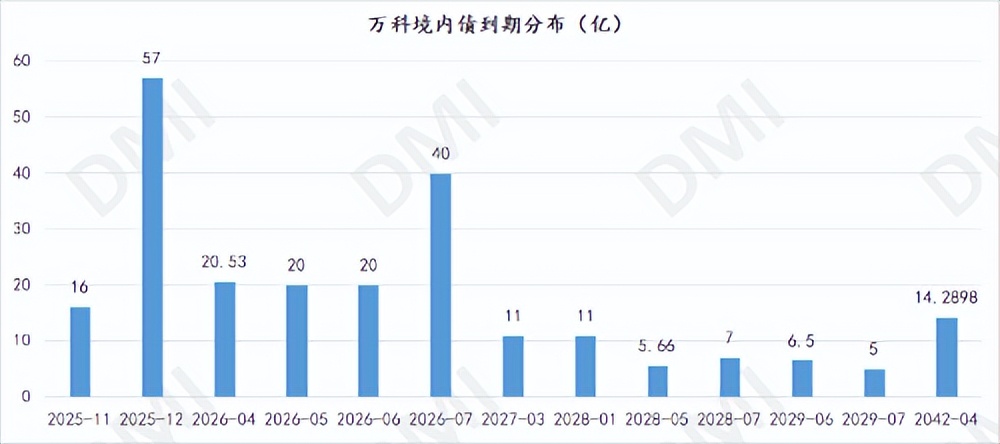

However, as of now, Shenzhen Metro has already extended approximately RMB 30.8 billion in shareholder loans to Vanke, of which Vanke has actually utilized RMB 21.376 billion in unsecured loans. This leaves only about RMB 600 million available from the aforementioned RMB 22 billion loan quota. Furthermore, with two bonds maturing in December, totaling RMB 5.7 billion, Vanke still confronts liquidity gap pressures.

▲Source: DM Debt Check

It is evident that Vanke continues to grapple with liquidity gap pressures. So, what forms of support will Shenzhen Metro provide, and how will Vanke secure additional funds for self-rescue? At the extraordinary shareholders' meeting, Vanke's management did not offer detailed answers to these queries.

New Chairman's Maiden Speech Outlines 'Reform and Risk Mitigation' Blueprint

The extraordinary shareholders' meeting was presided over by the new Chairman Huang Liping. Over a month ago, following Xin Jie's resignation as Vanke's chairman, Huang Liping from the major shareholder assumed the role. This marked his first public appearance as Vanke's chairman.

During the meeting, Huang Liping provided a holistic overview of Vanke's current state and future trajectory. He stated that the real estate industry is undergoing a period of transition pain from old to new models, and Vanke must digest the burdens from its past 'three highs' model, with current operations still under duress.

Huang Liping also urged consensus, confidence, and patience from all stakeholders, stating that Shenzhen Metro, as the major shareholder, will assist Vanke in resolving risks and overcoming difficulties in an orderly and lawful manner, fostering the company's robust development.

The meeting disclosed that Vanke will concentrate on three pivotal areas moving forward: first, maintaining strategic focus, refining business layout, and adjusting structure across five dimensions—city focus, business portfolio, development model, product positioning, and technology empowerment—while stabilizing development operations; second, upholding standardized operations, optimizing management mechanisms, facilitating organizational adjustments and resource integration, and bolstering governance empowerment; third, embracing technology empowerment, fully leveraging digital and green technologies, strengthening scenario cultivation and collaboration, and enhancing the operational capabilities of diversified businesses.

Management Details Operational Status, Yu Liang's Role Evolves

Li Feng, another representative dispatched by Shenzhen Metro and currently the Executive Vice President of Vanke, acknowledged that the company's operational pressures have not been effectively alleviated in the first 10 months of the year. He also outlined the operational situation from three vantage points: first, consolidating product and service capabilities, making strides in the transition from 'good housing' to 'good life,' while maintaining stable operational businesses; second, promoting resource activation and organizational optimization, with RMB 22.8 billion in new saleable inventory added in the first 10 months; additionally, enhancing operational efficiency through organizational restructuring, reducing management layers from 'three and a half tiers' to 'two tiers'.

Tian Jun, the Board Secretary of Vanke also hailing from Shenzhen Metro, stated that Vanke is currently navigating a critical period of reform and risk mitigation, and the company has implemented various measures. Despite Chairman Huang Liping's brief tenure, he engages in weekly discussions with the management on pertinent issues. He also mentioned that the company is striving to enhance operations and management, and will further streamline businesses and assets with low strategic relevance to the company through capital operations in the future, improving cash flow and asset-liability structure.

Yu Liang's movements have also garnered significant attention. Since his transition from chairman to director and executive vice president, his public statements have dwindled. At this shareholders' meeting, he only offered a few remarks on the real estate market trend, stating that the '15th Five-Year Plan' proposals underscore 'good housing and good services' as the bedrock for future industry competition and people's livelihood protection. Initiatives such as constructing a multi-tiered housing system, activating inefficient land use, and promoting urban renewal will usher in new demand and development opportunities for the industry.

A shareholders' meeting initially anticipated by the outside world to delve into rescue specifics concluded calmly amidst a high consensus on 'reform and risk mitigation.' However, Vanke's challenges persist post-meeting...